by Calculated Risk on 3/24/2010 04:11:00 PM

Wednesday, March 24, 2010

New Home Sales, Modifications, and Other News

1) New Home sales. New Home sales were at a record low in February. The weather might be partially to blame for the February record, but the reality is there are just too many existing home units available - so new home sales and single family housing starts will be under pressure for some time - and also housing related employment.

New home sales will probably get a boost in March and April from the homebuyer tax credit. To qualify, homebuyers must sign a contract by the end of April and close by the end of June. Since new home sales are counted when the contract is signed, any boost will happen in March or April. For existing home sales, the boost will come when the deal closes, so the boost to sales will come in May or June.

2) Modification Programs

The reason this program is so important though is because we know something is in the works over at Treasury to do something like it. We may even get news of that later this week, according to some of my sources.

3) And in other news today:

4) And on the Consumer financial protection agency from Jodi Kantor at the NY Times: Behind Consumer Agency Idea, a Fiery Advocate

Ask Elizabeth Warren, scourge of Wall Street bankers, how they treat consumers, and her no-nonsense bob will shake with indignation. She will talk about morality, about fairness, about what she calls their “let them eat cake” attitude towards taxpayers. If she is riled enough, she might even spit out the Warren version of an expletive.

“Dang gummit, somebody has got to stand up on behalf of middle-class families!” she exclaimed in a recent interview in her office here.

BofA's Principal Reduction Plan

by Calculated Risk on 3/24/2010 01:15:00 PM

Here is the BofA plan mentioned last night ... this is for specific loans only (Countrywide subprime, Option ARMs and a few others), and BofA estimates this will apply to about 45,000 borrowers for a total of about $3 billion in principal reduction.

From BofA: Bank of America Introduces Earned Principal Forgiveness Among Enhancements to Its National Homeownership Retention Program

Bank of America announced it will look first at principal forgiveness – ahead of an interest rate reduction – when modifying certain subprime, Pay-Option and prime two-year hybrid mortgages qualifying for its National Homeownership Retention Program (NHRP). Several enhancements are being made to the program, including the introduction of an earned principal forgiveness approach to modifying mortgages that are severely underwater.

...

Bank of America developed and launched the NHRP in 2008, in cooperation with state attorneys general, to provide assistance to Countrywide borrowers who financed their home with certain subprime and Pay-Option adjustable rate mortgages (ARMs). Bank of America removed these from the Countrywide product line upon acquiring Countrywide in July 2008.

These new components of the agreement apply to certain NHRP-eligible loans that also meet the basic qualifications for the government's Home Affordable Modification Program. They include:

• A first look at principal reductions in calculating an affordable payment through an earned principal forgiveness approach to severely underwater loans."The centerpiece of these enhancements is a program of earned principal forgiveness that addresses severely underwater mortgages with some of the highest rates of delinquency – specifically subprime loans, Pay-Option ARMs and prime two-year hybrid ARMs that are 60 days or more delinquent with a principal balance of 120 percent or more," said Barbara Desoer, president of Bank of America Home Loans.

• Principal forgiveness through a reduction of negative-amortization on certain Pay-Option ARMs.

• Conversion of certain Pay-Option ARMs to fully amortizing loans prior to a recast.

• Addition of certain prime two-year hybrid ARMs as eligible for the NHRP mortgage modification programs.

• Inclusion of Countrywide mortgages originated on or before January 1, 2009, as eligible for modifications under the terms of the NHRP.

• A six-month extension of the term of the NHRP program to December 31, 2012.

Home Sales: Distressing Gap

by Calculated Risk on 3/24/2010 12:38:00 PM

The following graph shows existing home sales (left axis) and new home sales (right axis) through February. I jokingly refer to this as the "distressing gap". Click on graph for larger image in new window.

Click on graph for larger image in new window.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The spike in existing home sales last year was due primarily to the first time homebuyer tax credit.

