by Calculated Risk on 4/19/2011 06:30:00 PM

Tuesday, April 19, 2011

Thoughts on Residential Investment Recovery

A few thoughts looking out a few years ...

• Residential investment (RI) is the best leading indicator for the economy. This isn't perfect - nothing is - but RI is usually a strong leading indicator for the business cycle. The slump in RI helped me call the 2007 recession correctly, and the lack of a recovery in residential investment is a key reason the recovery has been sluggish and choppy so far. Note: Residential investment, according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

• In 2011, residential investment will make a positive contribution to the economy for the first time since 2005. The five years of drag on GDP from RI (2006 through 2010) is the longest period on record, breaking the previous record of four years from 1930 to 1933 (yeah, the Great Depression). The positive contribution this year will mostly be due to a pickup in multifamily construction (apartments) and in home improvement. However single family housing starts will continue to struggle.

• This positive contribution from residential investment suggests the economy will continue to grow all year and also in 2012 (point 1: RI is best leading indicator). There are plenty of downside risks, but I expect the expansion to continue.

• A record low number of housing units will be added to the housing stock this year. With more jobs, and more household formation in 2011, the number of excess housing units will be reduced substantially this year – perhaps by 600,000 to 700,000 units (or more).

Recently economist Tom Lawler took a long look at the 2010 Census data, and estimated there were about 2 to 3 million excess vacant housing units as of April 1, 2010. With the record low number of housing units delivered last year, Lawler estimated that as of April 1, 2011 the excess “would be somewhere in the range of 1.45 to 2.45 million units – with the latter almost certainly too high”. With another record low number of units added to the housing stock this year, the excess will be in the 750 thousand to 1.7 million range next April (with the latter “certainly too high"). This suggests the excess supply will be gone sometime between early 2014 and 2016.

As the excess supply is absorbed, new residential investment will increase in some areas – and will probably return to normal sometime in 2014 - or as late as 2017 - depending on the actual number of excess vacant housing units. I'm leaning more towards 2015 or 2016.

• “Normal” for housing starts will be the rate of household formation (probably averaging around 1.1 million per year in 2015), plus the net number of 2nd homes purchased, plus the number of demolitions. I think the 2nd home markets will be slow to recover, so "normal" will probably be around 1.3 million housing starts in 2015 or 2016 or 2017 (after the excess supply is absorbed) – up sharply from the current rate of around 550 thousand. For new home sales, normal will probably be in the 800 thousand to 850 thousand range – far above the recent 250 thousand to 300 thousand range, but also far below the 1.2 to 1.3 million range in 2004 and 2005.

• Unfortunately it is hard to pin down the timing better right now because the number of excess vacant housing units is uncertain. My guess is housing starts will return to "normal" in 2015 or 2016.

Housing: On pace for Record Low Completions in 2011

by Calculated Risk on 4/19/2011 02:05:00 PM

With just three months of data for 2011, it is already pretty clear that there will be a record low number of housing completions this year. Here is a look at the data so far ...

In general multi-family housing starts are trending up. Apartment owners are seeing falling vacancy rates, and some have started to plan for 2012 and will be breaking ground this year. However it takes about 13 months on average to complete a multi-family building, and the low level of starts in 2010 means a low level of completions this year.

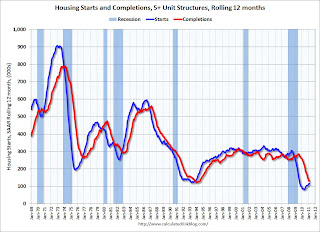

The following graph shows this lag between multi-family starts and completions through March:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

The blue line is for multifamily starts and the red line is for multifamily completions. Since multifamily starts collapsed in 2009, completions collapsed in 2010.

Notice that the blue line (Starts) is now trending up, and the red line (completions) is still falling. Based on starts in 2010, I expect mutlifamily completions to be around 100 thousand in 2011 - well below the 146.5 thousand in 2010, and below the previous record low of 127.1 thousand in 1993.

We can do a similar analysis for single family housing completions. Through March, about 90 thousand units have been completed (1 to 4 unit structures), and based on housing starts, another 200 thousand or so will be completed over the next 6 months (it takes about 6 months on average to complete single family structures). Even if starts increase over the next few months, it seems likely that 1 to 4 unit completions will be in the 400 thousand to 450 thousand range for the year - well below the previous record low of 505 thousand set in 2010.

This graph shows annual completions for 1 to 4 units, 5+ units and manufactured homes (and an estimate for 2011)

This graph shows annual completions for 1 to 4 units, 5+ units and manufactured homes (and an estimate for 2011)

In 2010, 1 to 4 unit completions were at a record low 505 thousand. This was just below the 535 thousand units completed in 2009 and was far below the previous record low of 712 thousand units in 1982. 1 to 4 units completions are currently on pace for another record low in 2011.

