by Calculated Risk on 9/08/2011 12:11:00 PM

Thursday, September 08, 2011

Mortgage Rates fall to Record Low

From Freddie Mac: Mortgage Rates Attain New All-Time Record Lows Again

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing mortgage rates, fixed and adjustable, hitting all-time record lows amid market and employment concerns and economic uncertainty. The previous record lows for fixed mortgage rates, and the 1-year ARM, were set the week of August 18, 2011. The 5-Year ARM matched its all-time low set last week at 2.96 percent.Here is a long term graph of 30 year mortgage rate in the Freddie Mac survey:

30-year fixed-rate mortgage (FRM) averaged 4.12 percent with an average 0.7 point for the week ending September 8, 2011, down from last week when it averaged 4.22 percent. Last year at this time, the 30-year FRM averaged 4.35 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The Freddie Mac survey started in 1971. Mortgage rates are currently at a record low for the last 40 years (mortgage rates were close to this range in the '50s).

The second graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

Refinance activity declined a little last week, but activity was up significantly in August compared to July.

Refinance activity declined a little last week, but activity was up significantly in August compared to July. With 30 year mortgage rates now at record lows, mortgage refinance activity will probably pick up some more in September - but so far activity is lower than in '09 - and much lower than in 2003.

Trade Deficit decreased sharply in July

by Calculated Risk on 9/08/2011 09:03:00 AM

The Department of Commerce reports:

[T]otal July exports of $178.0 billion and imports of $222.8 billion resulted in a goods and services deficit of $44.8 billion, down from $51.6 billion in June, revised. July exports were $6.2 billion more than June exports of $171.8 billion. July imports were $0.5 billion less than June imports of $223.4 billion.The trade deficit was well below the consensus forecast of $51 billion.

The first graph shows the monthly U.S. exports and imports in dollars through July 2011.

Click on graph for larger image.

Click on graph for larger image.Exports increased and imports decreased in July (seasonally adjusted). Exports are well above the pre-recession peak and up 15% compared to July 2010; imports are up about 13% compared to July 2010.

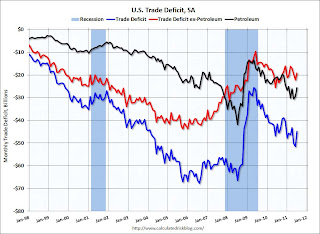

The second graph shows the U.S. trade deficit, with and without petroleum, through July.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil averaged $104.27 per barrel in July, down slightly from $106.00 per barrel in June. The trade deficit with China increased slightly to $26.95 billion; trade with China remains a significant issue.

The decline in the trade deficit was due to an increase in exports. Also the trade deficit for the first six months of the year was revised down - especially in Q2.

Weekly Initial Unemployment Claims increase to 414,000

by Calculated Risk on 9/08/2011 08:30:00 AM

The DOL reports:

In the week ending September 3, the advance figure for seasonally adjusted initial claims was 414,000, an increase of 2,000 from the previous week's revised figure of 412,000. The 4-week moving average was 414,750, an increase of 3,750 from the previous week's revised average of 411,000.The following graph shows the 4-week moving average of weekly claims since January 2000 (longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 414,750.

Weekly claims increased slightly, and the 4-week average is still elevated - and remains above the 400,000 level.

Wednesday, September 07, 2011

WSJ: Fed Prepares to Act

by Calculated Risk on 9/07/2011 08:33:00 PM

From Jon Hilsenrath at the WSJ: Fed Prepares to Act

Federal Reserve officials are considering three unconventional steps to revive the economic recovery and seem increasingly inclined to take at least one as they prepare to meet this month."QE3" remains an option, but it appears the first step would be to extend the maturity of the Fed's portfolio. We might get more hints tomorrow when Fed Chairman Ben Bernanke speaks on the economic outlook at 1:30 PM ET.

...

One step getting considerable attention inside and outside the Fed would shift the central bank's portfolio of government bonds so that it holds more long-term securities and fewer short-term securities.

...

A second step under consideration at the Fed, one getting mixed reviews internally, would reduce or eliminate a 0.25% interest rate the Fed currently is paying banks that keep cash on reserve with the central bank.

...

A third step Fed officials are debating would involve using their words to make their economic objectives and plans for interest rates more clear.

