by Calculated Risk on 3/29/2010 10:16:00 PM

Monday, March 29, 2010

Housing: Sales activity picking up

As expected, sales are picking up again (contracts must be signed before April 30th to qualify for the Federal tax credit):

From David Streitfeld at the NY Times: Spurt of Home Buying as End of Tax Credit Looms (ht Ann)

After several disastrous months for home sales across the country, when volume dropped by 23 percent, the pace appears to be picking up again. The number of Des Moines homes under contract in February rose by a third from the January level. The number of pending contracts jumped 10 percent in Naples, Fla., 14 percent in Houston and 21 percent in Portland, Ore.And unfortunately some people are calling for an extension:

These deals will be reflected in the national sales reports when they become final, this month or next. There is no evidence that prices have begun to move in response to the higher volume. Indeed, so many homes are coming on the market that prices might well fall further.

Robert Shiller, a professor of economics at Yale and co-developer of the Standard & Poor’s/Case-Shiller housing price index, is an early advocate. He thinks the credit was a bad idea that nevertheless the market cannot do without.Dr. Shiller is right that the credit was a bad idea, but he is forgetting that existing home sales add little to the economy - and encouraging new home sales with an excess supply is counterproductive.

“You don’t make drug addicts go cold turkey,” Mr. Shiller said. “The credit interferes with the market in an arbitrary way, but ending it now would be psychologically powerful. People will be in a bad mood about buying a house.” He advocates phasing it out gradually.

I am hearing from agents that sales activity is picking up in California too. But I don't expect the increase in sales to be as significant this May and June (when contracts close), as last October and November when the first tax credit was expiring.

We must remember not to mistake activity with accomplishment (to quote John Wooden). This little extra activity does nothing to reduce the overall supply.

Ireland to Report Bank Writedowns Tuesday

by Calculated Risk on 3/29/2010 07:52:00 PM

Two different perspectives, first from The Times: Ireland on the brink of full-scale bank nationalisation

The Republic of Ireland faced the prospect last night of having most of its banking system nationalised amid growing speculation that the Dublin Government would raise its stakes in both remaining private sector operators — Allied Irish Bank and Bank of Ireland.But Karl Whelan at The Irish Economy blog writes: Super Tuesday Leaks

[A] report [yesterday] that the Government’s stake in AIB would rise from 25 per cent to 70 per cent and its holding in BoI would be lifted from 16 per cent to 40 per cent.

...

With the Irish Nationwide and EBS building societies being merged and nationalised, and Anglo Irish Bank, the other large banking company, also nationalised, most of the industry would be in the State’s hands.

Ireland is the first significant Western country to be faced with the humiliation of wholesale bank nationalisation in this crisis, although the Republic took its three main banks into state ownership 18 months ago.

There is nothing new about the idea of the state potentially owning 70 percent of AIB. Even based on previous expectations for NAMA discounts, this was always a possibility. ... [I]t is hard to reconcile the continuing circulation of the same ownership statistics as before with the new information (if such it is) on discounts and also on capital levels.The world has come full circle. The main stream media screams "nationalization" and the blog keeps the numbers in perspective.

Note: NAMA is National Asset Management Agency, a "bad bank" set up by the government to take many of the distressed assets in Ireland. This was a very different approach than in the U.S.

Market and Greece Update

by Calculated Risk on 3/29/2010 04:00:00 PM

First, from the NY Times: In Crucial Test, Greece Raises $6.7 Billion in Bond Sale

The bonds, worth $6.7 billion, were priced to yield 6 percent, according to banks that managed the sale, meaning that Greece was paying a princely 3.34 percentage points above what Germany, considered the European benchmark, pays to borrow at a similar maturity. It was also well above the rates paid by governments in Portugal, Spain, Ireland and Italy, other countries whose indebtedness has caused concern.Since it is almost the end of Q1 ... here is a market update:

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today. The S&P 500 was first at this level in December 1998; over 11 years ago.

The S&P 500 is up 73.4% from the bottom in 2009 (497 points), and still off 25% from the peak (392 points below the max).

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Residential Investment Stalled

by Calculated Risk on 3/29/2010 01:37:00 PM

The BEA released an update to the underlying detail tables for Q4 today. The following graph uses the updated data for Residential Investment through Q4, and an estimate for Q1 based on housing data through February (a 10% annualized decline in residential investment).

