by Calculated Risk on 1/28/2013 03:30:00 PM

Monday, January 28, 2013

Existing Home Inventory up 3.7% in late January

One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'll be tracking inventory weekly for the next few months.

If inventory does bottom, we probably will not know for sure until late in the year. In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The NAR data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) kindly sent me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year.

In 2010 (blue), inventory followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through January - it appears inventory is increasing at a more normal rate.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

The key will be to see how much inventory increases over the next few months. In 2010, inventory was up 8% by early March, and up 15% by the end of March.

For 2011 and 2012, inventory only increased about 5% at the peak.

So far in 2013, inventory is up 3.7%, and the next few months will be very interesting for inventory!

Dallas Fed: Regional Manufacturing Activity "Strengthens" in January

by Calculated Risk on 1/28/2013 11:38:00 AM

From the Dallas Fed: Texas Manufacturing Activity Strengthens in January

Texas factory activity rose sharply in January, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 3.5 to 12.9, which is consistent with faster growth.This was the strongest regional manufacturing report for January and above expectations of a reading of 4.0 for the general business activity index.

Other measures of current manufacturing activity also indicated stronger growth in January. The new orders index jumped 13 points to 12.2, its highest reading since March 2011. The capacity utilization index shot up from 2.1 to 14.0, implying utilization rates increased faster than last month. The shipments index rose 9 points to 21.9, indicating shipments quickened in January.

Perceptions of broader business conditions were more positive in January. The general business activity index increased from 2.5 to 5.5, its best reading since March. The company outlook index also rose sharply to 12.6, largely due to a drop in the share of firms reporting a worsened outlook from 10 percent in December to 6 percent in January.

Labor market indicators reflected a sharp increase in hiring but flat workweeks.

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through January), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through December (right axis).

The average of the five regional surveys turned negative again.

The ISM index for January will be released Friday, Feb 1st, and these surveys suggest another weak reading - and probably indicating contraction (below 50). Note: The Markit Flash index was surprisingly strong in January.

Pending Home Sales index declines in December

by Calculated Risk on 1/28/2013 10:00:00 AM

From the NAR: Pending Home Sales Down in December but Remain on Uptrend

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, fell 4.3 percent to 101.7 in December from 106.3 in November but is 6.9 percent higher than December 2011 when it was 95.1. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

...

Lawrence Yun , NAR chief economist, said there is an uneven uptrend. "The supply limitation appears to be the main factor holding back contract signings in the past month. Still, contract activity has risen for 20 straight months on a year-over-year basis," he said. "Buyer interest remains solid, as evidenced by a separate Realtor® survey which shows that buyer foot traffic is easily outpacing seller traffic."

Yun said shortages of available inventory are limiting sales in some areas. "Supplies of homes costing less than $100,000 are tight in much of the country, especially in the West, so first-time buyers have fewer options," he said ...

The PHSI in the Northeast fell 5.4 percent to 78.8 in December but is 8.4 percent higher than December 2011. In the Midwest the index rose 0.9 percent to 104.8 in December and is 14.4 percent above a year ago. Pending home sales in the South declined 4.5 percent to an index of 111.5 in December but are 10.1 percent higher December 2011. In the West the index fell 8.2 percent in December to 101.0 and is 5.3 percent below a year ago.

As I've noted several times, with limited inventory at the low end and fewer foreclosures, we might see flat or even declining existing home sales. The key for sales is that the number of conventional sales is increasing while foreclosure and short sales decline.

Housing Spillover Effects

by Calculated Risk on 1/28/2013 09:04:00 AM

People frequently ask how a sector that currently accounts for 2.5% of the US economy can be so important. First, residential investment has large swings during the business cycle, and will probably increase sharply over the next few years. Second, there are spillover effects from housing - meaning housing has a much larger impact on overall economic activity than just "residential investment".

We are starting to see some signs of spillover from Kate Linebaugh and James Hagerty at the WSJ: From Power Tools to Carpets, Housing Recovery Signs Mount

Companies that sell power tools, air conditioners, carpet fibers, furniture and cement mixers are reporting stronger sales for the fourth quarter, providing further evidence that a turnaround in the housing market is taking hold.Weekend:

... executives at companies exposed to housing are growing more optimistic. Improvement in the sector could help broad tracts of the economy by creating jobs, improving consumer confidence and boosting property-tax receipts for municipalities. Construction typically is a big job creator during expansions, though the industry has been slow to staff up during the current recovery.

