by Calculated Risk on 5/20/2010 11:58:00 PM

Thursday, May 20, 2010

Krugman: Lost Decade Looming?

From Paul Krugman in the NY Times: Lost Decade Looming?

... Recent data don’t suggest that America is heading for a Greece-style collapse of investor confidence. Instead, they suggest that we may be heading for a Japan-style lost decade, trapped in a prolonged era of high unemployment and slow growth.The two key numbers: the unemployment rate is at 9.9% and inflation, by all key measures, is low and declining (CPI, core CPI, PCE deflator trimmed mean CPI, etc). Of the two problems, unemployment is real and now - and inflation is a possible future threat. The focus needs to stay on the real and now.

... As of Thursday, the 10-year [Treasury] rate was below 3.3 percent. I wish I could say that falling interest rates reflect a surge of optimism about U.S. federal finances. What they actually reflect, however, is a surge of pessimism about the prospects for economic recovery, pessimism that has sent investors fleeing out of anything that looks risky ...

Low inflation, or worse yet deflation, tends to perpetuate an economic slump ... just ask the Japanese, who entered a deflationary trap in the 1990s and, despite occasional episodes of growth, still can’t get out. And it could happen here.

So what we should really be asking right now isn’t whether we’re about to turn into Greece. We should, instead, be asking what we’re doing to avoid turning Japanese.

...

Will the worst happen? Not necessarily. Maybe the economic measures already taken will end up doing the trick, jump-starting a self-sustaining recovery. Certainly, that’s what we’re all hoping.

Financial Reform: Final Senate Vote Soon

by Calculated Risk on 5/20/2010 07:52:00 PM

Update: Passed 59 to 39.

From Brady Dennis at the WaPo: Senate clears way to vote on financial reform

A final vote on the legislation could come later Thursday evening, congressional aides said. Party leaders were working to resolve a number of procedural hurdles, but it appeared that a series of votes could begin around 7:30 p.m.

"We're passing this bill tonight," said Jim Manley, spokesman to Majority Leader Harry M. Reid (D-Nev.). "We're finishing this tonight."

Market Update

by Calculated Risk on 5/20/2010 03:45:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The S&P 500 was first at this level in March 1998; over 12 years ago.

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

As an aside, once again the Shanghai composite index appeared to lead both the S&P 500 and oil prices. Not only are there issues in Europe, but China is slowing ...

Freddie Mac: Near Record Low Mortgage Rates

by Calculated Risk on 5/20/2010 02:45:00 PM

From Freddie Mac: Long- and Short-Term Mortgage Rates Fall Again This Week

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.84 percent with an average 0.7 point for the week ending May 20, 2010, down from last week when it averaged 4.93 percent. Last year at this time, the 30-year FRM averaged 4.82 percent. Once again, the 30-year FRM has not been lower since the week ending December 10, 2009, when it averaged 4.81 percent.The record low was 4.71% for the week of Dec 3, 2009 (series started in 1971).

The decline in mortgage rates is being driven by the decrease in the Treasury yield. The Ten Year treasury yield is currently at 3.26%.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 30 year mortgage rates from the Freddie Mac survey, and the ten year Treasury yields, since January 2008.

The spread between the two series has widened slightly since the program ended.

From Bloomberg:

The difference between yields on the Fannie Mae securities and 10-year Treasuries widened 0.03 percentage point to 0.81 percentage point, Bloomberg data show. The spread reached 0.59 percentage point on March 29, the lowest on record ... The gap climbed to 0.86 percentage point May 6, after holding near that low in April.As an aside, the euro has strengthened a little and is close to 1.26 dollars today - up from 1.23 yesterday.

FDIC Q1 Banking Profile: 775 Problem Banks

by Calculated Risk on 5/20/2010 11:51:00 AM

The FDIC released the Q1 Quarterly Banking Profile today. The FDIC listed 775 banks with $431 billion in assets as “problem” banks in Q1, up from 702 banks with $403 billion in assets in Q4, and 305 banks and $220 billion in assets in Q1 of 2009.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 725 problem banks - and will continue to increase as more formal actions (or hints of pending actions) are released. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

All data is year end except Q1 2010.

The 775 problem banks reported at the end of Q1 is the highest since June 30, 1993, when the number of "problem" institutions totaled 793.

The FDIC is still on pace for 1,000 problem banks by the end of the year, although it also depends on how many banks are removed from the list.  The second graph shows the assets of "problem" banks since 1990.

The second graph shows the assets of "problem" banks since 1990.

