by Calculated Risk on 4/04/2012 03:05:00 PM

Wednesday, April 04, 2012

More: Apartment Vacancy Rate falls to 4.9% in Q1

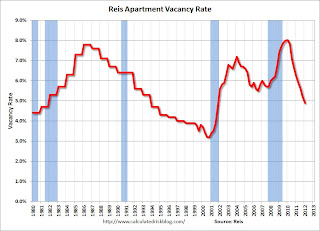

Early this morning I noted that Reis reported the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.

Here are a few more comments and a long term graph from Reis.

Comments from Ries:

The strong performance of the apartment sector has yet to show signs of letting up; national vacancies fell by 30 basis points in the first quarter to 4.9%, a level last observed more than ten years ago, back in 4Q2001. It is also significant to note that national vacancies have improved beyond the benchmark 5% level used as a rule of thumb by apartment landlords: for most markets, once vacancies tighten below 5%, effective rents tend to spike as landlords perceive that tight market conditions allow for greater pricing power.

...

Net absorption, or the net change in occupied stock, remained strong, with 36,484 units leasing up. As the economy begins to show signs of slow but steady improvement, households are flocking to rentals as expectations of single‐family home prices remain flat over the next year or two.

...

With demand for rentals benefiting from the continued moribund state of the for‐sale housing market, tight supply conditions are helping boost the performance of apartment properties around the nation. Only 7,342 apartment units came online in the first quarter – the lowest quarterly figure for new completions since Reis began publishing quarterly data in 1999. Risks may manifest later in the year, however. With multifamily remaining one of the few shining starts in commercial real estate, developers have begun building properties to take advantage of rising incomes. Unless there are delays, Reis expects about 70,000 units to come online in 2012. That is about double the rate of supply growth in 2011. Even more units are slated to come online in 2013, somewhere in the order of 150,000 to 200,000 units in the 79 main markets that Reis tracks.

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980 (prior to 1999 the data is annual). Back in the early '80s, there was overbuilding in the apartment sector (just like for offices) with the very loose lending that led to the S&L crisis. Once the lending stopped, starts of built-for-rent units slowed, and the vacancy rate started to decline.

Following the financial crisis, starts and completions of multi-family units fell to record lows (there were a record low number of completions last year). Builders have increased construction, but it usually takes over a year to complete a multi-family building, so this new supply hasn't reached the market yet. As Reis noted, the number of completions will increase this year, but the vacancy rate will probably decline further.

This will also impact on house prices. The upward pressure on rents will make the price-to-rent ratio a little more favorable for buying.

Data courtesy of Reis.

Ceridian-UCLA: Diesel Fuel index increased 0.3% in March

by Calculated Risk on 4/04/2012 12:21:00 PM

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Increased 0.3 Percent in March, Compared to March 2011, the Pulse is Down 2.2 Percent

The Ceridian-UCLA Pulse of Commerce Index® (PCI®), issued today by the UCLA Anderson School of Management and Ceridian Corporation, rose 0.3 percent in March following the 0.7 percent increase in February and the 1.7 percent decrease in January.This puts the index down 2.2% from March 2011. Note: For comparison, the ATA Trucking index was up 5.1% year-over-year in February.

Click on graph for larger image.

Click on graph for larger image.This graph shows the index since January 2000.

This index has been weaker than the ATA trucking index and reports for rail traffic. It is possible that the high cost of fuel is shifting some long haul traffic from trucks to rail (intermodal) - but it is unclear why this index is weaker than the trucking index.

ISM Non-Manufacturing Index indicates slower expansion in March

by Calculated Risk on 4/04/2012 10:00:00 AM

The March ISM Non-manufacturing index was at 56.0%, down from 57.3% in February. The employment index increased in March to 56.7%, up from 55.7% in February. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the 27th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI registered 56 percent in March, 1.3 percentage points lower than the 57.3 percent registered in February, and indicating continued growth at a slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 58.9 percent, which is 3.7 percentage points lower than the 62.6 percent reported in February, reflecting growth for the 32nd consecutive month. The New Orders Index decreased by 2.4 percentage points to 58.8 percent, and the Employment Index increased by 1 percentage point to 56.7 percent, indicating continued growth in employment at a slightly faster rate. The Prices Index decreased 4.5 percentage points to 63.9 percent, indicating prices increased at a slower rate in March when compared to February. According to the NMI, 16 non-manufacturing industries reported growth in March. Respondents' comments remain mostly optimistic about business conditions. They indicate that increased discretionary spending reflects the increased confidence level of businesses and consumers. There is continued concern about cost pressures and the instability of fuel prices."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 56.7% and indicates slightly slower expansion in March than in February.

