by Calculated Risk on 5/29/2013 12:03:00 PM

Wednesday, May 29, 2013

Reports: Small Business Credit Improving

From J.D. Harrison at the WaPo: Small business lending freeze starting to thaw

The credit health of small companies across the country improved during the first quarter of 2013, according to a new report by Experian and Moody’s Analytics ... Sageworks, a financial information firm, released its latest private company report earlier this week, which shows that the average risk of business loan default has dropped to 4.1 percent from 5.1 percent last April.Small businesses have been slow to recover, partially because so many small businesses are real estate and retail related. Improving credit is a positive sign and might lead to more small business hiring.

...

“The improvement in default rates coupled with healthy sales and profitability show that private companies may be well positioned to borrow,” said Sageworks Chairman Brian Hamilton.

The small business lending Index from Direct Capital, which provides equipment leasing and business loans, backs up that claim, showing that small business borrowing demand ticked higher nationwide for the fourth straight month in April. Over that period, the number of small business owners seeking loans has surged 44 percent compared to the first four months of 2012.

But are they actually finding the capital they need? More and more of them, yes, according to online lending platform Biz2Credit’s monthly survey.

The report showed the nation’s largest banks approved 16.8 percent of small business loans in April, up from 15.7 percent in March and 10.6 percent in April 2012.

FDIC reports Record Earnings for insured institutions, Fewer Problem banks, Residential REO Declines in Q1

by Calculated Risk on 5/29/2013 10:15:00 AM

The FDIC released the Quarterly Banking Profile for Q1 today.

Improvements in noninterest income and expense, plus broad-based reductions in loan loss provisions, outweighed declining net interest income and helped lift industry earnings to an all-time high of $40.3 billion in first quarter 2013. First-quarter net income was $5.5 billion (15.8 percent) higher than in first quarter 2012, as a reduction in expenses for litigation costs and proceeds from a legal settlement boosted reported earnings. Half of all insured institutions reported year-over-year improvement in quarterly earnings, the lowest proportion since fourth quarter 2009.The FDIC reported the number of problem banks declined:

The number of FDIC-insured institutions reporting financial results fell to 7,019 in the first quarter, down from 7,083 in fourth quarter 2012. Mergers absorbed 55 institutions during the quarter, and four institutions failed. This is the smallest number of failures in a quarter since second quarter 2008. For a 7th consecutive quarter, no new insured institutions were added. Except for charters created to absorb failed banks, there have been no new charters added since fourth quarter 2010. The number of insured institutions on the FDIC’s “Problem List” declined for an eighth consecutive quarter, from 651 to 612. Total assets of “problem” institutions declined from $233 billion to $213 billion. The number of full-time equivalent employees at insured institutions fell from 2,110,276 to 2,102,839 during the quarter.

Click on graph for larger image.

Click on graph for larger image.The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $8.34 billion in Q4 2012 to $7.89 billion in Q1. This is the lowest level of REOs since Q4 2007. Even in good times, the FDIC insured institutions have about $2.5 billion in residential REO.

This graph shows the dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

MBA: Mortgage Purchase Applications increase, Refinance Applications decline sharply in latest survey

by Calculated Risk on 5/29/2013 09:14:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 12 percent, the largest single week drop in refinance applications this year, from the previous week to the lowest level since December 2012. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

...

"Refinance applications fell for the third straight week bringing the refinance index to its lowest level since December 2012 as mortgage rates increased to their highest level in a year,” said Mike Fratantoni, MBA’s Vice President of Research and Economics. “Rates rose in response to stronger economic data and an increasing chance that the Fed may soon begin to taper their asset purchases."

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.90 percent, the highest rate since May 2012, from 3.78 percent, with points unchanged at 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

However the index is down almost 30% over the last three weeks, and this is the lowest level since last December.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up about 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up about 10% from a year ago.

Tuesday, May 28, 2013

Wednesday: FDIC Quarterly Banking Profile

by Calculated Risk on 5/28/2013 09:19:00 PM

Earlier on house prices:

• Case-Shiller: Comp 20 House Prices increased 10.9% year-over-year in March

• Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

And from Nick Timiraos at the WSJ about concerns of a new bubble: Home Sales Power Optimism

The pace of home-price gains has raised concerns among some economists over whether low mortgage rates have stimulated unsustainable home-price inflation—the proverbial bubble that some critics of Fed policies have feared. ...And from Catherine Rampell at the NY Times: Homes See Biggest Price Gain in Years, Propelling Stocks

The worries about rapid price growth look especially founded in more expensive markets such as San Francisco, Los Angeles and San Diego that have witnessed double-digit price gains over the past year. While home prices still look cheap on a historical basis, "the trouble is that that impression is almost entirely the function of low mortgage rates," said Stan Humphries, chief economist at Zillow Inc. Cheap credit is "distorting housing considerably," he said.