Note: Residential Investment includes new single family structures, new multi-family structures, home improvement, brokers' commissions on sale of structures and a few minor categories. Click on graph for large image.

Click on graph for large image.

This graph shows total Residential Investment, and single-family structures, both as a percent of GDP.

Residential investment (RI) is one of the best leading indicators for the economy. Usually RI as percent of GDP is declining before a recession, and climbs sharply coming out of a recession.

Note: The 2001 recession was a business led recession. Some readers will notice the sharp decline in 1966 and wonder why the economy didn't slide into a recession - the answer is the rapid build-up for the Vietnam war kept the economy out of recession (not the best antidote).

But this time RI is moving sideways. This time is different.

The reason RI is moving sideways is because of the huge overhang of existing housing units (both single family and rental units). And this is one of the key reasons I think the current recovery will be sluggish and choppy - and that unemployment will stay elevated for some time.

Stated simply: One of the usual engines of recovery - residential investment - isn't contributing this time.

ATA Truck Tonnage Index declines in February

by Calculated Risk on 3/29/2010 10:56:00 AM

From the American Trucking Association: ATA Truck Tonnage Index Fell 0.5 Percent in February Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.5 percent in February, following a revised 1.9 percent increase in January [revised down from 3.1%]. The latest drop put the SA index at 108.5 (2000=100), down from 109.1 in January.Trucking is a coincident indicator for the economy, but the snow makes it difficult to tell about February.

...

Compared with February 2009, SA tonnage increased 2.6 percent, which was the third consecutive year-over-year gain. For the first two months of 2010, SA tonnage was up 3.5 percent compared with the same period last year. For all of 2009, the tonnage index contracted 8.7 percent, which was the largest annual decrease since 1982.

ATA Chief Economist Bob Costello said that the February tonnage reading is difficult to interpret because of the severe winter storms that impacted truck freight movements during the month, particularly on the East Coast.

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.2 billion tons of freight in 2008. Motor carriers collected $660.3 billion, or 83.1 percent of total revenue earned by all transport modes.

February Personal Income Flat, Spending Increases

by Calculated Risk on 3/29/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, January 2010

Personal income increased $1.2 billion, or less than 0.1 percent ... Personal consumption expenditures (PCE) increased $34.7 billion, or 0.3 percent.Stagnant income and increased spending means the saving rate declined again ...

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in February, compared with an increase of 0.2 percent in January.

...

Personal saving -- DPI less personal outlays -- was $340.0 billion in February, compared with $374.9 billion in January. Personal saving as a percentage of disposable personal income was 3.1 percent in February, compared with 3.4 percent in January.

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the February Personal Income report. The saving rate fell to 3.1% in February.

I still expect the saving rate to rise over the next couple of years - possibly to 8% or more - slowing the growth in PCE.

The following graph shows real Personal Consumption Expenditures (PCE) through February (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The increase in PCE in February was fairly strong (a 3.0% annual rate over the last three months). Using the Two Month average method, this suggests PCE growth in Q1 2010 will be around 3.0%. That will be the highest growth rate since Q1 2007, however this is being driven by less saving and transfer payments - not growth in income.

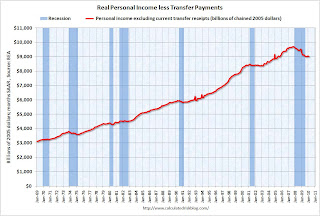

The National Bureau of Economic Research (NBER) uses several measures to determine if the economy is in recession. One of the measures is real personal income less transfer payments (see NBER memo). This declined in February to $9,006.4 billion (SAAR) from $9,020.2 billion in January, and is barely above the low of September 2009 ($9,000 billion).

This graph shows real personal income less transfer payments since 1969.

This graph shows real personal income less transfer payments since 1969.This measure of economic activity is moving sideways - similar to what happened following the 2001 recession.

To sum it up:

This is a decent report for PCE, but PCE growth is not sustainable without income growth.

Sunday, March 28, 2010

Edmunds.com: Vehicle Sales driven by Incentives in March

by Calculated Risk on 3/28/2010 08:24:00 PM

In the earlier Weekly Summary and a Look Ahead post, I forgot to mention that U.S. vehicle sales will be released on Thursday.

