by Calculated Risk on 7/02/2010 09:53:00 AM

Friday, July 02, 2010

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

Here are a few more graphs based on the employment report ...

Percent Job Losses During Recessions, aligned at Bottom Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - but this time aligned at the bottom of the recession.

The current recession bounced along the bottom for a few months - so the choice of bottom is a little arbitrary (plus or minus a month or two).

The dotted line shows the impact of Census hiring. In June, there were 339,000 temporary 2010 Census workers on the payroll. The number of Census workers will continue to decline - and the gap between the solid and dashed red lines will be mostly closed in three or four months.

Employment-Population Ratio

The Employment-Population ratio decreased to 58.5% in June from 58.7% in May. This had been increasing after plunging since the start of the recession, and the recovery in the Employment-Population ratio was considered a good sign - but the ratio has now decreased for two consecutive months. This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate decreased to 64.7% from 65.0% in May. This is the percentage of the working age population in the labor force. This decline is very disappointing, and the rate is well below the 66% to 67% rate that was normal over the last 20 years.

The reason the unemployment rate declined was because people left the workforce - and that is not good news. As the employment picture improves, people will return to the labor force, and that will put upward pressure on the unemployment rate.

Part Time for Economic Reasons  From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (some times referred to as involuntary part-time workers), at 8.6 million, was little changed over the month but was down by 525,000 over the past 2 months. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) was at 8.63 million in June. This slight decline was a little bit of good news.

The all time record of 9.24 million was set in October.

These workers are included in the alternate measure of labor underutilization (U-6) that was at 16.5% in June.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are 6.751 million workers who have been unemployed for more than 26 weeks and still want a job. This is a record 4.39% of the civilian workforce. (note: records started in 1948). It does appear the increases are slowing ... perhaps because people are giving up.

Summary

The underlying details of the employment report were mixed. The positives: the economy added 100 thousand payroll jobs ex-Census (still weak but better than in May), the unemployment rate decreased to 9.5%, the number of part time workers (for economic reasons) decreased slightly helping to push down U-6 to 16.5% (from 16.6%).

Negatives include the declines in the participation rate and employment-population rate, the slight decrease in hourly wages, the decline in average hours worked, and a record percent of workers unemployed for more than 26 weeks. The number of long term unemployed is one of the key stories of this recession, especially since many of them are now losing their unemployment benefits.

Overall this was a weak report.

Earlier employment post today:

June Employment Report: 100K Jobs ex-Census, 9.5% Unemployment Rate

by Calculated Risk on 7/02/2010 08:30:00 AM

From the BLS:

Total nonfarm payroll employment declined by 125,000 in June, and the unemployment rate edged down to 9.5 percent, the U.S. Bureau of Labor Statistics reported today. The decline in payroll employment reflected a decrease (-225,000) in the number of temporary employees working on Census 2010. Private-sector payroll employment edged up by 83,000.Census 2010 hiring decreased 225,000 in June. Non-farm payroll employment increased 100,000 in June ex-Census.

Click on graph for larger image.

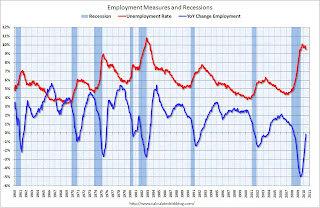

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 125 thousand in June. The economy has lost 170 thousand jobs over the last year, and 7.5 million jobs since the recession started in December 2007.

Ex-Census hiring, the economy added 100,000 jobs in June. The unemployment rate fell to 9.5 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).The dotted line is ex-Census hiring. The two lines will rejoin later this year when the Census hiring is unwound.

For the current employment recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

The decrease in the unemployment rate was because of a decline in the participation rate - and that is not good news. Although better than May, this is still a weak report. I'll have much more soon ...

