by Calculated Risk on 3/09/2010 01:10:00 AM

Tuesday, March 09, 2010

Quote of the Night: Consumer Financial Protection Agency

On the debate as to where to put the Consumer Financial Protection agency, Andrew Ross Sorkin brings us this quote in the NY Times:

[Edward L. Yingling, president of the American Bankers Association] says, “We don’t care where you put it,” adding that their position has always been “we’re totally against it.”That sure makes it clear.

Sorkin discusses the debate in So Where’s Consumer Protection?, but this one is simple - if it is not independent, don't bother. Anything else is failure.

Monday, March 08, 2010

Stress Test Update

by Calculated Risk on 3/08/2010 11:03:00 PM

In the previous post I praised the Fed's short-term liquidity facilities. Another program that I supported was the Treasury's Stress Tests (conducted by the Fed). Here is what I wrote in early 2008:

One of the key elements of the Financial Stability Plan is to build "Financial Stability Trust" by conducting "A Comprehensive Stress Test for Major Banks" and providing investors and the public "Increased Balance Sheet Transparency and Disclosure".and

Although lacking in details, this is a very good idea.

The real answer is to stress test the banks, and put them in three categories: 1) no additional capital needed, 2) some additional capital needed, and 3) preprivatization.Although no banks were placed in the "preprivatize" category (I probably would have preprivatized a couple), these tests were an important step in providing metrics for the banks.

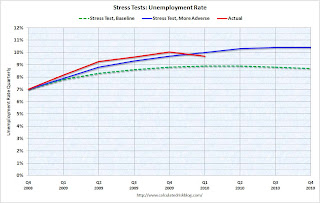

The following graphs compare the actual performance of the U.S. economy versus the two stress test scenarios - baseline and more severe - for GDP, house prices and unemployment.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows real GDP (in red) and the two stress test scenarios (baseline and more severe). For this graph I lined up real Q4 GDP.

So far GDP is performing slightly better than the baseline scenario.

It is important to remember that GDP was revised down substantially for 2008 after the stress test scenarios were released.

The second graph is quarterly for the unemployment rate.

The second graph is quarterly for the unemployment rate.For most of the last year the unemployment rate has been higher than the more severe scenario. Now, in Q1 with the unemployment rate at 9.7%, the rate is slightly better than the more severe scenario.

And the third graph is for house prices using the Case-Shiller Composite 10 Index.

The heavy government support for house prices has kept prices well above the baseline scenario. This has obviously been very beneficial for the banks.

The heavy government support for house prices has kept prices well above the baseline scenario. This has obviously been very beneficial for the banks.So far the economy is somewhat tracking the baseline scenario (slightly better for GDP, much better for house prices, and worse for unemployment). The key to the stress tests was to establish these metrics and have the banks raise adequate capital to survive the more severe scenario.

One of the problems with the stress tests was that the scenarios ended in 2010. And one of the policies has been to extend and hope (commonly called "extend and pretend") and this has pushed many problems out beyond the horizon of the stress tests.

Also I wouldn't judge the success of the stress tests by these graphs. Just establishing metrics was the key. The criteria for success be if any of the 19 banks get into trouble over the next couple of years and require additional support.

Some Praise for the Fed

by Calculated Risk on 3/08/2010 07:14:00 PM

I think the Fed deserves praise for the successful completion of the short-term liquidity facilities. As NY Fed Executive VP Brian Sack noted today:

With the wind-down of these short-term liquidity facilities, it is a good time to look back and assess their performance. The bottom line here is simple: These programs were an unquestionable success. We have witnessed a remarkable improvement in the functioning of short-term credit markets and an impressive recovery in the stability of large financial firms. While a whole range of government actions contributed to this recovery, giving financial institutions greater confidence about their access to funding, and that of their counterparties, was most likely a crucial step toward achieving stability.I've praised Chairman Bernanke several times (and thereby indirectly the entire Fed staff) about the liquidity facilities, while lambasting him on other aspects of his performance (like regulatory oversight). Every now and then I think we should pause and recognize a job well done.

Moreover, the exit from these facilities has been quite smooth. At their peak, these facilities provided more than $1.5 trillion of credit to the economy. Today, the remaining balance across them is around $20 billion. It is impressive that the Fed was able to remove itself from such a large amount of credit extension without creating any significant problems for financial markets or institutions. That success largely reflects the effective design of those programs, as most were structured to provide credit under terms that would be less and less appealing as markets renormalized. This design worked incredibly well, as activity in most of the facilities gradually declined to near zero, allowing the Fed to simply turn them off with no market disruption.

emphasis added

I agree with Sack's assessment. These short-term liquidity facilities were creative, well designed, and very effective. Nice work and thanks!

Make sure to read his entire speech. It is the best explanation of the exit strategy I've read.

NY Fed's Sack: Preparing for a Smooth (Eventual) Exit

by Calculated Risk on 3/08/2010 05:01:00 PM

From Brian Sack, Executive Vice President, Federal Reserve Bank of New York: Preparing for a Smooth (Eventual) Exit. Excerpts on MBS:

The Federal Reserve is approaching the scheduled end of its large-scale asset purchases. We have bought $169 billion of agency debt to date, nearly fulfilling our plan to purchase "about $175 billion." For MBS, we have only about $30 billion of purchases remaining to reach our $1.25 trillion target. In addition, we completed $300 billion of purchases of Treasury securities late last year. Looking across these programs, we have now purchased $1.69 trillion of assets, bringing us 98 percent of the way through our scheduled purchases.I recommend reading the entire speech, especially the section titled: Market Conditions: At Risk on Exit?