From Edmunds.com:

Edmunds.com analysts predict that March's Seasonally Adjusted Annualized Rate (SAAR) will be 12.4 million, up from 10.3 million in February 2010.

“Although this SAAR sounds promising, it’s too early to wave the flag and say that the economy has turned the corner,” Edmunds.com CEO Jeremy Anwyl told AutoObserver.com. “Incentives drove sales this month, but those were defensive moves in response to Toyota stepping up incentives and are unlikely to last because inventories are simply not high enough to justify them in the long term.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and a forecast for March from Edmunds.com.

Excluding the cash-for-clunkers month of August 2009, Edmunds is forecasting the highest sales rate since Sept 2008.

As Edmunds notes, the expected jump in March sales was driven by Toyota's incentive program to regain market share - and the response of the other manufacturers. As always I'll be posting the sales reports and an estimate of the SAAR around 4 PM ET on Thursday.

Weekly Summary and a Look Ahead

by Calculated Risk on 3/28/2010 12:30:00 PM

The employment report for March will be the focus this week, but there are several other key releases too.

On Monday, the Personal Income and Outlays report for February will be released by the BEA at 8:30 AM. The consensus is for a 0.1% increase in income and 0.3% increase in spending. This will provide a reasonable estimate of Q1 Personal Consumption Expenditure (PCE) growth.

On Tuesday, the January Case-Shiller house Price Index will be released at 9:00 AM. The consensus is for a small decline in prices (not seasonally adjusted). Consumer confidence will be released at 10 AM and former Fed Chairman Paul Volcker will be speaking on financial reform at noon.

On Wednesday, the ADP March employment report will be released (consensus is for 40,000 net private sector payroll jobs in March). This report excludes all government jobs and is not distorted by the temporary Census hiring. At 9:45 AM the Chicago PMI index for March will be released (consensus is for expansion, but at a slower rate than in February). At 10 AM, the Census Bureau will release the February Factory Orders report.

Also on Wednesday, Atlanta Fed President Dennis Lockhart will speak about employment.

On Thursday, the closely watched initial weekly unemployment claims will be released. Also the ISM Manufacturing Index for March at 10 AM (Consensus is for slightly less expansion in March), and Census Bureau will release February Construction Spending at 10 AM (consensus is for a decline of about 1.1%).

Also on Thursday, personal bankrutpcy filings for March will be released. Update: Also on Thursday, the auto manufacturers will releases March sales. The expectation is for a sharp rise to over 12 million units (SAAR) because of incentives.

And on Friday, the BLS will release the March employment report. The consensus is for 190,000 net payroll jobs, however this is distorted by both the February snow storms and temporary Census hiring (see Employment: March Madness). The consensus is for no change in the unemployment rate (9.7%), but historically the Census hiring has pushed down the unemployment rate in the March to May period – so we might see a slight decline. Goldman Sachs is estimate net payrolls increased 275,000 in March.

Also on Friday the FDIC will probably close several more banks. Once again I’ll be watching Puerto Rico!

And a summary of last week ...

A few stories:HAMP Principal Write-downs More on HAMP "Improvements" From David Streitfeld at the NY Times: A Bold U.S. Plan to Help Struggling Homeowners From Renae Merle at the WaPo: Second mortgages complicate efforts to help homeowners

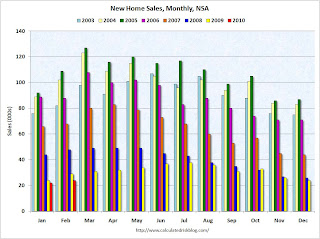

The Census Bureau reported New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 308 thousand. This is a new record low and a decrease from the revised rate of 315 thousand in January (revised from 309 thousand).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In February 2010, 24 thousand new homes were sold (NSA).

This is below the previous record low of 29 thousand hit three times; in February 2009, 1982 and 1970.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009. Sales of new single-family houses in February 2010 were at a seasonally adjusted annual rate of 308,000, according to estimates released jointly today ... This is 2.2 percent (±15.3%)* below the revised January rate of 315,000 and is 13.0 percent (±12.2%) below the February 2009 estimate of 354,000.Obviously this was another extremely weak report.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993. Sales in February 2010 (5.02 million SAAR) were 0.6% lower than last month, and were 7.0% higher than February 2009 (4.69 million SAAR).