Others say it's too soon for alarm. Price gains largely reflect a rebound from low levels and prices remain largely in line with their long-run relationship between incomes and rents, said Christopher Thornberg, an economist with Beacon Economics in Los Angeles. "Could this thing go on too long? Absolutely," he said. "Could it turn into the next bubble? Absolutely. But we're not there yet, so I'm not going to start screaming 'Bubble.' "

Economists generally expect home prices to continue rising, particularly as the economy improves and more young people move out of their parents’ homes and into homes of their own. And many dismiss concerns of a potential bubble, not only because household formation is growing but also because housing prices remain well below their highs. Even after 10 straight months of year-over-year gains, the 20-city Case-Shiller composite price index is 28 percent below its previous peak in July 2006, which is probably a good thing.Wednesday economic releases:

“Talk of a house price bubble seems premature,” said Ed Stansfield, an economist at Capital Economics. “In relation to incomes, rents or their own past, U.S. home prices still look low.”

What’s more, credit is still hard to come by. The Federal Reserve has pushed interest rates down about as far as they can go, but many people who want to buy are still finding it difficult to get a home loan.

“We usually think of bubbles as being driven by extremely easy credit, with people borrowing more than the outstanding value of the house and making little to no down payment,” said Mr. Gapen. “That’s not the case with credit standards today.”

• At 7:00 AM ET, Update: Because of the holiday, this will probably be released on Thursday. the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. Look for rising mortgage rates.

• At 10:00 AM, the FDIC will release the Q1 Quarterly Banking Profile and hold "a press conference to discuss a comprehensive summary of the first quarter 2013 financial results for all FDIC-insured institutions". The webcast of the press conference will be available here.

4% 30 Year Mortgage Rates?

by Calculated Risk on 5/28/2013 06:34:00 PM

From Zillow today: 30-Year Fixed Mortgage Rates Rise to 12-Month Highs; Current Rate is 3.71%

Mortgage rates for 30-year fixed mortgages rose this week, with the current rate borrowers were quoted on Zillow Mortgage Marketplace at 3.71 percent, up from 3.58 percent at this same time last week.Here is an update to an old graph - by request - that shows the relationship between the monthly 10 year Treasury Yield and 30 year mortgage rates from the Freddie Mac survey.

The 30-year fixed mortgage rate hovered between 3.65 and 3.68 percent for the majority of the week before rising to the current rate this morning.

“Rates spiked last week after meeting minutes revealed the Fed was contemplating scaling back economic stimulus plans much earlier than expected,” said Erin Lantz, director of Zillow Mortgage Marketplace. “Now at 12-month highs, we expect rates to remain stable in the near-term, but new direction from the Fed and employment figures could boost rates significantly.”

Click on graph for larger image.

Click on graph for larger image.Currently the 10 year Treasury yield is 2.135% and 30 year mortgage rates are at 3.71% (according to Zillow). Based on the relationship from the graph, if the ten year yield stays in this range, 30 year mortgage rates might move up to around 4%.

Note: The yellow markers are for the last three years with the ten year yield below 3%. A trend line through the yellow markers only is a little lower, but still close to 4% at the current 10 year Treasury yield.

Existing Home Inventory is up 16.4% year-to-date on May 27th

by Calculated Risk on 5/28/2013 02:24:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

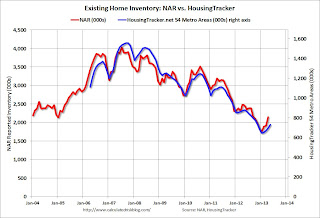

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for April). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 16.4%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.5% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases to slow.

This graph shows the NAR estimate of existing home inventory through April (left axis) and the HousingTracker data for the 54 metro areas through late May.

This graph shows the NAR estimate of existing home inventory through April (left axis) and the HousingTracker data for the 54 metro areas through late May.

Since the NAR released their revisions for sales and inventory in 2011, the NAR and HousingTracker inventory numbers have tracked pretty well.

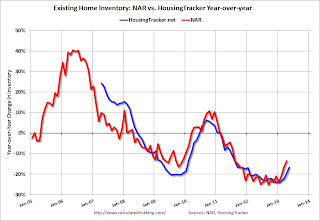

The third graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The year-over-year declines will probably continue to get smaller all year.

The year-over-year declines will probably continue to get smaller all year.

Right now I think inventory bottomed early this year, and, if correct, the year-over-year change will be zero late this year (or early in 2014).

Real House Prices, Price-to-Rent Ratio, City Prices relative to 2000

by Calculated Risk on 5/28/2013 11:49:00 AM

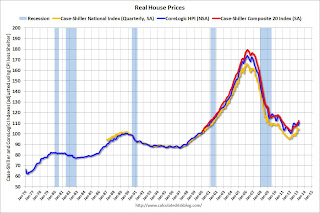

Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

As an example, if a house price was $200,000 in January 2000, the price would be close to $275,000 today adjusted for inflation. This is why economists also look at real house prices (inflation adjusted).

Note: If were I "wishcasting" as opposed to "forecasting", I'd like to see real house prices mostly move sideways for a few years. But given the low level of inventory, pent up demand, significant investor buying, and some bounce off the bottom in certain areas - real prices have been increasing fairly rapidly over the last year. I expect more inventory to come on the market and for price increases to slow.

