by Calculated Risk on 6/02/2013 11:38:00 AM

Sunday, June 02, 2013

Brent, Cushing and $3.50 per gallon Gasoline

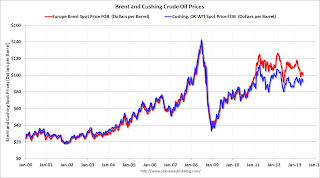

Oil prices have been declining. West Texas Intermediate (WTI) crude oil (quoted in terms of delivery in Cushing, Oklahoma) has fallen to $91.97 per barrel according to Bloomberg. Prices for Brent crude has fallen to $100.39 per barrel.

However national gasoline prices have only declined to $3.64 per gallon according to gasbuddy.com (graph at bottom).

For the last few years there have been some capacity issues at Cushing (see Jim Hamilton's post Prices of gasoline and crude oil for a discussion of the issues).

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the divergence between Brent and Cushing starting in 2011. As Hamilton noted:

[A]n increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.Recently the spread has been closing. At one point Brent was selling for about 25% more than WTI (even though they are comparable quality). Now the difference is under to 10%. (note: $100.39 per barrel for Brent, and $91.97 per barrel for WTI is about 9% difference).

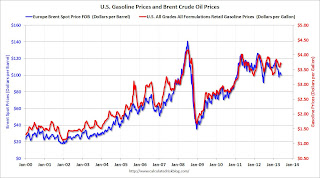

The second graph compares Cushing (WTI) crude oil prices (left axis) with U.S. gasoline prices (right axis).

The second graph compares Cushing (WTI) crude oil prices (left axis) with U.S. gasoline prices (right axis).Gasoline tracked WTI crude oil pretty well (with some noise), until 2011. Then - with the capacity issues at Cushing - gasoline prices have been much higher than the previous relationship just based on WTI.

As Hamilton noted:

The average retail price of gasoline in the United States historically has tracked the price of crude oil pretty closely, with each $1/barrel increase in the price of crude oil showing up as a 2.5-cent increase in the retail price of a gallon of gasoline. But the fact that the U.S. can sell refined petroleum markets at the world price means that for purposes of using that rule of thumb today, you'd want to look at the price of Brent rather than the price of WTI.

The third graph compares Brent crude oil prices (left axis) with U.S. gasoline prices (right axis).

The third graph compares Brent crude oil prices (left axis) with U.S. gasoline prices (right axis).This has been a much closer relationship over the last few years than for WTI and gasoline prices.

Right now - until the spread between WTI and Brent disappears - we need to continue to use Brent to estimate gasoline prices. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.35 per gallon. That is almost 30 cents below the current level according to Gasbuddy.com. There are probably some seasonal factors not included in the calculator, but if crude oil prices stay at the current level, we should expect national gasoline prices to fall below $3.50 per gallon.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |