by Calculated Risk on 5/27/2013 09:18:00 PM

Monday, May 27, 2013

Tuesday: Case-Shiller House Prices

From the WSJ: Lower Commodities Prices Provide Tailwind

Lower prices for commodities from cotton to copper are helping U.S. businesses by reducing their raw-material costs and buoying consumers by keeping a lid on prices paid.Not mentioned in the article, lumber prices are off about 20% from the recent high and oil prices are down over 10% from the February levels.

Copper, used in many goods including electronics, is off nearly 10% this year. Silver, which has various industrial uses, has tumbled more than 25%, and wheat is down more than 10%.

Tuesday economic releases:

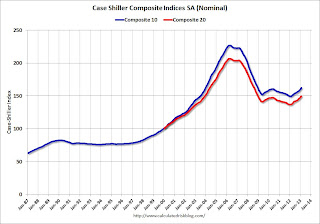

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March. The consensus is for a 10.2% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 9.8% year-over-year, and for prices to increase 0.9% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for May. The consensus is for a a reading of minus 3 for this survey, up from minus 6 in April (Below zero is contraction).

• Also at 10:00 AM, the Conference Board's consumer confidence index for May. The consensus is for the index to increase to 71.5 from 68.1.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for May. This is the last of regional surveys for May. The consensus is a reading of minus 8, up from minus 15 in April (below zero is contraction).

Weekend:

• Schedule for Week of May 26th

• Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

• States: Mo Money Mo Problems

The Asian markets are mixed tonight with the Nikkei down 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 9 and Dow futures are up 87 (fair value).

Oil prices are down slightly with WTI futures at $93.84 per barrel and Brent at $102.61 per barrel.

May Vehicle Sales forecast to be at or above 15 million SAAR

by Calculated Risk on 5/27/2013 06:23:00 PM

Note: The automakers will report May vehicle sales on Monday, June 3rd (next Monday). Here are a few forecasts:

From J.D. Power: J.D. Power and LMC Automotive Report: May New-Vehicle Retail Selling Rate Expected to be 1 Million Units Stronger than a Year Ago

Total light-vehicle sales in May 2013 are expected to increase to 1,439,400, up 8 percent from May 2012 [forecast is 15.2 million Seasonally Adjusted Annual Rate, SAAR]. Fleet sales have generally been weaker than expected in 2013, but continue to average nearly 21 percent of total sales. Fleet sales in May 2013 are projected to reach 281,000 units, representing less than 20 percent of total sales.From TrueCar: May 2013 New Car Sales Expected to Be Up Almost Nine Percent According to TrueCar; May 2013 SAAR at 15.2M, Highest May SAAR

...

Strong demand for full-size pickups is also helping to keep industry average transaction prices at record levels. The average transaction price for all new vehicles thus far in May is $28,921, the highest ever for the month of May and 3 percent higher than May 2012.

For May 2013, new light vehicle sales in the U.S. (including fleet) is expected to be 1,435,495 units, up 8.5 percent from May 2012 and up 12.1 percent from April 2013 (on an unadjusted basis).From Kelley Blue Book: New-car Sales To Improve 6 Percent In May With Help From Memorial Day Weekend Sale Events

The May 2013 forecast translates into a Seasonally Adjusted Annualized Rate ("SAAR") of 15.2 million new car sales, up from 14.9 April 2013 and up from 13.9 million in May 2012.

New-car sales will hit 15.0 million seasonally adjusted annual rate (SAAR) in May, which is an expected 6 percent year-over-year improvement, according to Kelley Blue Book ...Note: There were 1.33 million light vehicle sales in May 2012 or a 13.9 million SAAR. This year sales will probably be around 1.44 million with the same number of selling days - up about 8% from May 2012.

"Growth in the truck segment has been driven by a jump in new-home construction, relatively affordable gas prices and high inventory levels," said [Alec Gutierrez, senior market analyst of automotive insights for Kelley Blue Book.]

Two key points: 1) sales growth will slow in 2013, and 2) it appears auto sales were solid in May (no signs of a consumer slowdown).

Based on the first four months of 2013, it appears auto sales will increase again this year, but not double digit growth like the last few years. This suggests auto sales will contribute less to GDP growth this year than in the previous three years.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.2 | 5.3% |

| 1Sales rate for first four months of 2013. | ||

Public and Private Sector Payroll Jobs: Reagan, Bush, Clinton, Bush, Obama

by Calculated Risk on 5/27/2013 11:41:00 AM

Last month I posted two graphs comparing changes in public and private sector payrolls during the Bush and Obama presidencies. Several readers asked if I could add Presidents Reagan and Clinton (I've also added the single term of President George H.W. Bush).

Important: There are many differences between these periods. Overall employment was smaller in the '80s, so a better comparison might be to look at the percentage change, but this gives an overall view of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). President George H.W. Bush only served one term, and President Obama has just started his second term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

Click on graph for larger image.

Click on graph for larger image.

The employment recovery during Mr. G.W. Bush's first term was very sluggish, and private employment was down 946,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 665,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush, with 1,490,000 private sector jobs added.

Private sector employment increased by 20,864,000 under President Clinton and 14,688,000 under President Reagan.

There were only 1,933,000 more private sector jobs at the end of Mr. Obama's first term. A few months into Mr. Obama's second term, there are now 2,582,000 more private sector jobs than when he took office.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

A big difference between the presidencies has been public sector employment. Note the bumps in public sector employment due to the decennial Census in 1990, 2000, and 2010.

The public sector grew during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,748,000 jobs).

However the public sector has declined significantly since Mr. Obama took office (down 739,000 jobs). These job losses have mostly been at the state and local level, but they are still a significant drag on overall employment.

Looking forward, I expect the economy to continue to expand for the next few years, so I don't expect a sharp decline in employment as happened at the end of Mr. Bush's 2nd term (In 2005 and 2006 I was warning of a coming recession due to the bursting of the housing bubble).

A big question is when the public sector layoffs will end. It appears the cutbacks are mostly over at the state and local levels, but there are ongoing cutbacks at the Federal level.

Sunday, May 26, 2013

Gasoline Prices: Down slightly from last year on Memorial Day

by Calculated Risk on 5/26/2013 03:59:00 PM

According to Gasbuddy.com (see graph at bottom), gasoline prices are down slightly over the last few days to a national average of $3.66 per gallon. One year ago for the week of Memorial Day, prices were at $3.67 per gallon, and for the same week two years ago prices were $3.85 per gallon.

| Memorial Day | Weekly Average Gasoline Price |

|---|---|

| 28-May-07 | $3.25 |

| 26-May-08 | $3.99 |

| 25-May-09 | $2.57 |

| 31-May-10 | $2.78 |

| 30-May-11 | $3.85 |

| 28-May-12 | $3.67 |

| 27-May-13 | $3.66 |

According to Bloomberg, WTI oil is at $94.15 per barrel, and Brent is at $102.64 per barrel. Last year on Memorial Day, Brent was at $107.86 per barrel, and two years ago Brent was at $114.85.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.40 per gallon. That is about 26 cents below the current level according to Gasbuddy.com, however I think there is a seasonal factor that isn't included in the calculator.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

States: Mo Money Mo Problems

by Calculated Risk on 5/26/2013 10:15:00 AM

From the NY Times: California Faces a New Quandary, Too Much Money

After years of grueling battles over state budget deficits and spending cuts, California has a new challenge on its hand: too much money. An unexpected surplus is fueling an argument over how the state should respond to its turn of good fortune.A few comments:

The amount is a matter of debate, but by any measure significant: between $1.2 billion, projected by Gov. Jerry Brown, and $4.4 billion, the estimate of the Legislature’s independent financial analyst.

...

At least seven other states — among them Connecticut, Utah and Wisconsin — have reported budget surpluses in recent weeks, setting the stage for legislative battles that, if not as wrenching as the ones over cuts, promise to be no less pitched. Lawmakers are debating whether the new money should be used to restore programs cut during the recession, finance tax cuts or put into a rainy-day fund for future needs.

1) At the least, this means that the fiscal drag at the state and local levels is mostly over. This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

However the drag from state and local governments has continued. The drag from state and local governments has been a relentless drag on the economy. Just ending this drag will be a positive for the economy. Note: In real terms, state and local government spending is back to early 2001 levels.

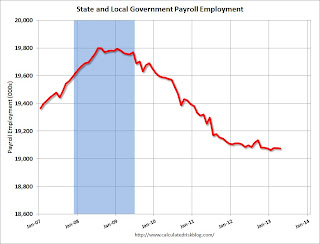

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) State and local employment is unchanged so far in 2013.

Of course the Federal government layoffs are ongoing with many more layoffs expected due to the sequestration spending cuts.

2) The article notes three possibilities for the small surpluses: "restore programs cut during the recession, finance tax cuts or put into a rainy-day fund". With the surpluses just starting, I think tax cuts should be off the table (they are too hard to reverse if revenue falters). My suggestion would be to pay down debt (rainy-day fund) and cautiously restore some cuts.

3) Last November, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”Nice to see it is happening in other states too.

Saturday, May 25, 2013

How to Calculate Q2 Personal Consumption Expenditure (PCE) Growth

by Calculated Risk on 5/25/2013 05:05:00 PM

In the schedule for the coming week, I mentioned that the consensus is for personal consumption expenditures (PCE) to be unchanged in April compared to March. Does this mean PCE might not grow in Q2?

First, we don't know the actual number for April yet - and we don't know about May and June - but even if PCE were flat for all three months compared to March, quarterly PCE would grow 1.3% in Q2. This is because quarterly PCE is calculated as an average of the current quarter divided by the average for the previous quarter (seasonally adjusted and annualized).

The following table shows how this works. For Q4 2012, PCE averaged $9,663.8 SAAR (Seasonally Adjusted Annual Rate, billions, 2005 dollars). For Q1 2013, PCE averaged $9,740.0.

If we divided $9,740.0 by $9,663.8 we get 1.007885. Then annualize (take to the fourth power) and subtract 1, and the growth rate is 3.2% (just what the BEA reported for PCE growth in Q1).

If we do the same calculation for Q2, even if PCE is flat for all three months in Q2 (April, May and June), PCE will grow by 1.3% in Q2.

| Q2 Personal Consumption Expenditure (PCE) Growth | ||||

|---|---|---|---|---|

| Quarter | Month | Real PCE, SAAR 2005 dollars (Billions) | Qtr Average | Qtr Growth Rate |

| Oct-12 | $9,629.5 | |||

| Q4 | Nov-12 | $9,673.0 | $9,663.8 | |

| Dec-12 | $9,689.0 | |||

| Jan-13 | $9,708.7 | |||

| Q1 | Feb-13 | $9,740.3 | $9,740.0 | 3.2% |

| Mar-13 | $9,771.1 | |||

| Apr-13 | $9,771.11 | |||

| Q2 | May-13 | $9,771.1 | 1.3% | |

| Jun-13 | ||||

| 1Consensus forecast for April 2013 | ||||

If instead we just compare April to January, PCE would be growing at a 2.6% annual rate in Q2. This is one of the reasons several analysts have recently upgraded their forecasts for Q2 GDP. It appears likely that PCE growth will be above 2% in Q2. Of course government spending - especially Federal government spending - will probably remain a drag on GDP in Q2 (there has been record shrinkage of the public sector over the last several years).

The following graph shows real Personal Consumption Expenditures (PCE) through March (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE.

Since PCE grew at just under a 4% annualized rate in February and March (and quarterly PCE is an average for the quarter), if PCE is flat in April, May and June, PCE already has some growth built in for Q2 compared to Q1.

Schedule for Week of May 26th

by Calculated Risk on 5/25/2013 11:26:00 AM

The key reports this week are the second estimate of Q1 GDP on Thursday, the April Personal Income and Outlays report on Friday, and the Case-Shiller house prices for March on Tuesday.

The FDIC will probably release the Q1 Quarterly Banking Profile this week (no scheduled date).

All US markets will be closed in observance of Memorial Day.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March.

