by Calculated Risk on 5/03/2013 11:13:00 AM

Friday, May 03, 2013

Employment Report Comments and more Graphs

Total nonfarm employment is up 2.077 million over the last year, and up 783 thousand so far in 2013 (a 2.35 million annual pace).

Private employment is up 2.166 million over the last year, and up 813 thousand so far in 2013 (a 2.44 million annual pace).

This would be the strongest annual rate for private sector job growth since 1999 (update) if this pace continues for the entire year! Imagine if there was less fiscal restraint ... Hopefully fiscal restraint will ease later this year, and we will see an increase in economic growth.

Although this report was somewhat better than expectations (and much better than some of the "whisper" numbers), it is still a fairly weak job growth considering the slack in the economy (the upward revisions to February and March make this a more solid report). I'd like to see an average or 250 thousand jobs per month or more.

Of course public payrolls are continuing to shrink (four years of declining public payrolls now), and that is one reason job growth is sluggish.

And on construction employment: Construction employment is up 154 thousand over the last year, and up 79 thousand so far in 2013 (a 237 thousand annual pace).

A few more graphs ...

Employment-Population Ratio, 25 to 54 years old

Click on graph for larger image.

Click on graph for larger image.

Since the participation rate declined recently due to cyclical (recession) and demographic (aging population) reasons, an important graph is the employment-population ratio for the key working age group: 25 to 54 years old.

In the earlier period the employment-population ratio for this group was trending up as women joined the labor force. The ratio has been mostly moving sideways since the early '90s, with ups and downs related to the business cycle.

This ratio should probably move close to 80% as the economy recovers. The ratio was unchanged at 75.9% in April. The participation rate for this group was also unchanged at 81.1% in April. The decline in the participation rate for this age group is probably mostly due to economic weakness, whereas most of the decline in the overall participation rate is probably due to demographics.

Percent Job Losses During Recessions

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the earlier post, the graph showed the job losses aligned at the start of the employment recession.

This financial crisis recession was much deeper than other post WWII recessions, and the recovery has been slower (the recovery from the 2001 recession was slow too). However, if we compare to other financial crisis recoveries, this recovery has actually been better than most.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

In April, the number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by 278,000 to 7.9 million, largely offsetting a decrease in March. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of part time workers increased in April to 7.92 million from 7.64 million in March.

These workers are included in the alternate measure of labor underutilization (U-6) that increased slightly to 13.9% in April.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 4.35 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 4.61 million in March. This is trending down, but is still very high. This is the fewest long term unemployed since June 2009. Long term unemployment remains one of the key labor problems in the US.

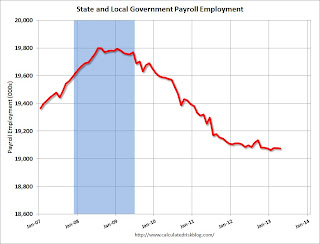

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In April 2013, state and local governments lost 3,000 jobs, however state and local employment is unchanged (update) so far in 2013.

I think most of the state and local government layoffs are over. Of course the Federal government layoffs are ongoing with many more layoffs expected due to the sequestration spending cuts.

Overall this was a somewhat weak report given the slack in the economy, but the revisions to payrolls in February and March make the report more solid.