CoreLogic: House Price Index falls to new post-bubble low in February, Rate of decline slows

by Calculated Risk on 4/04/2012 09:00:00 AM

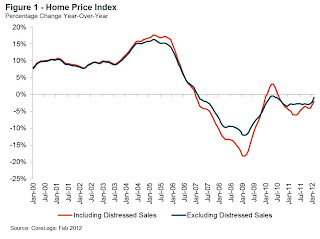

Notes: This CoreLogic House Price Index report is for February. The Case-Shiller index released last week was for January. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of the last three months and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® February Home Price Index Reports Month-Over-Month Increase, When Excluding Distressed Sales

[CoreLogic February Home Price Index (HPI®) report] shows national home prices, including distressed sales, declined on a year-over-year basis by 2.0 percent in February 2012 and by 0.8 percent compared to January 2012, the seventh consecutive monthly decline.

Excluding distressed sales, month-over-month prices increased 0.7 percent in February from January. The CoreLogic HPI® also showed that year-over-year prices declined by 0.8 percent in February 2012 compared to February 2011. Distressed sales include short sales and real estate owned (REO) transactions.

“House prices, based on data through February, continue to decline, but at a decreasing rate. The deceleration in the pace of decline is a first step toward ultimately growing again,” said Mark Fleming, chief economist for CoreLogic. “Excluding distressed sales, we already see modest price appreciation month over month in January and February.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was down 0.8% in February, and is down 2.0% over the last year.

The index is off 34.4% from the peak - and is now at a new post-bubble low.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller - this is the smallest year-over-year decline since 2010 when prices were impacted by the housing tax credit.

The second graph is from CoreLogic. As Mark Fleming noted, the year-over-year declines are getting smaller - this is the smallest year-over-year decline since 2010 when prices were impacted by the housing tax credit. Some of this decline was seasonal (the CoreLogic index is NSA) and month-to-month price changes will probably remain negative through March.

ADP: Private Employment increased 209,000 in March

by Calculated Risk on 4/04/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 209,000 from February to March on a seasonally adjusted basis. Estimated gains for previous months were revised higher; the gain from December to January was revised up by 9,000 to 182,000, and the gain from January to February was revised up by 14,000 to 230,000.This was slightly above the consensus forecast of an increase of 208,000 private sector jobs in March. The BLS reports on Friday, and the consensus is for an increase of 201,000 payroll jobs in March, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector increased 164,000 in March, after rising a revised 183,000 in February. Employment in the private, goods-producing sector rose 45,000 in March. Manufacturing employment added 23,000 jobs.

Government payrolls have been shrinking, so the ADP report suggests close to 200,000 nonfarm payroll jobs added in March. Note: ADP hasn't been very useful in predicting the BLS report.

Reis: Apartment Vacancy Rate falls to 4.9% in Q1

by Calculated Risk on 4/04/2012 12:12:00 AM

Reis reported that the apartment vacancy rate (82 markets) fell to 4.9% in Q1 from 5.2% in Q4 2011. The vacancy rate was at 6.1% in Q1 2010 and peaked at 8.0% at the end of 2009.

From Reuters: U.S. apartment vacancy rate falls to decade low

The U.S. apartment vacancy rate in the first quarter fell to its lowest level in more than a decade, and rents posted their biggest jump in four years ...

The national vacancy rate fell 0.30 percentage points in the first quarter to 4.9 percent, the lowest level since the fourth quarter 2001, according to preliminary results Reis released Wednesday.

...

Stripping away months of free rent and other perks designed to lure or retain tenants, effective rent rose to $1,018 per month, up 0.9 percent, the largest increase since the first quarter 2008, Reis said.

"I think that rent growth will accelerate this year," said Victor Calanog, head of Research & Economics at Reis.

But that may be short lived. About 150,000-200,000 new units are expected be built next year. That supply likely will dampen rent growth next year ...

"Once that supply hits the market next year, we may find that this is the year rent growth peaked," he said. "It's still going to be a great year for apartment landlords."

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 2005.