For 5+ units, completions were at 147 thousand units in 2010. This was just above the record low of 127 thousand in 1993 - and that record will be broken in 2011.

This doesn't include demolitions that were probably in the 200 thousand unit range (some estimate are as high as 300 thousand). This suggest the excess supply was reduced in 2010, and will probably be significantly reduced in 2011. Of course this also depends on household formation - and that means jobs.

Here is a table of housing units added to stock by year:

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 20111 | |

|---|---|---|---|---|---|---|---|

| 1 to 4 Units | 1,673.4 | 1,695.3 | 1,249.8 | 842.5 | 534.6 | 505.2 | 450.0 |

| 5+ Units | 258.0 | 284.2 | 253.0 | 277.2 | 259.8 | 146.5 | 100.0 |

| Manufactured Homes | 146.8 | 117.3 | 95.7 | 81.9 | 49.8 | 50 | 50 |

| Sub-Total | 2,078.2 | 2,096.8 | 1,598.5 | 1,201.6 | 844.2 | 701.7 | 600.0 |

| Demolitions | 200 | 200 | 200 | 200 | 150 | 150 | 150 |

| Total added to Stock | 1,878.2 | 1,896.8 | 1,398.5 | 1,001.6 | 694.2 | 551.7 | 450.0 |

1 Estimates for 2011.

2 Demolitions estimated (extra conservative for last few years).

This means a record low number of housing units will be added to the housing stock in 2011.

Special thanks to housing economist Tom Lawler who shared with me some of his thoughts on completions.

Housing: Feeling the Hate

by Calculated Risk on 4/19/2011 12:17:00 PM

I've seen previous housing busts in California, and although they were less severe than the current bust, there always seemed to be a stage when people hated housing. So I've been looking for the "hate", and maybe we found some ...

First, from Equity LifeStyle Properties, Inc. (ELS) conference call (an accidental landlord, ht Brian):

Analyst: Along the lines of the rental home program a couple more questions. How big do you expect that program to ultimately get?And from Bloomberg: Americans Shun Cheapest Homes in 40 Years as Ownership Fades

ELS: I think the answer to that question is really another question, how long do we think the current environment and distinct single-family home situation is going to last and what are the issues that are going to cause that thing to kind of loosen up and return to some maybe a different normal but at least some sense of normalcy. I have not been a fan of the rental program because it changes the dynamic of the business that we know and love where we owned the land and somebody owns a structure on it. I think our desire to get some other capital involved in a rental situation is indicative of that desire to focus on really being a landowner as opposed to being a homeowner, but that said, I would also have to say that it has been much better than what I would have anticipated in terms of the operational drag, the ability to rent the homes, the wear and tear on the homes, the value of the homes over time much better than what I would have anticipated . And I think in some respects there could be a place for a component of rental over the long term. It gets to a customer that is very focused on maintaining or preserving capital but may not have access to capital but otherwise it is a good customer in our communities.

Analyst: Back to the home rental program has the basic customer changed in the business, that is, I guess the conventional or the traditional buyer was someone who was selling their home in order to buy a retirement home and didn't need financing and so what is the dynamic? Is it someone that is just hanging onto their pre-retirement home and [wants] financing? I guess it is not clear to me why third-party financing is very critical to the business.

ELS: It is a use of capital issue. But with respect to the first part of your question , we run an application process that screens potential customers, and I would say the one thing that you will notice but I wouldn't call it a significant change but noticeable is that there are more customers with some type of history in their credit profile, meaning a foreclosure or short sale or something with respect to their previous housing arrangement. But as it relates to FICO and non-single-family home related credit issues, we are not seeing any change with respect to that. We are seeing a psychological change just in terms of people wanting to preserve their capital and not want to put much of it into a single-family home situation. They would rather have it in the bank or the stock market. I'm not sure where else but certainly not excited about putting large amounts of capital into a housing situation. That is what we are seeing at the level of the property

“I know people who have watched their home values get cut in half, and I know people who are losing their homes,” said [Victoria Pauli], 31, who works as a property manager for a real estate company. “It’s part of the American dream to want to own your own home, and I used to feel that way, but now I tell myself: Be careful what you wish for.”I disagree that housing is "cheap", but I'm starting to feel the hate.

...

At the end of 2010, the fourth year of the housing collapse, the share of people who said a home was a safe investment dropped to 64 percent from 70 percent in the first quarter. The December figure was the lowest in a survey that goes back to 2003, when it was 83 percent.

“The magnitude of the housing crash caused permanent changes in the way some people view home ownership,” said Michael Lea, a finance professor at San Diego State University. “Even as the economy improves, there are some who will never buy a home because their confidence in real estate is gone.”

