by Calculated Risk on 8/12/2012 04:43:00 PM

Sunday, August 12, 2012

Europe and US: A few misc dates in September and October

A few miscelleneous dates (just making some notes).

First, for Europe it looks like September and October will be very busy (after the Europeans get back from vacation). Greece will be back in the headlines in October according to the WSJ: Troika to Spend 'All of September' in Greece -EU Official

"The mission in September will stay the whole month in order to report to the October Eurogroup," the official said, referring to the ministers' meeting scheduled to take place in Luxembourg on Oct. 8.Here are a few key European dates:

• September 6th, Governing Council meeting of the European Central Bank in Frankfurt with a press conference to follow. ECB President Mario Draghi is expected to discuss how the ECB will help lower Spanish and Italian borrowing costs.

• September 12th, Germany's Constitutional Court is expected to rule on the new eurozone bailout fund and fiscal treaty.

• Mid-September: Euro-zone finance ministers' informal meetings in Nicosia.

• October 8th, Finance Ministers meeting in Luxembourg.

• European Council meeting, October 18th and 19th in Brussels.

And in the US:

• (Not key) Political conventions: Republicans August 27–30 in Tampa, and Democrats September 3–6 in Charlotte. The election is on November 6th.

• September 12th and 13th: the Federal Open Market Committee (FOMC) meets. After this meeting the FOMC will release updated Summary of Economic Projections, and Fed Chairman Ben Bernanke will hold a press conference. Major economic releases before the FOMC meeting: August 29th, second estimate of Q2 GDP, and September 7th, the August employment report.

Yesterday:

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

Mortgage Delinquencies by Loan Type

by Calculated Risk on 8/12/2012 10:06:00 AM

The following graphs show the percent of loans delinquent by loan type based on the MBA National Delinquency Survey: Prime, Subprime, FHA and VA. First a table comparing the number of loans in Q2 2007 and Q2 2012 so readers can understand the shift in loan types.

Both the number of prime and subprime loans have declined over the last five years; the number of subprime loans is down by about 35%. Meanwhile the number of FHA loans has more than doubled and VA loans have increased sharply.

An interesting point: Each loan type improved in Q2 2012, but the total delinquency rate increased. The reason is the shift in loan types - from prime loans to more FHA and VA loans.

Note: There are about 42.5 million first-lien loans in the survey, and the MBA survey is about 88% of the total.

| MBA National Delinquency Survey Loan Count | ||||

|---|---|---|---|---|

| Q2 2007 | Q2 2012 | Change | Q2 2012 Seriously Delinquent | |

| Prime | 33,916,830 | 30,120,941 | -3,795,889 | 1,500,023 |

| Subprime | 6,204,535 | 4,031,216 | -2,173,319 | 918,714 |

| FHA | 3,030,214 | 6,827,727 | 3,797,513 | 614,495 |

| VA | 1,096,450 | 1,526,913 | 430,463 | 70,696 |

| Survey Total | 44,248,029 | 42,506,797 | -1,741,232 | 3,103,928 |

Click on graph for larger image.

Click on graph for larger image.First a repeat: This graph shows the percent of loans delinquent by days past due. Loans 30 days delinquent increased to 3.18% from 3.13% in Q1. This is at about 2007 levels and around the long term average.

Delinquent loans in the 60 day bucket increased to 1.22% in Q2, from 1.21% in Q1.

The 90 day bucket increased to 3.19% from 3.06%. This is still way above normal (around 0.8% would be normal according to the MBA).

The percent of loans in the foreclosure process decreased to 4.27% from 4.39% and is now at the lowest level since Q1 2010.

Note: Scale changes for each of the following graphs.

The second graph is for all prime loans.

The second graph is for all prime loans. This is the category with the most seriously delinquent loans. Back in early 2007 when Fed Chairman Ben Bernanke said "the problems in the subprime market seems likely to be contained", my former co-blogger Tanta responded "We are all subprime!" - she was correct.

Since there are far more prime loans than any other category (see table above), about half the loans seriously delinquent now are prime loans - even though the overall delinquency rate is lower than other loan types.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.

This graph is for subprime. This category gets most of the attention - mostly because of all the terrible loans made through the Wall Street "originate-to-distribute" model and sold as Private Label Securities (PLS). Not all PLS was subprime, but the worst of the worst loans were packaged in PLS.Although the delinquency rate is still very high, the number of subprime loans has declined sharply.

This graph is for FHA loans. In Q2, there was a shift from 90+ days deliquent to in-foreclosure, but the overall percent of loans delinquent or in-foreclosure declined in Q2.

This graph is for FHA loans. In Q2, there was a shift from 90+ days deliquent to in-foreclosure, but the overall percent of loans delinquent or in-foreclosure declined in Q2. The improvement in late 2010 was a combination of the increase in number of loans (recent loans have lower delinquency rates) and eliminating Downpayment Assistance Programs (DAPs). These were programs that allowed the seller to give the buyer the downpayment through a 3rd party "charity" (for a fee of course). The buyer had no money in the house and the default rates were absolutely horrible.

The last graph is for VA loans. This is a fairly small but growing category (see table above).

