by Calculated Risk on 6/03/2013 03:10:00 PM

Monday, June 03, 2013

U.S. Light Vehicle Sales increased to 15.3 million annual rate in May

Based on an estimate from AutoData Corp, light vehicle sales were at a 15.31 million SAAR in May. That is up 10% from May 2012, and up 3% from the sales rate last month.

This was slightly above the consensus forecast of 15.2 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for May (red, light vehicle sales of 15.31 million SAAR from AutoData).

Click on graph for larger image.

Click on graph for larger image.

This was the near the post-recession high for auto sales.

After three consecutive years of double digit auto sales growth, the growth rate will probably slow in 2013 - but this will still be another positive year for the auto industry even if sales move mostly sideways for the rest of 2013.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Unlike residential investment, auto sales bounced back fairly quickly following the recession and had been a key driver of the recovery. Looking forward, growth will slow for auto sales. If sales average the recent pace for the entire year, total sales will be up about 5% from 2012.

Construction Spending increased in April

by Calculated Risk on 6/03/2013 11:35:00 AM

The Census Bureau reported that overall construction spending increased in April:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during April 2013 was estimated at a seasonally adjusted annual rate of $860.8 billion, 0.4 percent above the revised March estimate of $857.7 billion. The April figure is 4.3 percent above the April 2012 estimate of $825.1 billion.Private construction spending increased, and public construction spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $602.0 billion, 1.0 percent above the revised March estimate of $595.9 billion. ...

In April, the estimated seasonally adjusted annual rate of public construction spending was $258.8 billion, 1.2 percent below the revised March estimate of $261.8 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 55% below the peak in early 2006, and up 36% from the post-bubble low. Note: Residential spending was revised up for February and March.

Non-residential spending is 28% below the peak in January 2008, and up about 33% from the recent low.

Public construction spending is now 20% below the peak in March 2009 and at the lowest level since 2006 (not inflation adjusted).

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 19%. Non-residential spending is flat year-over-year. Public spending is down 5.1% year-over-year.

A few key themes:

1) Private residential construction is usually the largest category for construction spending, but there was a huge collapse in spending following the housing bubble (as expected). Private residential is now slightly higher than private non-residential, and residential will probably be the largest category of construction spending in 2013. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels.

3) Public construction spending has declined to 2006 levels (not adjusted for inflation). This has been a drag on the economy for 4 years. In real terms, this is the lowest level of public construction spending since February 2001.

ISM Manufacturing index declines in May to 49.0, Lowest since June 2009

by Calculated Risk on 6/03/2013 10:00:00 AM

The ISM manufacturing index indicated contraction in May. The PMI was at 49.0% in May, down from 50.7% in April. The employment index was at 50.1%, down from 50.2%, and the new orders index was at 48.8%, down from 52.3% in April.

From the Institute for Supply Management: May 2013 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector contracted in May for the first time since November 2012, and the overall economy grew for the 48th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI™ registered 49 percent, a decrease of 1.7 percentage points from April's reading of 50.7 percent, indicating contraction in manufacturing for the first time since November 2012 and only the second time since July 2009. This month's PMI™ reading is at its lowest level since June 2009, when it registered 45.8 percent. The New Orders Index decreased in May by 3.5 percentage points to 48.8 percent, and the Production Index decreased by 4.9 percentage points to 48.6 percent. The Employment Index registered 50.1 percent, a slight decrease of 0.1 percentage point compared to April's reading of 50.2 percent. The Prices Index registered 49.5 percent, decreasing 0.5 percentage point from April, indicating that overall raw materials prices decreased from last month. Several comments from the panel indicate a flattening or softening in demand due to a sluggish economy, both domestically and globally."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 51.0% and suggests manufacturing contracted in May for the first time since November 2012.

MarkIt PMI shows "only a modest rate of growth" in May

by Calculated Risk on 6/03/2013 09:07:00 AM

From MarkIt: Markit U.S. Manufacturing PMI™ – final data

The final Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1 signalled a further improvement in manufacturing business conditions in May. However, at 52.3, up slightly from a six-month low of 52.1 in April and higher than the earlier flash estimate of 51.9, the PMI was consistent with only a modest rate of growth.The ISM PMI will be released at 10 AM today.

...

Firms linked the increase in production to higher new order requirements. Incoming new work rose modestly in May, with the rate of increase stronger than the six-month low recorded in April and faster than signalled by the earlier flash estimate.

...

Manufacturing employment in the U.S. rose further in May. Nonetheless, the rate of job creation was only modest and the weakest since last November.

