by Calculated Risk on 4/21/2011 12:28:00 PM

Thursday, April 21, 2011

Other House Price Indexes

The most followed house price indexes are Case-Shiller and CoreLogic - and also the FHFA index based on repeat sales of homes with loans sold to or guaranteed by Fannie Mae or Freddie Mac.

The FHFA reported this morning: U.S. Monthly House Price Index Declined 1.6 Percent from January to February

U.S. house prices declined 1.6 percent on a seasonally adjusted basis from January to February, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.3 percent decrease in January was revised to a 1.0 percent decrease. For the 12 months ending in February, U.S. prices fell 5.7 percent. The U.S. index is 18.6 percent below its April 2007 peak and roughly the same as the February 2004 index level.There are several other house price indexes that I follow: RadarLogic (based on a house price per square foot method, to be released this afternoon for February), FNC Residential Price Index (a hedonic price index), Clear Capital and more.

I'm planning on mentioning these other indexes, in addition to Case-Shiller and CoreLogic, and discussing some of the differences.

From FNC this morning: February Single-Family Home Prices Decline 0.7 Percent

FNC announced Thursday that U.S. home prices weakened only slightly in February—a better-than-expected price seasonality.According to FNC, house prices are at a post-bubble low, and are back to May 2003 prices. You can see the FNC composite index, and prices for 30 cities here.

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ (RPI) indicated that home prices in February declined 0.7% from January, or 5.3% from a year ago.

Contrary to expectations of relatively rapid price deteriorations, February delivered instead the slowest one-month price declines since November. Even so, the trend shows that weak housing demand and spillovers from rising distressed sales continue to affect the mortgage market.

FNC’s RPI – the industry’s first hedonic price index built on a comprehensive database blending public records with real-time appraisals – also showed home prices nationwide are currently 1.9% below the end of 2010 and comparable to May 2003 on a cyclical basis.

Note on comments: The comment server is down due to an Amazon server failure. You can see the status here (comments are hosted in N. Virginia). Hopefully this will be resolved soon.

Philly Fed Survey shows slower expansion in April

by Calculated Risk on 4/21/2011 10:00:00 AM

From the Philly Fed: April 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased from 43.4 in March to 18.5 this month. [any reading above zero is expanion]. The demand for manufactured goods, as measured by the current new orders index, showed a similar slowing: The index fell 22 points, following seven consecutive months of increase. The shipments index declined 6 points and remained at a relatively high level. Firms continued to report that unfilled orders and delivery times were still rising.This indicates continued expansion in April, but at a slower pace. This was well below the consensus of 36.8. The concern remains the pickup in both prices paid and received:

Firms’ responses continue to indicate overall improvement in labor markets. The current employment index fell 6 points but has remained positive for eight consecutive months. The percentage of firms reporting an increase in employment (20 percent) is higher than the percentage reporting a decline (8 percent). Over twice as many firms reported a longer workweek (32 percent) than reported a shorter one (14 percent) and the workweek index increased 5 points.

Firms continue to report price increases for inputs as well as their own manufactured goods. The prices paid index declined 7 points this month but remains about 45 points higher than readings just seven months ago. Fifty-nine percent of the firms reported higher prices for inputs this month, compared to 64 percent last month. On balance, firms also reported an increase in prices for their own manufactured goods

Click on graph for larger image in graph gallery.

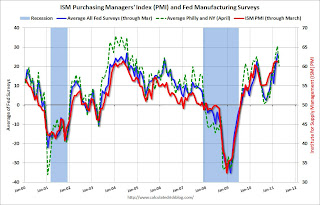

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

This early reading suggests the ISM index will be in the low 60s again in April. This showed slower expansion, but still decent growth in April.

Weekly Initial Unemployment Claims decrease, 4-Week average increases to 399,000

by Calculated Risk on 4/21/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 16, the advance figure for seasonally adjusted initial claims was 403,000, a decrease of 13,000 from the previous week's revised figure of 416,000. The 4-week moving average was 399,000, an increase of 2,250 from the previous week's revised average of 396,750.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week to 399,000.