CBO: An Evaluation of Large-Scale Mortgage Refinancing Programs

by Calculated Risk on 9/07/2011 06:33:00 PM

Some economists have proposed a large scale mortgage refinancing program for homeowners with loans owned or guaranteed by Fannie, Freddie or the FHA, and who are current on their mortgages but who can't refinance - usually because of Loan-to-values (LTV) much greater than 100%. Some economists have suggested this program could be used by 30 million borrowers and deliver $70 billion in annual savings - at essentially no cost.

Tom Lawler and I have pointed out that these economists (who missed the housing bubble) seem to be overlooking current programs - and also the offsetting losses for investors.

The CBO has analyzed a proposal for a large scale refinancing program: An Evaluation of Large-Scale Mortgage Refinancing Programs (ht mort-fin). Some key findings:

We analyze a stylized large-scale mortgage refinancing program that would relax current income and loan-to-value restrictions for borrowers who wish to refinance and whose mortgages are currently insured by Fannie Mae, Freddie Mac, or the Federal Housing Administration. The analysis relies on an estimate of the volume of incremental refinancing that would occur and an estimate of how future default and prepayment behavior would be affected by such refinancing. Relative to the status quo, the specific program analyzed here is estimated to cause an additional 2.9 million mortgages to be refinanced, resulting in 111,000 fewer defaults on those loans and estimated savings for the GSEs and FHA of $3.9 billion on their credit guarantee exposure, measured on a fair-value basis. Offsetting those savings, federal investors in MBSs, including the Federal Reserve, the GSEs, and the Treasury, would experience an estimated fair-value loss of $4.5 billion. Therefore, on a fair-value basis, the specific program analyzed here would have an estimated cost to the federal government of $0.6 billion.After a quick read, this analysis seems reasonable.

...

We also discuss the impact of this program on various stakeholders, including homeowners, non-federal mortgage investors, mortgage lenders, mortgage service providers, private mortgage insurers, and subordinated mortgage holders. For example, non-federal investors would experience an estimated fair-value loss of $13 to $15 billion; most of that wealth would be transferred to borrowers.

...

From the borrowers’ perspective, savings from lower mortgage payments is projected to total $7.4 billion in the first year of the program; the associated effect on consumption would decline significantly over time as borrowers pay off those loans.

...

The program has the potential to provide economic stimulus by increasing the resources households have available to spend because of the reduction in the size of their mortgage payments. However, those effects would be partially offset by a reduction in spending by investors as a result of their losses from the program. In aggregate, the fair-value loss to both federal and non-federal investors is equivalent to the gain experienced by borrowers from the decline in their interest payments (less transaction costs for both parties). Nevertheless, because a significant share of investors is composed of foreigners and the U.S. government, and because private investors would be expected to reduce spending in response their losses by less than the increase in spending by borrowers in response to their lower interest payments as well as their lower mortgage principal payments, the net effect would be an economic stimulus. ... We have not quantified the potential stimulus in our analysis, but it is likely to be small relative to GDP while large relative to the net federal cost of the program.

With respect to the housing market, the overall impact of the program is also small; the 111,000 homeowners saved from foreclosure by virtue of lower monthly mortgage payments will have a minor impact on the path of future home prices. Because this program is directed toward current homeowners, it would do little to alleviate the tighter underwriting standards and increased credit pricing for purchase loans. In addition, it would not create much demand for homes, because all of its participants would already have at least one property.

Fed's Williams: Downside Risks and Temporary Factors

by Calculated Risk on 9/07/2011 04:25:00 PM

Today San Francisco Fed President John Williams outlined some of the downside risks and temporary factors for the economic outlook: The Outlook for the U.S. Economy and Role for Monetary Policy. Here are some excerpts:

Temporary factors:

The recent slowdown was due in part to temporary factors. The weather was unusually bad in many parts of the country this past winter, the Japanese earthquake disrupted global supply chains, and, perhaps most importantly for U.S. economic growth, oil and other commodity prices surged. Higher prices at the pump staggered Americans and took a sizable bite out of consumer spending at a particularly sensitive moment for the economy.And on downside risks:

The effects of these temporary brakes on growth have largely faded.

...

[W]e are vulnerable to negative shocks that could put the recovery at risk. That’s why events in Europe are such a cause for concern. Fears that some nations in the euro zone will not be able to make payments on their debts have spread from smaller countries, such as Greece and Ireland, to larger economies, such as Spain and Italy. This is not something we can dismiss as somebody else’s problem. A full-blown financial meltdown in Europe would hit U.S. exports, which have been one of the economy’s few bright spots. Perhaps more importantly, it could slam U.S. financial markets and deal a further blow to already fragile confidence. In other words, a downturn in Europe could knock the props out from under the U.S. recovery.