Note: existing home sales are counted at closing, so even though contracts must be signed in April to qualify for the tax credit, buyers have until June 30th to close.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.59 million in February from 3.27 million in January. The all time record high was 4.57 million homes for sale in July 2008.

Inventory is not seasonally adjusted and there is a clear seasonal pattern - inventory should increase further in the spring.

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Historically, according to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through all of 2010, and probably longer.

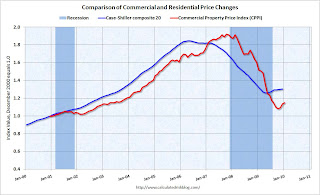

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

CRE prices peaked in late 2007 and are now 40% below the peak in October 2007. Prices are at about the same level as early 2003.

Last week the Department of Transportation (DOT) reported that vehicle miles driven in January were down from January 2009:

Travel on all roads and streets changed by -1.6% (-3.7 billion vehicle miles) for January 2010 as compared with January 2009. Travel for the month is estimated to be 222.8 billion vehicle miles.

This graph shows the percent change from the same month of the previous year as reported by the DOT.

This graph shows the percent change from the same month of the previous year as reported by the DOT. As the DOT noted, miles driven in January 2010 were down -1.6% compared to January 2009, and miles driven have declined 2.9% compared to January 2008, and are down 4.7% compared to January 2007. This is a multi-year decline, and miles driven appear to be falling again.

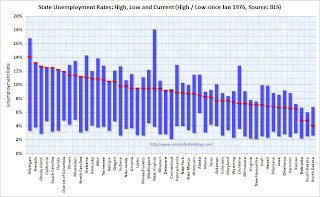

From the BLS: Regional and State Employment and Unemployment Summary

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).

This graph shows the high and low unemployment rates for each state (and D.C.) since 1976. The red bar is the current unemployment rate (sorted by the current unemployment rate).Fifteen states and D.C. now have double digit unemployment rates. New Jersey and Indiana are close.

Four states and set new series record highs: Florida, Nevada, Georgia and North Carolina. Three other states tied series record highs: California, Rhode Island and South Carolina.

Best wishes to all.

Aargh! Beware of reporting on the March Employment Report

by Calculated Risk on 3/28/2010 09:20:00 AM

I read this from Bloomberg this morning: Payrolls Probably Increased in March

Employers in the U.S. probably added jobs in March for the second time in more than two years, setting the stage for a broadening of the expansion, economists said before a report this week.Aargh.

Payrolls probably rose by 190,000, the most in three years, after declining 36,000 in February, according to the median forecast of 62 economists surveyed by Bloomberg News before the Labor Department’s April 2 report.

As I noted earlier this month in Employment: March Madness, a headline number of 200,000 net payroll jobs might be considered weak!

The March report will be distorted by two factors: 1) any bounce back from the snow storms in February, and 2) the decennial Census hiring that picked up sharply in March.

These are real payroll jobs, but the Census hiring is temporary - and the Census jobs that are added in March, April and May will all be lost over the following 6+ months.

What we are interested in is the underlying trend of payroll job growth. To find that number we need to adjust for the Census jobs (although they are reported NSA), and we also need to adjust for the February snow storms. Later this year we will need to add the Census jobs back to find the trend.

The important point is 190,000 is probably a weak number for March - and probably not "setting the stage for a broadening of the expansion" - although we need to see the details.

Saturday, March 27, 2010

Growth of Problem Banks (Unofficial)

by Calculated Risk on 3/27/2010 09:49:00 PM

By request here is a graph of the number of banks on the unofficial problem bank list over time.

We started posting the Unofficial Problem Bank list in early August 2009 (credit: surferdude808). The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest. Some of this data is released with a lag, for example the FDIC announced the February enforcement actions yesterday. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of banks on the unofficial list. The number has grown by almost 76% since early August 2009 - even with all the bank failures (failures are removed from the list).

The three red dots are the number of banks on the official problem bank list as announced in the FDIC quarterly banking profile for Q2, Q3, and Q4. The dots are lagged one month because of the delay in announcing formal actions.

The unofficial count is close, but is slightly lower than the official count - probably mostly due to timing issues.

Based on the current trend, there is a reasonable chance that the unofficial problem bank list will be over 1,000 banks later this year ...