by Calculated Risk on 12/27/2011 09:40:00 AM

Tuesday, December 27, 2011

Case Shiller: House Prices fall to new post-bubble lows in October (seasonally adjusted)

S&P/Case-Shiller released the monthly Home Price Indices for October (a 3 month average of August, September and October). This release includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data. Here is a table of the year-over-year and monthly changes for both SA and NSA.

| Case Shiller October 2011 | Seasonally Adjusted | Not Seasonally Adjusted | ||

|---|---|---|---|---|

| YoY Change | One Month Change | YoY Change | One Month Change | |

| Composite 10 | -3.0% | -0.5% | -3.0% | -1.1% |

| Composite 20 | -3.4% | -0.6% | -3.4% | -1.2% |

From S&P: The Fourth Quarter Starts with Broad-based Declines in Home Prices According to the S&P/Case-Shiller Home Price Indices

Data through October 2011, released today by S&P Indices for its S&P/Case-Shiller1 Home Price Indices ... showed decreases of 1.1% and 1.2% for the 10- and 20-City Composites in October vs. September. Nineteen of the 20 cities covered by the indices also saw home prices decrease over the month. The 10- and 20-City Composites posted annual returns of -3.0% and -3.4% versus October 2010, respectively.

“There was weakness in the monthly statistics, as 19 of the cities posted price declines in October over September,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Eleven of the cities and both composites fell by 1.0% or more during the month.

Click on graph for larger image.

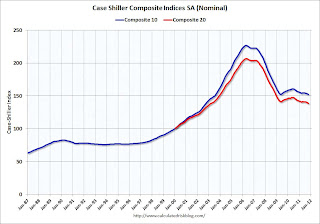

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.9% from the peak, and down 0.5% in October (SA). The Composite 10 is at a new post bubble low (Seasonally adjusted), but still above the low NSA.

The Composite 20 index is off 33.0% from the peak, and down 0.6% in October (SA). The Composite 20 is also at a new post-bubble low.

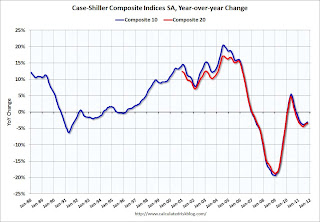

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.0% compared to October 2010.

The Composite 20 SA is down 3.4% compared to October 2010. This was a slightly smaller year-over-year decline for both indexes than in September.

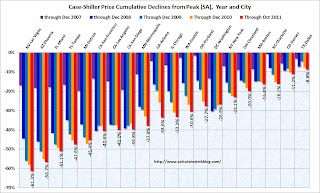

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 4 of the 20 Case-Shiller cities in October seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.3% from the peak, and prices in Dallas only off 8.8% from the peak.

Prices increased (SA) in 4 of the 20 Case-Shiller cities in October seasonally adjusted (only one city increased NSA). Prices in Las Vegas are off 61.3% from the peak, and prices in Dallas only off 8.8% from the peak.The NSA indexes are only about 2% above the March 2011 lows - and these indexes will hit new lows in the next few months since prices are falling again. Using the SA data, the Case-Shiller indexes are now at new post-bubble lows!

Case-Shiller: House Prices decline in October

by Calculated Risk on 12/27/2011 09:14:00 AM

From MarketWatch: Oct. U.S. home prices fall 1.2%: Case-Shiller

U.S. home prices fell 1.2% in October to take the 12-month drop to 3.4%, according to the S&P/Case-Shiller 20-city composite home price index released Tuesday. Nineteen of 20 cities saw price drops, and the index is now down 32.1% from its peak in 2006.S&P hasn't released the data online yet. The 1.2% decline is Not Seasonally Adjusted (NSA), and the seasonally adjusted decline will be smaller (prices decline seasonally in October). I'll post graphs after the data is released.