“The May survey paints a downbeat picture of U.S. manufacturing business conditions. Output, order books and employment are all growing modestly, suggesting the sector is at risk of stalling. The main weakness is from export markets, where new orders fell marginally due to weakening global demand. [said Chris Williamson, Chief Economist at Markit]

“There is a possibility that growth may pick up again. The deteriorating export performance is being offset by rising demand in the domestic market, and large firms are reporting the strongest growth of new orders for just over a year.”

“However, the short-term outlook is one of subdued growth at best, suggesting the recent slowdown in the manufacturing economy will add to the likelihood of GDP growth weakening in the second quarter.”

Sunday, June 02, 2013

Monday: ISM Manufacturing Index, Auto Sales, Construction Spending

by Calculated Risk on 6/02/2013 08:00:00 PM

Note: Several sites list May auto sales on Tuesday - that appears incorrect. GM, Ford and others have already announced they will release results on Monday.

For some amusement, Jon Hilsenrath at the WSJ lists several of Fed Chairman Ben Bernanke's jokes today: Funnyman Ben Bernanke? You’ve Got to Be Kidding

A dozen years ago I was minding my own business teaching Economics 101 in Alexander Hall and trying to think of good excuses for avoiding faculty meetings. Then I got a phone call ...From CNBC: Pre-Market Data and Bloomberg futures: the early S&P futures are up slightly and DOW futures are up 35 (fair value).

Oil prices have moved down recently with WTI futures at $91.42 per barrel and Brent at $99.94 per barrel.

• Schedule for Week of June 2nd

Monday economic releases:

• At 9:00 AM ET, the Markit US PMI Manufacturing Index for May. The consensus is for the index to be unchanged at 52.1.

• At 10:00 AM, ISM Manufacturing Index for May will be released. The consensus is for an increase to 51.0 from 50.7 in April. Based on the regional surveys, a reading at or below 50 is possible.

• Also at 10:00 AM, the Census Bureau will release Construction Spending for April. The consensus is for a 1.0% increase in construction spending.

• All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 15.2 million SAAR in May (Seasonally Adjusted Annual Rate) from 14.9 million SAAR in April.

Bernanke: The Ten Suggestions

by Calculated Risk on 6/02/2013 03:07:00 PM

Some humor and interesting comments in a commencement speech from Fed Chairman Ben Bernanke : The Ten Suggestions

It's nice to be back at Princeton. I find it difficult to believe that it's been almost 11 years since I departed these halls for Washington. I wrote recently to inquire about the status of my leave from the university, and the letter I got back began, "Regrettably, Princeton receives many more qualified applicants for faculty positions than we can accommodate."1I enjoyed this speech, but Bernanke's comment that "careful economic analysis ... can help kill ideas that are completely logically inconsistent or wildly at variance with the data" is at odds with the sequestration budget cuts, "debt ceiling" nonsense, expansionary austerity, and more. I wish data and careful analysis could actually kill bad ideas, but I'm not sure what Paul Ryan would do with his life.

... I thought I would use my few minutes today to make Ten Suggestions, or maybe just Ten Observations, about the world and your lives after Princeton. Please note, these points have nothing whatsoever to do with interest rates. My qualification for making such suggestions, or observations, besides having kindly been invited to speak today by President Tilghman, is the same as the reason that your obnoxious brother or sister got to go to bed later--I am older than you. All of what follows has been road-tested in real-life situations, but past performance is no guarantee of future results.

1. ... Life is amazingly unpredictable; any 22-year-old who thinks he or she knows where they will be in 10 years, much less in 30, is simply lacking imagination. ...

6. ... Economics is a highly sophisticated field of thought that is superb at explaining to policymakers precisely why the choices they made in the past were wrong. About the future, not so much. However, careful economic analysis does have one important benefit, which is that it can help kill ideas that are completely logically inconsistent or wildly at variance with the data. This insight covers at least 90 percent of proposed economic policies.

10. Call your mom and dad once in a while. A time will come when you will want your own grown-up, busy, hyper-successful children to call you. Also, remember who paid your tuition to Princeton.

Congratulations, graduates. Give 'em hell.

1 1. Note to journalists: This is a joke. My leave from Princeton expired in 2005.

Brent, Cushing and $3.50 per gallon Gasoline

by Calculated Risk on 6/02/2013 11:38:00 AM

Oil prices have been declining. West Texas Intermediate (WTI) crude oil (quoted in terms of delivery in Cushing, Oklahoma) has fallen to $91.97 per barrel according to Bloomberg. Prices for Brent crude has fallen to $100.39 per barrel.

However national gasoline prices have only declined to $3.64 per gallon according to gasbuddy.com (graph at bottom).

