by Calculated Risk on 9/06/2013 06:01:00 PM

Friday, September 06, 2013

Housing Watch: Inventory

A quick note: I'm watching housing inventory very closely this year. I think that inventory bottomed earlier this year, and that the NAR will report a year-over-year increase in inventory very soon (probably for September). As more inventory comes on the market, buyer urgency will wane and price increases will slow and even decline seasonally in many areas this winter. IMO this will be another step towards a more normal housing market.

We are starting to see more and more local areas report year-over-year increases in inventory. Housing economist Tom Lawler frequently sends out data on different areas across the country. In today's note, Lawler wrote:

The Arizona Regional MLS reported that residential home sales by realtors in the Greater Phoenix, Arizona area totaled 7,055 in August, down 6.9% from last August’s pace. Lender-owned properties were 8.9% of last month’s sales, down from 14.0% last August, while last month’s short-sales share was 10.3%, down from 29.4% a year ago. Active listings in August totaled 21,382, up 6.6% from July and up 2.1% from a year ago. The median home sales price last month was $180,200, up 23.4% from last August.Two out of three areas in today's note reported year-over-year increases. I'm seeing year-over-year increases in more and more areas - and soon the national numbers will reflect this change.

The Greater Nashville Association of Realtors reported that residential home sales by realtors in the Nashville, Tennessee area totaled 2,895 in August, up 16.9% from last August’s pace. Active listings in August totaled 11,371, down 4.9% from July and down 10.2% from a year ago. The median SF home sales price last month was $194,000, up 10.9% from last August. The number of sales pending at the end of August was up 12.3% from a year ago.

The Mid-Hudson MLS reported that residential home sales by realtors in Dutchess County, New York totaled 238 in August, up 32.2% from last August’s pace. Active listings in August totaled 2,386, up 3.0% from July and up 2.5% from a year ago. The median SF home sales price last month was $255,000, up 3.0% from last August.

emphasis added

WSJ's Hilsenrath: September FOMC Meeting "Cliffhanger"

by Calculated Risk on 9/06/2013 03:26:00 PM

From Jon Hilsenrath at the WSJ: Fed Officials Face Cliffhanger September Meeting After Mixed Jobs Report

Fed officials want to start scaling back their $85 billion-per-month bond-buying program this year and could take a small step in that direction at their policy meeting Sept. 17-18. But the economic data in recent months have been ambiguous and new threats to the economy and markets loom, which could prompt officials to wait longer before acting.

...

Many officials believe it matters little in theory whether they start pulling back the program in September or later this year. ... But in reality, officials have concluded ... it matters immensely what signal investors take from their actions.

...

Yields on the benchmark 10-year Treasury notes have jumped from 1.6% in May to nearly 3%

On the "downside risks", Ethan Harris at Merrill Lynch wrote today:

Perhaps the strongest case for tapering is reduced downside risks. The economy has weathered a fairly big fiscal shock—by our estimates, more than 2% of GDP—with just two bad quarters—0.1% growth in 4Q and 1.1% growth in 1Q. Moreover, stripping out inventories and trade—the two wildcards of GDP accounting—final sales to domestic purchasers follow a similar pattern, bottoming in 1Q, when the tax and spending shock hit. Unfortunately, when Congress returns from its summer siesta on September 9, three major policy risks loom: Syria, the 2014 budget and the debt ceiling. We don’t expect a major shock to the economy, but the Fed will not be sure when it meets September 17-18.A few months ago I thought the Fed would wait until December, but the upward revisions to GDP and the decline in the unemployment rate has made it less clear. I don't know how much the Fed will weigh the decline in the participation rate.

Update: Four Charts to Track Timing for QE3 Tapering

by Calculated Risk on 9/06/2013 01:59:00 PM

With the release of the August employment report we can update the unemployment rate chart that I'm using to track when the Fed will start tapering the QE3 purchases.

The September FOMC meeting is on the 17th and 18th. The employment report was the last key data that will be released before the September FOMC meeting.

At the June FOMC press conference, Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."

Click on graph for larger image.

Click on graph for larger image.The first graph is for the unemployment rate.

The current forecast is for the unemployment rate to decline to 7.2% to 7.3% in Q4 2013.

We only have data through August, and so far the unemployment rate is tracking at the bottom of the forecast (lower is better).

However, in July, Bernanke said that the unemployment rate "probably understates the weakness of the labor market." He suggested he is watching other employment indicators too, and I think the decline in the participation rate offsets the decline in the unemployment rate.

The second graph is for GDP.