Monday, December 26, 2011

WSJ: "Slowing Inflation Cheers Fed"

by Calculated Risk on 12/26/2011 09:05:00 PM

I always pay close attention to Fed stories from Jon Hilsenrath at the WSJ: Slowing Inflation Cheers Fed

U.S. inflation is slowing after a surge early in the year. ... The Fed has been considering new steps to spur growth. Two ideas are on the table: commit to keep short-term interest rates near zero for even longer than through mid-2013, and restart a bond-buying program aimed at driving already-low long-term interest rates lower. Before taking either step, though, Fed officials would want to have some comfort that they wouldn't be creating undesired inflation.As Hilsenrath notes, inflation is slowing by most key measures, and this will give the Fed more leeway. It always seems the Fed telegraphs their intentions, and it now seems very likely the Fed will add a range of Fed funds rate forecasts to their quarterly economic projections at the next FOMC meeting on January 24th and 25th.

If the Fed funds rate forecasts are added, this would replace the sentence in the FOMC statement - "The Committee ... currently anticipates that economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013". The bond buying program (aka QE3) would be data dependent and probably start a little later in the year if economic growth disappoints.

Weekend:

• Schedule for Week of Dec 25th

• Summary for Week ending Dec 23rd

Private Investment and the Business Cycle

by Calculated Risk on 12/26/2011 03:41:00 PM

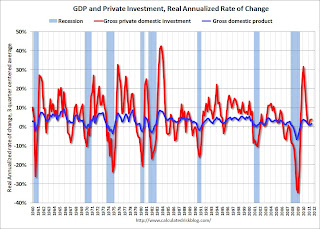

Discussions of the business cycle frequently focus on consumer spending (PCE: Personal consumption expenditures), but one key is to watch private domestic investment. Even though private investment usually only accounts for about 15% of GDP, private investment experiences significantly larger swings than PCE during the business cycle and has an outsized impact on GDP. Note: currently private investment is just over 12% of GDP - much lower than normal.

The first graph shows the real annualized change in GDP and private investment since 1960 (this is a 3 quarter centered average to smooth the graph).

Click on graph for larger image.

Click on graph for larger image.

GDP has fairly small annualized changes compared to the huge swings in investment, especially during and just following a recession. This is why investment is one of the keys to the business cycle.

The second graph shows the contribution to GDP from the four categories of private investment: residential investment, equipment and software, nonresidential structures, and "Change in private inventories". Note: this is a 3 quarter centered average of the contribution to GDP.

This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment lags the business cycle. Red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, and blue.

The dashed purple line is the "Change in private inventories". This category has significant ups and downs, but is always negative during a recession, and provides a boost to GDP just after a recession. Change in private inventories has made a large negative contribution to GDP over the last four quarters, and will probably make a positive contribution in Q4.

The dashed purple line is the "Change in private inventories". This category has significant ups and downs, but is always negative during a recession, and provides a boost to GDP just after a recession. Change in private inventories has made a large negative contribution to GDP over the last four quarters, and will probably make a positive contribution in Q4.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness is a key reason why the recovery has been sluggish so far.

Equipment and software investment has made a significant positive contribution to GDP for nine straight quarters (it is coincident).

The contribution from nonresidential investment in structures was positive in Q3. Nonresidential investment in structures typically lags the recovery; however investment in energy and power is masking weakness in office, mall and hotel investment.

And residential investment has finally turned slightly positive and will make a positive contribution to GDP in 2011 for the first time since 2005.

What does this mean for the business cycle? Usually residential investment would turn down before a recession, and that isn't happening right now. Instead residential investment is mostly moving sideways.

What does this mean for the business cycle? Usually residential investment would turn down before a recession, and that isn't happening right now. Instead residential investment is mostly moving sideways.

