by Calculated Risk on 4/23/2011 05:44:00 PM

Saturday, April 23, 2011

FOMC Preview

There will be a two day meeting of the Federal Open Market Committee (FOMC) this coming Tuesday and Wednesday. I expect no changes to the Fed Funds rate, or to the program to reinvest principal payments, or to the Large Scale Asset Purchase program (LSAP, aka "QE2").

Some things to look for:

1) Fed Chairman Press Briefing. This will be the first FOMC statement followed by a press briefing with Fed Chairman Ben Bernanke.

The FOMC statement will be released earlier than usual - around 12:30 PM ET on Wednesday, and the Chairman's press briefing will be held at 2:15 PM.

At the press briefing, Chairman Bernanke is expected to discuss the new FOMC forecasts (usually these have been released a few weeks later with the minutes of the meeting). Growth forecasts have probably been revised down since January, the unemployment rate revised down, and inflation forecasts revised up. Here is a table of the January (and November) forecasts for reference:

| January 2011 Economic projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| 2011 | 2012 | 2013 | |

| Change in Real GDP | 3.4 to 3.9 | 3.5 to 4.4 | 3.7 to 4.6 |

| Previous Projection (Nov 2010) | 3.0 to 3.6 | 3.6 to 4.5 | 3.5 to 4.6 |

| Unemployment Rate | 8.8 to 9.0 | 7.6 to 8.1 | 6.8 to 7.2 |

| Previous Projection (Nov 2010) | 8.9 to 9.1 | 7.7 to 8.2 | 6.9 to 7.4 |

| PCE Inflaton | 1.3 to 1.7 | 1.0 to 1.9 | 1.2 to 2.0 |

| Previous Projection (Nov 2010) | 1.1 to 1.7 | 1.1 to 1.8 | 1.2 to 2.0 |

| Core PCE Inflation | 1.0 to 1.3 | 1.0 to 1.5 | 1.2 to 2.0 |

| Previous Projection (Nov 2010) | 0.9 to 1.6 | 1.0 to 1.6 | 1.1 to 2.0 |

FOMC definitions:

1 Projections of change in real GDP and in inflation are from the fourth quarter of the previous year to the fourth quarter of the year indicated.

2 Projections for the unemployment rate are for the average civilian unemployment rate in the fourth quarter of the year indicated.

2) Possible Statement Changes. I don't expect the key sentence "likely to warrant exceptionally low levels for the federal funds rate for an extended period" to be changed any time soon.

There might be some minor changes to the first paragraph to mention the recent softer economic data - and also slightly stronger employment data. Also the FOMC statement will continue to note that "measures of underlying inflation continue to be somewhat low", but they will probably note the recent pickup in inflation - and also say the increase is expected to be transitory.

3) Timeline for Fed tightening It appears QE2 will end in June as scheduled with no tapering of purchases. It also appears the Fed will continue to reinvestment maturing securities - at least for a couple of months following the end of QE2.

This suggests a timeline for the earliest Fed funds rate increase:

• End of QE2 in June.

• End of reinvestment 2+ months later.

• Drop extended period language a couple months later

• Raise rates in early to mid-2012.

That is probably the earliest the Fed would raise rates - and it could be much later.

Earlier on U.S. economy:

• Summary for Week ending April 22nd

Summary for Week ending April 22nd

by Calculated Risk on 4/23/2011 11:45:00 AM

Below is a summary of economic data last week mostly in graphs:

• March Existing Home Sales: 5.10 million SAAR, 8.4 months of supply

The NAR reports: Existing-Home Sales Rise in March

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2011 (5.10 million SAAR) were 3.7% higher than last month, and were 6.3% lower than March 2010.

The second graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Although inventory increased from February to March (as usual), inventory decreased 2.1% year-over-year in March (from March 2010). This is the second consecutive month with a small YoY decrease in inventory.

Although inventory increased from February to March (as usual), inventory decreased 2.1% year-over-year in March (from March 2010). This is the second consecutive month with a small YoY decrease in inventory.

Inventory should increase over the next few months (the normal seasonal pattern), and the YoY change is something to watch closely this year. Inventory is already very high, and any YoY increase in inventory would put more downward pressure on house prices.

The third graph shows existing home sales Not Seasonally Adjusted (NSA).

The third graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns in January, February and March are for 2011.

Sales NSA are below the tax credit boosted level of sales in March 2010, but above the level of March sales in 2008 and 2009.

• Housing Starts increased in March

Total housing starts were at 549 thousand (SAAR) in March, up 7.2% from the revised February rate of 512 thousand (revised up from 479 thousand).

Total housing starts were at 549 thousand (SAAR) in March, up 7.2% from the revised February rate of 512 thousand (revised up from 479 thousand).

Single-family starts increased 7.7% to 422 thousand in March (February was revised up to 392 thousand from 375 thousand).

The graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

• AIA: Architecture Billings Index little changed in March

This graph shows the Architecture Billings Index since 1996. The index showed billings increased slightly in March (index at 50.5, anything above indicates an increase in billings).