9:00 AM: S&P/Case-Shiller House Price Index for March. Although this is the March report, it is really a 3 month average of January, February and March. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through February 2012 (the Composite 20 was started in January 2000).

The consensus is for a 10.2% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 9.8% year-over-year, and for prices to increase 0.9% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for May. The consensus is for the index to increase to 71.5 from 68.1.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May. The consensus is for a a reading of minus 3 for this survey, up from minus 6 in April (Below zero is contraction).

10:30 AM: Dallas Fed Manufacturing Survey for May. This is the last of regional surveys for May. The consensus is a reading of minus 8, up from minus 15 in April (below zero is expansion).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims at 340 thousand, unchanged from last week.

8:30 AM: Q1 GDP (second estimate). This is the second estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 2.5% annualized in Q1, unrevised from the advance report.

10:00 AM ET: Pending Home Sales Index for April. The consensus is for a 1.4% increase in the index.

8:30 AM ET: Personal Income and Outlays for April. The consensus is for a 0.1% increase in personal income in April, and for no change in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for an increase to 50.0, up from 49.0 in April.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 83.7.

Unofficial Problem Bank list declines to 767 Institutions

by Calculated Risk on 5/25/2013 10:01:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 24, 2013.

Changes and comments from surferdude808:

This week the Unofficial Problem Bank List declined to 767 institutions with assets of $283.7 billion after four removals and one addition. A year ago, the list held 931 institutions with assets of $358.0 billion. The removals were all from unassisted mergers including Centennial Bank, Fountain Valley, CA ($546 million); The Washington Savings Bank, FSB, Bowie, MD ($357 million); First National Bank of Baldwin County, Foley, AL ($187 million); and Kinderhook State Bank, Kinderhook, IL ($18 million). The addition was The Talbot Bank of Easton, Easton, MD ($713 million Ticker: SHBI).On the unofficial list:

The legal hearing in Nevada on Capitol Bancorp's restraining order to prevent the closing of 1st Commerce Bank, North Las Vegas ($24 million) was sealed by the presiding judge. So there is nothing new to report on that matter. Next week, we anticipate the FDIC will release its enforcement action activity through April 2013 and, perhaps, industry results for the first quarter of 2013, which will include updated figures for the Official Problem Bank List. The institution count difference between the official and the unofficial list was 157 at the last quarterly release and the difference will likely reduce to around 150.

Because the FDIC does not publish the official list, a proxy or unofficial list can be developed by reviewing press releases and published formal enforcement actions issued by the three federal banking regulators, reviewing SEC filings, or through media reports and company announcements describing that the bank is under a formal enforcement action. For the most part, the official problem bank list is comprised of banks with a safety & soundness CAMELS composite rating of 4 or 5 (the banking regulators use the FFIEC rating system known as CAMELS, which stands for the components that receive a rating including Capital adequacy, Asset quality, Management quality, Earnings strength, Liquidity strength, and Sensitivity to market risk. A composite rating is assigned from the components, but it does not result from a simple average of the components. The composite and component rating scale is from 1 to 5, with 1 being the strongest). Customarily, a banking regulator will only issue a safety & soundness formal enforcement when a bank has a composite CAMELS rating of 4 or 5, which reflects an unsafe & unsound financial condition that if not corrected could result in failure. There is high positive correlation between banks with a safety & soundness composite rating of 4 or worse and those listed on the official list. For example, many safety & soundness enforcement actions state in their preamble that an unsafe & sound condition exists, which is the reason for action issuance.

Since 1991, the banking regulators have statutorily been required to publish formal enforcement actions. For many reasons, the banking regulators have a general discomfort publishing any information on open banks especially formal enforcement actions, so not much energy is expended on their part ensuring the completeness of information in the public domain or making its retrieval simple. Given the difficulty for easy retrieval of all banks operating under a safety & soundness formal enforcement action, the unofficial list fills this void as a matter of public interest.

All of the banks on the unofficial list have received a safety & soundness formal enforcement action by a federal banking regulator or there is other information in the public domain such as an SEC filing, media release, or company statement that describe the bank being issued such an action. No confidential or non-public information supports any bank listed and a hypertext link to the public information is provided in the spreadsheet listing. The publishers make every effort to ensure the accuracy of the unofficial list and welcome all feedback and any credible information to support removal of any bank listed erroneously.

