by Calculated Risk on 3/05/2013 10:00:00 AM

Tuesday, March 05, 2013

ISM Non-Manufacturing Index indicates faster expansion in February

The February ISM Non-manufacturing index was at 56.0%, up from 55.2% in January. The employment index decreased in February to 57.2%, down from 57.5% in January. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: February 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in February for the 38th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 56 percent in February, 0.8 percentage point higher than the 55.2 percent registered in January. This indicates continued growth at a slightly faster rate in the non-manufacturing sector. This month's reading also reflects the highest NMI™ since February 2012, when the index registered 56.1 percent. The Non-Manufacturing Business Activity Index registered 56.9 percent, which is 0.5 percentage point higher than the 56.4 percent reported in January, reflecting growth for the 43rd consecutive month. The New Orders Index increased by 3.8 percentage points to 58.2 percent, and the Employment Index decreased 0.3 percentage point to 57.2 percent, indicating growth in employment for the seventh consecutive month. The Prices Index increased 3.7 percentage points to 61.7 percent, indicating prices increased at a faster rate in February when compared to January. According to the NMI™, 13 non-manufacturing industries reported growth in February. The majority of respondents' comments reflect a growing optimism about the trend of the economy and overall business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 55.0% and indicates faster expansion in February than in January.

CoreLogic: House Prices up 9.7% Year-over-year in January

by Calculated Risk on 3/05/2013 09:00:00 AM

Notes: This CoreLogic House Price Index report is for January. The recent Case-Shiller index release was for December. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Home Price Index Rises by Almost 10 Percent Year Over Year in January

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 9.7 percent in January 2013 compared to January 2012. This change represents the biggest increase since April 2006 and the 11th consecutive monthly increase in home prices nationally. On a month-over-month basis, including distressed sales, home prices increased by 0.7 percent in January 2013 compared to December 2012. The HPI analysis shows that all but two states, Delaware and Illinois, are experiencing year-over-year price gains.

Excluding distressed sales, home prices increased on a year-over-year basis by 9.0 percent in January 2013 compared to January 2012. On a month-over-month basis, excluding distressed sales, home prices increased 1.8 percent in January 2013 compared to December 2012. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that February 2013 home prices, including distressed sales, are expected to rise by 9.7 percent on a year-over-year basis from February 2012 and fall by 0.3 percent on a month-over-month basis from January 2013, reflecting a seasonal winter slowdown.

...

“The HPI showed strong growth during the typically slow winter season,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.7% in January, and is up 9.7% over the last year.

The index is off 26.4% from the peak - and is up 10.1% from the post-bubble low set in February 2012.

The second graph is from CoreLogic. The year-over-year comparison has been positive for eleven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).

The second graph is from CoreLogic. The year-over-year comparison has been positive for eleven consecutive months suggesting house prices bottomed early in 2012 on a national basis (the bump in 2010 was related to the tax credit).This is the largest year-over-year increase since 2006.

Since this index is not seasonally adjusted, it was expected to decline on a month-to-month basis in January - instead the index increased, and, considering seasonal factors, this month-to-month increase was very strong.

Monday, March 04, 2013

Tuesday: ISM Service Index

by Calculated Risk on 3/04/2013 09:09:00 PM

The kids are alright! From the WSJ: Young Adults Retreat From Piling Up Debt

Young people are racking up larger amounts of student debt than ever before, but fresh data suggest they are becoming warier of borrowing in general: Total debt among young adults dropped in the last decade to the lowest level in 15 years.Student debt is a significant problem, but less overall debt is good news.

A typical young U.S. household—defined as one led by someone under age 35—had $15,000 in total debt in 2010, down from $18,000 in 2001 and the lowest since 1995, according to a recent Pew Research Center report and government data. Total debt includes mortgage loans, credit cards, auto lending, student loans and other consumer borrowing.

In addition, fewer young adults carried credit-card balances and 22% didn't have any debt at all in 2010—the most since government tracking began in 1983.

The lower overall debt comes despite an increase in student borrowing, which ballooned to $966 billion last year from $253 billion at the end of 2003, according to the Federal Reserve.

Tuesday economic releases:

• At 10:00 AM ET, Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• Also at 10:00 AM, ISM non-Manufacturing Index for February. The consensus is for a decrease to 55.0 from 55.2 in January. Note: Above 50 indicates expansion, below 50 contraction.

Existing Home Inventory is only up 3.4% year-to-date in early March

by Calculated Risk on 3/04/2013 03:24:00 PM

Dude, Where's my inventory?

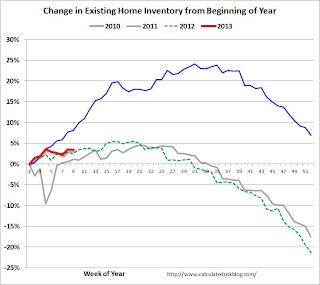

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through early March - it appears inventory is increasing at a sluggish rate. Housing Tracker reports inventory is down -23.2% compared to the same week in 2012 - still falling fast year-over-year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is only up 3.4%. If inventory doesn't increase more soon, then the bottom for inventory might not be until 2014.

Fannie Mae Mortgage Serious Delinquency rate declined in January, Lowest since early 2009

by Calculated Risk on 3/04/2013 02:02:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined in January to 3.18% from 3.29% in December 2012. The serious delinquency rate is down from 3.90% in January 2012, and this is the lowest level since March 2009.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac has not reported for January yet.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%. At the recent pace of improvement, it will take several years until the rates are back to normal.