by Calculated Risk on 8/31/2011 07:22:00 PM

Wednesday, August 31, 2011

Lawler: Census 2010: Homeownership Rates by Selected Age Groups

Update from Lawler: Yesterday I gave some stats on the "states" with the highest and lowest shares of owner-occupied homes owned free and clear. Those %'s were incorrect; they were %'s for the % of ALL occupied homes owner free and clear. (My bad).

From economist Tom Lawler:

While Census has not released “Summary File 1” for the US as a whole, it has released such data for all 50 states plus DC. As such, aggregate US data from these files, including homeownership rates by selected age groups, can be constructed using the mathematical tools called “addition” and “division.”

Note the sizable declines in homeownership rates over the last decade in the 25-54 year old age groups!

| US Homeownership by Age Group (Decennial Census) | ||||

|---|---|---|---|---|

| 1980 | 1990 | 2000 | 2010 | |

| 15 to 24 years | 22.1% | 17.1% | 17.9% | 16.1% |

| 25 to 34 years | 51.6% | 45.3% | 45.6% | 42.0% |

| 35 to 44 years | 71.2% | 66.2% | 66.2% | 62.3% |

| 45 to 54 years | 77.0% | 75.3% | 74.9% | 71.5% |

| 55 to 64 years | 77.6% | 79.7% | 79.8% | 77.3% |

| 65 years and over | 70.1% | 75.2% | 78.1% | 77.5% |

| Total | 64.4% | 64.2% | 66.2% | 65.1% |

Here is a comparison of the decennial Census homeownership rates (which reflect April 1st) and the Housing Vacancy Survey (which are yearly average estimates). HVS data by age group only go back to 1982.

| US Homeownership by Age Group (Housing Vacancy Survey) | ||||

|---|---|---|---|---|

| 1980 | 1990 | 2000 | 2010 | |

| 15 to 24 years | --- | 15.7% | 21.7% | 22.8% |

| 25 to 34 years | --- | 44.2% | 47.1% | 44.4% |

| 35 to 44 years | --- | 66.3% | 67.9% | 65.0% |

| 45 to 54 years | --- | 75.2% | 76.5% | 73.5% |

| 55 to 64 years | --- | 79.3% | 80.3% | 79.0% |

| 65 years and over | --- | 76.3% | 80.4% | 80.5% |

| Total | --- | 63.9% | 67.4% | 66.9% |

While the decennial Census data show that the homeownership rates for all age groups save for “geezers” in 2010 were down significantly from 1990, the HVS data do not show the same declines. Census officials are unsure of why there are such large discrepancies, but most – though not all -- feel that the decennial Census data are more accurate, and that there is “sumpin’ wrong” with the HVS data (the same is true for the HVS vacancy data), and not just for 2010, but for 2000 as well.

Some readers might be surprised at the sizable declines in the homeownership rates for younger householders from 1980 to 1990 – after all, they’ve been deluged with charts showing “aggregate” US homeownership rates over the last several years, but with little or no discussion of homeownership rates by age group. There was actually a fair amount written about the drop in younger householder homeownership rates from 1980 to 1990, with researchers attributing the decline to a number of factors – younger folks marrying later in life, job choices and labor mobility, and several other factors (I don’t plan to summarize the literature.)

Also from Tom Lawler: Number of Homes Owned Free and Clear

Here is a table derived from the decennial Census 2010 on the number of owner-occupied homes with a mortgage vs. those owned free and clear.

