by Calculated Risk on 3/24/2012 08:01:00 AM

Saturday, March 24, 2012

Summary for Week ending March 23rd

Last week was mostly about housing, and all of the reports were a little disappointing. Housing starts were down slightly from January; new home sales were down 1.6% from January on a seasonally adjusted annual rate (SAAR) basis, and existing home sales declined 0.9% from the January rate.

However, if we take a little longer view, the picture improves. Housing starts are up almost 46% compared to the low in 2009 (mostly multi-family), and new home sales and existing home sales are up 13% and 39%, respectively, from the post-tax credit lows in 2010.

So the housing data was a little disappointing – especially given the nice weather in February – but the trend is still up. The spring selling season starts in March, and the next few months will be important for housing.

Other news was a little better. Initial weekly unemployment claims fell to 348,000, the lowest level in over 4 years. The architectural billings index remained positive for the fourth consecutive month, and the remodeling index was up sharply in January.

Overall a little disappointing, but still sluggish growth.

Here is a summary in graphs:

• New Home Sales declined in February to 313,000 Annual Rate

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The Census Bureau reported New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 313 thousand. This was down from a revised 318 thousand in January (revised down from 321 thousand). November and December of last year were revised up. This was below the consensus forecast of 325 thousand.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed. This graph shows the three categories of inventory.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed. This graph shows the three categories of inventory.

The inventory of completed homes for sale was at 54,000 units in February. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2012 (red column), 25 thousand new homes were sold (NSA). Last year only 22 thousand homes were sold in February (although 2012 is a leap year). This was the second weakest February since this data has been tracked - the third weakest was February 2010 with 27 thousand homes sold. The high for February was 109 thousand in 2005.

In February 2012 (red column), 25 thousand new homes were sold (NSA). Last year only 22 thousand homes were sold in February (although 2012 is a leap year). This was the second weakest February since this data has been tracked - the third weakest was February 2010 with 27 thousand homes sold. The high for February was 109 thousand in 2005.

New home sales have averaged only 303 thousand SAAR over the 22 months since the expiration of the tax credit ... mostly moving sideways, although sales have been increasing a little lately (averaging 322 thousand rate over the last four months).

• Housing Starts declined slightly in February

Total housing starts were at 698 thousand (SAAR) in February, down 1.1% from the revised January rate of 706 thousand (SAAR). Note that January was revised up from 699 thousand.

Total housing starts were at 698 thousand (SAAR) in February, down 1.1% from the revised January rate of 706 thousand (SAAR). Note that January was revised up from 699 thousand. Single-family starts declined 9.9% to 457 thousand in February. Permits moved higher, so single family starts will probably increase in March.

The second graph shows total and single unit starts since 1968. Total starts are up 34.7% from a year ago.

This was slightly below expectations of 700 thousand starts in February.

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2012 (4.59 million SAAR) were 0.9% lower than last month, and were 8.8% above the February 2011 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 19.3% year-over-year in February from February 2011. This is the twelfth consecutive month with a YoY decrease in inventory.

Inventory decreased 19.3% year-over-year in February from February 2011. This is the twelfth consecutive month with a YoY decrease in inventory.Months of supply increased to 6.4 months in February, up from 6.0 months in January.

This was close to expectations of sales of 4.61 million.

• AIA: Architecture Billings Index indicated expansion in February

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index was at 51.0 in February (slight expansion). Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index was at 51.0 in February (slight expansion). Anything above 50 indicates expansion in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in early 2012, but perhaps stabilizing mid-year.

• Weekly Initial Unemployment Claims declined to 348,000

The DOL reports:

The DOL reports:In the week ending March 17, the advance figure for seasonally adjusted initial claims was 348,000, a decrease of 5,000 from the previous week's revised figure of 353,000. The 4-week moving average was 355,000, a decrease of 1,250 from the previous week's revised average of 356,250.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was declined to 355,000.

The 4-week moving average is near the lowest level since early 2008.

• Other Economic Stories ...

• NAHB Builder Confidence index unchanged in March

• Residential Remodeling Index increases 11% year-over-year in January

• LPS: Percent of delinquent mortgage loans declined in February

• DOT: Vehicle Miles Driven increased 1.6% in January

Friday, March 23, 2012

Bank Failure #15 in 2012: Premier Bank, Wilmette, Illinois

by Calculated Risk on 3/23/2012 06:26:00 PM

“Cheap, as if made with fool’s gold”

Booed off stage right

by Soylent Green is People

From the FDIC: International Bank of Chicago, Chicago, Illinois, Assumes All of the Deposits of Premier Bank, Wilmette, Illinois