Notice that there was also a bump last year in new home sales from the tax credit.

NOTE: New home sales and existing home sales are reported at different times: new home sales are reported when the contract is signed, and existing home sales are reported when the deal closes. So the bump in new home sales last year happened earlier than the spike in existing home sales.

The same thing will happen over the next few months. Any bump in new home sales from the tax credit will happen in March and April - when the contract is signed. Any bump in existing home sales will probably happen in May and June when escrow closes.

The second graph shows the same information as a ratio - new home sales divided by existing home sales - through February 2010. (In previous posts about this ratio, I graphed existing home sales divided by new home sales - this is the same ratio inverted). This ratio is near the all time low set last November. In November existing home sales were artificially boosted by the first time home buyer tax credit - but as mentioned above - the bump in new home sales had happened earlier.

This ratio is near the all time low set last November. In November existing home sales were artificially boosted by the first time home buyer tax credit - but as mentioned above - the bump in new home sales had happened earlier.

Eventually this ratio will return to the historical range of new home sales being around 15% to 20% of existing home sales. However it will probably take a number of years to return to a more normal market.

New Home Sales at Record Low in February

by Calculated Risk on 3/24/2010 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 308 thousand. This is a new record low and a decrease from the revised rate of 315 thousand in January (revised from 309 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

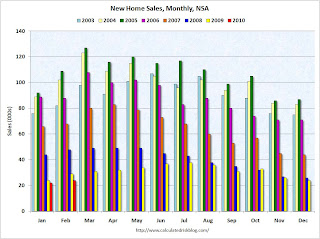

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In February 2010, 24 thousand new homes were sold (NSA).

This is below the previous record low of 29 thousand hit three times; in February 2009, 1982 and 1970. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

Sales of new single-family houses in February 2010 were at a seasonally adjusted annual rate of 308,000, according to estimates released jointly today ... This is 2.2 percent (±15.3%)* below the revised January rate of 315,000 and is 13.0 percent (±12.2%) below the February 2009 estimate of 354,000.And another long term graph - this one for New Home Months of Supply.

There were 9.2 months of supply in February. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.

There were 9.2 months of supply in February. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.The seasonally adjusted estimate of new houses for sale at the end of February was 236,000. This represents a supply of 9.2 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of excess housing inventory declines much further. Obviously this is another extremely weak report.

MBA: Mortgage Applications Decrease, Rates Rise

by Calculated Risk on 3/24/2010 08:52:00 AM

The MBA reports: Mortgage Refinance Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 4.2 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 7.1 percent from the previous week and the seasonally adjusted Purchase Index increased 2.7 percent from one week earlier. ...

The refinance share of mortgage activity decreased to 65.0 percent of total applications from 67.3 percent the previous week. This is the lowest refinance share observed in the survey since the week ending October 30, 2009. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.01 percent from 4.91 percent, with points decreasing to 0.76 from 1.30 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

There was a slight increase in purchase applications last week, but the 4-week average is still near the levels of 1997 - after falling sharply at the end of last year. This index shows no indication yet of the expected increase in home sales due to the expiration of the home buyer tax credit.

Report: BofA to Announce Mortgage Principal Reduction Plan

by Calculated Risk on 3/24/2010 05:35:00 AM

From Reuters: BofA to start reducing mortgage principal-sources

Bank of America will ... announce plans to start forgiving mortgage loan principal for troubled homeowners who owe more than 120 percent of their home's value or are battling ever-expanding "negative amortization" loans.Apparently under the plan, the mortgage debt will be reduced to 100% of the house's value over 5 years. The details should be released today by BofA.

According to a summary of the program obtained by Reuters, Bank of America pledged to offer an "earned principal forgiveness" of up to 30 percent in two stages. The lender will first offer an interest-free forbearance of principal that the homeowner can turn into forgiven principal annually over five years, provided they stay current on their payments.

