by Calculated Risk on 5/24/2013 01:13:00 PM

Friday, May 24, 2013

Update: The Two Bottoms for Housing

By request, I've updated the graphs in this post with the most recent data. Last year when I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Now it is, and here is another update to that graph.

Click on graph for larger image.

Click on graph for larger image.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the recent housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

We could use any of these three measures to determine the first bottom, and then use the other two to confirm the bottom. These measure are very important and are probably the best leading indicators for the economy. But this says nothing about house prices.

The second graph compares RI as a percent of GDP with the real (adjusted for inflation) CoreLogic house price index through February.

The second graph compares RI as a percent of GDP with the real (adjusted for inflation) CoreLogic house price index through February.

Although the CoreLogic data only goes back to 1976, look at what happened following the early '90s housing bust. RI as a percent of GDP bottomed in Q1 1991, but real house prices didn't bottom until Q4 1996 (real prices were mostly flat for several years). Something similar happened in the early 1980s - first activity bottomed, and then real prices - although the two bottoms were closer in the '80s.

Now it appears activity bottomed in 2009 through 2011 (depending on the measure) and real house prices bottomed in early 2012.

Merrill Lynch on Labor Force Participation Rate

by Calculated Risk on 5/24/2013 10:29:00 AM

Last week I summarized some recent research on the labor force participation rate. The following piece from Michelle Meyer at Merrill Lynch argues the LFPR will likely move sideways over the next few years. Changes in the participation rate have important implications for the number of jobs needed to lower the unemployment rate.

An excerpt from Michelle Meyer's piece:

The future trajectory of the labor force participation rate (LFPR) is very important in gauging the trend in the unemployment rate and risks to wage inflation. In order to forecast the labor force participation rate, we must understand the drivers behind its recent sharp movements – to what extent is a long-term trend related to demographics (aging population) versus secular or cyclical dynamics?

We can isolate the effect of demographics on the LFPR by looking at the participation rates by age cohort. The aggregate LFPR is equal to the summation of each individual age cohort's LFPR weighted by its share of the population. ... This suggests that half of the 2.7pp decline in the LFPR since the onset of the recession can be explained simply from the aging population. In other words, holding all else equal – meaning no business cycle dynamics – the LFPR would be at 64.6% today compared to the actual rate of 63.3%. The remaining 1.4pp drop is due to some combination of secular and short-term cyclical factors.

The two primary secular trends are the decline in the LFPR among the youth population and the rise among 55+. The LFPR for 16 to 19 year olds plunged to 34.3% last year from 52% in 2000. While this may have been accelerated by the past two recessions, we believe this is a permanent trend. On the other end, the LFPR of the older population has increased, likely reflecting higher life expectancy, less confidence in social benefit programs and loss of wealth from the Great Recession.

... we still believe that there are some cyclical components. One way to gauge the cyclicality of the LFPR is to observe state-level variation in the relationship between the LFPR and the health of the economy. Based on work from a recent San Francisco Fed paper, we compare the percentage decline in state payrolls to the decline in the LFPR during the recession, both weighted by the relative size of its labor force. We find a positive relationship where larger declines in employment are associated with bigger drops in the LFPR. The paper does the same exercise for prior recessions and finds a positive relationship existed in each, with the exception of the 2000 cycle.

If the relationship holds on the downside, do we also observe it during the recovery? There is little evidence of such correlation in this recovery, but it does exist for prior cycles. In prior cycles, the positive correlation did not become apparent until the economy had exceeded the previous employment peak by a significant amount. This suggests that the cyclical pressure in the LFPR may not be observed until 2015, at the earliest.

We can simulate a future path for the LFPR based on our assessment of the drivers of the downturn in the LFPR. The first step is to account for the continued aging of the population using the Census Bureau's projections by age cohort. If we keep the LFPR by age group constant at 2007 levels and only allow for demographic adjustments, we find that the LFPR will fall by another 3.3pp by 2025 and then slip to 59.2% in 2050. ...

We also assume that the secular trends exhibited during the last decade persist, but at a slower pace, implying a modest downturn in the LFPR among the youth and an upward trajectory for the 55+ age group. ... Based on these rough assumptions, we forecast the LFPR will slip slightly this year, but with a stronger recovery under way next year, the LFPR should start to level off some and potentially increase beginning in 2015 (Chart 4).

The cyclical dynamics, in our view, are not strong enough to generate a pop higher in the LFPR given the downward pull from demographics. But at a minimum, we expect these dynamics can counter the downside pressure and allow the LFPR to move sideways once the recovery builds momentum.

Durable Goods Orders increased 3.3% in April

by Calculated Risk on 5/24/2013 09:06:00 AM

From the Department of Commerce: Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders April 2013

New orders for manufactured durable goods in April increased $7.2 billion or 3.3 percent to $222.6 billion, the U.S. Census Bureau announced today. This increase, up two of the last three months, followed a 5.9 percent March decrease. Excluding transportation, new orders increased 1.3 percent. Excluding defense, new orders increased 2.1 percent.This was above expectations of a 1.1% increase. This report is difficult to predict and very noisy month-to-month.