The second graph is for GDP.The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

Combined the first and second quarter were below the FOMC projections. GDP would have to increase at a 2.8% annual rate in the 2nd half to reach the FOMC lower projection, and at a 3.3% rate to reach the higher projection.

The third graph is for PCE prices.

The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.So far PCE prices are close to this projection - however this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup, and a key is if the recent decline in inflation is "transitory".

PCE prices wouldn't have to increase much over the next five months to reach the upper FOMC projection.

The fourth graph is for core PCE prices

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.So far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%.

It now looks the year-end data might be "broadly consistent" with the June FOMC projections. However I think the decline in the participation rate will factor into the discussions.

Employment Report Comments (more graphs)

by Calculated Risk on 9/06/2013 10:30:00 AM

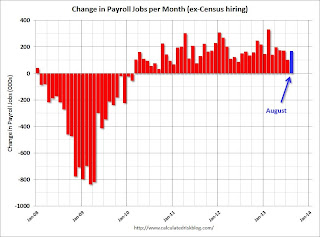

Overall this was a weak employment report. Although the headline number of 169,000 jobs added was just a little below the consensus forecast, the downward revisions to the June and July estimates were significant (74,000 fewer jobs than previously reported). Disappointing.

The decline in the unemployment rate to 7.3% in August, from 7.4% in July, was due to a decline in the participation rate (not good news). If the participation rate had held steady, the unemployment rate would have increased to 7.5% instead of declining to 7.3%.

However if we look at the year-over-year change in employment - to minimize the monthly volatility - total nonfarm employment is up 2.206 million from August 2012, and private employment is up 2.300 million. That is essentially the same year-over-year gain as in July (2.202 million total, 2.279 million private year-over-year in July).

So the story mostly remains the same: slow and steady job growth.

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

The ratio was unchanged at 75.9% in August. This ratio should probably move close to 80% as the economy recovers, but that also requires an increase in the 25 to 54 participation rate.

The participation rate for this group declined to 81.0% in August. The decline in the participation rate for this age group is probably mostly due to economic weakness (as opposed to demographics) and this suggests the labor market is still very weak.

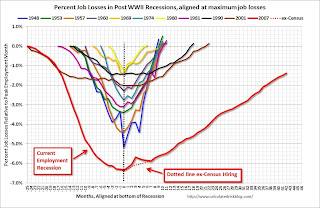

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses. At the recent pace of improvement, it appears employment will be back to pre-recession levels next year (Of course this doesn't include population growth).

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) declined by 334,000 to 7.9 million in August. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers declined in August to 7.911 million.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 13.7% in August from 14.0% in July. This is the lowest level for U-6 since December 2008.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.290 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 4.246 million in July. This is generally trending down, but is still very high. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In August 2013, state and local governments added 17,000 jobs, and state and local employment is up 17 thousand so far in 2013 (basically flat).

I think most of the state and local government layoffs are over. Of course Federal government layoffs are ongoing - and with many more layoffs expected.

Overall this was a weak report - especially with the downward revisions to June and July employment and the sharp decline in the participation rate (the reason the unemployment rate declined). The labor market is still weak and millions of people are unemployed or underemployed.

August Employment Report: 169,000 Jobs, 7.3% Unemployment Rate (graphs)

by Calculated Risk on 9/06/2013 08:30:00 AM

From the BLS:

Total nonfarm payroll employment increased by 169,000 in August, and the unemployment rate was little changed at 7.3 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was slightly below expectations of 175,000 payroll jobs added. However employment for June and July were also revised lower.

...

The change in total nonfarm payroll employment for June was revised from +188,000 to +172,000, and the change for July was revised from +162,000 to +104,000. With these revisions, employment gains in June and July combined were 74,000 less than previously reported.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The second graph shows the unemployment rate.

The unemployment rate declined in August to 7.3% from 7.4% in July.

This is the lowest level for the unemployment rate since November 2008.

This is the lowest level for the unemployment rate since November 2008.The unemployment rate is from the household report and the sharp decline in the participation rate helped lower the unemployment rate.

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate decreased to 63.2% in August (blue line) from 63.4% in July. This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio declined in August at 58.6% from 58.7% in July (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

With the revisions, this report was well below expectations. I'll have much more later ...

