by Calculated Risk on 6/20/2013 04:26:00 PM

Thursday, June 20, 2013

Four Charts to Track Timing for QE3 Tapering

Yesterday Fed Chairman Ben Bernanke said:

"If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear. In this scenario, when asset purchases ultimately come to an end, the unemployment rate would likely be in the vicinity of 7%, with solid economic growth supporting further job gains, a substantial improvement from the 8.1% unemployment rate that prevailed when the committee announced this program."Here are four graphs that we can use to track if the incoming data is "broadly consistent" with the FOMC projections.

Click on graph for larger image.

Click on graph for larger image.The first graph is for GDP.

The current forecast is for GDP to increase between 2.3% and 2.6% from Q4 2012 to Q4 2013.

The first quarter was consistent with the FOMC projections (red), however it appears the second quarter will be below the FOMC forecast - if so, then GDP will have to pickup in the 2nd half of 2013.

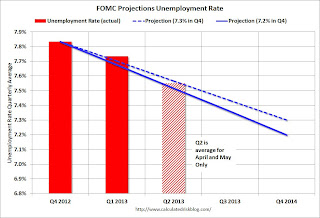

The second graph is for unemployment rate.

The second graph is for unemployment rate.The current forecast is for the unemployment rate to decline to 7.2% to 7.3% in Q4 2013.

We only have data through May, but so far the unemployment rate is tracking the forecast. However most of the decline in the unemployment rate has been due to a decline in the participation rate from 63.6% to 63.4%. It the participation rate stays level for the remainder of 2013, then job growth will have to pickup to meet the FOMC projections.

The third graph is for PCE prices.

The third graph is for PCE prices.The current forecast is for prices to increase 0.8% to 1.2% from Q4 2012 to Q4 2013.

We only have data through April, but so far PCE prices are below this projection - and this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects inflation to pickup.

The second graph is for core PCE prices.

The second graph is for core PCE prices.The current forecast is for core prices to increase 1.2% to 1.3% from Q4 2012 to Q4 2013.

Once again we only have data through April, but so far core PCE prices are below this projection - and, once again, this projection is significantly below the FOMC target of 2%. Clearly the FOMC expects core inflation to pickup too.

It is possible that the FOMC could start to taper QE3 purchases in December, but it would take a pickup in the economy. (September tapering is less likely, but not impossible - but the pickup would have to be significant).