State Unemployment Rates little changed in March

by Calculated Risk on 4/19/2011 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were generally little changed in March. Thirty four states recorded unemployment rate decreases, seven states registered rate increases, and nine states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue, the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 13.2 percent in March. The states with the next highest rates were California, 12.0 percent, Florida, 11.1 percent, and Rhode Island, 11.0 percent. North Dakota reported the lowest jobless rate, 3.6 percent, followed by Nebraska and South Dakota, 4.2 and 4.9 percent, respectively.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

The auto states - led by Michigan - seem to have seen the most improvement (blue area).

Two states are still at the recession maximum (no improvement): Idaho and Louisiana.

Housing Starts increase in March

by Calculated Risk on 4/19/2011 08:30:00 AM

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Total housing starts were at 549 thousand (SAAR) in March, up 7.2% from the revised February rate of 512 thousand (revised up from 479 thousand).

Single-family starts increased 7.7% to 422 thousand in March (February was revised up to 392 thousand from 375 thousand).

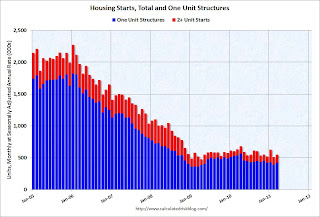

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over two years - with slight ups and downs due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was above expectations of 525 thousand starts, and there was probably some weather related bounce back in March.

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 549,000. This is 7.2 percent (±18.0%)* above the revised February estimate of 512,000, but is 13.4 percent (±9.1%) below the March 2010 rate of 634,000.

Single-family housing starts in March were at a rate of 422,000; this is 7.7 percent (±15.0%)* above the revised February figure of 392,000. The March rate for units in buildings with five units or more was 117,000.

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 594,000. This is 11.2 percent (±2.6%) above the revised February rate of 534,000, but is 13.3 percent (±1.3%) below the March 2010 estimate of 685,000.

Single-family authorizations in March were at a rate of 405,000; this is 5.7 percent (±1.1%) above the revised February figure of 383,000. Authorizations of units in buildings with five units or more were at a rate of 173,000 in March.

I expect starts to stay low until more of the excess inventory of existing homes is absorbed. I'll have more on starts later.

Monday, April 18, 2011

Jim the Realtor: Predict the Price of REO

by Calculated Risk on 4/18/2011 10:46:00 PM

Jim the Realtor is having a contest to predict the price of an REO in San Diego. This house is in the Rancho Santa Fe Covenant, 5,835 sq ft and listed for $785,400 ... you'll see why:

Here is Jim's post Covenant Giveaway (put prediction in his comments).

Extend and Pretend Greek Style

by Calculated Risk on 4/18/2011 05:59:00 PM

Landon Thomas at the NY Times discusses how a possible restructuring might work: Talk of Greek Debt Restructuring Just Won't Die

One option that has attracted some attention, though, is a plan that would ask bond holders to trade in their current paper for debt with lower rates and longer maturities.Last week, in a Bloomberg article, German Finance Minister Wolfgang Schaeuble was quoted concerning a report due in June on Greek debt sustainability:

Such a proposal, which was successfully deployed by Uruguay in 2003, would, in theory, minimize banking losses and extend debt payments further into the future, easing Greece’s financing burden in the near term.

“We will have to do something” if the review by the International Monetary Fund and European authorities in June raises doubts about Greece’s “debt sustainability,” Schaeuble was quoted as saying. “Then, further measures will have to be taken.”It seems unlikely that anything will happen until after the report is released in June.

The yield on Greece ten year bonds jumped to 14.5% today and the two year yield is now up to 20.3%. The curve is inverted because investors expect to wake up one morning and own longer maturity debt at lower rates. This possibility hits the price of the 2 year bond more than the 10 year.

Las Vegas adds jobs in March, first time in over 3 years

by Calculated Risk on 4/18/2011 02:54:00 PM

The BLS will release the Regional and State Employment and Unemployment report for March tomorrow ... here is a little good news from Nevada (highest state unemployment rate in the U.S.)

From Cy Ryan at the Las Vegas Sun: Las Vegas jobless rate dips to 13.3 percent in March

Employment in the Las Vegas area increased by more than 10,000 jobs in March -- the first increase in 38 months.It will not be all good news tomorrow. California lost jobs in March, although this follows a record increase in jobs added in February - and the California unemployment rate declined in March. From Alana Semuels at the LA Times: California employers cut a net 11,600 jobs in March

...

The state Department of Employment, Training and Rehabilitation reported today the Nevada jobless rate fell to 13.2 percent, down from 13.6 percent in February [peaked at 14.9% in 2010]. There were 1,114,400 Nevadans with jobs, an increase of more than 10,000 from a month earlier.