We’ve had our own shock right here at home in the form of the contentious debate over a long-term fix for the federal budget deficit. It’s essential that we bring the budget under control. But, how this is accomplished is extremely important, both for our country’s short- and long-run economic health. ... In the near term, efforts at deficit reduction may reduce demand and further slow the already precarious recovery. In addition, the deficit controversy has added one more ingredient to the currents of economic anxiety that are roiling households and businesses.

[S]everal more persistent trends are also impeding recovery. The news from the housing market has been particularly dismal. Past recoveries typically got a kick start from a rebound in home construction and spending on furniture, appliances, and other big-ticket items people needed for their new houses and apartments. This time, though, construction is stuck at post-World War II low levels. A huge supply of homes is available for sale, which keeps prices down. Add to that what might be called a shadow inventory of some 4 million homes whose owners are seriously delinquent on their mortgages or in foreclosure. Despite great loan terms and low prices, buyers who qualify for credit are understandably nervous about jumping back into the housing market. And, of course, millions of other potential buyers are underwater on their current mortgages, making it hard for them to sell or refinance.Right now I'd put the European crisis and premature austerity as the two biggest downside risks. High gasoline prices are still a drag, as is the ongoing housing crisis.

Meanwhile, the bounce in consumer spending often seen in the wake of recessions has been unusually tepid this time around. The combination of huge amounts of household debt, losses in the housing and stock markets, and high unemployment has clearly taken a toll on both the ability and willingness of households to spend. People are on edge waiting for the other shoe to drop. Consumer sentiment plunged last month, which was partly a reaction to the unnerving news about the federal debt ceiling debate in Washington, D.C., and the European debt crisis. In fact, the latest consumer sentiment readings are near the all-time lows recorded in late 2008 during the most terrifying moments of the financial crisis. Here is a telling statistic: Sixty-two percent of households expect their income to stay the same or decline over the next year, the worst reading in the over 30 years that this question has been asked. With consumer spending making up 70 percent of the economy, it’s hard to have a robust recovery when Americans are so dispirited.

John Williams concludes:

Right now, though, the real threat is an economy that is at risk of stalling and the prospect of many years of very high unemployment, with potentially long-run negative consequences for our economy.

Fed's Beige Book: "Economic activity continued to expand at a modest pace"

by Calculated Risk on 9/07/2011 02:00:00 PM

Reports from the twelve Federal Reserve Districts indicated that economic activity continued to expand at a modest pace, though some Districts noted mixed or weakening activity. The St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco Districts all reported either modest or slight expansion. Atlanta said activity continued to expand at a very subdued pace, while Cleveland reported slow growth and New York indicated growth remained sluggish. Economic activity expanded more slowly in the Chicago District and slowed in the Richmond District. Business activity in the Boston and Philadelphia Districts was characterized as mixed, with Philadelphia adding that activity was somewhat weaker overall. Several Districts also indicated that recent stock market volatility and increased economic uncertainty had led many contacts to downgrade or become more cautious about their near-term outlooks.And on real estate:

...

Consumer spending increased slightly in most Districts since the last survey, but non-auto retail sales were flat or down in several Districts.

...

Manufacturing conditions were mixed across the country, but the pace of activity slowed in many Districts. The New York, Philadelphia, and Richmond Districts reported declining activity overall, and contacts in the Boston and Dallas Districts noted slowing demand from European customers. Cleveland said factory production was stable, and manufacturing activity in the Atlanta and Chicago Districts grew at a slower pace. Minneapolis, Kansas City, and San Francisco reported slight expansions, and St. Louis said activity continued to increase and that several manufacturers planned to open plants and expand operations in the near future. Most manufacturing contacts were less optimistic than in the previous survey; however, future capital spending plans were solid in a few Districts.

...

Labor markets were generally steady, although some Districts reported modest employment growth.

Residential real estate activity remained weak overall, although a few Districts noted some slight improvements. Contacts in the Boston, Atlanta, Minneapolis, and Dallas Districts reported an increase in home sales over the previous year's weak levels; however, the uptick in the Atlanta District was concentrated mainly in Florida. The remaining Districts all reported stable or slower sales from the previous survey period ...This was based on data gathered on or before August 26th. More sluggish growth ...

