by Calculated Risk on 4/23/2012 02:47:00 PM

Monday, April 23, 2012

Lawler: Early Builder Reports Point to “Pretty Decent” Spring Selling Season, Contest Questions

From economist Tom Lawler:

NVR Inc, the fourth largest US home builder in 2010, reported last week that net home orders in the quarter ended March 31, 2012 totaled 3,157, up 31.4% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 10.3% last quarter, down form 12.3% a year ago. Home closings totaled 1,924 last quarter, up 17.7% from the comparable quarter of last year, while the company’s order backlog on 3/31/12 was 4,909, up 33.2% from last March.

D.R. Horton, the largest home builder in the US, reported today that net home orders in the quarter ended March 31, 2012 totaled 5,899, up 19.3% from the comparable quarter of 2011. The company’s sales cancellation rate, expressed as a % of gross orders, was 22% last quarter, down from 25% a year ago. Home closings totaled 4,240, up 20.6% from the comparable quarter of last year, while the company’s order backlog on 3/31/12 was 6,189, up 17.2% from a year ago.

Chairman of the Board Don Horton noted that the company’s strong sales pace had “continued through the first of April.”

There are been few scattered reports from other, smaller home builders that the current spring selling season has been significantly better than last year, The Ryland Group, PulteGroup, Meritage Homes, and M/I Homes report earnings and operating results for the quarter ended 3/31/12 on April 26.

The Commerce Department’s February report on new SF homes showed YTD new SF home sales (not seasonally adjusted) up by just 8.2% from the comparable period of 2011. The March new SF home sales report is due out tomorrow. While correlations between builder reports and Census new SF sales are not that strong, right now I’d guess that there is significant “upside surprise” to tomorrow.

| Settlements | Net Orders | Backlog | |||||||

|---|---|---|---|---|---|---|---|---|---|

| 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | 3/2012 | 3/2011 | 3/2010 | |

| D.R. Horton | 4,240 | 3,516 | 4,260 | 5,899 | 4,943 | 6,438 | 6,189 | 5,281 | 6,314 |

| NVR | 1,924 | 1,634 | 1,919 | 3,157 | 2,403 | 2,940 | 4,909 | 3,685 | 4,552 |

| Combined | 6,164 | 5,150 | 6,179 | 9,056 | 7,346 | 9,378 | 11,098 | 8,966 | 10,866 |

| YOY % Chg | 19.7% | -16.7% | 23.3% | -21.7% | 23.8% | -17.5% | |||

CR Note: There has probably been some shift to the larger builders, and that would suggest the Census reported increase in new home sales would be lower than the large builders report. The March New Home sales reported is scheduled to be released at 10 AM tomorrow, and the consensus is for an increase in sales to 318 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 313 thousand in February.

For those playing the prediction contest:

DOT: Vehicle Miles Driven increased 1.8% in February

by Calculated Risk on 4/23/2012 01:50:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by +1.8% (3.9 billion vehicle miles) for February 2012 as compared with February 2011. Travel for the month is estimated to be 216.1 billion vehicle miles..The following graph shows the rolling 12 month total vehicle miles driven.

Even with the year-over-year increase in February, the rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 51 months - and still counting.

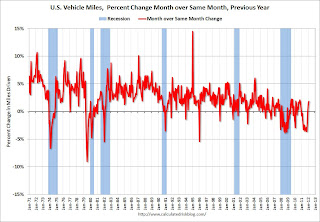

The second graph shows the year-over-year change from the same month in the previous year.

This is the third consecutive month with a year-over-year increase in miles driven - for the first time since 2010.

This is the third consecutive month with a year-over-year increase in miles driven - for the first time since 2010.Even though gasoline prices are up sharply over the last few of months, prices also increased quickly last year in March and April - so we might not see a year-over-year decline in miles driven in the coming months.

The lack of growth in miles driven over the last 4+ years is probably due to a combination of factors: the great recession and the lingering effects, the high price of gasoline - and the aging of the overall population. HS Dent has a graph of gasoline demand by age (see page 13 of Age of Consumer demand curves based on Census Bureau data) (ht Doug Short) - so this is probably, at least partially, another impact from the aging of the baby boomers (ht Brian).

FNC: February Residential Property Values Down 0.8%

by Calculated Risk on 4/23/2012 11:08:00 AM

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC, Zillow and RadarLogic indexes.