The last graph is for VA loans. This is a fairly small but growing category (see table above).There are still quite a few subprime loans that are in distress, but the real keys are prime loans and FHA loans.

Saturday, August 11, 2012

Update: Real GDP Percent Change Graph, 1980-Q2 2012

by Calculated Risk on 8/11/2012 08:32:00 PM

Earlier:

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

When the Q2 GDP report was released, I focused on the revisions and didn't post the usual graph showing the real GDP change since 1980. By request, here is an update.

The graph shows the annualized real quarterly change in GDP from 1980 through Q2 2012.

Click on graph for larger image.

For Q2, the BEA's advance estimate was 1.5%. Since Q3 2009, GDP has been positive every quarter and averaged about 2.2% real growth.

Another way to look at GDP is on a rolling year-over-year basis. See Tim Duy's graphs at US Baseline

Note: I've also update several graphs in the GDP graph gallery. See: GDP Graphs

Unofficial Problem Bank list increases to 900 Institutions

by Calculated Risk on 8/11/2012 06:09:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Aug 10, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

Activity by the Federal Reserve was responsible for most of the changes to the Unofficial Problem Bank List this week. The list pushed back up to 900 institutions but assets dropped by $780 million to $348.6 billion after three additions and two removals. A year ago, the list held 988 institutions with assets of $411.3 billion.Earlier:

The Federal Reserve terminated actions against LegacyTexas Bank, Plano, TX ($1.6 billion) and Coastal Community Bank, Everett, WA ($311 million). The additions were Beacon Federal, East Syracuse, NY ($1.0 billion Ticker: BFED); Asian Bank, Philadelphia, PA ($71 million); and The State Bank of Blue Mound, Blue Mound, IL ($37 million). The Federal Reserve issued a Prompt Corrective Action order against Gold Canyon Bank, Gold Canyon, AZ ($60 million).

Other news to report is the bankruptcy filing by Capitol Bancorp LTD (See Form 8-K) on August 9th. Back in the middle part of last decade, Capitol Bancorp owned/controlled more than 50 banks. After divestitures in an effort to prevent the collapse of the company, Capitol Bancorp is down to owning/controlling 15 banks, with 11 on the Unofficial Problem Bank List. The FDIC has issued cross-guaranty waivers in conjunction with several of the divestitures. This will bear watching to see if the bankruptcy filing results in any closings of the banks that Capitol Bancorp owns/controls.

• Summary for Week Ending Aug 10th

• Schedule for Week of Aug 12th

Schedule for Week of August 12th

by Calculated Risk on 8/11/2012 01:05:00 PM

Earlier:

• Summary for Week Ending Aug 10th

This will be a very busy week for economic data. There are two key housing reports to be released this week: August homebuilder confidence on Wednesday, and July housing starts on Thursday.

Another key report is retail sales for July. For manufacturing, the August NY Fed (Empire state) and Philly Fed surveys, and the July Industrial Production and Capacity Utilization report will be released this week.

On prices, PPI for July will be released on Tuesday, and CPI will be released on Wednesday.

No releases scheduled.

7:30 AM ET: NFIB Small Business Optimism Index for July. The consensus is for a decrease to 91.3 in July from 91.4 in June.

8:30 AM: Producer Price Index for July. The consensus is for a 0.2% increase in producer prices (0.2% increase in core).

8:30 AM ET: Retail Sales for July.

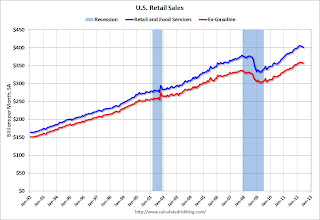

8:30 AM ET: Retail Sales for July. This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline). Retail sales are up 21.2% from the bottom, and now 6.0% above the pre-recession peak (not inflation adjusted)

The consensus is for retail sales to increase 0.3% in July, and for retail sales ex-autos to increase 0.4%.

10:00 AM: Manufacturing and Trade: Inventories and Sales for June (Business inventories). The consensus is for 0.2% increase in inventories.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

8:30 AM: Consumer Price Index for July. The consensus is for CPI to increase 0.2% in July and for core CPI to increase 0.2%.

8:30 AM: NY Fed Empire Manufacturing Survey for August. The consensus is for a reading of 7.0, down from 7.4 in July (above zero is expansion).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This shows industrial production since 1967.

The consensus is for Industrial Production to increase 0.5% in July, and for Capacity Utilization to increase to 79.2%.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 35, unchanged from 35 in July. Although this index has been increasing lately, any number below 50 still indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. Total housing starts were at 760 thousand (SAAR) in June, up 6.9% from the revised May rate of 711 thousand (SAAR).

The consensus is for total housing starts to decrease to 750,000 (SAAR) in July, down from 760,000 in June.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand from 361 thousand.

10:00 AM: Philly Fed Survey for August. The consensus is for a reading of -5.0, up from -12.9 last month (above zero indicates expansion).

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for sentiment to decrease slightly to 72.0 from 72.3 in July.

10:00 AM: Conference Board Leading Indicators for August. The consensus is for a 0.2% increase in this index.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2012