by Calculated Risk on 8/04/2010 08:15:00 AM

Wednesday, August 04, 2010

ADP: Private Employment increases 42,000 in July

ADP reports:

Nonfarm private employment increased 42,000 from June to July 2010 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from May to June was revised up slightly, from the previously reported increase of 13,000 to an increase of 19,000.Note: ADP is private nonfarm employment only (no government jobs).

July’s rise in private employment was the sixth consecutive monthly gain. However, over those six months increases have averaged a modest 37,000, with no evidence of acceleration.

Unlike the estimate of total establishment employment to be released on Friday by the Bureau of Labor Statistics (BLS), today’s figure does not include the effects of federal hiring — and now firing — for the 2010 Census.

The consensus was for ADP to show an increase of about 35,000 private sector jobs in July, so this was slightly above consensus.

The BLS reports on Friday, and the consensus is for a decrease of 70,000 payroll jobs in July, on a seasonally adjusted (SA) basis, with the loss of around 145,000 temporary Census 2010 jobs (+75,000 ex-Census).

MBA: Mortgage Purchase Applications increase slightly last week

by Calculated Risk on 8/04/2010 07:24:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 1.3 percent from the previous week. The seasonally adjusted Purchase Index increased 1.5 percent from one week earlier. This third straight weekly increase in the Purchase Index was driven by government purchase applications which increased 3.4 percent from last week, while conventional purchase applications were essentially flat.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.60 percent from 4.69 percent, with points increasing to 0.93 from 0.88 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has increased slightly for three straight weeks - but is still 40% below the level of the last week of April (and about 33% below the last week of April using the 4-week average).

This recent collapse in the purchase index has already shown up as a decline in new home sales (counted when the contract is signed), and will show up in the July and August existing home sales reports (counted at close of escrow).

Tuesday, August 03, 2010

D.R. Horton conference call comments: No more tax credits!

by Calculated Risk on 8/03/2010 08:15:00 PM

A few quotes from homebuilder D.R. Horton conference call today ... (ht Mike in Long Island, Zach, Pat)

"Frankly, I don't want the tax credits to be re-enacted or be re-created or extended," CEO Donald Tomnitz said. "We want to get back to a normalized market. It's a lot easier ... designing your business with the current demand as opposed to having any kind of stimuluses or incentives to create abnormal demand."CR Note: As I've noted before, the housing tax credit was a clear and unequivocal failure. Not only did most of the benefit go to people who were going to buy anyway, but the credit didn't reduce the overall supply. The credit just incentivized some people to move - and pulled some sales forward - and to the extent the credit went to new home sales, it was actually counterproductive by increasing the excess supply.

On the cancellation rate increase to 28%:

"I was surprised it only increased to 28%. But nevertheless we wanted to give every buyer the opportunity to buy and close on a home. And so if they had a pulse and they were warm, we wrote 'em," Tomnitz said. "And so as a result we did have some cancellations because people couldn't qualify."CR Note: A normal cancellation rate for Horton is in the 16% to 20% range.

On the outlook:

"The next 12 to 24 months will be challenging in the homebuilding industry."CR Note: Yes. Probably more home builders will go bankrupt during the "recovery" than during the bust.

Personal Bankruptcy Filings up 9% in July

by Calculated Risk on 8/03/2010 05:42:00 PM

From the American Bankruptcy Institute: July Consumer Bankruptcy Filings up 9 Percent from last Month, Year

The 137,698 consumer bankruptcies filed in July represented a 9 percent increase nationwide over the 126,434 filings recorded in July 2009, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). NBKRC’s data also showed that the July consumer filings represented a 9 percent increase from the 126,270 consumer filings recorded in June 2010. Chapter 13 filings constituted 28 percent of all consumer cases in July, a slight increase from June.

“Debt burdens, unemployment and an uncertain economic climate continue to weigh on consumers,” said ABI Executive Director Samuel J. Gerdano. “The pace of consumer filings this year remains on track to top 1.6 million filings.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Excluding 2005, when the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted (really a pro-lender act), the record year was in 2003 when 1.62 million personal bankruptcies were filed. This year will be close to that level.

U.S. Light Vehicle Sales 12.1 Million* SAAR in July

by Calculated Risk on 8/03/2010 04:00:00 PM

UPDATE at 5:25 PM ET, 8/3/2010: AutoData revised their estimate to 11.98 million SAAR.

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.06 million SAAR in July. That is up 7.5% from July 2009, and up 9.1% from the June sales rate.

IMPORTANT: AutoData notes: "*The July 2010 SAAR factors have been estimated by averaging the factors from July 2007, July 2008 and July 2009. We will restate the July 2010 SAAR after the Bureau of Economic Analysis publishes the appropriate factors." Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for July (red, light vehicle sales of 12.06 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Note: dashed line is current month sales rate.

Note: dashed line is current month sales rate.

Excluding the surge in sales during August 2009 (cash-for-clunkers), this is the highest sales rate since September 2008.

This was above most forecasts of around 11.6 to 11.8 million SAAR. Light truck sales were up significantly compared to July 2009.