This graph shows the Architecture Billings Index since 1996. The index showed billings increased slightly in March (index at 50.5, anything above indicates an increase in billings).

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year 2011 or so - but there won't be a strong increase in investment.

• Moody's: Commercial Real Estate Prices declined 3.3% in February

Moody's reported that the Moody’s/REAL All Property Type Aggregate Index declined 3.3% in February. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales and there are a large percentage of distressed sales - and that can impact prices and make the index very volatile.

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 4.9% from a year ago and down about 44.7% from the peak in 2007. Prices are just above the post-bubble low last August - and about at the levels of 2002.

• Other Economic Stories ...

• Residential Remodeling Index shows strong increase year-over-year in February

• NAHB Builder Confidence index declines slightly in April

• DOT: Vehicle Miles Driven increased in February

• Philly Fed Survey shows slower expansion in April

• Unofficial Problem Bank list at 978 Institutions

Best wishes to all!

Home Builders still see no recovery

by Calculated Risk on 4/23/2011 08:12:00 AM

From David Streitfeld at the NY Times: Builders of New Homes Seeing No Sign of Recovery

Builders and analysts say a long-term shift in behavior seems to be under way. Instead of wanting the biggest and the newest, even if it requires a long commute, buyers now demand something smaller, cheaper and, thanks to $4-a-gallon gas, as close to their jobs as possible. That often means buying a home out of foreclosure from a bank.This has led to the "distressing gap" between new and existing home sales! Here is a repeat of the graph showing existing home sales (left axis) and new home sales (right axis). This graph starts in 1994, but the relationship has been fairly steady back to the '60s. Then along came the housing bubble and bust, and the "distressing gap" appeared (due mostly to distressed sales).

Four out of 10 sales of existing homes are foreclosures or otherwise distressed properties. Builders ... cannot compete despite chopping prices.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The gap is due mostly to the flood of distressed sales. This has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

In a few years - when the excess housing inventory is absorbed and the number of distressed sales has declined significantly - I expect existing home-to-new home sales to return to something close to this historical relationship.

Also - earlier this week I mentioned a possible change in sentiment toward homeownership - Streitfeld picked this up and I appreciate the mention!

Friday, April 22, 2011

Unofficial Problem Bank list at 976 Institutions

by Calculated Risk on 4/22/2011 09:06:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Apr 22, 2011.

Changes and comments from surferdude808:

Given the flurry of closings last week and the Easter weekend, it is probably safe to assume the FDIC will be on the sidelines this Friday. During the week, however, there were four removals and two additions, which leave the Unofficial Problem Bank List standing at 976 institutions with assets of $422.2 billion.

The FDIC terminated its action against CIT Bank, Salt Lake City, UT ($7.1 billion). The other removals were further intercompany consolidations by the multi-bank holding company Metropolitan Bank Group, Inc., first mentioned last week. This week Metropolitan Bank and Trust Company, Chicago, IL ($307 million); Chicago Community Bank, Chicago, IL ($276 million); and Community Bank of DuPage, Downers Grove, IL ($63 million) merged into the affiliated Metro Bank (f/k/a Citizens Community Bank Of Illinois), Berwyn, IL, which is also on the Unofficial Problem Bank List.

The new addition are Hopkins Federal Savings Bank, Baltimore, MD ($355 million) and TransPecos Banks, Pecos, TX ($157 million). Look for more activity next week as the FDIC should release its enforcement actions through March 2011 on April 29th.

Budget Deficit: Gang of Six

by Calculated Risk on 4/22/2011 05:57:00 PM

From the LA Times: Gang of Six gives old-time politics a try

The six senators — three Democrats, three Republicans — working behind closed doors to deal with the nation's debt crisis have put aside the hyper-partisanship of today's Washington and are engaging in the give-and-take necessary to craft an agreement.I do not want to prejudge the result of these meetings, however I've outlined my suggestions on how to approach the deficit issue.

...

For now, the group's deliberations are largely secret. But its proposals are expected to include changes in the government's most costly programs — defense, the healthcare safety net and Social Security — as well as the closure of tax loopholes.

I'd be happy if the "Gang of Six" just offered a proposal on how to close the structural general fund deficit ex-healthcare. That would be an important first step ... and I think should be THE first step.

Another Boom in Silicon Valley

by Calculated Risk on 4/22/2011 01:55:00 PM

From Jason Lloren at the San Francisco Chronicle: Silicon Valley CEOs see hiring surge continuing

In a survey of 175 chief executives, 66 percent said their companies added jobs in 2010 - twice the number of those polled the previous two years. That was also the highest percentage since the annual Business Climate survey began eight years agoThat is good news.

...

Fifty-five percent of the CEOs polled anticipate job growth in the region to be better in 2011. Only 5 percent expect it to be worse.

For fun, here is a video from the Richter Scales a few years ago "Here Comes Another Bubble v1.1".

Wow - it seems out of date now. Making fun of Facebook at a valuation of $15 billion? Goldman invested at a $50 billion valuation earlier this year. And house prices have fallen too ...

