by Calculated Risk on 6/20/2013 10:06:00 PM

Thursday, June 20, 2013

Two more articles on QE3

From Merrill Lynch:

Fed Chairman Bernanke expects to start tapering before year-end, provided momentum continues in the labor market. Bernanke has clarified his reaction function and, as a result, we are changing our Fed call: we now expect the Fed to announce tapering in December with the first rate hike to begin in summer 2015. Soft inflation in the near-term will not dissuade the Fed from tapering, but we think the Fed will want to see inflation make steady progress toward its 2% target to begin rate hikes.From Neil Irwin at the WaPo: This is why global markets are freaking out

emphasis added

This isn’t a crisis like the ones that struck the United States starting in 2008 or Europe in 2010. Rather, it is a byproduct of the world’s central banks, having intervened on vast scale to deal with the economic travails of the last several years, introducing uncertainty and even a little chaos as they start to contemplate how and when the era of easy money might end.Friday economic releases:

...

One saving grace for the United States: If the market swings really do undermine U.S. growth, then the Fed, as Bernanke said repeatedly in his news conference, will move that much more gingerly in removing its help for the economy. Indeed, just Thursday, investors’ expectations for inflation over the next few years fell 0.1 percentage point, to 1.75 percent, the lowest since last July. Because the Fed aims for inflation of 2 percent, that would suggest there is more room for the central bank to pump money into the economy without sparking an outburst of higher prices.

In effect, with the Fed starting to think about an exit from an era of easy money, it will be a great test of just how resilient this economic recovery really is. If the whole thing — the rises in stock prices, in corporate earnings, in the housing market, even in job growth — is driven solely by the flood of money, or whether five years of zero-interest rates and trillions of dollars in bond purchases have succeeded at getting a more resilient economic engine for the United States up and running.

• At 10:00 AM ET, the Regional and State Employment and Unemployment report (Monthly) for May 2013

Four Charts to Track Timing for QE3 Tapering

by Calculated Risk on 6/20/2013 04:26:00 PM

Yesterday Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."Here are four graphs that we can use to track if the incoming data is "broadly consistent" with the FOMC projections.

Click on graph for larger image.

Click on graph for larger image.The first graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first quarter was consistent with the FOMC projections (red), however it appears the second quarter will be below the FOMC forecast - if so, then GDP will have to pickup in the 2nd half of 2013.

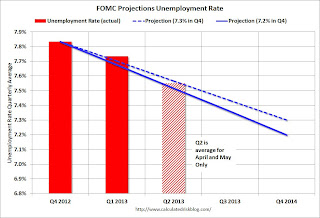

The second graph is for unemployment rate.

The second graph is for unemployment rate.The current forecast is for the unemployment rate to decline to 7.2% to 7.3% in Q4 2013.

We only have data through May, but so far the unemployment rate is tracking the forecast. However most of the decline in the unemployment rate has been due to a decline in the participation rate from 63.6% to 63.4%. It the participation rate stays level for the remainder of 2013, then job growth will have to pickup to meet the FOMC projections.

The third graph is for PCE prices.

The third graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through April, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup.

The second graph is for core PCE prices.

The second graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through April, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It is possible that the FOMC could start to taper QE3 purchases in December, but it would take a pickup in the economy. (September tapering is less likely, but not impossible - but the pickup would have to be significant).

Philly Fed Manufacturing Survey indicates Expansion in June

by Calculated Risk on 6/20/2013 01:35:00 PM

Catching up ... from the Philly Fed: June Manufacturing Survey

Manufacturing firms responding to the monthly Business Outlook Survey indicated that regional manufacturing activity increased this month. Most of the survey’s broadest current indicators were positive this month, suggesting an improvement in business conditions. The survey's indicators of future activity continue to suggest that firms expect growth over the next six months.Earlier in the week, the Empire State manufacturing survey also indicated expansion in June.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased from ‑5.2 in May to 12.5, its highest reading since April 2011.

Labor market conditions showed continued weakness, however, with indexes suggesting lower employment among the reporting manufacturers. Although it increased 3 points to ‑5.4, the employment index remained negative for the third consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through June. The ISM and total Fed surveys are through May.

The average of the Empire State and Philly Fed surveys turned positive in June, and this suggests a rebound in the ISM report for June. The June ISM report will be released Monday, July 1, 2013.

Comment on Existing Home Sales: Inventory near Bottom

by Calculated Risk on 6/20/2013 11:49:00 AM

The key number in the existing home sales report is inventory (not sales), and the NAR reported that inventory increased 3.3% in May from April, and is only down 10.1% from May 2012. This fits with the weekly data I've been posting.