| Owner-Occupied Homes (Census 2010) | |

|---|---|

| Total | 75,986,074 |

| Owned with a mortgage or loan | 52,979,430 |

| Owned free and clear | 23,006,644 |

Update: By state with correction:

| % of OO Homes owned free and clear, 2010 | |

|---|---|

| US Total | 30.3% |

| Alabama | 36.6% |

| Alaska | 31.2% |

| Arizona | 27.9% |

| Arkansas | 38.9% |

| California | 22.3% |

| Colorado | 22.3% |

| Connecticut | 26.4% |

| Delaware | 28.2% |

| District of Columbia | 19.6% |

| Florida | 33.0% |

| Georgia | 25.6% |

| Hawaii | 29.3% |

| Idaho | 29.1% |

| Illinois | 28.3% |

| Indiana | 27.9% |

| Iowa | 34.8% |

| Kansas | 33.3% |

| Kentucky | 35.9% |

| Louisiana | 40.9% |

| Maine | 33.5% |

| Maryland | 21.2% |

| Massachusetts | 25.8% |

| Michigan | 31.3% |

| Minnesota | 27.2% |

| Mississippi | 41.5% |

| Missouri | 31.5% |

| Montana | 38.5% |

| Nebraska | 33.7% |

| Nevada | 21.4% |

| New Hampshire | 27.5% |

| New Jersey | 27.1% |

| New Mexico | 37.7% |

| New York | 33.0% |

| North Carolina | 30.3% |

| North Dakota | 42.9% |

| Ohio | 30.0% |

| Oklahoma | 37.7% |

| Oregon | 28.2% |

| Pennsylvania | 35.0% |

| Rhode Island | 26.2% |

| South Carolina | 33.9% |

| South Dakota | 39.1% |

| Tennessee | 34.1% |

| Texas | 34.4% |

| Utah | 23.7% |

| Vermont | 31.9% |

| Virginia | 25.3% |

| Washington | 25.6% |

| West Virginia | 47.7% |

| Wisconsin | 30.3% |

| Wyoming | 36.5% |

CR Note: So, in 2010, about 30.3% of owner-occupied homes were owned free and clear. There will be much more on the 2010 Census data once the Summary File is released.

Fannie Mae and Freddie Mac Serious Delinquency Rates mostly unchanged in July

by Calculated Risk on 8/31/2011 04:15:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate was unchanged at 4.08% in July. This is down from 4.82% in July of 2010. The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate increased to 3.51% in July from 3.50% in June. This is down from 3.89% in July 2010. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are loans that are "three monthly payments or more past due or in foreclosure".

Note that the Fannie and Freddie serious delinquency rates are much lower than the overall serious delinquency rate (LPS reported that the overall serious delinquency rate and in-foreclosure was 7.72% in July).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Some of the rapid increase in 2009 was probably because of foreclosure moratoriums, and also because loans in trial mods were considered delinquent until the modifications were made permanent.

Although the delinquency rate was unchanged in July, the serious delinquency rate has been falling as Fannie and Freddie work through the backlog of delinquent loans.

The normal serious delinquency rate is under 1%, and it doesn't look like the delinquency rate will be back to "normal" for a number of years.

Restaurant Performance Index declined in July

by Calculated Risk on 8/31/2011 01:41:00 PM

From the National Restaurant Association: Restaurant Industry Outlook Softened in July as Restaurant Performance Index Slipped to Its Lowest Level in 11 Months

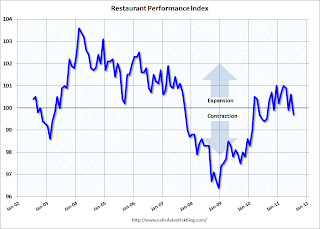

As a result of softer same-store sales and traffic levels and a dampened outlook among restaurant operators, the National Restaurant Association’s (www.restaurant.org) Restaurant Performance Index (RPI) fell below 100 in July. The RPI – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 99.7 in July, down from 100.6 in June and the lowest level in 11 months.

“Although same-store sales and customer traffic levels remained positive in July, restaurant operators’ outlook for the economy took a pessimistic turn,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “This survey month was burdened with the debt ceiling crisis and the downgrade in the nation’s credit rating, which added an additional layer of uncertainty in an already fragile economic recovery.”

...