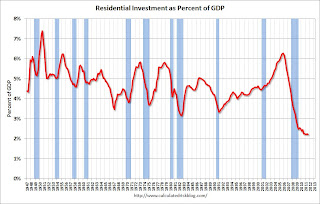

The third graph shows residential investment as a percent of GDP. Residential investment as a percent of GDP is at a record low, and it seems unlikely that residential investment will decline significantly lower as a percent of GDP - especially with a pickup in multifamily investment and some increase in home improvement (Note: Residential investment is mostly investment in new single family and multifamily structures, home improvement and brokers' commissions). It seems likely that residential investment will make a positive contribution to GDP in 2012.

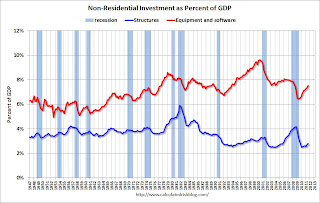

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

Equipment and software investment has increased sharply, but is still at a fairly normal level of GDP. And non-residential investment in structures increased in Q3, but this is still very low.

A key fear is that the financial crisis in Europe could drag the US economy into another recession. That is possible, especially combined with ongoing household deleveraging and fiscal tightening in the US (with current policy, Federal, state and local governments will all subtract from GDP growth in 2012).

However it seems unlikely there will be a sharp decline in private investment. Residential investment is already at record lows as a percent of GDP and will probably increase in 2012. Changes in private inventories will probably rebound a little, and investment in non-residential structures is also near record lows. It is possible that investment in equipment and software could decline in 2012, but it doesn't seem likely there will be a sharp decline in overall private investment.

If the euro zone comes apart rapidly - or there is further non-private tightening - a new recession is possible in the US, but without a sharp decline in private investment, it is unlikely a US recession would be severe. Right now it appears overall US private investment will increase in 2012, and that the US will avoid a new recession.

WaPo: "Falling home values mean budget crunches for cities"

by Calculated Risk on 12/26/2011 09:48:00 AM

From Brady Dennis at the WaPo: Falling home values mean budget crunches for cities

Because of the time it often takes for property assessments to reflect falling home values, the bust that began in 2007 has just begun to ravage tax revenues in communities from coast to coast. The problem is unlikely to subside soon.As the article notes, some states cap the annual increase in property taxes (there is a 2% annual cap in California). For long term owners, this means their property taxes will continue to increase since their assessed value is probably still below the current market value. This will keep overall taxes from falling quickly in certain states.

For instance, Baltimore collected $815 million in property taxes during the most recent fiscal year, according to Bill Voorhees, Baltimore’s director of revenue and tax analysis. Next year, the figure is predicted to shrink to $803.5 million. The following year, $773 million. The year after that, $735.7 million. The year after that, $729.4 million.

In California, property values are assessed annually - and most cities have already reduced assessments and taxes on many homeowners. Also in California, properties are assessed whenever ownership changes, and all the foreclosures and short sales have already pushed down property taxes. So these communities will probably not see a further dramatic decline in property tax revenue.

But there is still more pain to come in other areas.

Weekend:

• Schedule for Week of Dec 25th

• Summary for Week ending Dec 23rd

Sunday, December 25, 2011

Germany's Schaeuble pushes for Financial Transaction Tax

by Calculated Risk on 12/25/2011 07:36:00 PM

Update: The UK has a stamp tax on stock shares (but not other financial transactions), see:

http://www.hmrc.gov.uk/stats/stamp_duty/table15-1.pdf

and

http://www.cepr.net/documents/publications/financial-transactions-tax-2008-12.pdf

This could be a key story in 2012 ...

From Bloomberg: Schaeuble vows to push for financial transaction tax

"In the EU we've agreed to explore the chances of a financial transaction tax in the first months of the new year," [Schaeuble] said. "If the hurdles are too high then Germany and France will push for introducing the tax only in the euro zone."This might sound good, but if this was just introduced in the euro zone, many financial transactions would move to the UK or the US. I think a transaction tax would have to enacted everywhere to be effective.

...

"I don't want to wait until such a tax is introduced worldwide. Otherwise we would risk not only the stability of our financial markets... but we would also be endangering the legitimacy in the public eye for the entire system.