Pending and Existing Home Sales

by Calculated Risk on 8/03/2010 02:23:00 PM

Here is a graph of the NAR's Pending Home Sales index (left axis) and existing home sales (left axis on a seasonally adjusted annual rate basis): Click on graph for large image.

Click on graph for large image.

Note: the scale doesn't start at zero to better show the change.

A few key points:

1) The Pending Home sales index leads existing home sales by about 45 days.

2) The peaks in the Pending Home sales index are related to the home buyer tax credit. For the 2nd tax credit, the peak for the pending index was much higher than the existing home sales spike. One reason is that short sales sometimes take longer to close - and since the tax credit closing date was extended, these sales will close later. But probably the more important reasons are: a) appraisals are coming in below the agreed upon price, because the asking prices for similar homes have fallen since the end of April, and b) some buyers put in offers on two homes to beat the tax credit deadline, and then decided which house to buy.

3) It is hard to tell from the Pending Home sales index how far existing home sales will fall in July and August. However, with the Pending home sales index below the lows of early 2009, a first guess might be 4.5 million or so. (Existing home sales in Jan 2009 were 4.49 million SAAR).

4) With July inventory of about 4 million units and sales of 4.5 million units (SAAR), the months-of-supply will be just under 11 months and that will put downward pressure on prices. (see Existing Homes: Double Digit Months-of-Supply Watch )

General Motors: Sales up sharply compared to July 2009

by Calculated Risk on 8/03/2010 11:00:00 AM

From General Motors: Chevrolet-Buick-GMC-Cadillac Sales Up 25 Percent in July.

General July sales for Chevrolet, Buick, GMC and Cadillac increased by a combined 25 percent to 199,432 units.There was one more selling day in July 2010, so this increase is overstated a little. Note: this is just these brands too.

Note: in July 2009 U.S. light vehicle sales rose to 11.2 million (SAAR) from 9.7 million (SAAR) in June 2009. This increase was related to "Cash-for-clunkers". General Motors didn't emerge from bankruptcy until July 10, 2009, so GM will probably have the best year-over-year comparison of the major automakers.

I'll add reports from the other major auto companies as updates to this post.

Update 1: From MarketWatch: Ford U.S. July sales up 3.1% to 170,411 vehicles

Update 2: From MarketWatch: Chrysler U.S. July sales rise 5% to 93,313 units

Update 3: From MarketWatch: Toyota U.S. July sales fall 3.2% to 169,224 units

NOTE: Once all the reports are released, I'll post a graph of the estimated total July sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for an increase to 11.6 to 11.8 million SAAR in July from the 11.1 million SAAR in June.

Pending Home fall to record series low in June

by Calculated Risk on 8/03/2010 10:02:00 AM

From the NAR: Pending Home Sales Ease in Post-Tax Credit Market

The Pending Home Sales Index, a forward-looking indicator, declined 2.6 percent to 75.7 based on contracts signed in June from an upwardly revised level of 77.7 in May [revised from 77.6], and is 18.6 percent below June 2009 when it was 93.0. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.This decline was expected and suggests existing home sales - reported at closing - will fall sharply in July and probably a little further in August.

NAR chief economist Lawrence Yun says: “Over the short term, inventory will look high relative to home sales."

Yes, the months-of-supply will be in double digits, and that will put downward pressure on prices.

Note: This is a record low for this series that started in 2001.

Personal Income, Spending flat in June

by Calculated Risk on 8/03/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, June 2010

Personal income increased $3.0 billion, or less than 0.1 percent ... Personal consumption expenditures (PCE) decreased $2.9 billion, or less than 0.1 percent.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in June, compared with an increase of 0.2 percent in May.

...

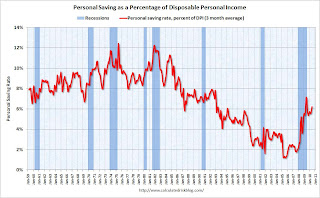

Personal saving as a percentage of disposable personal income was 6.4 percent in June

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the June Personal Income report. The saving rate increased to 6.4% in June (increased to 6.2% using a three month average).

I expect the saving rate to rise some more over the next year, perhaps to 8% or so - keeping the pace of PCE growth below income growth. But the good news is the saving rate is much higher than orginally estimated, so much of the expected drag from an increase in the saving rate has already happened.

Monday, August 02, 2010

WSJ: FOMC considering reinvesting when MBS Matures

by Calculated Risk on 8/02/2010 11:59:00 PM

From Jon Hilsenrath at the WSJ: Fed Mulls Symbolic Shift

Federal Reserve officials will consider a modest but symbolically important change in the management of their massive securities portfolio ...This seems unlikely to happen at the Aug 10th meeting based on Chairman Bernanke's speech this morning, and his testimony to Congress less than two weeks ago.

The issue: Whether to use cash the Fed receives when its mortgage-bond holdings mature to buy new mortgage or Treasury bonds, instead of allowing its portfolio to shrink gradually, as it is expected to do in the months ahead. ...

Buying new bonds with this stream of cash from maturing bonds—projected at about $200 billion by 2011—would show the public and markets that the Fed is seeking ways to support economic growth.