Supply Chain Disruption Update

by Calculated Risk on 4/22/2011 09:29:00 AM

From Reuters: Toyota: Output to Return to Normal in November or December

Toyota Motor said it expects its production to make a full recovery by November or December ... Toyota and other Japanese automakers have been hit hard by a supply disruption of mostly electronic and resin-based parts made in Japan's northeastSeveral tech companies have said supply chain issues will impact Q2. As an example, from the Western Digital conference call this week:

[T]here is uncertainty around the ability of our customers and the HDD industry to fully satisfy this demand due to Supply Chain challenges ... we believe that we'll be supply constrained in both June quarter and in the September quarter. We think that in the December quarter, it will be, we'll be able to supply pretty much what the industry, what the customers demand so we think that the comfort level as far as inventory in the pipeline will not be able to be reached again until this quarter next year, the March quarter of next yearThis will be an issue most of the year, although most of the impact for the U.S. in Q2 and a little in Q3. I've seen estimates that supply issues will be a drag on U.S. GDP growth of about 0.25 to 0.5 percentage points in Q2 and probably less in Q3.

Thursday, April 21, 2011

Greece Update

by Calculated Risk on 4/21/2011 11:13:00 PM

This was amusing. Greece is probing an email discussion of a possible default. The Financial Times has the Citi email sent on Wednesday: Greece probes market talk of debt restructuring

“Over the last 20min, there seems to be some increased noise over [Greek] debt restructuring as early as this Easter weekend. Spreads are moving wider now with 2-year spread +100 from +35 mid-day, while [Greek] banks are at -4%, i6% vs +2% in the morning.Geesh - that seems like pretty normal speculation!

“The last few days the talks over [Greek] restructuring/rescheduling have intensified, despite the ongoing denials by [Greek] and foreign officials.

“If a credit event takes place it is crucial to see what the terms would be as a haircut would have a much different outcome vs an extension of maturities.”

The yield on Greece ten year bonds increased to 14.9% today and the two year yield is up to 23%. Sounds like a credit event might happen soon. If so, I wonder if it will be haircut or an extension of maturities?

Here are the ten year yields for Ireland up to a record 10.5%, Portugal up to a record 9.5%, and Spain at 5.5%.

Correct Reporting and the Philly Fed Manufacturing Index

by Calculated Risk on 4/21/2011 06:12:00 PM

When the Philly Fed business outlook report was released this morning, I made several points:

• The index showed slower expansion in April than in March.

• This was below expectations, but ...

• This index showed decent growth in April, and this suggests the ISM index will be in the low 60s for April.

Several readers have sent me other reports arguing the Philly Fed report suggests, well, the end of the world or something. That is wrong.

First, the Philly Fed index is noisy month-to-month.

Second, the reading of 18.5 is above the median during expansions for the last 40 years. The median during expansions is 14.

Third, the reading in March was the highest since January 1984 - and a decline was expected (although this reading was below expectations).

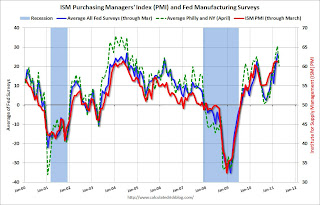

Here is a long term graph of the index:

Click on graph for larger image.

Click on graph for larger image.

Obviously this index is noisy, and this is just one month. Still a reading of 18.5 shows decent expansion, not the end of the world as we know it.

Because this index is noisy, I average it with the NY Fed (Empire state) each month. Remember the NY Fed index showed faster expansion in April, and was at the highest level in a year.

Then I average both the Philly Fed and NY Fed indexes with several other regional surveys - and that helps predict the ISM manufacturing index.

This graph compares the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

This graph compares the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

And what does a 60 reading for the ISM mean? Here is a long term graph of the ISM manufacturing index:

The dashed line is for the March ISM PMI of 61.2% (very strong).

The dashed line is for the March ISM PMI of 61.2% (very strong).

Clearly a reading in the low 60s (or even high 50s) shows pretty decent expansion for manufacturing.

One reader told me he was surprised by the negativity. He wrote: "We're finally seeing signs of real growth here. Kinda sad in a way. I was getting comfortable coming in late and still finding a parking spot close to the door." Too bad - my guess he is going to have to get in a little earlier, or walk a little further!

Hotels: Occupancy Rate improves in Latest Survey

by Calculated Risk on 4/21/2011 02:38:00 PM

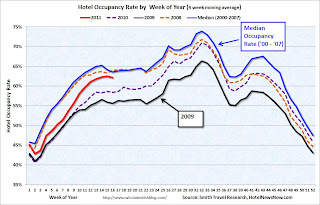

Here is the weekly update on hotels from HotelNewsNow.com: Oahu Island reports strong weekly results

Overall, the U.S. hotel industry’s occupancy was up 4.8% to 63.2%, ADR increased 3.6% to US$102.28, and RevPAR finished the week up 8.5%to US$64.67.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the seasonal pattern for the hotel occupancy rate.

The occupancy rate is well above the levels in 2009 and 2010, but still below the occupancy rate for the same period in 2008.

RevPAR and ADR are well below the peak levels prior to the recession. So even though the occupancy rate has improved, hotel income is still much lower now than prior to the recession.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com