"The housing recovery will help lift businesses that have long been dormant," said Mark Vitner, senior economist at Wells Fargo. "People will be fixing up homes to put them up for sale—buying new air conditioners, painting, fixing roofs. As the new-home market picks up, that really feeds into [gross domestic product]."

• Summary for Week Ending Jan 25th

• Schedule for Week of Jan 27th

• Thresholds for QE

• Me, Me, Me

Sunday, January 27, 2013

Monday: Durable Goods, Pending Home Sales

by Calculated Risk on 1/27/2013 09:16:00 PM

This is related to my earlier post on Thresholds for QE, from Binyamin Appelbaum at the NY Times: At Fed, Nascent Debate on When to Slow Asset Buying

The looming question is how much longer the asset purchases will continue.This discussion is just starting, and I don't expect any significant announcements after the FOMC meeting this week.

... the discussion already has begun to swing toward informal thresholds.

Mr. Rosengren said last year that the Fed should certainly continue the purchases until the unemployment rate declines at least below 7.25 percent.

James Bullard, president of the Federal Reserve Bank of St. Louis ... [told] CNBC that he expected the unemployment rate to drop to near 7 percent by the end of the year and that it would then be appropriate for the Fed to consider suspending its program of asset purchases.

The Asian markets are mostly green tonight; the Shanghai Composite index is up 1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures and DOW are flat (fair value).

Oil prices have moved up a little recently with WTI futures at $95.97 per barrel and Brent at $113.27 per barrel. Gasoline prices are up about 5 cents over the last 10 days.

Monday:

• At 8:30 AM ET, Durable Goods Orders for December from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders.

• At 10:00 AM, the NAR will release their Pending Home Sales Index for December. The consensus is for a 0.3% decrease in the index.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for January will be released. This is the last of the regional surveys for January. The consensus is a decrease to 4.0 from 6.8 in December (above zero is expansion).

Weekend:

• Summary for Week Ending Jan 25th

• Schedule for Week of Jan 27th

• Thresholds for QE

• Me, Me, Me

Does this mark the top for bond prices?

by Calculated Risk on 1/27/2013 05:35:00 PM

Fun on a Sunday with a hat tip to reader Jeff for suggesting this post.

Last year I posted a photo of the early construction phase of the PIMCO Taj Mahal. Now they are working on the interior of the building (building on the left).

The question is: Does completion of the PIMCO building mark the top for bond prices?

Earlier:

• Summary for Week Ending Jan 25th

• Schedule for Week of Jan 27th

• Thresholds for QE

• Me, Me, Me

Thresholds for QE

by Calculated Risk on 1/27/2013 02:42:00 PM

In the schedule for this coming week, I mentioned there is a two day Federal Open Market Committee (FOMC) meeting ending on Wednesday, January 30th with the FOMC announcement expected at 2:15 PM ET on Wednesday. No significant changes are expected at this meeting.

At the last meeting, the FOMC set "thresholds" for raising the Fed Funds rate. From the December FOMC statement:

"[The FOMC] anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored. The Committee views these thresholds as consistent with its earlier date-based guidance."An interesting question is if the FOMC will set thresholds for reducing or ending the current $85 billion per month in asset purchases (aka Quantitative Easing or QE). Goldman Sachs chief economist Jan Hatzius discussed this possibility last week:

emphasis added

"The rationale for QE thresholds is similar to that for funds rate thresholds, namely that they would help the financial markets understand the Fed's reaction function with respect to changes in the economic outlook. If the committee adopted such an approach, the most likely thresholds would be 7.25% for the unemployment rate, 2.5% for the 1-2 year PCE inflation outlook, and "well anchored" inflation expectations. We would also expect an additional "out," namely that QE must not impair market functioning or create financial imbalances.Boston Fed President Eric Rosengren discussed this in a speech last year:

Any move to QE thresholds would probably not occur until the spring or summer of 2013. But the future of QE, the criteria for slowing or ending it, and perhaps even the question of whether QE thresholds are desirable in principle are likely to be on the FOMC's agenda as soon as next week."

"My own personal assessment is that as long as inflation and inflation expectations are expected to remain well-behaved in the medium term, we should continue to forcefully pursue asset purchases at least until the national unemployment rate falls below 7.25 percent and then assess the situation.Based on the current FOMC projections of the unemployment rate, this threshold would not be reached until some time in 2014. I don't expect QE thresholds to be announced this week, but this might happen later this year.