This is the lowest level of inventory for the month of May since 2002, but this is also the smallest year-over-year decline since July 2011. The key points are: 1) inventory is very low, but 2) the year-over-year inventory decline will probably end soon. With the low level of inventory, there is still upward pressure on prices - but as inventory starts to increase, buyer urgency will wane, and price increases will slow.

Important: The NAR reports active listings, and although there is some variability across the country in what is considered active, most "contingent short sales" are not included. "Contingent short sales" are strange listings since the listings were frequently NEVER on the market (they were listed as contingent), and they hang around for a long time - they are probably more closely related to shadow inventory than active inventory. However when we compare inventory to 2005, we need to remember there were no "short sale contingent" listings in 2005. In the areas I track, the number of "short sale contingent" listings is also down sharply year-over-year.

Another key point: The NAR reported total sales were up 12.9% from May 2012, but conventional sales are probably up over 20% from May 2012, and distressed sales down. The NAR reported (from a survey):

Distressed homes – foreclosures and short sales – accounted for 18 percent of May sales, unchanged from April, but matching the lowest share since monthly tracking began in October 2008; they were 25 percent in May 2012.Although this survey isn't perfect, if total sales were up 12.9% from May 2012, and distressed sales declined from 25% of total sales (25% of 5.18 million) to 18% (18% of 4.59 million in May 2012), this suggests conventional sales were up sharply year-over-year - a good sign. However some of this increase is investor buying; the NAR is reporting:

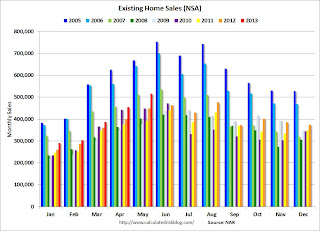

All-cash sales were at 33 percent of transactions in May, up from 32 percent in April and 28 percent in May 2012. Individual investors, who account for many cash sales, purchased 18 percent of homes in May; they were 19 percent in April and 17 percent in May 2012.The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in May (red column) are above the sales for 2007 through 2012, however sales are well below the bubble years of 2005 and 2006.

The bottom line is this was a solid report. Conventional sales have increased sharply, although some of this is investor buying. And inventory is low, but the year-over-year decline in inventory is decreasing.

Earlier:

• Existing Home Sales in May: 5.18 million SAAR, 5.1 months of supply

Existing Home Sales in May: 5.18 million SAAR, 5.1 months of supply

by Calculated Risk on 6/20/2013 10:00:00 AM

The NAR reports: Existing-Home Sales Rise in May with Strong Price Increases

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 4.2 percent to a seasonally adjusted annual rate of 5.18 million in May from 4.97 million in April, and is 12.9 percent above the 4.59 million-unit pace in May 2012.

Total housing inventory at the end of May rose 3.3 percent to 2.22 million existing homes available for sale, which represents a 5.1-month supply at the current sales pace, down from 5.2 months in April. Listed inventory is 10.1 percent below a year ago, when there was a 6.5-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2013 (5.18 million SAAR) were 4.2% higher than last month, and were 12.9% above the May 2012 rate. This is the highest sales rate since November 2009 (housing tax credit).

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 2.22 million in May up from 2.15 million in April. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 2.22 million in May up from 2.15 million in April. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 10.1% year-over-year in May compared to May 2012. This is the 27th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).

Inventory decreased 10.1% year-over-year in May compared to May 2012. This is the 27th consecutive month with a YoY decrease in inventory, and the smallest YoY decrease since 2011 (I expect the YoY decrease to get smaller all year).Months of supply decreased to 5.1 months in May.

This was just above expectations of sales of 5.0 million. For existing home sales, the key number is inventory - and inventory is still down year-over-year, although the declines are slowing. This was another solid report. I'll have more later ...

Weekly Initial Unemployment Claims increase to 354,000

by Calculated Risk on 6/20/2013 08:35:00 AM

The DOL reports:

In the week ending June 15, the advance figure for seasonally adjusted initial claims was 354,000, an increase of 18,000 from the previous week's revised figure of 336,000. The 4-week moving average was 348,250, an increase of 2,500 from the previous week's revised average of 345,750.The previous week was revised up from 334,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 348,250.

The 4-week average has mostly moved sideways over the last few months. Claims were above the 340,000 consensus forecast.