As of December 31, 2011, Premier Bank had approximately $268.7 million in total assets and $199.0 million in total deposits ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $64.1 million. Compared ... Premier Bank is the fifteenth FDIC-insured institution to fail in the nation this year, and the third in IllinoisOn February New Home Sales:

• New Home Sales decline in February to 313,000 Annual Rate

• Home Sales: Distressing Gap

• New Home Sales graphs

Earlier this week on Existing Home sales:

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

Bank Failure #14 in 2012: Covenant Bank & Trust, Rock Spring, Georgia

by Calculated Risk on 3/23/2012 05:38:00 PM

Another Georgia bank down

The Ouroboros

by Soylent Green is People

From the FDIC: Stearns Bank, National Association, St. Cloud, Minnesota, Assumes

All of the Deposits of Covenant Bank & Trust, Rock Spring, GeorgiaAre there any banks left in Georgia?

As of December 31, 2011, Covenant Bank & Trust had approximately $95.7 million in total assets and $90.6 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.5 million. ... Covenant Bank & Trust is the fourteenth FDIC-insured institution to fail in the nation this year, and the fourth in Georgia.

DOT: Vehicle Miles Driven increased 1.6% in January

by Calculated Risk on 3/23/2012 04:30:00 PM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by +1.6% (3.5 billion vehicle miles) for January 2012 as compared with January 2011. Travel for the month is estimated to be 224.8 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Even with a small year-over-year increase in December, the rolling 12 month total is mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 50 months - and still counting!

The second graph shows the year-over-year change from the same month in the previous year.

This is the second consecutive month with a year-over-year increase in miles driven - for the first time since 2010.

This is the second consecutive month with a year-over-year increase in miles driven - for the first time since 2010.Looking back, gasoline prices (regular) were around $3.06 per gallon in January 2011, and averaged $3.33 per gallon this year. Even though prices are up sharply over the last couple of months, prices also increased quickly last year in March and April - so we might not see a year-over-year decline in miles driven in the coming months.

Zillow's forecast for Case-Shiller House Price index in January

by Calculated Risk on 3/23/2012 02:35:00 PM

Zillow Forecast: January Case-Shiller Composite-20 Expected to Show 3.7% Decline from One Year Ago

On Tuesday, March 27th, the Case-Shiller Composite Home Price Indices for January will be released. Zillow predicts that both the 20-City and the 10-City Composite Home Price Indices (non-seasonally adjusted [NSA]) will decline by 3.7 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from December to January will be zero percent and -0.1 percent for the 20 and 10-City Composite Home Price Index (SA), respectively.Zillow's forecasts for Case-Shiller have been pretty close, and I expect Case-Shiller will report house prices at a new post-bubble low in January for the Not Seasonally Adjusted (NSA) indexes.

The seasonally adjusted indexes will probably be close to the level reported in December.

One of the keys this year will be to watch the year-over-year change in the various house price indexes. The composite 10 and 20 indexes declined 3.9% and 4.0% respectively in December, after declining 3.8% in November. Zillow is forecasting a slightly smaller year-over-year decline in January.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | January 2011 | 154.36 | 155.43 | 140.78 | 141.98 |

| Case-Shiller (last month) | December 2011 | 149.89 | 149.76 | 136.71 | 136.63 |

| Zillow January Forecast | YoY | -3.7% | -3.7% | -3.7% | -3.7% |

| MoM | -0.8% | -0.1% | -0.8% | 0.0% | |

| Zillow Forecasts1 | 148.7 | 149.6 | 135.6 | 136.7 | |

| Post Bubble Lows | 149.89 | 149.76 | 136.71 | 136.63 | |

| Date of Low | December 2011 | December 2011 | December 2011 | December 2011 | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Home Sales: Distressing Gap

by Calculated Risk on 3/23/2012 12:16:00 PM

Here is an update to the "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through February. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image.

Click on graph for larger image.

I expect this gap to eventually close once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

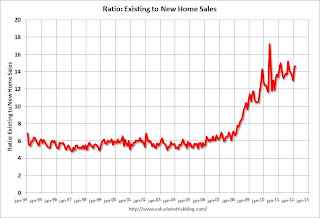

The second graph shows the same information but as a ratio of existing sales to new home sales.

The ratio was fairly stable for years until the market was flooded with distressed sales.

The ratio was fairly stable for years until the market was flooded with distressed sales.

So far there has been little progress towards a more "normal" market.

On February New Home Sales:

• New Home Sales decline in February to 313,000 Annual Rate

• New Home Sales graphs

Earlier this week on Existing Home sales:

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

New Home Sales decline in February to 313,000 Annual Rate

by Calculated Risk on 3/23/2012 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 313 thousand. This was down from a revised 318 thousand in January (revised down from 321 thousand). November and December of last year were revised up.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in February 2012 were at a seasonally adjusted annual rate of 313,000 ... This is 1.6 percent (±23.9%)* below the revised January rate of 318,000, but is 11.4 percent (±17.8%)* above the February 2011 estimate of 281,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply increased to 5.8 in February from 5.7 in January.