For the last few years there have been some capacity issues at Cushing (see Jim Hamilton's post Prices of gasoline and crude oil for a discussion of the issues).

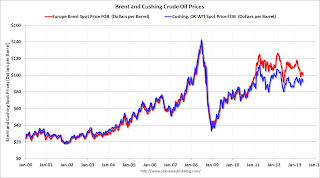

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the divergence between Brent and Cushing starting in 2011. As Hamilton noted:

[A]n increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.Recently the spread has been closing. At one point Brent was selling for about 25% more than WTI (even though they are comparable quality). Now the difference is under to 10%. (note: $100.39 per barrel for Brent, and $91.97 per barrel for WTI is about 9% difference).

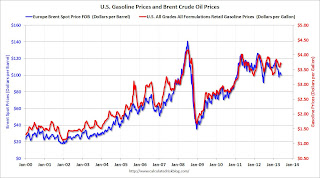

The second graph compares Cushing (WTI) crude oil prices (left axis) with U.S. gasoline prices (right axis).

The second graph compares Cushing (WTI) crude oil prices (left axis) with U.S. gasoline prices (right axis).Gasoline tracked WTI crude oil pretty well (with some noise), until 2011. Then - with the capacity issues at Cushing - gasoline prices have been much higher than the previous relationship just based on WTI.

As Hamilton noted:

The average retail price of gasoline in the United States historically has tracked the price of crude oil pretty closely, with each $1/barrel increase in the price of crude oil showing up as a 2.5-cent increase in the retail price of a gallon of gasoline. But the fact that the U.S. can sell refined petroleum markets at the world price means that for purposes of using that rule of thumb today, you'd want to look at the price of Brent rather than the price of WTI.

The third graph compares Brent crude oil prices (left axis) with U.S. gasoline prices (right axis).

The third graph compares Brent crude oil prices (left axis) with U.S. gasoline prices (right axis).This has been a much closer relationship over the last few years than for WTI and gasoline prices.

Right now - until the spread between WTI and Brent disappears - we need to continue to use Brent to estimate gasoline prices. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.35 per gallon. That is almost 30 cents below the current level according to Gasbuddy.com. There are probably some seasonal factors not included in the calculator, but if crude oil prices stay at the current level, we should expect national gasoline prices to fall below $3.50 per gallon.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, June 01, 2013

Zillow: Case-Shiller House Price Index expected to show over 12% year-over-year increase in April

by Calculated Risk on 6/01/2013 03:28:00 PM

The Case-Shiller house price indexes for April will be released Tuesday, June 25th. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Zillow makes a strong argument that the Case-Shiller index is currently overstating national house price appreciation.

Zillow: April Case-Shiller Composite To Show Annual Appreciation Above 12%

Buckle up, folks. If you thought the Case-Shiller numbers ... for March were eye-popping, just wait until next month. Our updated forecast indicates that the April 20-City Composite Case-Shiller Home Price Index (non-seasonally adjusted [NSA]) will rise 12.1 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will increase 11.4 percent from year-ago levels. The seasonally adjusted (SA) month-over-month change from March to April will be 1.7 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA).The following table shows the Zillow forecast for the April Case-Shiller index.

...

As we’ve described , the Case-Shiller indices are giving an inflated sense of national home value appreciation because they are biased toward the large, coastal metros currently seeing such enormous home value gains, and because they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed. In contrast, the ZHVI does not include foreclosure resales and shows home values for April 2013 up 5.2 percent from year-ago levels. We expect home value appreciation to continue to moderate in 2013, rising only 4 percent between April 2013 and April 2014. Further details on our forecast of home values can be found here, and more on Zillow’s full April 2013 report can be found here.

To forecast the Case-Shiller indices, we use the March Case-Shiller index level, as well as the April Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with April foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

| Zillow April Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Apr 2012 | 148.44 | 151.51 | 135.98 | 138.90 |

| Case-Shiller (last month) | Mar 2013 | 161.48 | 165.06 | 148.65 | 151.71 |

| Zillow Forecast | YoY | 11.4% | 11.4% | 12.1% | 12.1% |

| MoM | 2.4% | 1.7% | 2.5% | 1.7% | |

| Zillow Forecasts1 | 165.4 | 168.3 | 152.4 | 155.0 | |

| Current Post Bubble Low | 146.46 | 149.59 | 134.07 | 136.83 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Mar-12 | |

| Above Post Bubble Low | 12.9% | 12.5% | 13.7% | 13.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Schedule for Week of June 2nd

by Calculated Risk on 6/01/2013 11:21:00 AM

The key report this week is the May employment report on Friday.