Reis is just for large cities, but this decline in vacancy rates is happening just about everywhere.

Tuesday, April 03, 2012

Lawler comments on FHA Single-Family Mutual Mortgage Insurance Fund Quarterly Report to Congress

by Calculated Risk on 4/03/2012 08:20:00 PM

From economist Tom Lawler:

Last week HUD released the FHA Single-Family Mutual Mortgage Insurance Fund Quarterly Report to Congress for the first quarter of FY 2012 (ending 12/31/2011), which gave some insights into the disturbing rise is the number of seriously delinquent FHA-insured SF loans, as well on the surprising slow pace of foreclosure resolutions.

At the bottom of this post is a table summarizing SDQ rates by FY endorsement.

And here is a chart from the report showing SDQ rates by calendar year origination and months of seasoning.

Needless to say, this is not a pretty picture.

In the discussion on the sizable jump in the FHA’s SF SDQ rate, the report said that

“(t)wo factors appear to be driving this result. The first is the persistency of loans in 90-day delinquency as lenders attempt to craft workout plans, and persistency of loans in foreclosure processing. The second is that the historically large FY 2009 and FY 2010 books-of-business are at the age where their serious delinquency rates are increasing toward their life-cycle peaks. Because those books are much larger than is the new FY 2011 book, their loan-age seasoning patterns are not offset by the low default rates on recent endorsements.”The report did not mention the sharp falloff in FHA modifications in the second half of 2011.

Relative to the projection in the FY 2011 annual independent actuarial study, actual FHA claims were 52% lower by loan count and 57% lower by dollars, but NOT because the loans are performing better than projected. Here is an excerpt from the report:

“The number of claims paid this quarter (27,356) is down slightly from that of the previous quarter (30,108). The gap between predicted and actual claims paid shows little variation from the previous quarters, with year-to-date counts 52% below forecast, and year-to-date dollars 57% below forecast. The principal contributing factor to this gap continues to be delays in foreclosure processing in many areas of the country. We anticipate the recent settlement will accelerate foreclosure activity, perhaps within the next two quarters.”The report also included some historical data on the FHA’s loss rate on REO and on pre-foreclosure sales, which showed rising trends in both.

In the quarter ended 12/31/2011, FHA’s loss severity on REO averaged 71.7%, while the loss severity on short sales was 47.4%. Delays in foreclosure processing appear to be a significant factor in rising loss severity rates. The combination of rising SDQs and rising loss severities bodes very poorly for the MMIF outlook, which may help explain the sizable recently-announced hikes in FHA’s premiums.

In the quarter ended 12/31/2011, FHA’s loss severity on REO averaged 71.7%, while the loss severity on short sales was 47.4%. Delays in foreclosure processing appear to be a significant factor in rising loss severity rates. The combination of rising SDQs and rising loss severities bodes very poorly for the MMIF outlook, which may help explain the sizable recently-announced hikes in FHA’s premiums. Here is the table summarizing SDQ rates by FY endorsement.

| Serious Delinquency Rate by Endorsement Fiscal Year, FHA SF Mortgages | |||||||

|---|---|---|---|---|---|---|---|

| Endorsement FY | Pre-2007 | 2007 | 2008 | 2009 | 2010 | 2011 | All Years |

| Q1/12 | 12.58% | 25.59% | 23.83% | 10.92% | 4.07% | 0.93% | 9.59% |

| Q4/11 | 11.57% | 23.36% | 21.38% | 9.13% | 2.96% | 0.45% | 8.70% |

| Q3/11 | 10.77% | 21.83% | 19.97% | 8.05% | 2.13% | 0.22% | 8.18% |

| Q2/11 | 10.98% | 21.71% | 19.49% | 7.58% | 1.61% | 0.08% | 8.31% |

| Q1/11 | 11.59% | 22.44% | 19.65% | 7.23% | 1.20% | 0.01% | 8.78% |

| Q4/10 | 11.41% | 21.49% | 18.37% | 6.08% | 0.65% | 8.66% | |

| Q3/10 | 11.15% | 21.11% | 17.35% | 4.94% | 0.33% | 8.59% | |

| Q2/10 | 11.56% | 21.40% | 17.13% | 4.07% | 0.16% | 9.05% | |

| Q1/10 | 11.89% | 21.55% | 16.22% | 3.05% | 0.02% | 9.44% | |

| Q4/09 | 10.72% | 18.60% | 12.19% | 1.59% | 8.52% | ||

| Q3/09 | 8.71% | 14.23% | 8.45% | 0.84% | 7.14% | ||

U.S. Light Vehicle Sales at 14.4 million annual rate in March

by Calculated Risk on 4/03/2012 03:59:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 14.37 million SAAR in March. That is up 10.4% from March 2011, but down 4.4% from the sales rate last month (15.03 million SAAR in Feb 2012).

