by Calculated Risk on 5/26/2013 10:15:00 AM

Sunday, May 26, 2013

States: Mo Money Mo Problems

From the NY Times: California Faces a New Quandary, Too Much Money

After years of grueling battles over state budget deficits and spending cuts, California has a new challenge on its hand: too much money. An unexpected surplus is fueling an argument over how the state should respond to its turn of good fortune.A few comments:

The amount is a matter of debate, but by any measure significant: between $1.2 billion, projected by Gov. Jerry Brown, and $4.4 billion, the estimate of the Legislature’s independent financial analyst.

...

At least seven other states — among them Connecticut, Utah and Wisconsin — have reported budget surpluses in recent weeks, setting the stage for legislative battles that, if not as wrenching as the ones over cuts, promise to be no less pitched. Lawmakers are debating whether the new money should be used to restore programs cut during the recession, finance tax cuts or put into a rainy-day fund for future needs.

1) At the least, this means that the fiscal drag at the state and local levels is mostly over. This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

Click on graph for larger image.

Click on graph for larger image.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

However the drag from state and local governments has continued. The drag from state and local governments has been a relentless drag on the economy. Just ending this drag will be a positive for the economy. Note: In real terms, state and local government spending is back to early 2001 levels.

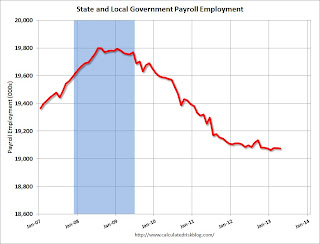

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) State and local employment is unchanged so far in 2013.

Of course the Federal government layoffs are ongoing with many more layoffs expected due to the sequestration spending cuts.

2) The article notes three possibilities for the small surpluses: "restore programs cut during the recession, finance tax cuts or put into a rainy-day fund". With the surpluses just starting, I think tax cuts should be off the table (they are too hard to reverse if revenue falters). My suggestion would be to pay down debt (rainy-day fund) and cautiously restore some cuts.

3) Last November, I was interviewed by Joe Weisenthal at Business Insider. One of my comments during our discussion on state and local governments was:

I wouldn’t be surprised if we see all of a sudden a report come out, “Hey, we’ve got a balanced budget in California.”Nice to see it is happening in other states too.