"That's why I'm fighting with such determination for a financial transaction tax. It might not be able to stop the ludicrous developments in financial markets but it would at least brake them a bit."

Schaeuble said he wanted the tax to slow down the pace of financial transactions and possibly make some speculative business unprofitable.

"The markets are a bit too preoccupied with themselves these days rather than supporting the real economy," he said. "We've got to decelerate the pace of transactions."

...

"I'm very much in favour of Europe leading the way," he said. "That can possibly mean that certain speculative business models are no longer profitable. But that is what we want."

Schaeuble also said the European financial situation is "controllable". That is pretty scary since Schaeuble has misdiagnosed the problems in Europe - calling for more and more austerity - and it looks like Europe will get "Schaeubled" again in 2012!

Yesterday:

• Schedule for Week of Dec 25th

• Summary for Week ending Dec 23rd

Happy Holidays!

Happy Holidays!

by Calculated Risk on 12/25/2011 09:31:00 AM

Happy Holidays and Merry Christmas to all!

• A better job market would be a great present for 2012. Although hiring will probably remain sluggish, there is a little good news ... from Greg Robb at MarketWatch: Jobless Claims becoming tought to ignore

While it is a bit of a stretch to say that economists are snug in their beds with visions of jobless claims dancing in their heads, there is no denying that they are growing more excited about the improvement in claims over the past month and will be focusing on that release in the holiday-shortened week.• And a little gift ... a common question, using excel, is how do you get from this:

“People are going to be focusing pretty heavily on claims,” said Josh Shapiro, chief U.S. economist at MFR Inc.

Claims have fallen by 40,000 over the past four weeks to a post-recession low of 364,000. After initial doubts when the decline started, many analysts are putting more weight on the down trend.

Yesterday:

• Schedule for Week of Dec 25th

• Summary for Week ending Dec 23rd

Thanks to all. Happy Holidays!

Saturday, December 24, 2011

Interview with Stand Up economist Yoram Bauman

by Calculated Risk on 12/24/2011 07:08:00 PM

Earlier:

• Schedule for Week of Dec 25th

• Summary for Week ending Dec 23rd

Bauman discusses a number of topics. He has spent the last 5 months in China - see his earlier video here on the Chinese housing bubble - and he doesn't think the Chinese economy is "not slowing down".

Some humor (the knock knock joke at the end is pretty funny - especially the goof by the interviewer).

Schedule for Week of Dec 25th

by Calculated Risk on 12/24/2011 02:07:00 PM

Earlier:

• Summary for Week ending Dec 23rd

Happy Holidays! This will be a light week for U.S. economic data. The Case-Shiller house price index will be released on Tuesday. Also the December Chicago PMI and three more regional Fed manufacturing surveys will released this week.

All US markets will be closed in observance of the Christmas Day holiday.

9:00 AM: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October.

9:00 AM: S&P/Case-Shiller House Price Index for October. Although this is the October report, it is really a 3 month average of August, September and October. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes (the Composite 20 was started in January 2000).

The consensus is for a 0.2% decrease in prices in October. The CoreLogic index showed a 1.3% decrease in October (NSA). I expect new post-bubble lows for the Case-Shiller indexes (seasonally adjusted).

10:00 AM: Conference Board's consumer confidence index for December. The consensus is for an increase to 58.1 from 56.0 last month.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for December. The consensus is for the index to be at 5, up from 0 in November (above zero is expansion).

10:30 AM: Dallas Fed Manufacturing Survey for December. The index showed contraction in November with a reading of -5.1 (the only regional survey showing contraction).

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index has been especially weak all year, although this doesn't include cash buyers.

8:30 AM: The initial weekly unemployment claims report will be released. Last week was the lowest level for the 4-week average of weekly claims since early 2008.

9:45 AM: Chicago Purchasing Managers Index for December. The consensus is for a decrease to 60.1 from 62.6 in November.

10:00 AM: Pending Home Sales Index for November. The consensus is for a 1.5% increase in the index.

