by Calculated Risk on 5/04/2013 08:52:00 AM

Saturday, May 04, 2013

Unofficial Problem Bank list declines to 773 Institutions

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 3, 2013.

Changes and comments from surferdude808:

Unlike last week, this week was a quiet one for the Unofficial Problem Bank List with only two removals. After removal, the list now holds 773 institutions with assets of $284.9 billion. A year ago, the list held 925 institutions with assets of $361 billion. Actions were terminated against Coatesville Savings Bank, Coatesville, PA ($199 million) and Choice Bank, Oshkosh, WI ($190 million Ticker: CBKW). Next week should be a quiet one as well unless the FDIC cranks up the closing machine like it did last week.Yesterday on the employment report:

• April Employment Report: 165,000 Jobs, 7.5% Unemployment Rate

• Employment Report Comments and more Graphs

• Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

Friday, May 03, 2013

Graphs for Duration of Unemployment, Unemployment by Education and Diffusion Indexes

by Calculated Risk on 5/03/2013 08:09:00 PM

Earlier on the employment report:

• April Employment Report: 165,000 Jobs, 7.5% Unemployment Rate

• Employment Report Comments and more Graphs

A few more employment graphs ...

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.The general trend is down for all categories, but only the less than 5 weeks is back to normal levels. All three other categories remain elevated.

The long term unemployed is at 2.8% of the labor force - the lowest since May 2009 - however the number (and percent) of long term unemployed remains a serious problem.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters for the unemployment rate, it doesn't appear to matter as far as finding new employment (all four categories are only gradually declining).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

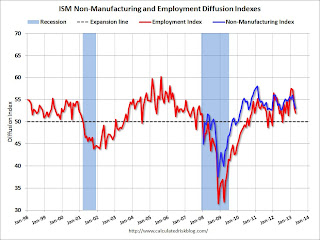

The BLS diffusion index for total private employment was at 53.9 in April, down from 56.2 in March.

The BLS diffusion index for total private employment was at 53.9 in April, down from 56.2 in March.For manufacturing, the diffusion index decreased to 44.4, down from 51.9 in March.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.Job growth for total private employment was fairly narrow in April. This is a not good sign and suggests only a few industries were hiring last month. For manufacturing, more companies were decreasing employment than adding jobs in April.

AAR: Rail Traffic "mixed" in April

by Calculated Risk on 5/03/2013 05:24:00 PM

From the Association of American Railroads (AAR): AAR Reports Mixed Rail Traffic for April, and Week Ending April 27

Intermodal traffic in April 2013 totaled 962,019 containers and trailers, up 1.6 percent (15,053 units) compared with April 2012. April’s weekly average of trailers and containers, 240,505, was the highest for any April in history.

Carloads originated in April 2013 totaled 1,108,722, down 0.4 percent (4,640 carloads) compared with the same month last year.

“Coal and grain carloads remain depressed, but by and large rail traffic in April was consistent with an economy that’s continuing to grow, albeit slowly,” said AAR Senior Vice President John T. Gray. “There’s nothing in the traffic data to indicate that a sharp economic slowdown is imminent. On the other hand, there’s nothing to indicate that a dramatic uptick in economic growth is imminent either.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Green is 2013.

U.S. rail carloads of petroleum and petroleum products were up 46.4% (17,524 carloads) in April 2013 over April 2012. ...Note that building related commodities were up.

Carloads of crushed stone, gravel, and sand were up 11.5% (8,959 carloads) in April 2013 over April 2012. Industrial sand is part of this category, and frac sand is a type of industrial sand.

Other commodities showing carload gains in April 2013 over April 2012 include coke (up 1,359 carloads, or 10.1%), lumber and wood products (up 1,093 carloads, or 8.4%), and food products (up 835 carloads, or 3.3%).

The second graph is for intermodal traffic (using intermodal or shipping containers):

Graphs and excerpts reprinted with permission.

Graphs and excerpts reprinted with permission.Intermodal traffic is on track for a record year in 2013:

U.S. rail intermodal traffic was up 1.6% (15,053 containers and trailers) in April 2013 over April 2012 to 962,019 units. The weekly average in April 2013 — 240,505 units — was the highest for any April in history. Year-to-date intermodal volume on U.S. railroads was 4,046,935 units, up 4.4% (171,446 units) over the same period in 2012.Earlier on the employment report:

• April Employment Report: 165,000 Jobs, 7.5% Unemployment Rate

• Employment Report Comments and more Graphs

Update: The Future's so Bright ...

by Calculated Risk on 5/03/2013 03:24:00 PM

Back in January I wrote: The Future's so Bright .... I started by writing that "It looks like economic growth will pickup over the next few years", although for 2013, I was expecting "another year of sluggish growth" due to fiscal policy.

