by Calculated Risk on 3/06/2013 08:19:00 AM

Wednesday, March 06, 2013

ADP: Private Employment increased 198,000 in February

Private sector employment increased by 198,000 jobs from January to February, according to the February, according to the January ADP National Employment Report®, which is produced by ADP® ... in collaboration with Moody’s Analytics. The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis. The January 2013 report, which reported job gains of 192,000, was revised upward by 23,000 to 215,000 jobs.This was above the consensus forecast for 173,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 171,000 payroll jobs in February, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market remains sturdy in the face of significant fiscal headwinds. Businesses are adding to payrolls more strongly at the start of 2013 with gains across all industries and business sizes. Tax increases and government spending cuts don’t appear to be affecting the job market.”

Note: ADP hasn't been very useful in predicting the BLS report.

MBA: Mortgage Applications Increase Sharply in Latest Weekly Survey

by Calculated Risk on 3/06/2013 07:00:00 AM

From the MBA: Mortgage Applications Increase as Rates Drop in Latest MBA Weekly Survey

The Refinance Index increased 15 percent from the previous week and was at its highest level since mid-January. The seasonally adjusted Purchase Index also increased 15 percent from one week earlier and was at its highest level since the week ending February 1.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.70 percent from 3.77 percent, with points decreasing to 0.39 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

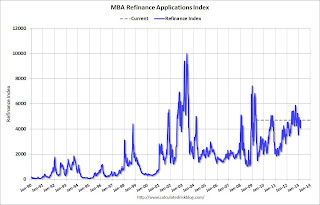

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year, and 77 percent of all mortgage applications are for refinancing.

Refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last six months.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up (slowly) over the last six months.This index will probably continue to increase as conventional home purchase activity increases.

Tuesday, March 05, 2013

Wednesday: ADP Employment, Beige Book

by Calculated Risk on 3/05/2013 07:11:00 PM

Back in October, ADP revised their methodology for estimating changes in private employment. Here is a table of the four releases since the methodology was changed.

| Comparison of BLS Private Employment and ADP (000s) | ||||

|---|---|---|---|---|

| ADP Initial | Revised | BLS Initial (Private Only) | BLS Revised (Private) | |

| Oct-12 | 158 | 159 | 184 | 217 |

| Nov-12 | 118 | 173 | 147 | 256 |

| Dec-12 | 215 | 185 | 168 | 202 |

| Jan-13 | 192 | - | 166 | - |

In general it appears the new methodology is better, but it is still too early for a statistical analysis. With this small sample, it appears that the initial BLS report will be +/- 20% of the ADP number or so.

Wednesday economic releases:

• At 10:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 173,000 payroll jobs added in February.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 2.2% decrease in orders.

• At 2:00 PM, the Federal Reserve Beige Book will be released. This is an informal review by the Federal Reserve Banks of current economic conditions in their Districts. Analysts will look for signs of an impact from the recent tax increases.

Market Update

by Calculated Risk on 3/05/2013 04:45:00 PM

Click on graph for larger image.

By request - following the new high on the Dow today - here are a couple of stock market graphs. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in July 2007, just before the recession started. We can't call it a "lost decade" for stocks any more.

Another note: A new high doesn't tell us much. Over the last 50 years (starting in 1963) there were 27 years with new highs. If we excluded the miserable '00s, there were new highs in 26 of 38 years. So new highs are not unusual.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...

Trulia: Asking House Prices increased in February, Inventory not expected to bottom in 2013

by Calculated Risk on 3/05/2013 12:39:00 PM

Press Release: Trulia Reports Asking Home Price Gains Accelerating While Housing Inventory No Longer in Free Fall

Since bottoming 12 months ago, national asking home prices rose 7.0 percent year-over-year (Y-o-Y) in February. Seasonally adjusted, asking prices also increased 1.4 percent month-over-month (M-o-M) and 3.0 percent quarter-over-quarter (Q-o-Q) – marking two post-recession highs. Asking prices locally are up in 90 of the 100 largest U.S. metros, rising fastest in Phoenix, Las Vegas, and Oakland.More on inventory from Jed Kolko, Trulia Chief Economist: Rising Prices Mean Falling Inventory … in the Short Term

Meanwhile, rent increases are slowing down. In February, rents rose just 3.2 percent Y-o-Y. This is a notable decrease from three months ago, in November, when rents were up 5.4 percent Y-o-Y. Among the 25 largest rental markets, rents rose the most in Houston, Oakland, and Miami, while falling slightly in San Francisco and Las Vegas.

...

Inventory Will Not Turn Around in 2013 Even Though Decline Is Slowing Down

Inventory falls most sharply just after prices bottom, creating an “inventory spiral”: rising prices reduce inventory as would-be home sellers hold off in the hopes of selling later at a higher price, and falling inventory boosts prices further as buyers compete for a limited number of for-sale homes. Nationally, the annualized rate of inventory decline was 23 to 29 percent from March to September 2012, the months after home prices first bottomed one year ago, but has softened to a 14 to 21 percent rate since October [1]

emphasis added

Inventory and prices affect each other in three ways:These are important points on inventory, and I now think inventory will not bottom this year (this is why I've been tracking inventory weekly). This probably means more price appreciation in 2013 than most analysts expect (I think the consensus was around 3% price increase in 2013), and this is also positive for new home sales.

1.Less inventory leads to higher prices. That’s because buyers are competing for a limited number of for-sale homes.In the short term, the first two reasons create an “inventory spiral”: less inventory leads to higher prices, which leads to less inventory, and so on. But the inventory spiral can’t go on forever because eventually rising prices will encourage homeowners to sell and builders to build, which add to inventory and breaks the spiral. The critical question for the housing market – especially for buyers fighting over tight inventories – is how long until that kicks in? How long do prices have to rise before sellers and builders start adding to inventory?

2.Higher prices lead to less inventory – at least in the short term. Everyone wants to buy at the bottom; no one wants to sell at the bottom. When prices start to rise, buyers get impatient while many would-be sellers want to hold out in the hopes of selling later at a higher price.

3.Higher prices lead to more inventory – in the long term. As prices keep rising, more homeowners decide it’s worthwhile to sell, especially those who get back above water, which adds to inventory. Also, builders take rising prices as a cue to rev up construction activity, which also adds to inventory.

...

How long until inventory turns positive, rather than becoming just less negative? ... it could be at least another year until national inventory starts expanding. Of course, inventory will probably turn up this spring and summer because of the regular seasonal pattern, but the underlying trend will be less inventory than is typical for each season, not more.

Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.