Tuesday, March 23, 2010

AIA: Architecture Billings Index Shows Contraction in February

by Calculated Risk on 3/23/2010 11:59:00 PM

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment. Any reading below 50 indicates contraction.

The WSJ reports that the American Institute of Architects’ Architecture Billings Index increased to 44.8 in February from 42.5 in January.

The ABI press release is not online yet. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

The second graph compares the Architecture Billings Index with the year-over-year change in non-residential structure investment.  Historically, according to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through all of 2010, and probably longer.

Historically, according to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through all of 2010, and probably longer.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

California Extends Homebuyer Tax Credit

by Calculated Risk on 3/23/2010 08:03:00 PM

From the Mercury News: Gas tax deal comes with goodies for California home buyers and green-tech manufacturers

The deal reached Monday provides $200 million in new tax credits for homebuyers, to be split evenly among those buying a home for the first time and anyone buying a newly constructed home. Anyone qualified who makes a purchase between this May and August 2011 will receive a credit for 5 percent of the home's purchase price, up to $10,000 over three years.Dumb. Not that there is budget problem in California ...

Fed's Yellen: Outlook for the Economy and Inflation

by Calculated Risk on 3/23/2010 03:43:00 PM

From San Francisco Fed President Janet Yellen: The Outlook for the Economy and Inflation, and the Case for Federal Reserve Independence

Some excerpts on housing (Note: Yellen is likely to be nominated as the next Fed Vice Chairman):

It was housing of course that led the economy down. The great bust wiped out some $7 trillion in home values. In the second half of 2009 though, housing showed signs of stabilizing and I became hopeful that the sector would provide a significant boost to the economy this year. Now the market seems to have stalled. Home prices have been more or less stable since the middle of last year, but new home sales have resumed a downward slide and are at very low levels. Existing home sales spiked towards the end of last year in response to the homebuyer tax credit and have receded markedly since then. The credit expires this spring, removing an important prop. With sales still weak, builders have little incentive to ramp up home construction.As Yellen notes, one of the defining characteristics of this housing bust is how few mortgage delinquencies are cured. Of course when a borrower has equity in their home, they can cure the delinquency by selling. And this time many borrowers have negative equity and can't sell.

The continued high pace of foreclosures also creates risks to the recovery of the housing sector. Mortgage delinquencies and foreclosures are still rising as a consequence of the plunge in house prices over the past few years combined with high levels of unemployment. Despite the return to growth of the broader economy, we’ve seen no let-up in the pace at which borrowers are falling behind in their loans. Further additions to the already swollen stockpile of vacant homes represent a threat to house prices and new home construction activity.

It’s not always easy to understand the dynamics of the housing sector. Last year, for example, the share of mortgages that was 30 to 89 days past due declined. On the face of it, that looked like a hopeful sign. Unfortunately, when my staff examined the numbers more closely, it turned out that the drop actually represented a worsening of mortgage market conditions. What you want to see is delinquent borrowers becoming current. Instead, what happened was that delinquent mortgages moved in the other direction to an even poorer performance status. Many wound up in foreclosure. All in all, I expect that the share of loans that are seriously delinquent will continue to move higher. I am also concerned that we had a temporary reprieve in new foreclosures as the federal government’s trial modification program got under way. But not all of these modifications will stick, which means that some borrowers in the program could find themselves facing foreclosure again.

At the end of this month, the Fed will complete a large-scale program of purchases of mortgage-backed securities issued by Fannie Mae and Freddie Mac. Lenders sell mortgages to these two agencies, which package them as securities sold to investors. Last year, the Fed began buying these securities as part of a series of extraordinary measures to promote recovery. At the time the program was announced, mortgage spreads over yields on Treasury securities of comparable maturity were very high, reflecting in part the disruptions that had occurred in financial markets. I believe that our program worked to narrow those spreads, bringing mortgage rates down and contributing to the stabilization of the housing market. Financial markets have improved considerably over the last year, and I am hopeful that mortgages will remain highly affordable even after our purchases cease. Any significant run-up in mortgage rates would create risks for a housing recovery.