I also argued that the "key short term risk is too much additional deficit reduction too quickly". Unfortunately I was expecting some sort of agreement to delay or reduce the sequester budget cuts - so there will be more fiscal drag this year than I expected - but I still think the future is bright.

The following is an update to the graphs and text in the earlier post:

Click on graph for larger image.

Click on graph for larger image.

This graph shows total and single family housing starts through March 2013. Even after the 28.2% in 2012, the 781 thousand housing starts in 2012 were the fourth lowest on an annual basis since the Census Bureau started tracking starts in 1959. Starts averaged 1.5 million per year from 1959 through 2000. Demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will come close to doubling from the 2012 level.

Residential investment and housing starts are usually the best leading indicator for economy, so this suggests the economy will continue to grow over the next couple of years.

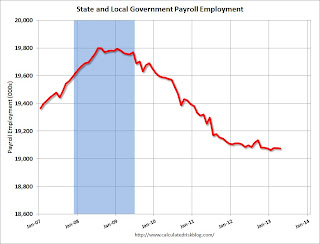

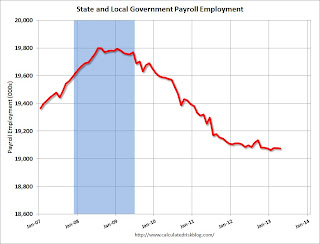

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 239,000 in 2011, and 34,000 jobs in 2012. So far in 2013, state and local government employment is unchanged.

The second graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 239,000 in 2011, and 34,000 jobs in 2012. So far in 2013, state and local government employment is unchanged.

It appears most of the state and local government layoffs are over. Some states, like California, are now running a budget surplus, so the layoffs will probably end.

Note: Federal employment is still declining.

Here is a key graph on the US deficit. As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to under 3% in fiscal 2015 with no additional policy changes (there are still long term issues).

Here is a key graph on the US deficit. As we've been discussing, the US deficit as a percent of GDP has been declining, and will probably decline to under 3% in fiscal 2015 with no additional policy changes (there are still long term issues).

This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

Note: With 7.5% unemployment, there is a strong argument for less deficit reduction in the short term, but that doesn't seem to be getting any traction.

This graph from the the NY Fed shows aggregate consumer debt through Q4. The NY Fed reported: "Total consumer indebtedness was $11.34 trillion, 0.3% higher than the previous quarter but considerably lower than its peak of $12.68 trillion in the third quarter of 2008". Most of the decline since 2008 was due to declining mortgage debt.

Household debt peaked in Q2 2008 and has been declining for over four years. There is probably more deleveraging ahead (mostly from foreclosures and distressed sales), but this suggests some improvement in household balance sheets.

The second debt graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The second debt graph is from the Fed's Household Debt Service and Financial Obligations Ratios. These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households.

The graph shows the DSR for both renters and homeowners (red), and the homeowner financial obligations ratio for mortgages and consumer debt. The overall Debt Service Ratio has declined to a record low thanks to very low interest rates. The homeowner's financial obligation ratio for consumer debt is at early '80s levels.

The blue line is the homeowner's financial obligation ratio for mortgages (blue). This ratio increased rapidly during the housing bubble, and continued to increase until 2008. Now, with falling interest rates, and less mortgage debt (mostly due to foreclosures), the ratio is back to 2001 levels. This will probably decline further, but for many homeowners, the obligation ratio is low.

There are several tailwinds for the economy (housing is key), and several headwinds (like household deleveraging, and state and local cutbacks) are subsiding. There are other headwinds that remain like Federal fiscal policy and Europe, but overall it appears the U.S. economy is poised for more growth over the next few years.

The future's so bright, I gotta wear shades.

Yes, the song was about nuclear holocaust ... but the phrase was originally intended the way I'm using it.

Employment Report Comments and more Graphs

by Calculated Risk on 5/03/2013 11:13:00 AM

Total nonfarm employment is up 2.077 million over the last year, and up 783 thousand so far in 2013 (a 2.35 million annual pace).

Private employment is up 2.166 million over the last year, and up 813 thousand so far in 2013 (a 2.44 million annual pace).