This is the 8th consecutive week with the 4-week average below the 400,000 level (not by much).

Wednesday, April 20, 2011

More than a Lost Decade

by Calculated Risk on 4/20/2011 09:13:00 PM

I've been more upbeat lately, but even as the economy recovers - and I think the recovery will continue - we need to remember a few facts.

There are currently 130.738 million payroll jobs in the U.S. (as of March 2011). There were 130.781 million payroll jobs in January 2000. So that is over eleven years with no increase in total payroll jobs.

And the median household income in constant dollars was $49,777 in 2009. That is barely above the $49,309 in 1997, and below the $51,100 in 1998. (Census data here in Excel).

Just a reminder that many Americans have been struggling for a decade or more. The aughts were a lost decade for most Americans.

And I'd like to think every U.S. policymaker wakes up every morning and reminds themselves of the following:

There are currently 7.25 million fewer payroll jobs than before the recession started in 2007, with 13.5 million Americans currently unemployed. Another 8.4 million are working part time for economic reasons, and about 4 million more workers have left the labor force. Of those unemployed, 6.1 million have been unemployed for six months or more.

So even as we start to discuss how to fix the structural budget deficit, and also to address the long term fiscal challenges from healthcare costs, we can't forget about all of these Americans.

Earlier:

• Existing Home Inventory decreases 2.1% Year over Year

• March Existing Home Sales: 5.10 million SAAR, 8.4 months of supply

DOT: Vehicle Miles Driven increased in February

by Calculated Risk on 4/20/2011 05:07:00 PM

The Department of Transportation (DOT) reported that vehicle miles driven in February were up 0.9% compared to February 2010:

Travel on all roads and streets changed by +0.9% (2.0 billion vehicle miles) for February 2011 as compared with February 2010. Travel for the month is estimated to be 214.8 billion vehicle miles.

Cumulative Travel for 2011 changed by +0.6% (2.8 billion vehicle miles).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 39 months too - so this record will be broken in March!

The second graph shows the year-over-year change from the same month in the previous year. The DOT reported vehicle miles driven in February were up 0.9%.

The second graph shows the year-over-year change from the same month in the previous year. The DOT reported vehicle miles driven in February were up 0.9%.No signs of demand destruction yet, however in February U.S. oil prices averaged $90 per barrel, and we might see $100+ oil lead to a decrease in driving in March or April.

Earlier:

• Existing Home Inventory decreases 2.1% Year over Year

• March Existing Home Sales: 5.10 million SAAR, 8.4 months of supply

Moody's: Commercial Real Estate Prices declined 3.3% in February

by Calculated Risk on 4/20/2011 02:16:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 3.3% in February. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales and there are a large percentage of distressed sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

The Moody’s/REAL Commercial Property Price Index fell 3.3 percent from January and 4.9 percent from a year earlier. It’s up 0.8 percent from an eight-year low in August, Moody’s said in a statement today.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 4.9% from a year ago and down about 44.7% from the peak in 2007. Prices are just above the post-bubble low last August - and about at the levels of 2002.

Earlier:

• Existing Home Inventory decreases 2.1% Year over Year

• March Existing Home Sales: 5.10 million SAAR, 8.4 months of supply

Existing Home Inventory decreases 2.1% Year over Year

by Calculated Risk on 4/20/2011 11:30:00 AM

Earlier the NAR released the existing home sales data for March; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Although inventory increased from February to March (as usual), inventory decreased 2.1% year-over-year in March (from March 2010). This is the second consecutive month with a small YoY decrease in inventory.

Inventory should increase over the next few months (the normal seasonal pattern), and the YoY change is something to watch closely this year. Inventory is already very high, and any YoY increase in inventory would put more downward pressure on house prices.

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns in January, February and March are for 2011.

Sales NSA are below the tax credit boosted level of sales in March 2010, but above the level of March sales in 2008 and 2009.