11:00 AM: Kansas City Fed regional Manufacturing Survey for December. The consensus is for the index to be at 6, up from 4 in November (above zero is expansion).

No releases scheduled.

Summary for Week Ending December 23rd

by Calculated Risk on 12/24/2011 08:51:00 AM

This was another week with mostly improving U.S. economic data. Housing starts increased - mostly due to multi-family starts, and new home sales ticked up slightly (still mostly moving sideways).

Existing home sales were revised down sharply, but the good news is listed inventory has fallen to 2005 levels. Of course there is still a large "shadow inventory", and there are many more homeowners waiting for a better market - but the decline in listed inventory is a positive.

Also builder confidence increased slightly (still depressed), the Architecture Billings Index increased (and is indicating expansion again), consumer sentiment has rebounded from the recent lows, and initial weekly unemployment claims are at the lowest level since early 2008.

Personal income and spending was sluggish in November, but most of the data showed a little improvement.

Here is a summary of last week in graphs:

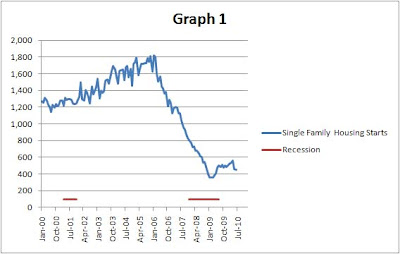

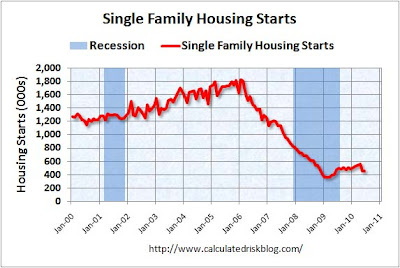

• Housing Starts increased in November

Click on graph for larger image.

Click on graph for larger image.

Total housing starts were at 685 thousand (SAAR) in November, up 9.3% from the revised October rate of 627 thousand (SAAR). Most of the increase this year has been for multi-family starts, but single family starts are increasing a little recently too.

Single-family starts increased 2.3% to 447 thousand in November.

Multi-family starts are increasing in 2011 - although from a very low level. This was well above expectations of 630 thousand starts in November.

Single family starts are still mostly "moving sideways".

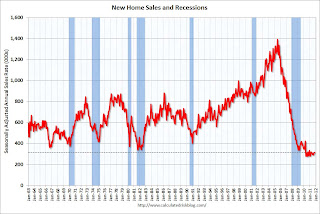

• New Home Sales increased in November to 315,000 SAAR

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 315 thousand. This was up from a revised 310 thousand in October (revised up from 307 thousand).

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 315 thousand. This was up from a revised 310 thousand in October (revised up from 307 thousand).This graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

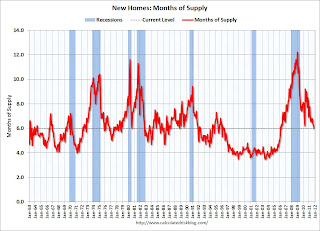

The next graph shows New Home Months of Supply.

Months of supply decreased to 6.0 in November.

Months of supply decreased to 6.0 in November. The all time record was 12.1 months of supply in January 2009

This is now close to normal (less than 6 months supply is normal).

The seasonally adjusted estimate of new houses for sale at the end of November was 158,000. This represents a supply of 6.0 months at the current sales rate.

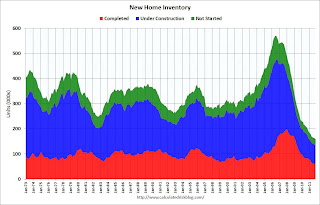

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.

Starting in 1973 the Census Bureau broke inventory down into three categories: Not Started, Under Construction, and Completed.This graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale was at 59,000 units in November. The combined total of completed and under construction is at the lowest level since this series started.