Restaurant operators reported somewhat softer same-store sales results in July. ... Restaurant operators also reported softer customer traffic levels in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The index declined to 99.7 in July (above 100 indicates expansion).

Unfortunately the data for this index only goes back to 2002.

This is a minor report, but still interesting (barely "D-List" data).

CoreLogic: Home Price Index increased 0.8% in July

by Calculated Risk on 8/31/2011 10:10:00 AM

• First on the Chicago PMI Chicago Business Barometer™ Slipped: The overall index decreased to 56.5 from 58.8 in July. This was above consensus expectations of 53.5. Note: any number above 50 shows expansion. The employment index increased to 52.1 from 51.5. The new orders index decreased to 56.9 from 59.4.

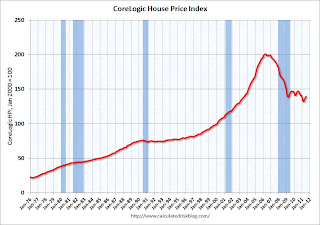

• Notes: This CoreLogic Home Price Index is for July. The Case-Shiller index released yesterday was for June. Case-Shiller is the most followed house price index, but CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average of May, June and July (July weighted the most) and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® July Home Price Index Shows Fourth Consecutive Month-Over-Month Increase

CoreLogic ... today released its July Home Price Index (HPI) which shows that home prices in the U.S. increased for the fourth consecutive month, inching up 0.8 percent on a month-over-month basis. On a year-over-year basis, however, national home prices, including distressed sales, declined by 5.2 percent in July 2011 compared to July 2010. In June 2011, prices declined by 6.0 percent* compared to June 2010. Excluding distressed sales, year-over-year prices declined by 0.6 percent in July 2011 compared to July 2010 and by 1.9* percent in June 2011 compared to June 2010. Distressed sales include short sales and real estate owned (REO) transactions. [*CR note: June index was revised up]

“While July’s numbers remained relatively positive, particularly for non-distressed sales which have been stable, seasonal influences are expected to fade in late summer. At that point the month-over-month growth will most likely turn negative. The slowdown in economic growth and increased uncertainty caused by the recent stock market volatility will continue to exert downward pressure on prices,” said Mark Fleming, chief economist for CoreLogic.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.8% in July, and is down 5.2% over the last year, and off 30.6% from the peak - and up 5.5% from the March low.

As Mark Fleming noted, some of this increase is seasonal (the CoreLogic index is NSA) and the index is still off 5.2% from last July. Month-to-month prices will probably turn negative later this year (the normal seasonal pattern).

Yesterday:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

• LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

ADP: Private Employment increased 91,000 in August

by Calculated Risk on 8/31/2011 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector rose 91,000 from July to August on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated advance in employment from June to July was revised down modestly to 109,000, from the initially reported 114,000.Note: ADP is private nonfarm employment only (no government jobs).

...

Employment in the service-providing sector rose by 80,000 in August, marking 20 consecutive months of employment gains. Employment in the goods-producing sector rose by 11,000 in August, up from a loss of 2,000 jobs last month. Manufacturing employment slipped 4,000 in August.

This was slightly below the consensus forecast of an increase of 100,000 private sector jobs in August. The BLS reports on Friday, and the consensus is for an increase of 67,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

Of course the ADP report has not been very useful in predicting the BLS report.

MBA: Mortgage Purchase Activity "near 15-year lows"

by Calculated Risk on 8/31/2011 07:13:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 12.2 percent from the previous week. The seasonally adjusted Purchase Index increased 0.9 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Refinance application volume declined for a second week from recent highs, despite rates staying near a 10-month low, while purchase volume remained near 15-year lows," said Mike Fratantoni, MBA's Vice President of Research and Economics.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.32 percent from 4.39 percent, with points increasing to 1.30 from 0.88 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is now at the lowest levels since August 1995!

This doesn't include the large number of cash buyers ... but purchase application activity was especially weak over the last three weeks, and this suggests weak home sales in the coming months.