Thursday, September 05, 2013

Friday: Jobs, Jobs, Jobs

by Calculated Risk on 9/05/2013 09:19:00 PM

Earlier: Employment Situation Preview

And an employment preview from Goldman Sachs:

We expect a 200k gain in nonfarm payrolls in August, modestly above consensus expectations of 180k and in line with the 6- and 12-month moving averages. We expect that the unemployment rate held steady at 7.4% after a two-tenths decline in July, with some risk of a further decline to 7.3%.Friday:

Most labor market indicators point to strong employment gains in August. Initial jobless claims have continued to fall, the employment component of the ISM non-manufacturing index posted a large gain, and household reports of job availability improved. In addition, we expect only a small sequester impact. Our forecast of 200k is also broadly in line with our labor market tracker, which summarizes 24 labor market indicators.

• 8:30 AM ET, the Employment Report for August. The consensus is for an increase of 175,000 non-farm payroll jobs in August; the economy added 162,000 non-farm payroll jobs in June. The consensus is for the unemployment rate to be unchanged at 7.4 in August.

The Deregulators, Smarts and Judgment

by Calculated Risk on 9/05/2013 06:55:00 PM

Quiz: who said what (two different people):

1) “Let me be clear, it is the private sector, not the public sector, that is in the best position to provide effective supervision. Counterparties and creditors have more knowledge of their counterparts, more skill in evaluating risk and greater incentives than any public regulator will ever have.”

2) "As we move into a new century, the market-stabilizing private regulatory forces should gradually displace many cumbersome, increasingly ineffective government structures."

Hint: One person partially apologized in 2008: “Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief."

Of course the 2nd quote from April 1997 - and the admission of error in 2008 - is former Fed Chairman Alan Greenspan.

The first quote is from then Treasury Secretary Larry Summers in March 2000.

I'm posting this as a response to all the recent articles about Larry Summers. Every articles says he is "smart". But intelligence is only part of the puzzle. Since we never have complete information, or foreknowledge of what will happen, we frequently have to make decisions on partial information (use our best judgment).

Summers is obviously smart, but I wonder about his judgment. I could post many examples of judgment errors - from putting too much confidence in "Counterparties and creditors", to ignoring Brooksley Born, to calling Raghuram Rajan a "luddite" in 2005 for correctly pointing out potential "severe adverse consequences" of the financial system, to the housing tax credit (that I vigorously opposed), to the ludicrous "Summer of recovery" campaign in 2010 (when many of us were arguing the recovery would be sluggish), to the pivot to austerity ... and on and on.

I think articles should discuss both "smarts" and judgment.

And Zachary Goldfarb at the WaPo points out another issue; the lack of discipline when speaking:

If he’s appointed Fed chairman, Summers will probably have to bite his tongue a lot more than usual, both internally and externally. The words of a Fed chairman can create or cost millions of jobs and send markets up and down. A quieter Summers would ... be crucial if Summers doesn’t want the controversies that have followed him over the past decade to undermine his leadership at the Fed.Like Goldfarb, I'm concerned about Summers' speaking discipline. It is important for a Fed Chairman to stick to their talking points, and limit their comments to the responsibilities of the Federal Reserve (Greenspan was terrible about this, overall Bernanke was very disciplined).

Employment Situation Preview

by Calculated Risk on 9/05/2013 02:49:00 PM

Tomorrow (Friday), at 8:30 AM ET, the BLS will release the employment report for August. The consensus is for an increase of 175,000 non-farm payroll jobs in August, and for the unemployment rate to be unchanged at 7.4%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 176,000 private sector payroll jobs in August. This was close to expectations of 177,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth in line with expectations.

• The ISM manufacturing employment index decreased in August to 53.3% from 54.4% in July. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs were mostly unchanged in August. The ADP report indicated a 5,000 increase for manufacturing jobs in August.

The ISM non-manufacturing employment index increased in August to 57.0% from 53.2% in July. A historical correlation between the ISM non-manufacturing index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 260,000 in August.

Taken together, these surveys suggest around 260,000 jobs added in August - well above the consensus forecast.

• Initial weekly unemployment claims averaged close to 330,000 in August. This was down from an average of 342,000 in July, and at the lowest level since the recession started in December 2007.

For the BLS reference week (includes the 12th of the month), initial claims were at 337,000; about the same as in July.

• The final August Reuters / University of Michigan consumer sentiment index decreased to 82.1 from the July reading of 85.1. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors.

• The small business index from Intuit showed a slight decrease in small business employment in August.