The all time record was 12.1 months of supply in January 2009.

This is now close to normal (less than 6 months supply is normal).

This is now close to normal (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of February was 150,000. This represents a supply of 5.8 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 54,000 units in February. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2012 (red column), 25 thousand new homes were sold (NSA). Last year only 22 thousand homes were sold in February (although 2012 is a leap year). This was the second weakest February since this data has been tracked - the third weakest was February 2010 with 27 thousand homes sold. The high for February was 109 thousand in 2005.

This was below the consensus forecast of 325 thousand.

This was below the consensus forecast of 325 thousand.New home sales have averaged only 303 thousand SAAR over the 22 months since the expiration of the tax credit ... mostly moving sideways, although sales have been increasing a little lately (averaging 322 thousand rate over the last four months).

KB Home: Deliveries Up, Net Orders down year-over-year

by Calculated Risk on 3/23/2012 08:46:00 AM

While we wait for the new home sales report, from KB Home via MarketWatch: KB Home Reports First Quarter 2012 Results. A few excerpts:

Homes delivered increased 21% to 1,150, up from 949 homes delivered in the year-earlier quarter ... The average selling price rose 6% to $219,000 from $205,700 for the year-earlier quarter ...Gross orders were only up 3% year-over-year (not much of an increase), and net orders were down due to an increase in cancellations. Hopefully they will address the increase in cancellations on the conference call - and which local markets are "showing greater strength".

Net orders totaled 1,197 in the first quarter of 2012, down 8% from 1,302 net orders in the year-earlier quarter ... gross orders were up 3%, an increase in the cancellation rate to 36% from 29% in the year-earlier quarter led to the year-over-year decrease in net orders.

The Company had a backlog of 2,203 homes, representing potential future housing revenues of $460.0 million, as of February 29, 2012, compared to a backlog of 1,689 homes, representing potential future housing revenues of $353.6 million, as of February 28, 2011.

...

“Reflecting the improving trends in the economy, including recent job growth and higher consumer confidence, we are seeing signs that the overall housing market is stabilizing and beginning to recover,” said Jeffrey Mezger, president and chief executive officer. “The pace of the recovery is uneven, however, with certain local markets showing greater strength and more normalized activity than other areas where a rebound will take longer to manifest. We expect that the housing market in general will gradually strengthen as the economy continues to advance.”

Thursday, March 22, 2012

WSJ: BofA to try Deed-in-lieu to Rental Program

by Calculated Risk on 3/22/2012 11:30:00 PM

From Nick Timiraos at the WSJ: Alternative to Foreclosure Tested

Bank of America Corp. BAC -2.24% is launching a pilot program that will allow homeowners at risk of foreclosure to hand over deeds to their houses and sign leases that will let them rent the houses back from the bank at a market rate.Dean Baker proposed something like this a few years ago.

... the "Mortgage to Lease" program is small—the bank began sending letters Thursday offering leases to 1,000 homeowners in Arizona, Nevada and New York

...Borrowers would agree to a what is known as a "deed-in-lieu" of foreclosure, where they essentially sign over ownership of the property to the lender. ... In exchange, former owners would be offered one-year leases with options to renew the leases in each of the following two years at rents that the bank determines are at or below the current market price.

Also - and Timiraos didn't mention this - in the recent white paper on housing, the Fed proposed to relax the rules on how banks can manage rented REOs. From the Fed white paper:

In light of the current unusually difficult circumstances in many housing markets across the nation, the Federal Reserve is contemplating issuing guidance to banking organizations and examiners to clarify supervisory expectations regarding rental of residential REO properties by such organizations while such circumstances continue (and within relevant federal and statutory and regulatory limits). If finalized and adopted, such guidance would explain how rental of a residential REO property within applicable holding-period time limits could meet the supervisory expectation for ongoing good faith efforts to sell that property. Relatedly, if a successful model is developed for the GSEs to transition REO properties to the rental market, banks may wish to participate in such a program or adopt some of its features.

Bernanke: "The Federal Reserve and the Financial Crisis" Part 2

by Calculated Risk on 3/22/2012 07:08:00 PM

This is part 2 of 4 of a lecture series on the Federal Reserve. The first lecture (about 1 hour) discussed monetary policy history, the tools and goals of the reserve - and he spent some time on the gold standard.

The second lecture focuses on the Fed from after World War II up to the financial crisis. Here are the slides Lecture 2: The Federal Reserve after World War II. Link to lecture series (Part 3 is next Tuesday).

Video here.