Commercial real estate conditions remained weak or little changed in most Districts, although some improvements were noted by New York, Minneapolis, and Dallas. Commercial real estate activity was sluggish in the Boston, Cleveland, Richmond, Atlanta, Kansas City, and San Francisco Districts.

Fed's Evans on the Fed's Dual Mandate

by Calculated Risk on 9/07/2011 12:20:00 PM

From Chicago Fed President Charles Evans: The Fed's Dual Mandate Responsibilities and Challenges Facing U.S. Monetary Policy

Suppose we faced a very different economic environment: Imagine that inflation was running at 5% against our inflation objective of 2%. Is there a doubt that any central banker worth their salt would be reacting strongly to fight this high inflation rate? No, there isn’t any doubt. They would be acting as if their hair was on fire. We should be similarly energized about improving conditions in the labor market.The current unemployment rate of 9.1% (16.2% U-6) is a tragedy. Even though the high unemployment rate was a direct result of the bursting of the housing bubble and the financial crisis - Evans argues that we shouldn't just accept a sluggish recovery:

In the United States, the Federal Reserve Act charges us with maintaining monetary and financial conditions that support maximum employment and price stability. This is referred to as the Fed’s dual mandate and it has the force of law behind it.

The most reasonable interpretation of our maximum employment objective is an unemployment rate near its natural rate, and a fairly conservative estimate of that natural rate is 6%. So, when unemployment stands at 9%, we’re missing on our employment mandate by 3 full percentage points. That’s just as bad as 5% inflation versus a 2% target. So, if 5% inflation would have our hair on fire, so should 9% unemployment.

In their book This Time is Different, Carmen Reinhart and Ken Rogoff documented the substantially more detrimental effects that financial crises typically impose on economic recoveries. Recoveries following severe financial crises take many years longer than usual, and the risk of a second recession before the ultimate economic recovery returns to the previous business cycle peak is substantially higher. In a related study of the current U.S. experience, Reinhart and Rogoff show that the current anemic recovery is following the typical post-financial crisis path quite closely, given the size of the financial contraction. It would be nice to point to some features of the recovery that suggest greater progress relative to the Reinhart-Rogoff benchmark. But those are hard to come by.

It bears keeping in mind that the Reinhart-Rogoff predictions of a slow recovery are based on historical averages of macroeconomic performances across many different countries at many different times. They highlight a challenge we face today, but from the standpoint of the underlying economic analysis, there is nothing pre-ordained about these outcomes. They are not theoretical predictions—rather, they are reduced form correlations. The economy can perform better than it did in these past episodes if policy responds better than it did in those situations. In my opinion, maintaining the Fed’s focus on both of our dual-mandate responsibilities is a necessary and critical element of an appropriate response to the financial crisis that can produce better economic outcomes.

BLS: Job Openings "little changed" in July

by Calculated Risk on 9/07/2011 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in July was 3.2 million, little changed from June. Although the number of job openings remained below the 4.4 million openings when the recession began in December 2007, the level in July was 1.1 million openings higher than in July 2009 (the most recent trough).The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for July, the most recent employment report was for August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In general job openings (yellow) has been trending up - and job openings increased slightly again in July - and are up about 13% year-over-year compared to July 2010.

Overall turnover is increasing too, but remains low. Quits increased slightly in July, and have been trending up - and quits are now up about 9% year-over-year.

MBA: Mortgage Purchase Application Index near 15 Year Low

by Calculated Risk on 9/07/2011 07:26:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 6.3 percent from the previous week. The seasonally adjusted Purchase Index increased 0.2 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Heading into the Labor Day weekend, the 30-year rate was at its second lowest level in the history of our survey (the low point was reached last October), and the 15-year rate marked a new low in our survey," said Mike Fratantoni, MBA's Vice President of Research and Economics. "Despite these rates however, refinance application volume fell for the third straight week, and is more than 35 percent below levels at this time last year. Purchase application volume remains relatively flat at extremely low levels, close to lows last seen in 1996."

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.23 percent from 4.32 percent, with points decreasing to 1.04 from 1.29 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. This is the second lowest 30-year rate recorded in the survey.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is now at the lowest levels since August 1995.

This doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the previous month, and this suggests weak home sales in September and October.

Also - with the 10 year treasury yield below 2% this week - mortgage rates will probably be at record lows in the survey next week.