I think of this number as a threshold, not as a trigger – and the distinction is important. I think of a trigger as a set of conditions that necessarily imply a change in policy. A threshold, unlike a trigger, does not necessarily precipitate a change in policy."

Me, Me, Me

by Calculated Risk on 1/27/2013 10:32:00 AM

After this ... enough about me! From Alejandro Lazo at the LA Times: Blogger keeps finger on pulse of housing market. An excerpt:

These days, Calculated Risk has become a go-to source for Wall Street, the media, academics and anyone else looking for authoritative analysis of housing and the broader economy. When McBride makes a prediction — as when he called a housing bottom early in 2012 — the housing world takes note.On Friday, from From Nick Timiraos at the WSJ: Six Housing Forecasters Who Got Things Right in 2012

"If you only follow one economics blog, it has to be Calculated Risk," said James Hamilton, an economics professor at UC San Diego. "If you find yourself reaching a different conclusion from Bill about where the economy is headed, my recommendation is think again."

Although many economics blogs have ideological slants, Calculated Risk established a reputation as an objective source of commentary on an increasingly politicized topic. The blog's name — borrowed from that of a friend's boat — accurately implies an impartial, yet edgy, take on the economy.

But McBride himself has remained somewhat a mystery. Even while promoting his work, McBride shunned the spotlight personally. He wrote anonymously during the first years he blogged, which only heightened interest among a growing number of followers.

"He was one of the first people to stand up and, objectively, just by brutally falling back on the facts, just say that the emperor didn't have any clothes," said longtime reader Stan Humphries, Zillow.com's chief economist. "It was this deep mystery about who this guy actually was. I remember the first time I went and met him, it was like meeting Batman."

After correctly calling the top of sales activity in 2005 and prices in 2006, [McBride] proclaimed last February that the “housing bottom is here” in a blog post that laid out all the dirty details. “I’ve tried over the years to call the turns when they arrive. I’m trying to call it when it happens and not wait six months or a year,” said Mr. McBride in an interview last February.Saturday:

• Summary for Week Ending Jan 25th

• Schedule for Week of Jan 27th

Saturday, January 26, 2013

Unofficial Problem Bank list declines to 825 Institutions

by Calculated Risk on 1/26/2013 07:18:00 PM

Here is the unofficial problem bank list for Jan 25, 2012.

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions through December 2012, which led to several changes to the Unofficial Problem Bank List. For the week, there were six removals and five additions leaving the list at 825 institutions with assets of $308.9 billion. A year ago, the list held 958 institutions with assets of $389.0 billion. For the month, the list was down by 13 and $4.1 billion in assets after two failures, four unassisted mergers, 15 action terminations, one voluntary liquidation, and nine additions.Earlier:

First National Bank, Hays, KS ($79 million) found a merger partner to get off the list. The FDIC terminated actions against Farmers & Merchants Bank, Lakeland, GA ($597 million); Border State Bank, Greenbush, MN ($338 million); Stoneham Savings Bank, Stoneham, MA ($326 million); Paragon Bank, Wells, MN ($30 million); and Peoples State Bank of Madison Lake, Madison Lake, MN ($24 million).

The FDIC issued actions against Bank of Washington, Washington, MO ($853 million); Community First Bank, Inc., Walhalla, SC ($463 million Ticker: CFOK); Central Bank, Savannah, TN ($160 million); Mountain Valley Bank, Dunlap, TN ($99 million); and US Metro Bank, Garden Grove, CA ($88 million Ticker: USMT). Also, the FDIC issued a Prompt Corrective Action order against First South Bank, Spartanburg, SC ($336 million Ticker: FSBS).

Next week should be a quiet one for the changes to the list.

• Summary for Week Ending Jan 25th

• Schedule for Week of Jan 27th

Schedule for Week of Jan 27th

by Calculated Risk on 1/26/2013 01:48:00 PM

Earlier:

• Summary for Week Ending Jan 25th

This will be a very busy week for economic data. The key reports are the Q4 advance GDP report to be released on Wednesday, and the January employment report on Friday.

Other key reports include Case-Shiller house prices for November on Tuesday, the ISM manufacturing index on Friday, and auto sales on Friday.

There is an FOMC meeting on Tuesday and Wednesday, with an announcement scheduled for Wednesday at 2:15 PM ET. No significant changes are expected.

8:30 AM: Durable Goods Orders for December from the Census Bureau. The consensus is for a 1.6% increase in durable goods orders.