Wednesday, June 19, 2013

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 6/19/2013 07:57:00 PM

Another take on the FOMC statement and Bernanke press conference from Goldman Sachs' economists Jan Hatzius and Sven Jari Stehn:

The FOMC was more hawkish than we had expected. First, Chairman Bernanke suggested that tapering would start “later” this year and might conclude in mid-2014 assuming a 7% unemployment rate at that point. Second, the committee moved down its unemployment rate forecasts by about 0.2 percentage points throughout the forecast horizon. Third, the committee noted that downside risks had “diminished” since last fall ... Fourth, although inflation projections moved down, the chairman was somewhat dismissive of the recent inflation drop, attributing much of it to special factors. Fifth, the chairman was a bit more reluctant to push back on the increase in short-term rate expectations than we had expected, although he did state explicitly that the 6.5% unemployment threshold might eventually move down.Thursday economic releases:

Our takeaway is that the risk to our forecast of QE tapering starting in December has increased. However, our own GDP forecast for the second half of 2013 is more than ½ percentage point below the committee’s, and our labor market forecasts are also less optimistic.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for an increase to 340 thousand from 334 thousand last week.

• At 9:00 AM, the Markit US PMI Manufacturing Index Flash for June. The index was at 52.3 in May.

• At 10:00 AM, the Existing Home Sales report for April from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in April were at a 4.97 million SAAR. Economist Tom Lawler is estimating the NAR will report a May sales rate of 5.2 million. A key will be inventory (especially the year-over-year change) and the months-of-supply.

• Also at 10:00 AM, the Philly Fed manufacturing survey for June. The consensus is for a reading of -0.5, up from -5.2 last month (above zero indicates expansion).

Analysis on Tapering QE3

by Calculated Risk on 6/19/2013 06:19:00 PM

Last month there were quite a few analysts predicting the Fed would start tapering off QE purchases in June. My response was Three words: Will Not Happen.

Now we are seeing a flurry of articles with headlines suggesting reducing the monthly purchases of assets is "close" or "near". It depends on the definition of "close" or "near", but it is clear tapering will not happen until later this year at the earliest. Here is the key quote from Bernanke:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."What does "consistent with this forecast" mean? (see projections here)

• First, year-over-year GDP growth would have to be in the 2.3% to 2.6% range in Q4 2013. The first half of 2013 will probably be just over 2% - so this suggests 2nd half GDP growth in the 2.5% to 3.2% range. If the FOMC decides to taper in September, growth would have to seem fairly strong in Q3. By December, the FOMC will have Q3 data and a sense of growth in Q4 - and the impact of fiscal policy (the key downside risk to the U.S. economy is excessive fiscal tightening). So even if the economic data is consistent with the FOMC forecasts, it seems tapering in December is more likely than September. NOTE: Economic growth for 2013 was revised down slightly in the projections released today - several articles have incorrectly stated that growth was revised up.

• Second, the unemployment rate will have to be on track to be in the 7.2% to 7.3% range in December. Since December 2012, the unemployment rate has fallen from 7.8% to 7.6%, but much of that improvement was due to a decline in the participation rate from 63.6% to 63.4%. If the participation rate stays flat for the remainder of 2013 (about what I currently expect), then job growth would have to increase to reach the Fed's projections.

• Third, inflation would have to be increasing. Over the first four months of 2013, the PCE price index increased at a 0.3% annualized rate (core PCE increased at a 1.0% annualized rate). This is significantly below the Fed's target. The FOMC members believe this low inflation is partially due to transitory factors, but I expect the Fed will want to see some increase in inflation before reducing the pace of asset purchases.

Although I think the future is bright - and the Fed's projections are possible, I don't think the Fed will have enough positive economic data to "moderate the monthly pace of purchases" by September. Right now it seems likely they will start tapering in December or in early 2014. So little has changed on timing - even with the somewhat more positive tone of the FOMC statement, especially that "downside risks have diminished".

Tapering is coming, but can December be described as "near" or "close"? If so, I haven't even started my Christmas shopping yet ...

And more from Tim Duy: FOMC Statement: Second Reaction

Of course, Bernanke did not say September. But I think he made clear that assuming the Fed's forecasts hold, they see that asset purchases will be gradually reduced beginning later this year with the expectation that the Fed will QE draw to a close by the middle of next year. He confirmed my suspicion that although the Fed sees the fiscal sector as a drag on overall growth, they do not believe it has harmed the underlying momentum of the economy. I would even say that he sounded relatively optimistic. Thus, downside risks have diminished and it is appropriate to begin reducing accommodation.

Interesting, he seemed to set a trigger, not a threshold, for ending QE - the program should be concluded when unemployment hits 7%. I am surprised that he set a number, although it is consistent with the idea that the Fed wants to end QE well ahead of the 6.5% threshold for unemployment. Watching the unemployment rate just became even more important, as a faster than expected move to 7% will be associated with a faster end to QE.