Tuesday, August 30, 2011

LPS: Average Loan in Foreclosure Is Delinquent for Record 599 Days

by Calculated Risk on 8/30/2011 08:14:00 PM

LPS Applied Analytics released their July Mortgage Monitor Report today. From LPS: LPS' Mortgage Monitor Report Shows Average Loan in Foreclosure Is Delinquent for Record 599 Days; First-Time Foreclosure Starts Near Three-Year Lows

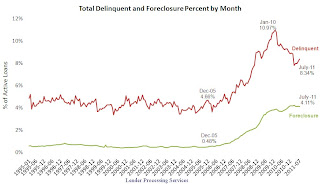

The July Mortgage Monitor report released by Lender Processing Services, Inc. shows that foreclosure timelines continue their steady upward trend, as a payment has not been made on the average loan in foreclosure in a record 599 days. Of the nearly 1.9 million loans that are 90 or more days delinquent but not yet in foreclosure, 42 percent have not made a payment in more than a year with an average delinquency of 397 days, also a new record. At the same time, first-time foreclosure starts in June were near three-year lows, and first-time delinquencies accounted for only 25 percent of new delinquent inventory.According to LPS, 8.34% of mortgages were delinquent in July, up from 8.15% in June, and down from 9.31% in July 2010.

As of the end of June, 4.1 million loans were either 90 or more days delinquent or in foreclosure, as delinquencies remain two times and foreclosures eight times pre-crisis levels. Foreclosure sales remain constricted, with foreclosure starts outnumbering sales by a factor of almost three to one.

LPS reports that 4.11% of mortgages were in the foreclosure process, down slightly from 4.12% in June, and up from 3.74% in July 2010. This gives a total of 12.45% delinquent or in foreclosure. It breaks down as:

• 2.48 million loans less than 90 days delinquent.

• 1.90 million loans 90+ days delinquent.

• 2.16 million loans in foreclosure process.

For a total of 6.54 million loans delinquent or in foreclosure in July.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has increased recently (part of the increase is seasonal), but the rate has fallen to 8.34% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long long ways to go.

However the in-foreclosure rate at 4.11% is barely below the peak rate of 4.21% in March 2011. There are still a large number of loans in this category (about 2.16 million) - and the average loan in foreclosure has been delinquent for a record 599 days!

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.

This graph provided by LPS Applied Analytics shows the number of loans entering the foreclosure process each month and the number of foreclosure sales.Looking at this graph, one might expect the number of loans in the foreclosure process to be increasing sharply since there are so many more starts than sales.

And there are very few cures too - what is happening is a large number of loans each month have been moving from "in foreclosure" back to "90+ days delinquent" status - so the number of loans "in foreclosure" hasn't increased recently.

The third graph shows mortgage origination by the original term.

The third graph shows mortgage origination by the original term. This graph is interesting because of the surge in shorter duration loans.

This is probably being driven by two factors: 1) older borrowers are hoping to pay off their loans as part of their retirement planning and are taking out 15 year mortgages, and 2) many jumbo borrowers are probably taking out 5 year loans with a balloon payment since 30 year jumbo rates are much higher.

Earlier:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

Recession Measures

by Calculated Risk on 8/30/2011 05:39:00 PM

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that most major indicators are still way below the pre-recession peaks.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.5% below the previous pre-recession peak. However Gross Domestic Income (red) is now back to the pre-recession peak. (For a discussion of GDI, see here).

At the worst point, real GDP was off 5.1% from the 2007 peak. Real GDI was off 5.7% at the trough.

And real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through July.

This graph shows real personal income less transfer payments as a percent of the previous peak through July.

With the revisions, this measure was off almost 11% at the trough - a significant downward revision!

Real personal income less transfer payments is still 4.8% below the previous peak.

This graph is for industrial production through July.

This graph is for industrial production through July.

Industrial production had been one of the stronger performing sectors because of inventory restocking and some growth in exports.