10:00 AM ET: Pending Home Sales Index for December. The consensus is for a 0.3% decrease in the index.

10:30 AM: Dallas Fed Manufacturing Survey for January. This is the last of the regional surveys for January. The consensus is a decrease to 4.0 from 6.8 in December (above zero is expansion).

9:00 AM: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November.

9:00 AM: S&P/Case-Shiller House Price Index for November. Although this is the November report, it is really a 3 month average of September, October and November. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through October 2012 (the Composite 20 was started in January 2000).

The consensus is for a 5.8% year-over-year increase in the Composite 20 index (NSA) for November. The Zillow forecast is for the Composite 20 to increase 5.3% year-over-year, and for prices to increase 0.4% month-to-month seasonally adjusted.

10:00 AM: Conference Board's consumer confidence index for January. The consensus is for the index to be unchanged at 65.1.

10:00 AM: Q4 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to report on the homeownership rate, and the homeowner and rental vacancy rates. However, this report doesn't track other measures (like the decennial Census and the ACS) and this survey probably shouldn't be used to estimate the excess vacant housing supply.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 172,000 payroll jobs added in January. Even with the new methodology, the report still isn't that useful in predicting the BLS report.

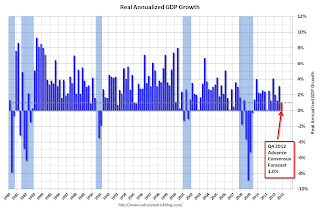

8:30 AM: Q4 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.0% annualized in Q4.

8:30 AM: Q4 GDP (advance release). This is the advance release from the BEA. The consensus is that real GDP increased 1.0% annualized in Q4.This graph shows the quarterly GDP growth (at an annual rate) for the last 30 years.

The Red column (and dashed line) is the consensus forecast for Q4 GDP.

2:15 PM: FOMC Meeting Announcement. No significant announcement is expected.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 350 thousand from 330 thousand last week.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.7% increase in personal income in December, and for 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a decrease to 50.5, down from 51.6 in December.

8:30 AM: Employment Report for January. The consensus is for an increase of 155,000 non-farm payroll jobs in January; there were also 155,000 jobs added in December.

8:30 AM: Employment Report for January. The consensus is for an increase of 155,000 non-farm payroll jobs in January; there were also 155,000 jobs added in December. The consensus is for the unemployment rate to decrease to 7.7% in January.

Note: As usual, the January report will include revisions. From the BLS: "the Current Employment Statistics (CES) survey will introduce revisions to nonfarm payroll employment, hours, and earnings data to reflect the annual benchmark adjustment for March 2012 and updated seasonal adjustment factors. Not seasonally adjusted data beginning with April 2011 and seasonally adjusted data beginning with January 2008 are subject to revision."

For the Household survey, from the BLS: "Effective with the release of The Employment Situation for January 2013, scheduled for February 1, 2013, new population controls will be used in the monthly household survey estimation process."

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions through December.

The second employment graph shows the percentage of payroll jobs lost during post WWII recessions through December.The economy has added 5.8 million private sector jobs since employment bottomed in February 2010 including preliminary benchmark revision (5.2 million total jobs added including all the public sector layoffs).

There are still 3.1 million fewer private sector jobs now than when the recession started in 2007 (including benchmark revision).

9:00 AM: The Markit US PMI Manufacturing Index. The consensus is for an increase to 55.5, up from 54.0.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for January). The consensus is for a reading of 71.5, up from 71.3.

10:00 AM ET: ISM Manufacturing Index for January.

10:00 AM ET: ISM Manufacturing Index for January. Here is a long term graph of the ISM manufacturing index. The ISM manufacturing index indicated expansion in December at 50.7% (dashed line). The employment index was at 48.4% in December, and the new orders index was at 50.3%. The consensus is for PMI to be unchanged at 50.7%. (above 50 is expansion).

10:00 AM: Construction Spending for December. The consensus is for a 0.8% increase in construction spending.

All day: Light vehicle sales for January. The consensus is for light vehicle sales to be at 15.3 million SAAR in January (Seasonally Adjusted Annual Rate) unchanged from the December rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate.

This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the December sales rate. Edmunds.com is forecasting:

Edmunds.com ... forecasts that 1,045,587 new cars and trucks will be sold in the U.S. in January for an estimated Seasonally Adjusted Annual Rate (SAAR) of 15.3 million light vehicles. The projected sales will be ... a 14.5 percent increase from January 2012.