I think Yellen is a little too optimistic on the overall economy - she is forecasting 3 1/2% GDP growth this year. And on unemployment:

I was heartened when the unemployment rate dropped in January to 9.7 percent from 10 percent the month before. I was further encouraged when the rate remained at 9.7 percent in February, suggesting it was not just a flash in the pan. In the months ahead, we could get a bump in employment from census hiring. But that, of course, would be temporary. Given my moderate growth forecast, I fear that unemployment will stay high for years. The rate should edge down from its current level to about 9 1/4 percent by the end of this year and still be about 8 percent by the end of 2011, a very disappointing prospect.I think that is a little optimistic too - although the next few months will see a slight decline because of Census hiring (but that will be unwound later in the year).

HAMP applicants tanned and juiced

by Calculated Risk on 3/23/2010 01:23:00 PM

CR Note: The following is from long time reader Shnaps. Shnaps has been working in the mortgage industry in various capacities "since people were extending the antennas on their mobile phones". Shnaps currently serves in a key role related to HAMP at one of the largest non-prime mortgage servicers in the Nation.

Shnaps writes:

One aspect of the Making Home Affordable loan modification program known as ‘HAMP’ is almost always taken for granted in its wide reporting – that the borrowers in fact need ‘help’. Moreover, it is generally taken for granted that those seeking modification under HAMP simply cannot afford their monthly mortgage payment. It is assumed that they have made great sacrifices, assumed they have already cut back drastically on discretionary expenses, assumed that they have already gone over their monthly budgets with a fine-toothed comb to eliminate all but the most necessary expenditures in an effort to keep their home. So prepare to be shocked – shocked! – as I share with you that I have seen first-hand that this assumption is oftentimes greatly, seriously flawed.

Let me begin with a word to the wise for HAMP applicants: unless you believe Snooki is now in charge of approving HAMP applications, it might be a good idea to cut back a bit on some of the creature comforts to which you have become accustomed at least a month before submitting your HAMP modification application.

Allow me to explain. The guidelines for servicers participating in HAMP stipulate that the borrower must submit a “hardship affidavit”. This, ostensibly, is to serve as their sworn testimony that they have been driven into default due to some particular hardship they encountered, and despite making every possible sacrifice, they can no longer “maintain payment on the mortgage and cover basic living expenses at the same time". (see HAMP Directive)

To demonstrate this, applicants are required to submit recent paystubs and bank statements. The statements are to help further corroborate the income they report (lest they forget to include all of their paystubs) and also to demonstrate that their monthly expenses are as described on their application. Which is to say that they have already ‘cut back to the bone’ and STILL are unable to make ends meet.

So how do these look in practice? The very first ‘HAMPlication’ that your correspondent pulled up recently showed a wanton disregard for minimizing spending. On the contrary, it looked like “cutting back” for this applicant does not involve such Draconian cuts as eliminating:

• visits to the tanning salon

• the nail spa

• some kind of gourmet produce market (have you seen the price of arugula?)

• various liquor stores

• A DirecTV bill that must involve some serious premium programming or pay-per-view events (or both?).

• And over $1,700 in retail purchases, including: Best Buy, Baby Gap, Brookstone, Old Navy, Bed, Bath & Beyond, Home Depot, Macy’s, Pac Sun, Urban Behavior, Sears, Staples, and Footlocker.

And that was just in one month! They were seeking to reduce a $1,880 mortgage payment that had just gotten to be a real cramp to their ability to keep a roof over their heads.

I’d like to say this is the exception, but it’s much closer to the norm. Many people who request HAMP modifications submit bank statements that demonstrate little if any “belt-tightening” going on.

Somehow, we now expect the same people who asked for ‘liar’s loans’ to be truthful on when it comes to ‘hardship affidavits’?