However industrial production is still 6.5% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

On the timing of the trough of the recession, GDP and industrial production would suggest the end of Q2 2009 (and June 2009). The other two indicators would suggest later troughs.

And of course the recovery in all indicators has been very sluggish compared to recent recessions.

Earlier:

• Case Shiller: Home Prices increased in June

• Real House Prices and Price-to-Rent

FOMC Minutes: Discussed Options for additional monetary accommodation

by Calculated Risk on 8/30/2011 02:00:00 PM

From the Fed: Minutes of the Federal Open Market Committee, August 9, 2011. Excerpts:

Participants discussed the range of policy tools available to promote a stronger economic recovery should the Committee judge that providing additional monetary accommodation was warranted. Reinforcing the Committee's forward guidance about the likely path of monetary policy was seen as a possible way to reduce interest rates and provide greater support to the economic expansion; a few participants emphasized that guidance focusing solely on the state of the economy would be preferable to guidance that named specific spans of time or calendar dates. Some participants noted that additional asset purchases could be used to provide more accommodation by lowering longer-term interest rates. Others suggested that increasing the average maturity of the System's portfolio--perhaps by selling securities with relatively short remaining maturities and purchasing securities with relatively long remaining maturities--could have a similar effect on longer-term interest rates. Such an approach would not boost the size of the Federal Reserve's balance sheet and the quantity of reserve balances. A few participants noted that a reduction in the interest rate paid on excess reserve balances could also be helpful in easing financial conditions. In contrast, some participants judged that none of the tools available to the Committee would likely do much to promote a faster economic recovery, either because the headwinds that the economy faced would unwind only gradually and that process could not be accelerated with monetary policy or because recent events had significantly lowered the path of potential output. Consequently, these participants thought that providing additional stimulus at this time would risk boosting inflation without providing a significant gain in output or employment. Participants noted that devoting additional time to discussion of the possible costs and benefits of various potential tools would be useful, and they agreed that the September meeting should be extended to two days in order to provide more time.The forward guidance was included in the last FOMC statement. The other three options are: Additional asset purchases (QE3), extend maturities, and reduce interest paid on reserves. As Bernanke noted in his Jackson Hole speech, the next meeting has been extended to allow for more discussion of these options.

...

In the discussion of monetary policy for the period ahead, most members agreed that the economic outlook had deteriorated by enough to warrant a Committee response at this meeting. While all felt that monetary policy could not completely address the various strains on the economy, most members thought that it could contribute importantly to better outcomes in terms of the Committee's dual mandate of maximum employment and price stability. In particular, some members expressed the view that additional accommodation was warranted because they expected the unemployment rate to remain well above, and inflation to be at or below, levels consistent with the Committee's mandate. Those viewing a shift toward more accommodative policy as appropriate generally agreed that a strengthening of the Committee's forward guidance regarding the federal funds rate, by being more explicit about the period over which the Committee expected the federal funds rate to remain exceptionally low, would be a measured response to the deterioration in the outlook over the intermeeting period. A few members felt that recent economic developments justified a more substantial move at this meeting, but they were willing to accept the stronger forward guidance as a step in the direction of additional accommodation. Three members dissented because they preferred to retain the forward guidance language employed in the June statement.

Real House Prices and Price-to-Rent

by Calculated Risk on 8/30/2011 11:25:00 AM

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 2000 levels.

Nominal House Prices

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2011), and the monthly Case-Shiller Composite 20 SA (through June) and CoreLogic House Price Indexes (through June) in nominal terms (as reported).

In nominal terms, the Case-Shiller National index is back to Q4 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to June 2003 levels, and the CoreLogic index is back to May 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q3 1999 levels, the Composite 20 index is back to September 2000, and the CoreLogic index back to May 2000.

In real terms, all appreciation in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through May).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is back to September 2000 levels, and the CoreLogic index is back to May 2000.

Earlier:

• Case Shiller: Home Prices increased in June