This was below the consensus forecast of 14.7 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 14.37 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

The annualized sales rate is up in Q1 from Q4.

March was above the August 2009 rate with the spike in sales from "cash-for-clunkers". Only February had a higher sales rates since early 2008.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June of last year.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Even though this was below expectations, growth in auto sales will make another strong positive contribution to GDP in Q1 2012.

FOMC Minutes: No Push for QE3

by Calculated Risk on 4/03/2012 02:00:00 PM

"Several members" were concerned that the unemployment rate would be elevated, and inflation subdued in late 2014. That would suggest further action now, but, later in the discussion, "a couple of members" indicated further action might be necessary if the "economy lost momentum". So it doesn't seem like there is any push for QE3 in the short term.

From the Fed: Minutes of the Federal Open Market Committee, March 13, 2012. Excerpts:

With the economic outlook over the medium term not greatly changed, almost all members again agreed to indicate that the Committee expects to maintain a highly accommodative stance for monetary policy and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014. Several members continued to anticipate, as in January, that the unemployment rate would still be well above their estimates of its longer-term normal level, and inflation would be at or below the Committee's longer-run objective, in late 2014. It was noted that the Committee's forward guidance is conditional on economic developments, and members concurred that the date given in the statement would be subject to revision in response to significant changes in the economic outlook. While recent employment data had been encouraging, a number of members perceived a nonnegligible risk that improvements in employment could diminish as the year progressed, as had occurred in 2010 and 2011, and saw this risk as reinforcing the case for leaving the forward guidance unchanged at this meeting.

The Committee also stated that it is prepared to adjust the size and composition of its securities holdings as appropriate to promote a stronger economic recovery in a context of price stability. A couple of members indicated that the initiation of additional stimulus could become necessary if the economy lost momentum or if inflation seemed likely to remain below its mandate-consistent rate of 2 percent over the medium run.

Update on Possible GSE Principal Reductions

by Calculated Risk on 4/03/2012 11:48:00 AM

Following a ProPublica story last week, Fannie and Freddie: Slashing Mortgages Is Good Business, there was some commentary suggesting that principal reductions would result in a windfall for banks holding 2nd liens.

Michael Stegman, Counselor to the Secretary of the Treasury for Housing Finance Policy responded: GSEs & Principal Reduction: How HAMP Helps More Underwater Homeowners (ht Dan)

Recently, various sources have alleged that large banks will get a windfall if Fannie Mae and Freddie Mac (the GSEs) reduce the principal balance on first lien mortgage loans that are owned or guaranteed by the GSEs. The claims arise from a concern that if the GSEs reduce the principal balance on a GSE first lien mortgage loan, any investor holding a second (and subordinated) lien on the property stands to benefit unfairly.The bank "windfall" argument was incorrect.

In fact, the principal reduction program that we have asked the FHFA to allow the GSEs to participate in, the principal reduction alternative of the Home Affordable Modification Program (HAMP), is designed to protect against exactly this result.

Of course, not all under water GSE loans have second liens. But if they do, under HAMP, where a first lien mortgage is modified, then the holder of an eligible second lien must modify that lien proportionately if they are a participant in the Second Lien Modification Program (2MP). ...

So quite contrary to providing a windfall to the banks, GSE participation in this program would force them to help homeowners even further by writing down these second lien loans.

However a valid point was raised by Tom Lawler: The program might make sense to Fannie and Freddie only if the Treasury incentive is included. If that is the case, then the program might not make sense for taxpayers.

Principal reduction can be a very effective and cost saving program if done correctly, but I have to see the details of the proposal before deciding if this makes sense.

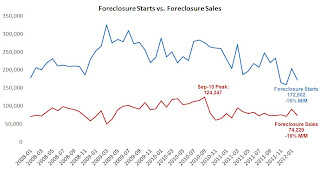

LPS: February Foreclosure Starts and Sales Reversed Prior Month’s Increases

by Calculated Risk on 4/03/2012 09:24:00 AM

LPS released their Mortgage Monitor report for February today.