”Nevada's labor markets showed signs of life in March, hinting what may be the beginnings of an economic recovery,” says Bill Anderson, chief economist of the department.

The state lost a net 11,600 jobs in March after adding a record 84,600 in February, and the unemployment rate fell to 12% from 12.1%.

A Comment on the Deficit

by Calculated Risk on 4/18/2011 11:50:00 AM

As everyone knows, S&P issued a "negative outlook" on U.S. debt this morning. Although S&P has made plenty of recent rating mistakes, this is a reminder that there is work to do in the U.S.

Here is the approach an effective manager would take to analyzing the deficit.

The first step would be to divide up the deficit into several components and calculate the NPV (net present value) of each component. I'd divide the deficit into 1) cyclical portion, 2) General Fund ex-healthcare, 3) healthcare (Medicare and Medicaid), and 4) Social Security Insurance. This is nothing new - I've been pointing this out since I started the blog in 2005!

The cyclical deficit is due to the severe recession (and was predictable in 2005). As a result of the recession tax revenues declined, and there was more spending (both stimulus and automatic safety net expenditures). The good news is the cyclical deficit will decline as the economy slowly recovers. The bad news is recoveries following housing/credit bubbles and a financial crisis are usually sluggish and choppy. This is the portion of the deficit that gets the most attention, but from a long run perspective it is the least significant.

The General Fund ex-healthcare deficit is the most immediate problem. I've been writing about this for years. Back in 2006, Professor Samwick (who served as Chief Economist on the Staff of President Bush's Council of Economic Advisers) wrote: First Things First

CR writes:In five years, nothing has changed. This structural deficit is still the most pressing problem.

Everyone should agree that the most immediate fiscal problem is the structural General Fund deficit. Excluding future health care costs, the structural deficit is around 4% to 4.5% of GDP. This serious problem has been caused almost exclusively by Bush's policies. And imagine if the economy slows next year, as many people expect, adding a cyclical deficit on top of the huge Bush structural deficit.CR is correct in his diagnosis of the immediacy and the size of the problems of the General Fund deficit. As I have discussed in earlier posts ... the appropriate target for the General Fund deficit is for it to average to zero over a business cycle. A corollary to that is that the General Fund should be in surplus during the non-recessionary parts of that business cycle. (A slightly weaker target that I would also accept is that the Debt/GDP ratio not trend upward over time.)

So isn't it reasonable to suggest that Mr. Bush and the GOP fix the structural deficit first, before addressing other long-term issues? Of course.

Some politicians refuse to even address this issue, apparently because of a "no tax" pledge. This is silly and juvenile. Besides many of these politicians supported the policies that created the structural deficit, because they thought we were going to have surpluses forever. Since the forecasts for "surpluses forever" were inaccurate, reversing those policies should be a priority. There is no way to balance the General Fund ex-healthcare without gutting defense spending or reversing those earlier policies.

After this is resolved, the next step would be to address the long run healthcare issues. And the last step should be to address any Social Security shortfall.

As an experienced manager, I know that people will avoid the difficult choices and try to fix the wrong problems first. But an important role of management is to focus people on the more immediate and serious problem. And that is:

1) General Fund ex-healthcare, and

2) Healthcare.

So if we are serious about the deficit, we need to start by finally addressing the General Fund ex-healthcare structural deficit issue.

NAHB Builder Confidence index declines slightly in April

by Calculated Risk on 4/18/2011 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) declined slightly to 16 in April from 17 in March. This was below expectations for a reading of 17. Confidence remains very low ... any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the April release for the HMI and the February data for starts (March housing starts will be released tomorrow).

Both confidence and housing starts have been moving sideways at a very depressed level for several years.

Press release from the NAHB: Builder Confidence Slips Back a Notch in April

Builder confidence in the market for newly built, single-family homes slipped back one notch to 16 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for April, released today. The index has now held at 16 for five of the last six monthsBuilders are still depressed, and the HMI has been below 25 for forty-six consecutive months - almost 4 years.

...

“The spring home buying season is getting off to a slow start due to persistent concerns about home values as more foreclosures seem to be hitting the market, increasingly restrictive lending requirements for home buyers and builders, and the slow pace of economic recovery,” acknowledged NAHB Chief Economist David Crowe. “While pockets of improving activity are appearing in some markets, the best sales activity appears to be happening in the lower price ranges, where first-time buyers have greater flexibility than repeat buyers who must sell their current home"

...

Two out of three of the HMI’s component indexes posted declines in April. While the component gauging current sales conditions fell one point to 16, the component gauging sales expectations for the next six months declined three points to 23, its lowest mark since October of 2010. However, the index gauging traffic of prospective buyers rose a single point to 13 in April, marking its highest level since last June.