This would be the strongest annual rate for private sector job growth since 1999 (update) if this pace continues for the entire year! Imagine if there was less fiscal restraint ... Hopefully fiscal restraint will ease later this year, and we will see an increase in economic growth.

Although this report was somewhat better than expectations (and much better than some of the "whisper" numbers), it is still a fairly weak job growth considering the slack in the economy (the upward revisions to February and March make this a more solid report). I'd like to see an average or 250 thousand jobs per month or more.

Of course public payrolls are continuing to shrink (four years of declining public payrolls now), and that is one reason job growth is sluggish.

And on construction employment: Construction employment is up 154 thousand over the last year, and up 79 thousand so far in 2013 (a 237 thousand annual pace).

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio was unchanged at 75.9% in April. The participation rate for this group was also unchanged at 81.1% in April. The decline in the participation rate for this age group is probably mostly due to economic weakness, whereas most of the decline in the overall participation rate is probably due to demographics.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

In April, the number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by 278,000 to 7.9 million, largely offsetting a decrease in March. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in April to 7.92 million from 7.64 million in March.

These workers are included in the alternate measure of labor underutilization (U-6) that increased slightly to 13.9% in April.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.35 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.61 million in March. This is trending down, but is still very high. This is the fewest long term unemployed since June 2009. Long term unemployment remains one of the key labor problems in the US.

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In April 2013, state and local governments lost 3,000 jobs, however state and local employment is unchanged (update) so far in 2013.

I think most of the state and local government layoffs are over. Of course the Federal government layoffs are ongoing with many more layoffs expected due to the sequestration spending cuts.

Overall this was a somewhat weak report given the slack in the economy, but the revisions to payrolls in February and March make the report more solid.

ISM Non-Manufacturing Index indicates slower expansion in April

by Calculated Risk on 5/03/2013 10:00:00 AM

Note: I'll have much more on the employment report soon.

The April ISM Non-manufacturing index was at 53.1%, down from 54.4% in March. The employment index decreased in April to 52.0%, down from 53.3% in March. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: April 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the 40th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 53.1 percent in April, 1.3 percentage points lower than the 54.4 percent registered in March. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55 percent, which is 1.5 percentage points lower than the 56.5 percent reported in March, reflecting growth for the 45th consecutive month. The New Orders Index decreased by 0.1 percentage point to 54.5 percent, and the Employment Index decreased 1.3 percentage points to 52 percent, indicating growth in employment for the ninth consecutive month. The Prices Index decreased 4.7 percentage points to 51.2 percent, indicating prices increased at a slower rate in April when compared to March. According to the NMI™, 14 non-manufacturing industries reported growth in April. Respondents' comments remain mostly positive about business conditions. Cost management and revenue pressures are areas of concern for many of the respective companies."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.0% and indicates slower expansion in April than in March.

April Employment Report: 165,000 Jobs, 7.5% Unemployment Rate

by Calculated Risk on 5/03/2013 08:30:00 AM

From the BLS:

Total nonfarm payroll employment rose by 165,000 in April, and the unemployment rate was little changed at 7.5 percent, the U.S. Bureau of Labor Statistics reported today. ...The headline number was somewhat above expectations of 153,000 payroll jobs added. Also employment for February and March were revised higher.

...

The change in total nonfarm payroll employment for February was revised from +268,000 to +332,000, and the change for March was revised from +88,000 to +138,000. With these revisions, employment gains in February and March combined were 114,000 higher than previously reported.

Click on graph for larger image.

Click on graph for larger image.NOTE: This graph is ex-Census meaning the impact of the decennial Census temporary hires and layoffs is removed to show the underlying payroll changes.

The second graph shows the unemployment rate.

The unemployment rate decreased to 7.5% in April from 7.6% in March.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.

The unemployment rate is from the household report and the household report showed a sharp increase in employment, and that meant a lower unemployment rate.The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 63.3% in April (blue line). This is the percentage of the working age population in the labor force.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.

The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although a significant portion of the recent decline is due to demographics.The Employment-Population ratio increased to 58.6% in April (black line) from 58.5% in March. I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.

The fourth graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. The dotted line is ex-Census hiring.This shows the depth of the recent employment recession - worse than any other post-war recession - and the relatively slow recovery due to the lingering effects of the housing bust and financial crisis.

This was still fairly weak job growth, but somewhat better than expectations, especially considering the upward revisions to the February and March employment reports. I'll have much more later ...

Thursday, May 02, 2013

Friday: Employment Report

by Calculated Risk on 5/02/2013 07:07:00 PM

A couple more previews ...