FOMC Projections and Press Conference

by Calculated Risk on 6/19/2013 02:15:00 PM

Just a couple of months ago, several analysts argued that the Fed would start to taper QE purchases in June. That was NEVER in the cards. September is possible, but I still expect they will wait until December or early 2014 to start to taper.

The Fed is clearly missing on the low side of their inflation target. If that continues, the next move will be to increase purchases! James Bullard even argued "the Committee should signal more strongly its willingness to defend its inflation goal in light of recent low inflation readings".

Bernanke press conference here or watch below.

Free desktop streaming application by Ustream

On the projections, GDP was revised down slightly, the unemployment rate was revised down, and inflation was revised down sharply for 2013.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | 2.3 to 2.6 | 3.0 to 3.5 | 2.9 to 3.6 |

| Mar 2013 Meeting Projections | 2.3 to 2.8 | 2.9 to 3.4 | 2.9 to 3.7 |

| Dec 2012 Meeting Projections | 2.3 to 3.0 | 3.0 to 3.5 | 3.0 to 3.7 |

The unemployment rate was at 7.6% in May.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | 7.2 to 7.3 | 6.5 to 6.8 | 5.8 to 6.2 |

| Mar 2013 Meeting Projections | 7.3 to 7.5 | 6.7 to 7.0 | 6.0 to 6.5 |

| Dec 2012 Meeting Projections | 7.4 to 7.7 | 6.8 to 7.3 | 6.0 to 6.6 |

The FOMC believes inflation will stay significantly below target.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | 0.8 to 1.2 | 1.4 to 2.0 | 1.6 to 2.0 |

| Mar 2013 Meeting Projections | 1.3 to 1.7 | 1.5 to 2.0 | 1.7 to 2.0 |

| Dec 2012 Meeting Projections | 1.3 to 2.0 | 1.5 to 2.0 | 1.7 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 |

| June 2013 Meeting Projections | 1.2 to 1.3 | 1.5 to 1.8 | 1.7 to 2.0 |

| Mar 2013 Meeting Projections | 1.5 to 1.6 | 1.7 to 2.0 | 1.8 to 2.0 |

| Dec 2012 Meeting Projections | 1.6 to 1.9 | 1.6 to 2.0 | 1.8 to 2.1 |

FOMC Statement: "Downside risks have diminished", Inflation outlook revised down, No Taper

by Calculated Risk on 6/19/2013 02:00:00 PM

Information received since the Federal Open Market Committee met in May suggests that economic activity has been expanding at a moderate pace. Labor market conditions have shown further improvement in recent months, on balance, but the unemployment rate remains elevated. Household spending and business fixed investment advanced, and the housing sector has strengthened further, but fiscal policy is restraining economic growth. Partly reflecting transitory influences, inflation has been running below the Committee's longer-run objective, but longer-term inflation expectations have remained stable.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic growth will proceed at a moderate pace and the unemployment rate will gradually decline toward levels the Committee judges consistent with its dual mandate. The Committee sees the downside risks to the outlook for the economy and the labor market as having diminished since the fall. The Committee also anticipates that inflation over the medium term likely will run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. Taken together, these actions should maintain downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

The Committee will closely monitor incoming information on economic and financial developments in coming months. The Committee will continue its purchases of Treasury and agency mortgage-backed securities, and employ its other policy tools as appropriate, until the outlook for the labor market has improved substantially in a context of price stability. The Committee is prepared to increase or reduce the pace of its purchases to maintain appropriate policy accommodation as the outlook for the labor market or inflation changes. In determining the size, pace, and composition of its asset purchases, the Committee will continue to take appropriate account of the likely efficacy and costs of such purchases as well as the extent of progress toward its economic objectives.

To support continued progress toward maximum employment and price stability, the Committee expects that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens. In particular, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee's 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. In determining how long to maintain a highly accommodative stance of monetary policy, the Committee will also consider other information, including additional measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments. When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Jerome H. Powell; Sarah Bloom Raskin; Eric S. Rosengren; Jeremy C. Stein; Daniel K. Tarullo; and Janet L. Yellen. Voting against the action was James Bullard, who believed that the Committee should signal more strongly its willingness to defend its inflation goal in light of recent low inflation readings, and Esther L. George, who was concerned that the continued high level of monetary accommodation increased the risks of future economic and financial imbalances and, over time, could cause an increase in long-term inflation expectations.