Friday, May 24, 2013

Labor Force Participation Rate Sensitivity

by Calculated Risk on 5/24/2013 09:25:00 PM

This morning I posted some comments from Michelle Meyer at Merrill Lynch on the likely path of the labor force participation rate. She wrote:

[W]e forecast the LFPR will slip slightly this year, but with a stronger recovery under way next year, the LFPR should start to level off some and potentially increase beginning in 2015.The following table is an estimate of the unemployment rate in December 2013 and December 2014 assuming the LFPR stays close to the current level of 63.3% (I looked at 63.0%, 63.3% and 63.6%). The current unemployment rate is 7.5%.

I also looked at three rates of payroll job growth, 167 thousand per month, 185 thousand per month and 200 thousand per month. I think it is possible that employment growth will pick up later this year, and if that happens, the unemployment rate will fall further in 2014.

Caveat: The payroll estimate is for the establishment survey, and the unemployment rate and participation rate are from the household survey - and this is just a rough estimate.

Looking at the table, the participation rate is very important for estimating the unemployment rate. If the participation rate stays steady, the unemployment rate will probably be close to 7.1% in December at the current rate of payroll growth, and around 6.6% in December 2014. If the participation rate dips further, the unemployment rate could fall below 7% this year and low 6%s at the end of 2014.

| December 2013 Unemployment Rate | |||

|---|---|---|---|

| Jobs added per month (000s) | |||

| Participation Rate | 167 | 183 | 200 |

| 63.0% | 6.8% | 6.7% | 6.6% |

| 63.3% | 7.2% | 7.1% | 7.1% |

| 63.6% | 7.6% | 7.5% | 7.4% |

| December 2014 Unemployment Rate | |||

| Jobs added per month (000s) | |||

| Participation Rate | 167 | 183 | 200 |

| 63.0% | 6.4% | 6.2% | 6.0% |

| 63.3% | 6.8% | 6.6% | 6.4% |

| 63.6% | 7.2% | 7.0% | 6.7% |

Lawler: Vegas Housing Market: “Sizzlin’ Hot,” and Yet So Cold

by Calculated Risk on 5/24/2013 03:06:00 PM

From housing economist Tom Lawler:

Dataquick released its April report on Las Vegas home sales based on property records in Clark County, Nevada, and the report portrayed “mixed” news on the health of the Vegas housing market. Here are some summary stats on home sales and median prices, as well as various shares of sales in the report.

| Selected Share of New And Resale Home Sales, Las Vegas | ||

|---|---|---|

| Apr-12 | Apr-13 | |

| Absentee Buyer Share of Total Sales | 50.5% | 53.1% |

| All-Cash Share of Total Sales | 53.6% | 56.6% |

| Foreclosure Share of Resales | 43.7% | 12.2% |

| Estimated Short-Sales Share of Resales | 29.4% | 30.3% |

| Las Vegas-Paradise, Nevada Home Sales | ||||

|---|---|---|---|---|

| Number of sales | Apr-12 | Mar-13 | Apr-13 | YOY % Change |

| Resale houses | 3,233 | 2,998 | 3,309 | 2.4% |

| Resale condos | 807 | 803 | 848 | 5.1% |

| New homes | 510 | 684 | 712 | 39.6% |

| All homes | 4,550 | 4,485 | 4,869 | 7.0% |

| Median sale price | Apr-12 | Mar-13 | Apr-13 | YOY % Change |

| Resale houses | $122,000 | $155,199 | $160,000 | 31.1% |

| Resale condos | $60,000 | $79,995 | $84,948 | 41.6% |

| New homes | $197,320 | $220,000 | $234,981 | 19.1% |

| All homes | $119,000 | $155,000 | $160,000 | 34.5% |

The report also included some stats on buyers of multiple homes, as well as median home prices for absentee-buyer and all-cash home sales.