From FNC: February Residential Property Values Down 0.8%

FNC’s latest Residential Price Index™ (RPI), released Friday, indicates that U.S. residential property values continued to show signs of persistent weakening - ending in February with a seventh consecutive month-to-month decline. Despite sharply rising activities in existing home sales and new housing starts from a year ago, prices on non-distressed home sales (excluding foreclosure auction sales, REO sales, and short sales) continue to slide, down 0.8% from February or 3.0% from a year ago.

...

All three RPI composites (the National, 30-MSA, and 10-MSA indices) show similar month-to-month declines in February, down about a percentage point from January. ... The indices’ year-to-year trends continue to show signs of improvement. According to the national RPI, home prices nationwide declined at a seasonally adjusted rate of 3.0% in February, the slowest pace in the last 20 months. The year-to-year declines at the nation’s top housing markets, as indicated by the 30- and 10-MSA composites, have also decelerated to below 4.0% -- their slowest pace since May 2010.

Click on graph for larger image.

Click on graph for larger image.This graph is based on the FNC index (four composites) through February 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The indexes are generally showing less of a year-over-year decline in February (I think prices will fall seasonally through the March report). This is the smallest year-over-year decline in the FNC index since the housing tax credit expired.

The February Case-Shiller index will be released tomorrow, and the consensus is for a 3.3% decrease in year-over-year prices (NSA) in February. (Zillow is forecasting that Case-Shiller will report a 3.5% decline for the Composite 10 index, and a 3.4% decline for the Composite 20).

Eurozone Worries Again

by Calculated Risk on 4/23/2012 08:54:00 AM

A few stories:

From the Financial Times: Eurozone angst spooks investors

Markets reacted nervously on Monday to the socialists’ first-round victory in France’s presidential election, as the eurozone crisis claimed another victim on Monday with the collapse of the Dutch government.From the WSJ: Euro-Zone's Private Sector Shrinking Fast

excerpt with permission

The euro zone's private sector contracted in April at the sharpest pace since November, damaged by a steep decline in the manufacturing sector, suggesting the region won't rebound quickly from the recession recent data are pointing to.From the WSJ: Spain's Economy Dwindling

The preliminary composite PMI for the euro zone slumped to 47.4 in April from March's 49.1, Markit's preliminary purchasing managers' index showed Monday. The April manufacturing PMI slipped to 46 from March's 47.7 while the services PMI also declined to 47.9 from 49.2 over the same period ...

Spain's central bank said Monday that the country's economy contracted 0.4% in the first quarter from the fourth, evidence that a worsening downturn is making it tougher for Madrid to reach ambitious austerity targets.

On an annual basis, the economy contracted 0.5%, the first negative reading after seven-consecutive quarters of modest growth, the Bank of Spain said in its monthly economic report. This marks the official end of a mild recovery between late 2010 and late 2011 ...

Sunday, April 22, 2012

Sunday Night Futures

by Calculated Risk on 4/22/2012 11:30:00 PM

From the NY Times: Hollande and Sarkozy Head to Runoff in French Race

The Socialist candidate, François Hollande, won a narrow victory in Sunday’s first round of France’s presidential elections, riding promises of economic growth and a general dislike for the incumbent, Nicolas Sarkozy, into a favorable position before a runoff with Mr. Sarkozy on May 6.It sounds link Hollande is leading right now. The election in Greece is also scheduled for May 6th.

The strong showing by the left and anger on the political extremes seemed to reflect a desire for change in France after 17 years of centrist, conservative presidents. And it could continue an anti-incumbency trend that began with the economic crisis in Western Europe, where center-right governments dominate from Britain to Spain to Germany.

It may also represent the first stirrings of a challenge to the German-dominated narrative of the euro crisis, which holds that public debt and runaway spending are the main culprits and that austerity must precede growth.

The Asian markets are mostly red tonight. The Nikkei is down about 0.3%, but the Shanghai Composite is up 0.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down slightly, and Dow futures are down 20.

Oil: WTI futures are down to $103.81 (this is down from $109.77 in February) and Brent is up to $118.79 per barrel.

Earlier:

• Summary for Week Ending April 20th

• Schedule for Week of April 22nd

• FOMC Meeting Preview