Thursday, May 23, 2013

Friday: Durable Goods (and a comment on housing driving the recovery)

by Calculated Risk on 5/23/2013 08:32:00 PM

Several people have asked me about this article at CNBC by Jeff Cox: Why Housing Won't Drive the Recovery

Despite data points that in some cases are at multiyear highs, Robert Shiller, Karl Case and David Blitzer believe there are multiple headwinds that will keep a lid on housing gains.First, housing (technically residential investment) will be a key driver for the economy. Period.

Among the obstacles are a low level of new housing starts, an unexpectedly slow migration of so-called shadow inventory onto the market, and continued difficulty for buyers to secure financing.

"You've got a lot of breathless commentary in the media," said Shiller, a Yale University economist. "All this talk that we're in this great recovery—we probably are in the short run, the longer run doesn't look so terrific to me."

It is important to understand that "residential investment" is mostly new homes and home improvement. For existing home sales, only the broker's commission is included in residential investment (nothing is added to the housing stock). Those looking at the level of existing home sales are looking at the wrong number, as are those focused only on house prices.

Look at "headwinds" that are mentioned in the article:

1) "a low level of new housing starts". That is a headwind? To me, the low level of starts means there is more upside based on demographics. The homeownership rate peaks for those in the 55 to 75 age group, so the boomers will not negatively impact homeownership for a decade or more.

2) "an unexpectedly slow migration of so-called shadow inventory onto the market". Do they expect the pace of foreclosures to increase? I don't. The process is very long in most judicial states, and I don't expect another wave of foreclosures hitting the market - but I do think we will see distressed sales for years.

3) "continued difficulty for buyers to secure financing". OK, but this has been a headwind for the last couple of years. Looking forward, I expect some loosening in lending standards. So this is really a potential tailwind.

Nothing in this article changes my view.

Friday economic release:

• At 8:30 AM ET, Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.1% increase in durable goods orders.

Note: The bond market will close early Friday at 2PM ET. The stock market will close at the normal time. All markets are closed on Monday in observance of Memorial Day.

The Calculated Risk blog is always open!

Freddie Mac: "Mortgage Rates Continue Upward Trend"

by Calculated Risk on 5/23/2013 03:33:00 PM

From Freddie Mac today: Mortgage Rates Continue Upward Trend

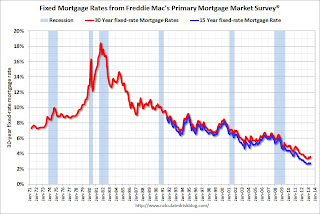

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey(R) (PMMS®), showing fixed mortgage rates trending higher for the third consecutive week and putting pressure on refinance momentum. ...

30-year fixed-rate mortgage (FRM) averaged 3.59 percent with an average 0.7 point for the week ending May 23, 2013, up from last week when it averaged 3.51 percent. Last year at this time, the 30-year FRM averaged 3.78 percent.

15-year FRM this week averaged 2.77 percent with an average 0.7 point, up from last week when it averaged 2.69 percent. A year ago at this time, the 15-year FRM averaged 3.04 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®. Not much of an increase recently ... but it will slow refinance activity.

The Freddie Mac survey started in 1971 and 30 year mortgage rates are still near the record low set last November.

A few comments on New Home Sales

by Calculated Risk on 5/23/2013 12:47:00 PM

Obviously the new home sales report this morning was solid with sales above expectations and significant upward revisions to prior months. I try not to react too much to the month to month ups and downs; the key points right now are that sales are increasing and will probably continue to increase for some time.

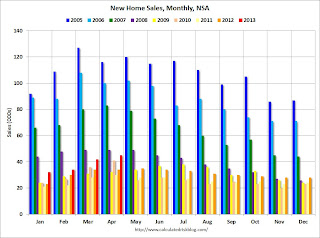

Now that we have four months of data for 2013, one way to look at the growth rate is to use the "not seasonally adjusted" (NSA) year-to-date data.

According to the Census Bureau, there were 153 thousand new homes sold in 2013 through April, up about 26.4% from the 121 thousand sold during the same period in 2012. That is a very solid increase in sales, and this was the highest sales for these months since 2008.

Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or an increase of around 22% to 25% on an annual basis from the 369 thousand in 2012.

Although there has been a large increase in the sales rate, sales are just above the lows for previous recessions. This suggests significant upside over the next few years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years - substantially higher than the current sales rate.

And an important point worth repeating: Housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to start to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through April 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to continue to close - mostly from an increase in new home sales.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and I expect this ratio to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing expanded in May

by Calculated Risk on 5/23/2013 11:47:00 AM

From the Kansas City Fed: Tenth District Manufacturing Survey Improved Somewhat

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity improved somewhat, rising above zero for the first time in seven months, and producers’ expectations for future activity also increased.The last regional surveys for May will be released next Tuesday (Dallas and Richmond), and the ISM index for May will be released on Monday, June 1st. Based on the regional surveys released so far, and the Markit Flash PMI released this morning, I expect a fairly weak reading for the ISM index (perhaps at or below 50).