Earlier: Case-Shiller: Comp 20 House Prices increased 10.9% year-over-year in March

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2013), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through March) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q3 2003 levels (and also back up to Q4 2008), and the Case-Shiller Composite 20 Index (SA) is back to December 2003 levels, and the CoreLogic index (NSA) is back to February 2004.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q2 2000 levels, the Composite 20 index is back to March 2001, and the CoreLogic index back to March 2001.

In real terms, house prices are back to early '00s levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q2 2000 levels, the Composite 20 index is back to February 2001 levels, and the CoreLogic index is back to March 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to early 2000 levels.

Nominal Prices: Cities relative to Jan 2000

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

The last graph shows the bubble peak, the post bubble minimum, and current nominal prices relative to January 2000 prices for all the Case-Shiller cities in nominal terms.

As an example, at the peak, prices in Phoenix were 127% above the January 2000 level. Then prices in Phoenix fell slightly below the January 2000 level, and are now up 32% above January 2000. Some cities - like Denver and Dallas - are close to the peak level. Detroit prices are still below the January 2000 level.

Dallas and Richmond Fed: Regional Manufacturing Activity mixed in May

by Calculated Risk on 5/28/2013 10:30:00 AM

These are the last two regional manufacturing surveys for May. From the Richmond Fed: Manufacturing Activity Declined At A Slightly Slower Rate In May; Expectations Improved

Manufacturing activity in the central Atlantic region contracted at a less pronounced rate in May after pulling back in April, according to the Richmond Fed’s latest survey. ...And from the Dallas Fed: Texas Manufacturing Activity Expands

In May, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — gained four points settling at −2 from April's reading of −6. Among the index's components, shipments recouped seventeen points to 8, the gauge for new orders slipped two points to finish at −10, and the jobs index subtracted six points to end at −3.

Texas factory activity increased sharply in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from -0.5 to 11.2, indicating a notable pickup in output.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Stronger manufacturing activity was reflected in other survey measures as well. The new orders index rebounded to 6.2 after falling to -4.9 in April. Similarly, the shipments index bounced back to 3.1 after dipping to -0.4. The capacity utilization index came in at 6.4, up from 2.7 last month.

Perceptions of broader business conditions continued to worsen in May. The general business activity index remained negative but moved up five points to -10.5. The company outlook index declined from -2.2 to -6.8, reaching its lowest level since July 2010.

Labor market indicators reflected weaker labor demand. The employment index fell to -6.3 in May, registering its first negative reading this year and reaching its lowest level since November 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The ISM index for May will be released Monday, June 3rd, and these surveys suggest another weak reading, possibly even at or below 50 (contraction).

Case-Shiller: Comp 20 House Prices increased 10.9% year-over-year in March

by Calculated Risk on 5/28/2013 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March ("March" is a 3 month average of January, February and March prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the Q1 national index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Prices See Strong Gains in the First Quarter of 2013 According to the S&P/Case-Shiller Home Price Indices

Data through March 2013, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices ... showed that all three composites posted double-digit annual increases. The 10-City and 20-City Composites increased by 10.3% and 10.9% in the year to March with the national composite rising by 10.2% in the last four quarters. All 20 cities posted positive year-over-year growth.

In the first quarter of 2013, the national composite rose by 1.2%. On a monthly basis, the 10- and 20-City Composites both posted increases of 1.4%. Charlotte, Los Angeles, Portland, Seattle and Tampa were the five MSAs to record their largest month-over-month gains in over seven years.

“Home prices continued to climb,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Home prices in all 20 cities posted annual gains for the third month in a row. Twelve of the 20 saw prices rise at double-digit annual growth. The National Index and the 10- and 20-City Composites posted their highest annual returns since 2006.

“Phoenix again had the largest annual increase at 22.5% followed by San Francisco with 22.2% and Las Vegas with 20.6%. Miami and Tampa, the eastern end of the Sunbelt, were softer with annual gains of 10.7% and 11.8%. The weakest annual price gains were seen in New York (+2.6%), Cleveland (+4.8%) and Boston (+6.7%); even these numbers are quite substantial.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 27.3 % from the peak, and up 1.5% in March (SA). The Composite 10 is up 10.3% from the post bubble low set in Jan 2012 (SA).

The Composite 20 index is off 26.6% from the peak, and up 1.3% (SA) in March. The Composite 20 is up 10.9% from the post-bubble low set in Jan 2012 (SA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 10.2% compared to March 2012.

The Composite 20 SA is up 10.9% compared to March 2012. This was the tenth consecutive month with a year-over-year gain and this was the largest year-over-year gain for the Composite 20 index since 2006.

Prices increased (SA) in 20 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 53.6% from the peak, and prices in Denver only off 0.1% from the peak.

This was above the consensus forecast for a 10.2% YoY increase. I'll have more on prices later.

LPS: House Price Index increased 1.4% in March, Up 7.6% year-over-year

by Calculated Risk on 5/28/2013 07:31:00 AM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses March closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 1.4 Percent for the Month; Up 7.6 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on March 2013 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 19.5% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 49.0% from the peak in Las Vegas, 37.3% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and at a new peak in Austin, Dallas and Denver! (Also a new peak for the state of Texas).

Note: Case-Shiller for March will be released this morning.