My view is that the purchase programs have helped to hold down longer-term interest rates, thereby supporting economic activity. With the conclusion of the programs approaching, the Desk has been tapering the pace of its purchases of agency debt and MBS. However, even as the pace of our purchases has slowed, longer-term interest rates have remained low, and MBS spreads over Treasury yields have remained tight. This pattern suggests that the effects of the purchases have been primarily associated with the stock of the Fed's holdings rather than with the flow of its purchases. In that case, the market effects of the purchase program will only slowly unwind as the balance sheet shrinks gradually over time.

...

Chairman Bernanke noted that the Fed's holdings of agency debt and MBS are being allowed to roll off the balance sheet, without reinvestment, as those securities mature or are prepaid, and that the FOMC may choose to redeem some of its holdings of Treasury securities in the future, as well.

With this approach, the FOMC would be shrinking its balance sheet in a gradual and passive manner. That, in my view, is a crucial message for the markets. It should limit any reversal of the portfolio balance effects described earlier, effectively putting reductions in asset holdings in the background for now as a policy instrument. As long as this approach is maintained, it would leave the adjustment of short-term interest rates as the more active policy instrument—the one that would carry the bulk of the work in tightening financial conditions when appropriate.

This approach is cautious in several dimensions. First, a decision to shrink the balance sheet more aggressively could be disruptive to market functioning. Second, a more aggressive approach would risk an immediate and substantial rise in longer-term yields that, at this time, would be counterproductive for achieving the FOMC's objectives. Third, the effects of swings in the balance sheet on the economy are difficult to calibrate and subject to considerable uncertainty, given our limited history with this policy tool. And fourth, policymakers do not need to use this tool to tighten financial conditions. They can tighten financial conditions as much as needed by raising short-term interest rates, offsetting any lingering portfolio balance effects arising from the still-elevated portfolio.

Even under this cautious strategy of relying only on redemptions, the Federal Reserve could achieve a considerable decline in the size of its balance sheet over time. From now to the end of 2011, we project that more than $200 billion of the agency debt and MBS held by the Federal Reserve will mature or be prepaid, though the actual total will depend on the path of long-term interest rates and the prepayment behavior of mortgage holders. Thus, the Fed's asset holdings would shrink meaningfully if the FOMC maintains its current strategy of not reinvesting those proceeds. In addition, about $140 billion of Treasury securities mature between now and the end of 2011, giving the FOMC scope to reduce its asset holdings even further if it chooses to not replace some of those maturing securities.

While the passive strategy of relying on redemptions may be appropriate for now, it might not be sufficient over the longer-term. One problem is that relying only on redemptions would still leave some MBS holdings on our balance sheet for several decades. As indicated in the minutes from the January meeting, the FOMC intends to return to a Treasuries-only portfolio over time. This consideration could motivate the FOMC to sell its agency debt and mortgage-backed securities at some point, once the economic recovery has progressed sufficiently.

emphasis added

Sack believes there will be little increase in the spread between mortgage rates and the Ten Year Treasury yield when the MBS purchase program ends. Right now the Fed plans on letting the MBS roll off the balance sheet, so in Sack's view the impact on rates should be gradual.

Employment: March Madness

by Calculated Risk on 3/08/2010 03:43:00 PM

If you thought Snowmageddon distorted the employment figures in February, just wait until March. (ht JH)

The BLS could report a March headline number of 200,000 net payroll jobs, and that could be viewed as a weak report.

The March report will be distorted by two factors: 1) any bounce back from the snow storms, and 2) the decennial Census hiring that picked up sharply in March.

Many analysts considered the February BLS report - showing a headline net loss of 36,000 jobs - as an improvement over January because of snow factors. The general view is the snowstorms subtracted 50,000 to 150,000 payroll jobs from the report. I think this is a huge unknown, but I think the actual impact was fairly low.

Also in February, the Census added 15,000 workers. Although this number is NSA (Not Seasonally Adjusted), there really is no seasonal factor for this hiring. If we estimate job losses at 50,000 ex-Census in February, this would imply a range of 0 to 100,000 jobs would have been added without snow factors - if the analysts are correct about the impact of the snow storm.

Also the Census will add something like 100,000 workers to the March report. Luckily the Census Bureau reports the Census hiring - May will be the really crazy month with 100s of thousands of workers added to follow-up on anyone who didn't mail back the Census (Mail it back!).

Add the numbers up: If the economy added no jobs in February (after snow effects) and no jobs in March, the March employment number would be 150,000 (50,000 bounce back from the snow, 0 for March, and 100,000 Census hiring).

If the economy added 50,000 jobs in February (after snow) - the consensus view - and adds another 50,000 in March, the March number will be around 250,000. And remember it takes 100,000 to 150,000 net jobs added per month to stay up with population growth. So a headline number of 250,000 - though an improvement - would still be a weak report because it just means 50,000 in March after distortions.

And if the economy added 100,000 jobs in February (very unlikely in my view), and another 100,000 in March - the bounce back would be 150,000 + 100,000 for March + 100,000 for the Census - and we would see a report of 350,000 jobs!

The Census distortions will last most of the year. The Census will add jobs through May, and then subtract jobs for the following 6+ months. Right now it is making the payroll report look better and will lower the unemployment rate slightly over the next few months (just 0.1% to 0.2%), and starting in June, Census hiring will make the payroll report look worse - but the net will be close to zero by the end of the year.