The assets of problem banks are the highest since June 30, 1993 when the assets of "problem" institutions were $467 billion.

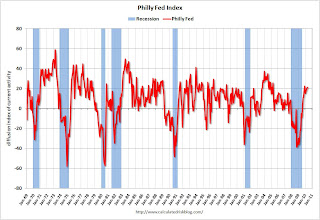

Philly Fed Index increases slightly in May, New orders index declines

by Calculated Risk on 5/20/2010 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased slightly from 20.2 in April to 21.4 this month. The index has now edged higher for four consecutive months and has remained positive for the ninth consecutive month (see Chart). Although still positive and suggesting growth, indexes for new orders and shipments showed a mixed pattern this month: The new orders index fell 8 points, while the shipments index increased 10 points. The current inventory index decreased 10 points and fell into negative territory, suggesting declines in inventories. Indexes for unfilled orders and delivery times were both negative this month, suggesting some weakening in activity from April.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

The index has been positive for nine months now, after being negative or zero for 21 straight months.

The internals suggest manufacturing conditions are softening a little, as also suggested earlier by the New York Empire State manufacturing index.

Weekly Initial Unemployment Claims Increase 25,000

by Calculated Risk on 5/20/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 15, the advance figure for seasonally adjusted initial claims was 471,000, an increase of 25,000 from the previous week's revised figure of 446,000. The 4-week moving average was 453,500, an increase of 3,000 from the previous week's unrevised average of 450,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 8 was 4,625,000, a decrease of 40,000 from the preceding week's revised level of 4,665,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 3,000 to 453,500.

The dashed line on the graph is the current 4-week average. The 4-week average first declined to this level at the end of December 2009, and has been at this level for almost five months. The current level of 471,000 (and 4-week average of 453,500) is still high, and suggests ongoing weakness in the labor market.

Wednesday, May 19, 2010

Summary: Busy Day

by Calculated Risk on 5/19/2010 09:44:00 PM

1) Press Release from the MBA: Delinquencies, Foreclosure Starts Fall in Latest MBA National Delinquency Survey

2) Comments from MBA conference call.

3) Two key graphs: Mortgage Delinquencies by Period and by State

The Euro is back up a little to 1.23 dollars.

And CNBC Pre-Market Data shows the S&P 500 futures off

Moody's: CRE Prices Decline 0.5% in March

by Calculated Risk on 5/19/2010 06:49:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 0.5% in March. This is a repeat sales measure of commercial real estate prices.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

Commercial real estate values are now down 25% over the last year, and down 42% from the peak in August 2007.

Mortgage Delinquencies by Period and by State

by Calculated Risk on 5/19/2010 04:01:00 PM

Much was made last quarter about the decline in the 30 day delinquency "bucket" (percent of loans between 30 and 60 days delinquent). Unfortunately the seasonally adjusted 30 day delinquency rate increased in Q1 2010.

Note: there are some questions about the seasonal adjustment, especially for the 90 day bucket since we've never seen numbers this high before, but the adjustment for the 30 and 60 day periods are probably reasonable. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loans 30 days delinquent increased to 3.45%, about the same level as in Q4 2008.

Delinquent loans in the 60 day bucket increased too, and are also close to the Q4 2008 level. This suggests that the pipeline is still filling up at a high rate, but slightly below the rates of early 2009.

The 90+ day and 'in foreclosure' rates are at record levels. Obviously the lenders have been slow to start foreclosure proceedings - and the 90+ day delinquent bucket is very full. Also lenders have been slow to actually foreclose - and the 'in foreclosure' bucket is at record levels.

These seriously delinquent loans are the 4.3 million loans MBA Chief Economist Jay Brinkmann referred to as the "shadow inventory" on the conference call this morning. Not all are really "shadow inventory" since some of these loans will be modified, some will be cured (probably very few), and some are probably already listed as short sales. But it does suggest a significant number of distressed sales coming.  The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days).

The second graph shows the delinquency rate by state (red is seriously delinquent: 90+ days or in foreclosure, blue is delinquent less than 90 days).

This highlights a couple more points that Brinkmann made this morning: 1) the largest category of delinquent loans are fixed rate prime loans, and 2) this is not just a "sand state" problem. Brinkmann argued the foreclosure crisis is now being driven by economic problems as opposed to the bursting of the housing price bubble - and this is showing up in prime loans and all states. Although Florida and Nevada are very high, notice that the blue bar (new delinquencies) are higher in many other states.

Thirty four states and the District of Columbia have total delinquency rates over 10%. This is a widespread problem.