• And on the unemployment rate from Gallup: Gallup's seasonally adjusted U.S. unemployment rate for August was 8.6%, up from 7.4% in July

Gallup's unadjusted unemployment rate for the U.S. workforce was 8.7% in August, up from 7.8% in July and from 8.1% in August 2012. Similar to P2P, unemployment fluctuates seasonally, and the year-over-year change is the most informative comparison. The uptick in unemployment this August compared with August of last year is the first year-over-year increase since Gallup was able to begin tracking yearly changes in 2011.Oh my, 8.6%? I have very little confidence in the Gallup survey as far as predicting the BLS reported unemployment rate, and I will probably stop looking at their results going forward (unless the unemployment rate increases significantly in August!).

Gallup's seasonally adjusted U.S. unemployment rate for August was 8.6%, up from 7.4% in July. Gallup calculates this rate by applying the adjustment factor the government used for the same month in the previous year. Last year, the government adjusted August's rate down by 0.1 points, but adjusted July's down by 0.4 points, which partly accounts for the increase in seasonally adjusted unemployment.

• Conclusion: The data was mixed. The ADP report was a little lower in August than in July, however the ISM surveys suggest a significant increase in hiring. Weekly claims for the reference week were about the same in August as in July, and consumer sentiment decreased slightly.

There is always some randomness to the employment report - and there are reasons for optimism (ISM surveys, decline in unemployment claims) so maybe we will see an upside surprise - but my guess is the BLS will report close to the consensus of 175,000 jobs added in August. It will be important to look at payroll revisions and the unemployment rate (the Gallup number seems way off). This is an especially important report because this is the last major data point before the September FOMC meeting.

Trulia: "Asking home prices rose 11.0 percent year-over-year (Y-o-Y) and 1.2 percent month-over-month (M-o-M) in August"

by Calculated Risk on 9/05/2013 11:59:00 AM

This was released earlier today: Asking home prices rose 11.0 percent year-over-year (Y-o-Y) and 1.2 percent month-over-month (M-o-M) in August

Asking home prices rose 11.0 percent year-over-year (Y-o-Y) and 1.2 percent month-over-month (M-o-M) in August. However, a closer look at the quarterly changes in asking home prices reveals a downward trend that’s much less volatile than the monthly changes suggest. Quarter-over-quarter (Q-o-Q), asking home prices rose 3.1 percent in August, down from 3.2 percent in July and 4.0 percent in April. And this downward slope will likely continue as mortgage rates rise, inventory expands, and investor interest declines.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis (but the year-over-year increases will probably slow).

...

Rents rose 3.5 percent Y-o-Y nationally, jumping 3.9 percent on apartment units and only 1.6 percent on single-family homes. Among the 25 largest U.S. rental markets, rents increased the most in Seattle, Portland, and Miami, while declining slightly in Philadelphia, Washington, and Sacramento. Looking at single-family homes only, rents fell Y-o-Y in 6 of the 25 largest rental markets, including investor favorites such as Las Vegas, Phoenix, and Atlanta. ...

“The rate spike since early May has raised the cost of a mortgage by more than 10 percent, but rising rates aren’t the whole story behind the price slowdown,” said Jed Kolko, Trulia’s Chief Economist. “Expanding inventory and declining investor interest have helped cool prices, too. At the same time, mortgage credit has finally started to expand, and the economy continues to strengthen – both of which boost housing demand and offset some of the dampening effect of rising rates.”

emphasis added

More from Kolko: Most Price-Boomtown Markets are Still Far From Fully Recovered

ISM Non-Manufacturing Index at 58.6 indicates faster expansion in August

by Calculated Risk on 9/05/2013 10:00:00 AM

The August ISM Non-manufacturing index was at 58.6%, up from 56.0% in July. The employment index increased in August to 57.0%, up from 53.2% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 44th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 58.6 percent in August, 2.6 percentage points higher than the 56 percent registered in July. This indicates continued growth at a faster rate in the non-manufacturing sector. This month's NMI™ is the highest reading for the index since its inception in January 2008. The Non-Manufacturing Business Activity Index increased to 62.2 percent, which is 1.8 percentage points higher than the 60.4 percent reported in July, reflecting growth for the 49th consecutive month. The New Orders Index increased by 2.8 percentage points to 60.5 percent, and the Employment Index increased 3.8 percentage points to 57 percent, indicating growth in employment for the 13th consecutive month. The Prices Index decreased 6.7 percentage points to 53.4 percent, indicating prices increased at a significantly slower rate in August when compared to July. According to the NMI™, 16 non-manufacturing industries reported growth in August. The majority of respondents' comments continue to be mostly positive about business conditions and the direction of the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 55.0% and indicates faster expansion in August than in July. A very strong survey.