Thursday, July 01, 2010

Employment Report: Which payroll number to use?

by Calculated Risk on 7/01/2010 09:56:00 PM

Reading some of the employment preview articles tonight, I can see there will be some confusion just like last month. In May there were three payroll numbers commonly reported:

This created some confusion because I reported the underlying trend as +20,000 ex-Census, and many other reports used the private sector hiring of +41,000.

All three numbers have meaning, but the number consistent with previous reports (after removing temporary Census workers) was +20,000.

Tomorrow some sites will report private sector payroll jobs only - and that is not the correct method to remove the temporary Census workers and is inconsistent with previous reports (unless they were reporting private sector jobs only). Government hiring counts, especially since state and local governments might be cutting back later this year.

I will use the headline number and adjust by the number of temporary Census hires (the number will be reported here).

Housing: Timing for reported increase in Months-of-Supply and Decrease in House Prices

by Calculated Risk on 7/01/2010 07:10:00 PM

Some housing statistics are released with a long lag. Here is an overview ...

Earlier today, the NAR reported that the NAR's Pending Home Sales Index (PHSI) declined to a record low 77.6 in May. Although there is some variability, the PHSI usually leads existing home sales by about 45 to 60 days, so this suggests existing home sales will decline sharply in July. Of course we already knew this since tax credit buyers had to close by June 30th before the closing extension.

Note: The closing date for the tax credit was extended until Sept 30th, but that will only boost sales in July a little. (See from Reuters: US Congress Backs Home Tax Credit Extension)

In January 2009, the Pending Home Sales Index fell to a then record low 80.4. Two months later, existing home sales in March 2009 were at a 4.61 million rate. We can use that to estimate sales and months of supply in July.

If we assume sales fall a little little lower level in July 2010 than in March 2009 (because of the new record low PHSI), to say a 4.5 million sales rate, and that inventory stays about the same as in May 2010, say 3.9 million units for sale, the months-of-supply in July will be:

3.9 million units of inventory divided by 4.5 million existing sales (SAAR) times 12 months = 10.4 months of supply.

Maybe sales will be a little higher, or inventory a little lower, but the months-of-supply should be close to double digits in July.

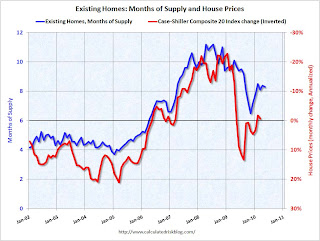

Earlier I posted this graph showing the relationship between months-of-supply and the change in house prices (change in house prices plotted inverted to show the relationship): Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows months of supply from NAR, and the annualized change in the Case-Shiller Composite 20 house price index (inverted).

Below 6 months of supply (blue line) house prices are typically rising (red line, inverted).

Above 6 months of supply house prices are usually falling (although there were many programs to support house prices over the last year).

Since the months-of-supply will probably be close to 10 months this summer, house prices will probably be falling again. I don't expect dramatic price declines later this year because prices are much closer to normal now, based on price-to-rent and price-to-income measures, than in 2007 and 2008. But I do expect falling house prices.

However it will take some time for this to show up in the house price indexes. The Case-Shiller index is a three month average and is released with a two month lag (the release this week was for a three month average ending in April).

The first Case-Shiller release with July prices will be released at the end of September - and that will include the months of May, June and July! And prices will be up in May and June.

The Corelogic data for July will also be released in September. There are other repeat sales measures (like from Radar Logic and Clear Capital), but in general it will be a long wait before reported house prices are falling.

U.S. Light Vehicle Sales 11.1 Million SAAR in June

by Calculated Risk on 7/01/2010 03:43:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.08 million SAAR in June. That is up 14% from June 2009 (when sales were very low), and down 4.6% from the May sales rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for June (red, light vehicle sales of 11.08 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Note: dashed line is current month sales rate.

Note: dashed line is current month sales rate.

Auto sales have recovered from the low levels of early 2009, but are below the lowest point of the '90/'91 recession (even with a larger number of registered drivers).

This was below most forecasts of around 11.4 million SAAR.