by Calculated Risk on 3/13/2012 08:30:00 AM

Tuesday, March 13, 2012

Retail Sales increased 1.1% in February

On a monthly basis, retail sales were up 1.1% from January to February (seasonally adjusted, after revisions), and sales were up 6.5% from February 2011. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for February, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $407.8 billion, an increase of 1.1 percent (±0.5%) from the previous month and 6.5 percent (±0.7%) above February 2011. ... The December 2011 to January 2012 percent change was revised from 0.4 percent (±0.5)* to 0.6 percent (±0.2%).Ex-autos, retail sales increased 0.9% in February.

Click on graph for larger image.

Click on graph for larger image.Sales for January were revised up from a 0.4% increase to a 0.6% increase.

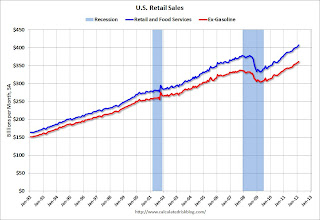

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 22.6% from the bottom, and now 7.8% above the pre-recession peak (not inflation adjusted)

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.8% from the bottom, and now 6.9% above the pre-recession peak (not inflation adjusted).

The second graph shows the same data since 2006 (to show the recent changes). Excluding gasoline, retail sales are up 18.8% from the bottom, and now 6.9% above the pre-recession peak (not inflation adjusted).The third graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail sales ex-gasoline increased by 6.0% on a YoY basis (6.5% for all retail sales). Retail sales ex-gasoline increased 0.8% in February.

This was below the consensus forecast for retail sales of a 1.2% increase in February, but above the consensus for a 0.8% increase ex-auto.

This was below the consensus forecast for retail sales of a 1.2% increase in February, but above the consensus for a 0.8% increase ex-auto. NFIB: Small Business Optimism increases slightly in February

by Calculated Risk on 3/13/2012 07:45:00 AM

From the National Federation of Independent Business (NFIB): Historically Low Business Confidence Begins to Edge Up, Ever so Slightly

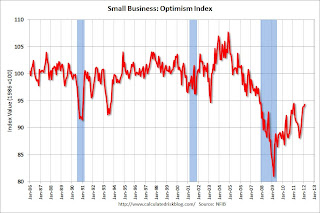

The Small-Business Optimism Index gained 0.4 points in February to 94.3 marking the sixth consecutive month of gains. While still historically low, the latest increase is a sign that the recovery is likely to continue, albeit at a glacial pace. The Index is lower than that of February 2011 but is the second highest reading since December 2007, the beginning of the recession.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

...

While the fog over Main Street appears to be lifting to some degree, confidence in the economy remains fragile. Twenty-two (22) percent of small-business owners report “poor sales” as their top business problem, unchanged from January. February’s report suggests cautious optimism ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986. The index increased to 94.3 in February from 93.9 in January. This is the sixth increase in a row after for the index, and the index is now at second highest level since December 2007 (the index was slightly higher - at 94.5 - in February 2011).

This index is still low - probably due to a combination of sluggish growth, and the high concentration of real estate related companies in the index.

Monday, March 12, 2012

Housing: Short Sales increase, Foreclosure Sales down Year-over-year

by Calculated Risk on 3/12/2012 06:15:00 PM

CR Note: This will be very useful data over the next several months as we try to track the impact of the mortgage servicer settlement. There are only a few areas where the MLS breaks down monthly sales by foreclosure, short sales and conventional (non-distressed) sale. I've been tracking the Sacramento market to watch for changes in the mix over time. (here was my post this weekend: Distressed House Sales using Sacramento Data for February)

Economist Tom Lawler sent me the following table today for several other areas. Lawler writes: "With the exception of Reno (the data for which I did NOT get directly from a realtor association/MLS), the foreclosure share of home sales was down from a year ago – in some cases by a lot – while the short-sales share of sales was up – in some cases significantly."

CR Note: For most of the areas (with the exception of Reno), the distressed share of sales is down from February 2011. The share of short sales has increased in most areas, while the share of foreclosure sales are down - and down significantly in some areas.

Note: The table is a percentage of total sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Feb | 11-Feb | 12-Feb | 11-Feb | 12-Feb | 11-Feb | |

| Las Vegas | 29.3% | 26.6% | 42.0% | 51.6% | 71.3% | 78.2% |

| Reno | 28.0% | 30.0% | 42.0% | 36.0% | 70.0% | 66.0% |

| Phoenix | 28.1% | 21.1% | 23.3% | 49.6% | 51.4% | 70.7% |

| Sacramento | 31.9% | 22.1% | 33.9% | 49.2% | 65.8% | 71.3% |

| Minneapolis | 15.0% | 13.6% | 42.3% | 47.9% | 57.3% | 61.5% |

| Mid-Atlantic (MRIS) | 16.4% | 14.5% | 17.5% | 27.2% | 33.9% | 41.7% |

Mortgage Settlement filed with Court

by Calculated Risk on 3/12/2012 03:16:00 PM

The documents are now available online here.

From the WSJ: Foreclosure-Abuse Settlement Formally Filed

Bank of America has by far the largest share of the settlement, at nearly $2.4 billion in cash payments, plus $7.6 billion of aid to troubled consumers and nearly $950 million in refinancing aid. Bank of America also reached a $1 billion settlement to resolve allegations that Countrywide Financial, which it acquired in 2008, issued loans to borrowers who didn't qualify for mortgage backed by the Federal Housing Administration, the government-run mortgage insurer.

J.P. Morgan is paying the second-largest share, at $1.1 billion in cash, plus $3.7 billion of aid to troubled homeowners and nearly $540 million in refinancing help. Wells Fargo is paying $1 billion in cash, plus $3.4 billion worth of assistance to troubled homeowners and $900 million in refinancing aid.

Citi is paying $413 million in cash, plus $1.4 billion in assistance to homeowners and $378 million in refinancing relief. Ally is making a cash payment of about $110 million, plus $185 million in consumer relief and $15 million in refinancing aid.

Report: New Bank Stress Test results expected by Thursday

by Calculated Risk on 3/12/2012 12:04:00 PM

From Nelson Schwartz at the NY Times: Latest Stress Tests Are Expected to Show Progress at Most Banks

[T]he Federal Reserve this week will release the results of its latest stress tests, which are expected to show broadly improved balance sheets at most institutions.The stress test scenario was announced last November and is outlined here.

...

Unlike the findings of the last round of stress tests, which ended last March, the results of this round will be made public by the Federal Reserve, with an announcement expected by Thursday.

The stress tests assumed the unemployment rate will rise to 13% in 2013, that the Dow Jones Total Stock Market Index will decline by more than 50% from the November level. The scenario assumed that house prices would fall another 20%+, and bottom at almost 47% down from the peak.

Note: The Fed uses the CoreLogic index for house prices, and the index has declined over 4% since the stress test scenario was released in November, and the index was off 34% from the peak as of January.