From the Sudeep Reddy at the WSJ: What to Expect From the Jobs Report

UBS economists forecast payroll growth of 130,000 jobs in April but warn that it’s because of “technical oddities rather than fundamental weakening” in the labor market. The gap between the Labor Department’s March and April surveys — four weeks instead of five weeks — “has historically been associated with April payrolls about 60,000 below the surrounding trend,” they write.From Forbes: April Jobs Report: Economy To Add Only 100K On Falling Consumption, Unemployment To Hit 7.5%, Nomura Says

The April jobs report promises to be another disappointing data point, according to Nomura, which expects a meager job gain of only 100,000 as consumer spending wanes and manufacturing activity slows.Friday economic releases:

• At 8:30 AM ET, the BLS will release the Employment Report for April. The consensus is for an increase of 153,000 non-farm payroll jobs in April; the economy added 88,000 non-farm payroll jobs in March. The consensus is for the unemployment rate to be unchanged at 7.6% in April.

• At 10:00 AM, the ISM non-Manufacturing Index for April. The consensus is for a reading of 54.0, down from 54.4 in March. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) report for March will be released. The consensus is for a 2.8% decrease in orders.

Freddie Mac: Mortgage Rates decrease in latest Survey, 15-Year at All-Time Low

by Calculated Risk on 5/02/2013 03:42:00 PM

From Freddie Mac today: Mortgage Rates Keep Pushing Lower

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving lower for the fifth consecutive week amid the weaker than expected first quarter economic growth advance estimate. The 30-year fixed-rate mortgage at 3.35 percent is hovering just above its all-time record low of 3.31 percent set the week of November 21, 2012. The 15-year fixed-rate mortgage set a new all-time record low this week at 2.56 percent, eclipsing the record set last week.

30-year fixed-rate mortgage (FRM) averaged 3.35 percent with an average 0.7 point for the week ending May 2, 2013, down from last week when it averaged 3.40 percent. Last year at this time, the 30-year FRM averaged 3.84 percent.

15-year FRM this week averaged 2.56 percent with an average 0.7 point, down from last week when it averaged 2.61 percent. A year ago at this time, the 15-year FRM averaged 3.07 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the the 30 year and 15 year fixed rate mortgage interest rates from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and 30 year mortgage rates are currently near the record low set last November.

Employment Situation Preview

by Calculated Risk on 5/02/2013 11:44:00 AM

On Friday, at 8:30 AM ET, the BLS will release the employment report for April. The consensus is for an increase of 153,000 non-farm payroll jobs in April, and for the unemployment rate to be unchanged at 7.6%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 119,000 private sector payroll jobs in April. This was below expectations of 155,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. In general this suggests employment growth below expectations.

• The ISM manufacturing employment index decreased in April to 50.2% from 54.2% in March. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased by close to 20,000 in April. The ADP report indicated a 10,000 decrease in manufacturing jobs.

The ISM non-manufacturing (service) employment index will be released on Friday after the employment report.

• Initial weekly unemployment claims averaged about 342,500 in April. This was down from 355,000 in March, and the lowest average for a month this year.

For the BLS reference week (includes the 12th of the month), initial claims were at 355,000; up from 341,000 in March.

• The final April Reuters / University of Michigan consumer sentiment index decreased to 76.4, down from the March reading of 78.6. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. Note: the preliminary index dipped mid-month suggesting some weakness during the reference period (we saw the same pattern in March with the preliminary reading lower).

• The small business index from Intuit showed 20,000 payroll jobs added, up from 15,000 in March. This index remains disappointing.

• And on the unemployment rate from Gallup: Seasonally Unadjusted Unemployment Declines in April

Gallup's unadjusted unemployment rate for the U.S. workforce was 7.4% for the month of April, down more than half a point since March 2013, and nearly a one-point drop from April 2012. This is the second-lowest monthly employment rate Gallup has measured since it began tracking employment in 2010. ...Note: So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate.

Gallup's seasonally adjusted U.S. unemployment rate for April was 7.8%, unchanged from March 2013, but down almost a full point compared with April 2012.

• Conclusion: The employment related data was mostly disappointing in April. The ADP and ISM manufacturing reports suggest a decrease in hiring (the ISM service report will not be released until after the BLS report), the small business index increased but was still weak, and weekly claims for the reference week were higher in April than in March (although claims for the month were lower).

There is always some randomness to the employment report, but my guess is the BLS will report somewhat below the consensus of 153,000 jobs added in April.