The bottom line: March is the beginning of the selling season, and sales activity (so far) is above the 2008 and 2009 levels. Much of this activity is from all cash-sales (both investors and homebuyers). The NAR reported "All-cash sales were at a record market share of 35 percent in March, up from 33 percent in February; they were 27 percent in March 2010."

The NAR also mentioned: "Distressed homes – typically sold at discounts in the vicinity of 20 percent – accounted for a 40 percent market share in March, up from 39 percent in February and 35 percent in March 2010." A higher percentage of distressed sales probably means lower prices - and we should expect the repeat sales indexes to show further price declines in March.

The year-over-year decline in inventory will put less downward pressure on house prices, although the level is still very high (and this is just the visible inventory).

Note: The Case-Shiller price index will be released next Tuesday (April 26th), and is released with a significant lag. The Case-Shiller report will be for February (average of three months) - and the NAR report, with the high level of distressed sales and cash buyers, suggests further price declines in March.

March Existing Home Sales: 5.10 million SAAR, 8.4 months of supply

by Calculated Risk on 4/20/2011 10:00:00 AM

The NAR reports: Existing-Home Sales Rise in March

Existing-home sales1, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92 million in February, but are 6.3 percent below the 5.44 million pace in March 2010.

...

All-cash sales were at a record market share of 35 percent in March, up from 33 percent in February; they were 27 percent in March 2010. Investors accounted for 22 percent of sales activity in March, up from 19 percent in February; they were 19 percent in March 2010.

...

Total housing inventory at the end of March rose 1.5 percent to 3.55 million existing homes available for sale, which represents an 8.4-month supply4 at the current sales pace, compared with a 8.5-month supply in February.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in March 2011 (5.10 million SAAR) were 3.7% higher than last month, and were 6.3% lower than March 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.549 million in March from 3.498 million in February.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. Inventory will probably increase significantly over the next several months.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply decreased to 8.4 months in March, down from 8.5 months in February. The months of supply will probably increase over the next few months as inventory increases. This is higher than normal.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% or 15% or more in 2009 and 2010). I reported in January that the NAR was working on benchmarking existing home sales for earlier years with other industry data, and I expected "this effort will lead to significant downward revisions to previously reported sales". The numbers reported today were estimated using the old method and will probably be revised down significantly, but they are still useful on a month-to-month basis.

These sales numbers were above the consensus of 5.0 million SAAR, and are about what I expected (Lawler's forecast was 5.08 million). I'll have more soon.

MBA: Mortgage Purchase Application activity increases

by Calculated Risk on 4/20/2011 07:37:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 2.7 percent from the previous week. The seasonally adjusted Purchase Index increased 10.0 percent to its highest level since December 3, 2010, driven largely by a 17.6 percent increase in Government purchase applications.

...

“Purchase application volume jumped last week largely due to another sharp increase in applications for government loans. Borrowers were likely motivated to apply for loans before the scheduled increase in FHA insurance premiums,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Refinance activity increased somewhat, as rates dropped to their lowest level in a month towards the end of the week.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.83 percent from 4.98 percent, with points increasing to 1.07 from 0.93 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the MBA Purchase Index and four week moving average since 1990.

Although this is the highest level of purchase activity this year, the level is still low compared to recent years.

AIA: Architecture Billings Index little changed in March

by Calculated Risk on 4/20/2011 12:01:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

From Reuters: US architecture billings index flat in March -AIA

The Architecture Billings Index slipped 0.1 point to 50.5 in March, according to the American institute of Architects.

...

"Demand is not falling back into the negative territory, but also not exhibiting the same pace of increases seen at the end of 2010," said AIA Chief Economist Kermit Baker.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the Architecture Billings Index since 1996. The index showed billings increased slightly in March (index at 50.5, anything above indicates an increase in billings).

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So this indicator suggests the drag from CRE investment will end mid-year 2011 or so - but there won't be a strong increase in investment.