According to LPS, 7.57% of mortgages were delinquent in February, down sharply from 7.97% in January, and down from 8.80% in February 2011.

LPS reports that 4.13% of mortgages were in the foreclosure process, down slightly from 4.15% in January, and down slightly from 4.15% in February 2011.

This gives a total of 11.7% delinquent or in foreclosure. It breaks down as:

• 2,059,000 loans less than 90 days delinquent.

• 1,722,000 loans 90+ days delinquent.

• 2,065,000 loans in foreclosure process.

For a total of 5,846,000 loans delinquent or in foreclosure in February.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 7.57% from the peak in January 2010 of 10.97%, but the decline has halted. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

The in-foreclosure rate was at 4.11%, down from the record high in October 2011 of 4.29%. There are still a large number of loans in this category (about 2.07 million).

This graph provided by LPS Applied Analytics shows foreclosure starts and sales.

This graph provided by LPS Applied Analytics shows foreclosure starts and sales.

Foreclosure starts and sales were up in January, but then declined in February. This was before the mortgage servicer settlement was announced in mid-February and filed with the court in March, so it is still too early to see the impact of the settlement.

Bloomberg article on House Prices

by Calculated Risk on 4/03/2012 08:44:00 AM

Several people have sent me this Bloomberg article by Kathleen Howley: Home Prices Seen Dropping 10% in U.S. on Foreclosures: Mortgages

From the second paragraph:

Sales of repossessed properties probably will rise 25 percent this year from 1 million in 2011, according to Moody’s Analytics Inc. Prices for the homes could drop as much as 10 percent because they deteriorated as they were held in reserve during investigations by state officials resolved in February, according to RealtyTrac Inc.So RealtyTrac is saying prices for some repossessed properties could fall 10 percent "because they deteriorated" while in the foreclosure process. That sounds correct, but that isn't overall prices.

Later in the article, Howley does quote an economist predicting a further 5% to 10% price decline this year:

The [Case-Shiller Composite 20] index probably will fall 5 percent to 10 percent this year, a range that depends on the condition of the mothballed homes, [Patrick Newport, an economist at IHS Global Insight] said.An added thought: The most recent Case-Shiller report was for January. If the Composite 20 index fell as much from January through March as in 2011, prices are already down 3% this year as of the end of March (Compare that to Celia Chen and Diane Swonk's predictions for the year).

That compares with a forecast for a 2.9 percent decline by Celia Chen, a housing economist at Moody’s Analytics in West Chester, Pennsylvania, and a prediction of a 3.9 percent decline by Diane Swonk, chief economist of Mesirow Financial Inc. in Chicago.

Jim the Realtor: Multiple Offers at the low-to-mid end

by Calculated Risk on 4/03/2012 12:18:00 AM

Jim makes some interesting comments on multiple offers in the following video.

It probably seems strange to hear Jim talking about the "lower end" while showing a $655,000 house, but this is in an expensive area of coastal north county in San Diego.

Jim discusses some other recent listings that have had multiple offers - one with eight offers, another with 14 offers that for 10% over list price.

Monday, April 02, 2012

WaPo: Student Debt and Senior Citizens

by Calculated Risk on 4/02/2012 07:18:00 PM

From the WaPo: Senior citizens continue to bear burden of student loans

New research from the Federal Reserve Bank of New York shows that Americans 60 and older still owe about $36 billion in student loans ... More than 10 percent of those loans are delinquent. As a result, consumer advocates say, it is not uncommon for Social Security checks to be garnished or for debt collectors to harass borrowers in their 80s over student loans that are decades old.The NY Fed research has some data and graph on student debt: Grading Student Loans

The outstanding student loan balance now stands at about $870 billion,1 surpassing the total credit card balance ($693 billion) and the total auto loan balance ($730 billion). With college enrollments increasing and the costs of attendance rising, this balance is expected to continue its upward trend.

This chart from the NY Fed shows the student debt outstanding by age. From the NY Fed:

This chart from the NY Fed shows the student debt outstanding by age. From the NY Fed: Among people under thirty years old, 40.1 percent have outstanding student loan debt. Among people between the ages of thirty and thirty-nine, 25.1 percent have outstanding student loan debt. In contrast, only 7.4 percent of people who are at least forty years old have outstanding student loan debt. As a result, $580 billion of the total $870 billion in student loan debt is owed by people younger than forty.There is much more in the research paper.