Other key reports include the ISM manufacturing index on Monday, auto sales also on Monday, the Trade Balance report on Tuesday, and the ISM service index on Wednesday.

Also, the Federal Reserve will release the Q1 Flow of Funds report on Thursday.

9:00 AM: The Markit US PMI Manufacturing Index for May. The consensus is for the index to be unchanged at 52.1.

10:00 AM ET: ISM Manufacturing Index for May. The consensus is for an increase to 51.0 from 50.7 in April. Based on the regional surveys, a reading at or below 50 is possible.

10:00 AM ET: ISM Manufacturing Index for May. The consensus is for an increase to 51.0 from 50.7 in April. Based on the regional surveys, a reading at or below 50 is possible.Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in April at 50.7%. The employment index was at 50.2%, and the new orders index was at 52.3%.

10:00 AM: Construction Spending for April. The consensus is for a 1.0% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 15.2 million SAAR in May (Seasonally Adjusted Annual Rate) from 14.9 million SAAR in April.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to increase to 15.2 million SAAR in May (Seasonally Adjusted Annual Rate) from 14.9 million SAAR in April.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

8:30 AM: Trade Balance report for April from the Census Bureau.

8:30 AM: Trade Balance report for April from the Census Bureau. Exports declined slightly in March, and imports declined even more, so the deficit declined.

The consensus is for the U.S. trade deficit to increase to $41.2 billion in April from $38.8 billion in March.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 171,000 payroll jobs added in May.

10:00 AM: ISM non-Manufacturing Index for May. The consensus is for a reading of 53.8, up from 53.1 in April. Note: Above 50 indicates expansion, below 50 contraction.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for April. The consensus is for a 1.4% increase in orders.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 345 thousand from 354 thousand last week.

10:00 AM: Trulia Price Rent Monitors for May. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for May. The consensus is for an increase of 167,000 non-farm payroll jobs in May; the economy added 165,000 non-farm payroll jobs in April.

The consensus is for the unemployment rate to be unchanged at 7.5% in May.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through April.

The economy has added 6.8 million private sector jobs since employment bottomed in February 2010 (6.2 million total jobs added including all the public sector layoffs).

The economy has added 6.8 million private sector jobs since employment bottomed in February 2010 (6.2 million total jobs added including all the public sector layoffs).There are still 2.0 million fewer private sector jobs now than when the recession started in 2007.

3:00 PM: Consumer Credit for April from the Federal Reserve. The consensus is for credit to increase $14.0 billion in April.

Unofficial Problem Bank list declines to 761 Institutions

by Calculated Risk on 6/01/2013 08:04:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 31, 2013.

Changes and comments from surferdude808:

As expected, the FDIC released quarterly industry results for the first quarter on Wednesday and its enforcement action activity through April 2013 on Friday. Also, the FDIC closed a bank today. These actions contributed to many changes to the Unofficial Problem Bank List. In all, there were eight removals and two additions, which leave the list with 761 institutions with assets of $277.3 billion. A year ago, the list held 927 institutions with assets of $355.7 billion.

After the changes this week, assets declined by $6.5 billion. However, $4.9 billion of the decline came from asset shrinkage during the first quarter. For the month of May, the list declined by 14 institutions and assets by $8.0 billion. The month included five additions, four failures, four unassisted mergers, and 11 action terminations. Since March 2012, the 11 action terminations match the lowest total posted in October 2012. Along with industry quarterly results, the FDIC released the Official Problem Bank count of 612 institutions with assets of $213.3 billion. We anticipated the difference between the two lists to come in at 150 institutions, which was close to the actual difference of 149. The difference peaked at 185 in the second quarter of 2012.

Removals include the failed Banks of Wisconsin, Kenosha, WI ($134 million). The FDIC terminated actions against First Mariner Bank, Baltimore, MD ($1.3 billion Ticker: FMAR); Cornerstone Community Bank, Saint Petersburg, FL ($230 million); BANKWEST, Rockford, MN ($105 million); Bank of South Texas, McAllen, TX ($78 million); Metro Phoenix Bank, Phoenix, AZ ($76 million); Midwest Community Bank, Plainville, KS ($72 million); and First State Bank, Wilmot, SD ($38 million).

The two additions this week were Enterprise Bank of South Carolina, Ehrhardt, SC ($404 million) and North Milwaukee State Bank, Milwaukee, WI ($90 million).

There is nothing new to report on the status of Capitol Bancorp's banking subsidiaries, particularly 1st Commerce Bank, North Las Vegas ($24 million), which is subject to a sealed hearing on the ability of the Nevada Department of Business and Industry's Financial Institutions Division to terminate its banking charter. We will continue to monitor the status next week.