“It was good to finally see a positive number after seven months of modest declines, and for optimism about future activity to return after dropping last month,” said Wilkerson. “Still, activity remains at only about year-ago levels and firms are having difficulty passing cost increases through.”

The month-over-month composite index was 2 in May, up from -5 in both April and March. ... Other month-over-month indexes were mixed. The production index edged up from 1 to 5, and the shipments, new orders, and new orders for export indexes also rose. In contrast, the employment index fell from -3 to -7, while the order backlog index was unchanged.

New Home Sales at 454,000 SAAR in April

by Calculated Risk on 5/23/2013 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 454 thousand. This was up from 444 thousand SAAR in March (March sales were revised up from 417 thousand).

January sales were revised up from 445 thousand to 458 thousand, and February sales were revised up from 411 thousand to 429 thousand. Very strong upward revisions.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in April 2013 were at a seasonally adjusted annual rate of 454,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 2.3 percent above the revised March rate of 444,000 and is 29.0 percent above the April 2012 estimate of 352,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply was unchanged in April at 4.1 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of April was 156,000. This represents a supply of 4.1 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is at a record low. The combined total of completed and under construction is also just above the record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In April 2013 (red column), 45 thousand new homes were sold (NSA). Last year 34 thousand homes were sold in April. The high for April was 116 thousand in 2005, and the low for April was 30 thousand in 2011.

This was well above expectations of 425,000 sales in April, and a solid report, especially with all the upward revision to previous months. I'll have more soon ...

Weekly Initial Unemployment Claims decline to 340,000

by Calculated Risk on 5/23/2013 08:51:00 AM

The DOL reports:

In the week ending May 18, the advance figure for seasonally adjusted initial claims was 340,000, a decrease of 23,000 from the previous week's revised figure of 363,000. The 4-week moving average was 339,500, a decrease of 500 from the previous week's revised average of 340,000.The previous week was revised up from 360,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 339,500.

Claims were slightly below the 345,000 consensus forecast.

Wednesday, May 22, 2013

Thursday: New Home Sales, Weekly Unemployment Claims

by Calculated Risk on 5/22/2013 08:50:00 PM

Most of the coverage of the FOMC minutes today focused on this sentence:

"A number of participants expressed willingness to adjust the flow of purchases downward as early as the June meeting if the economic information received by that time showed evidence of sufficiently strong and sustained growth; however, views differed about what evidence would be necessary and the likelihood of that outcome."Three words: Will Not Happen. Not in June. Probably not this year (although tapering could start late this year).

emphasis added

The real Fed story today was that Fed Chairman Ben Bernanke scolded Congress. In his speech he said:

"Notably, over the past four years, state and local governments have cut civilian government employment by roughly 700,000 jobs, and total government employment has fallen by more than 800,000 jobs over the same period. For comparison, over the four years following the trough of the 2001 recession, total government employment rose by more than 500,000 jobs.And in the Q&A, Bernanke added:

Most recently, the strengthening economy has improved the budgetary outlooks of most state and local governments, leading them to reduce their pace of fiscal tightening. At the same time, though, fiscal policy at the federal level has become significantly more restrictive. In particular, the expiration of the payroll tax cut, the enactment of tax increases, the effects of the budget caps on discretionary spending, the onset of the sequestration, and the declines in defense spending for overseas military operations are expected, collectively, to exert a substantial drag on the economy this year."

“I fully realize the importance of budgetary responsibility, but I would argue that it’s not responsible to focus all of the restraint on the very near term and do nothing about the long term, which is where most of the problem exists. I do think that we would all be better off, with no loss to fiscal sustainability or market confidence, if we had somewhat less restraint in the very near term – this year and next year, say – and more aggressive action to address these very real long-term issues, which threaten within a decade or so to begin to put our fiscal budget on an unsustainable path.”Current policy is "not responsible". Unfortunately most members of Congress weren't even aware that Bernanke was giving them a failing grade! Most of the media reports ignored the reprimand too. Even the FOMC statement mentioned fiscal restraint several times. Oh well ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 345 thousand from 360 thousand last week.

• At 9:00 AM, FHFA House Price Index for March 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.9% increase.

• Also at 9:00 AM, The Markit US PMI Manufacturing Index Flash for May. The consensus is for a decrease to 50.8 from 52.0 in April.

• At 10:00 AM, New Home Sales for April from the Census Bureau. The consensus is for an increase in sales to 425 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 417 thousand in March.

• At 11:00 AM, Kansas City Fed regional Manufacturing Survey for May. The consensus is for a reading of minus 2, up from minus 5 in April (below zero is contraction).