New home sales have averaged only 300 thousand SAAR over the 19 months since the expiration of the tax credit ... mostly moving sideways at a very low level ... although sales have been increasing a little lately.

• Existing Home Sales in November: 4.42 million SAAR, 7.0 months of supply

Note: this includes the downward revisions for years 2007 through 2011.

The NAR reports: Existing-Home Sales Continue to Climb in November

Total existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 4.0 percent to a seasonally adjusted annual rate of 4.42 million in November from 4.25 million in October, and are 12.2 percent above the 3.94 million-unit pace in November 2010.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in November 2011 (4.42 million SAAR) were 4.0% higher than last month, and were 12.2% above the November 2010 rate.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 18.1% year-over-year in November from November 2010. This is the ninth consecutive month with a YoY decrease in inventory.

Inventory decreased 18.1% year-over-year in November from November 2010. This is the ninth consecutive month with a YoY decrease in inventory.Months of supply decreased to 7.0 months in November, down from 7.7 months in October. This is still a little higher than normal.

• Personal Income increased 0.1% in November, Spending increased 0.1%

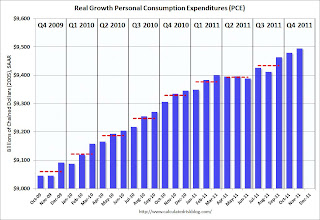

This graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars).

This graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars).PCE increased 0.1% in November, and real PCE increased 0.2%.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

The personal saving rate was at 3.5% in November.

Both personal income and spending were lower than expectations. Using the "two month" method to forecast real Q4 PCE growth suggests an increase of about 2.9% in Q4. However September was especially strong (the two month method uses the first two months of a quarter), so Q4 PCE growth will probably be closer to 2.5%.

• AIA: Architecture Billings Index increased in November

This graph shows the Architecture Billings Index since 1996. The index increased to 52.0 in November from 49.4 in October. Anything above 50 indicates expansion in demand for architects' services.

This graph shows the Architecture Billings Index since 1996. The index increased to 52.0 in November from 49.4 in October. Anything above 50 indicates expansion in demand for architects' services.Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this suggests further declines in CRE investment in 2012, but perhaps stabilizing later in 2012 - if this doesn't take another dip.

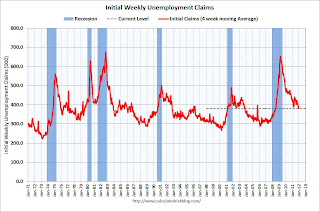

• Weekly Initial Unemployment Claims decline to 364,000

This graph shows the 4-week moving average of weekly claims since January 1971.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 380,250.

This is the lowest level for weekly claims - and the lowest level for the 4-week average - since early 2008.

This survey was for the BLS reference week for the employment report, so this suggests an increase in payroll jobs in December (compared to November).

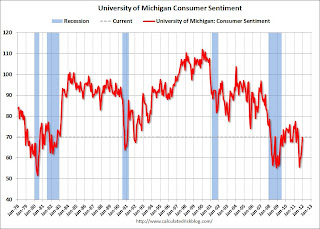

• Final December Consumer Sentiment at 69.9

The final December Reuters / University of Michigan consumer sentiment index increased to 69.9, up from the preliminary reading of 67.7, and up from the November reading of 64.1.

The final December Reuters / University of Michigan consumer sentiment index increased to 69.9, up from the preliminary reading of 67.7, and up from the November reading of 64.1.Most of the recent sharp decline was event driven due to the debt ceiling debate, and sentiment has rebounded as expected. Now it is all about jobs - and gasoline prices.

Sentiment is still very weak, although above the consensus forecast of 68.0.

• Other Economic Stories ...

• NAHB Builder Confidence index increases in December

• ATA Trucking Index increased 0.3% in November

• Chicago Fed: Economic activity index declined in November

• Philly Fed State Coincident Indexes increased in November

• Residential Remodeling Index at new high in October

• Q3 2011: Mortgage Equity Withdrawal strongly negative