Based on the share and other data in the report, here are some “derived” stats for home sales by various “cuts.” Also included are partial data for April 2011 based on last year’s report. (Note: The short-sales share for April 2011 is not available, because Dataquick revised its methodology for estimating short sales in the latter part of last year but has not released historical revisions to the public.)

From several perspectives the data suggest that the Vegas market has been “sizzlin’ hot,” mainly reflecting increased buying from investors despite huge declines in the number of “distressed” properties for sale. To others, however, the lack of any growth in homes purchased by folks who plan to live in the purchased home suggests that the Vegas market is disturbingly “cold.”

| April Home Sales, Las Vegas Region | April 2013 vs | ||||

|---|---|---|---|---|---|

| Apr-11 | Apr-12 | Apr-13 | Apr-11 | Apr-12 | |

| Total | 4,490 | 4,550 | 4,869 | 8.4% | 7.0% |

| New | 399 | 510 | 712 | 78.4% | 39.6% |

| Existing | 4,091 | 4,040 | 4,157 | 1.6% | 2.9% |

| Absentee Buyer | 2,128 | 2,298 | 2,585 | 21.5% | 12.5% |

| Primary Residence | 2,362 | 2,252 | 2,284 | -3.3% | 1.4% |

| All-Cash | 2,425 | 2,439 | 2,756 | 13.6% | 13.0% |

| Mortgage Financed | 2,065 | 2,111 | 2,113 | 2.3% | 0.1% |

| Foreclosure Resales | 2,279 | 1,765 | 507 | -77.8% | -71.3% |

| Short-Sales Resales | N/A | 1,188 | 1,260 | N/A | 6.1% |

| Distressed Resales | N/A | 2,953 | 1,767 | N/A | -40.2% |

| Ex-Foreclosure Resales | 1,812 | 2,275 | 3,650 | 101.4% | 60.4% |

| Ex-Distressed Resales | N/A | 1,087 | 2,390 | N/A | 119.9% |

| Ex-Foreclosure Total | 2,211 | 2,785 | 4,362 | 97.3% | 56.6% |

| Ex-Distressed Total | N/A | 1,597 | 3,102 | N/A | 94.2% |

| Multi-Home Buyers | N/A | 454 | 813 | N/A | 79.1% |

| 10+ Buyers | N/A | 81 | 360 | N/A | 344.4% |

| Median Sales Price | April 2013 vs | ||||

| Apr-11 | Apr-12 | Apr-13 | Apr-11 | Apr-12 | |

| Resale Home | $125,000 | $122,000 | $160,000 | 28.0% | 31.1% |

| Resale Condo | $61,000 | $60,000 | $84,948 | 39.3% | 41.6% |

| New Home | $190,000 | $197,320 | $234,981 | 23.7% | 19.1% |

| All Homes | $117,000 | $119,000 | $160,000 | 36.8% | 34.5% |

| Absentee | $99,000 | $96,000 | $136,000 | 37.4% | 41.7% |

| All-Cash | $90,000 | $89,900 | $135,000 | 50.0% | 50.2% |

The numbers that have gotten the most attention, of course, are the median sales prices, which are way up from their lows. This partly reflects the huge decline in foreclosure resales, but also reflects continued increases in “absentee” buyer (mostly investor) purchases of homes in Vegas, despite the plunge in the number of foreclosure (as well as overall “distressed”) home sales.

From the standpoint of overall home sales, the recent sales increase despite the sizable drop in “distressed” home sales -- “ex-distressed” home sales this April were up 94.2% from last April – seems rather remarkable. In addition, the sizable jump in new home sales both this year and last year – albeit from extremely low levels – is “encouraging.” What is equally remarkable but less encouraging (at least to some) is that purchases by buyers for their primary residence last month were virtually unchanged from last year, and down from two years ago. Homes purchased by absentee buyers (identified by buyers who indicated that the property tax bill would go to a different address than the property purchased) continued to increase, with the biggest increases coming from buyers who purchased one or more homes, with homes purchased by “entities” that purchased 10 or more homes jumping sharply. (Dataquick notes that some “individuals and partnerships” purchase homes under multiple names, so the “multi-home” buyer numbers may be understated).

CR Note: This was from Tom Lawler.