Wells Fargo on Housing: Better Days Ahead, Prices to bottom mid-year

by Calculated Risk on 4/02/2012 02:59:00 PM

Earlier this year I argued that there was a good chance house prices would bottom this year (I predicted a bottom in Not Seasonally Adjusted prices in March - of course that data will not be released for several months). There are several other analysts and economists who now see prices bottoming this year or early next year.

Wells Fargo economists put out a special commentary on housing this morning: Spring Came Early for the Housing Market

The latest data on home prices also came in a little better than expected, and the survey data from the NAHB/Wells Fargo Homebuilders Survey as well as anecdotal reports from builders and realtors all suggest better days are ahead for the industry.Wells Fargo believes the housing recovery will unfold slowly, and they only expect new home sales to increase 12% in 2012 to 340 thousand, and housing starts to increase to 710 thousand (includes multifamily, owner built and more).

Drawing definitive conclusions from the winter housing data is perilous. The winter months account for the smallest proportion of the year’s housing activity, and unseasonably mild weather during the winter months can cause the data to bounce around quite a bit from month to month. The March and April data are much more important, and all indications suggest that the key spring selling season has gotten off to a solid start.

...

We have nudged our forecast for home sales and new home construction slightly higher, as the spring selling season appears to have gotten off to a strong start. ... the anecdotal evidence is hard to dismiss. Most builders and realtors report significant gains in buyer interest and sales. Moreover, the gains are organic rather than incentive induced. Unfortunately, conservative appraisals and tight mortgage underwriting continue to undermine a large number of deals. We suspect that the undertow from these two hindrances will subside over the course of this year, as the fog surrounding shadow inventories lightens up a bit and more lenders come back to the market.

...

We expect home prices to definitively bottom by the middle of this year, as the backlog of foreclosures finally begins clear. For properties not in foreclosure, prices have probably already bottomed, but should remain relatively low nonetheless given the competition and perceived competition from foreclosures.

It is important to note that Wells Fargo is forecasting a very weak year for housing - just an increase from the weakest years on record. Their forecast would be the 3rd worst year for new home sales since 1963, only behind the 2011 and 2010 - and about half the median annual sales since 1963.

Their forecast would be the 4th worst year for housing starts since 1959. Note: starts bottomed in 2009, and most of the increase since then has been from multifamily starts). The Wells Fargo forecast is for about half the median for annual housing starts since 1959.

Sometimes I see commentary saying there is no recovery in housing, and the commentator then points to the current low level of sales and starts. However, when most people use the word "recovery" they mean an increase from the previous period - not the absolute level of sales and starts. Sales and starts will be weak in 2012, but better than 2011.

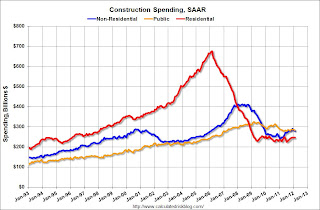

Construction Spending declines in February

by Calculated Risk on 4/02/2012 12:09:00 PM

Catching up ... This morning the Census Bureau reported that overall construction spending declined in February:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during February 2012 was estimated at a seasonally adjusted annual rate of $808.9 billion, 1.1 percent (±1.3%)* below the revised January estimate of $818.1 billion. The February figure is 5.8 percent (±1.8%) above the February 2011 estimate of $764.2 billion.Private construction spending was also declined in February:

Spending on private construction was at a seasonally adjusted annual rate of $527.3 billion, 0.8 percent (±1.1%)* below the revised January estimate of $531.7 billion. Residential construction was at a seasonally adjusted annual rate of $246.5 billion in February, nearly the same as (±1.3%)* the revised January estimate of $246.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $280.8 billion in February, 1.6 percent (±1.1%) below the revised January estimate of $285.3 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 63.5% below the peak in early 2006, and up 10% from the recent low. Non-residential spending is 32% below the peak in January 2008, and up about 15% from the recent low.

Public construction spending is now 13% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down slightly on a year-over-year basis. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit), and this suggest the bottom is in for residential investment.

ISM Manufacturing index indicates slightly faster expansion in March

by Calculated Risk on 4/02/2012 10:00:00 AM

PMI was at 53.4% in March, up from 52.4% in February. The employment index was at 56.1%, up from 53.2%, and new orders index was at 54.5%, down from 54.9%.

From the Institute for Supply Management: March 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in March for the 32nd consecutive month, and the overall economy grew for the 34th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 53.4 percent, an increase of 1 percentage point from February's reading of 52.4 percent, indicating expansion in the manufacturing sector for the 32nd consecutive month. The Production Index increased 3 percentage points from February's reading of 55.3 percent to 58.3 percent, and the Employment Index increased 2.9 percentage points to 56.1 percent. Of the 18 industries included in the survey, 15 are experiencing overall growth. Comments from the panel remain positive, with several respondents citing increased sales and demand for the next few months."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was slightly above expectations of 53.0%. This suggests manufacturing expanded at a faster rate in March than in February. It appears manufacturing employment expanded in March with the employment index at 56.1%.

Over There: Unemployment rate at new high in Euro Zone

by Calculated Risk on 4/02/2012 08:48:00 AM

From Reuters: Unemployment in Euro Zone Hit New High in February

Unemployment in the euro zone reached its highest level in almost 15 years in February, with more than 17 million people out of work, according to figures released Monday.Here is the Eurostat data by country.

Joblessness in the 17-nation currency zone rose to 10.8 percent, up by 0.1 point from January, Eurostat said Monday.

...

Separate data released Monday showed manufacturing activity in the euro zone shrank for an eighth successive month in March, providing further support for Brussels’s forecast that euro zone output will shrink 0.3 percent this year.

Rising unemployment, falling manufacturing, declining output ... no surprise.

Sunday, April 01, 2012

WaPo on Investors buying Foreclosures to Rent

by Calculated Risk on 4/01/2012 06:57:00 PM

A long article from Edward Robinson at the WaPo: Foreclosures give rise to new industry. A few excerpts:

Waypoint, which owns 1,100 houses and is buying five more a day, is betting that converting foreclosures into rentals is a better way to make a profit. Other firms, such as Landsmith in San Francisco, are now cropping up and pursuing the same strategy in Arizona, California and Nevada.I've talked to several smaller investor groups, and they have all done very well. Now the larger groups are moving in.

With many suburban homes selling for half their peak values and demand for rentals from prospective tenants climbing, Waypoint was earning a return of

8 to 9 percent on its capital as of Dec. 31, according to a quarterly report. That beats the 6.3 percent gain in the BI NA Multifamily REIT Index, which tracks the performance of 27 apartment-building operators.

...

The home rental market boasts a total property value of $3 trillion, according to Morgan Stanley housing analyst Oliver Chang. Yet institutions have long shunned it as too scattered and impractical to be profitable.

...

Oaktree Capital Management, the investment firm co-founded by billionaire Howard Marks, announced a $450 million deal with Carrington Capital Management to acquire and convert foreclosed single-family homes into rental properties. Carrington rents out more than 3,000 houses in California and other states.

Starwood Capital Group is poised to enter the foreclosure-to-rental market, according to an investor familiar with its plans. So, too, are Zell and the real estate arm of Apollo Investment Management.

...

Investors are already having an effect: The supplies of homes for sale in Phoenix, Orlando and other hard-hit markets have fallen more than 60 percent from their post-crash highs as bargain hunters scoop up foreclosures.

Investors buying foreclosures to rent is one of the reasons inventory levels of existing homes has fallen so sharply.

Yesterday:

• Summary for Week Ending March 30th

• Schedule for Week of April 1st

And the winner is ... me!

by Calculated Risk on 4/01/2012 11:43:00 AM

For the question contest in March, the leaders were:

1) Bill (Calculated Risk)

2) Billy Forney

3) Bryant Dodson

4) Charles Chuckray

5 tie) Walt Tucker

5 tie) Ed Hodder

Congratulations to all.

For fun I've added a monthly question contest on the right sidebar. It takes a Facebook login.

In April, I'll ask some economic predictions several times a week: For April 2nd, I'm asking: Will the March ISM Manufacturing Index be over 53? (Note: I'm leaving the market predictions out for April).

Contestants receive 1 point for each correct answer. At the end of each month, I'll list the leaders in a post on the blog.

For both February and March, the winner was ... CR. Hey, play along and beat CR!

Yesterday:

• Summary for Week Ending March 30th

• Schedule for Week of April 1st