by Calculated Risk on 3/07/2010 04:32:00 PM

Sunday, March 07, 2010

Housing: A Tale of Boom and Bust and a Puzzle

Leslie Berkman at the Press Enterprise writes about how the housing bubble and bust impacted a small city in Socal: Turnkey Tales: Moreno Valley is prime example of housing boon and a bust. An excerpt:

Last year the inventory of bank-owned homes for sale began to dwindle in Moreno Valley and throughout Inland Southern California as banks began to delay the foreclosure process.That is happening in many areas - I've heard a number of stories of homeowners staying in their homes and not paying their mortgage, and the banks not foreclosing - and, at the same time, there is intense competition for any home that comes on the market.

For some, it's a puzzle, though.

Bianca Ward, an assistant to [Mike Novak-Smith, an agent with Re/Max], said her parents had no way of keeping an investment home they owned in Moreno Valley after renters left a year ago and her mother's wages at a casino were cut in half because of the poor economy. Ward said she stayed in the house for seven months without paying rent or the mortgage before moving into a home she bought for herself in Hemet.

"I was waiting any second for the bank to knock on the door ... But that didn't happen," Ward said.

She said the bank repeatedly has delayed foreclosing on the house although her parents would like to get it over with so they can start rebuilding their credit. Meanwhile, she said, "no one is watering the lawn. It is probably an eyesore for the former neighbors."

Whatever the reason for the lower volume of available bank-owned homes for sale, the competition for them now is intense, with banks routinely receiving multiple offers, many of them above list price. "The average house gets seven or eight bids and the average bid is 10 percent above the asking price," said Novak-Smith.

This is a real mystery right now. With 14 percent of mortgages delinquent or in foreclosure according to the MBA - why aren't the lenders foreclosing? Is this because of modifications? Are lenders waiting for the HAFA short sale program? And why do Fannie, Freddie and the FHA have a record number of REOs waiting to sell if the market is so "intense"?

There is much more in the article.

UPDATE: To be clear, I have my own views why the lenders are not foreclosing. Part of it is policy - it is government policy to restrict supply and boost demand to support asset prices and limit the losses for the banks. Part of it is inadequate staffing. Another reason is the lenders are making an effort to find alternatives to foreclosure (modifications, short sales, deed-in-lieu). Of course a majority of modifications will eventually redefault, but that still restricts supply for now. It isn't one reason - and the real puzzle is when (and how many) distressed sales will hit the market.

Weekly Summary and a Look Ahead

by Calculated Risk on 3/07/2010 12:15:00 PM

The focus this week will be on the February Retail Sales report to be released by the Census Bureau on Friday. The consensus is for a decline of -0.2% from January and for a slight increase ex-auto. Blame it on the snow ...

On Monday, FDIC Chairman Sheila Bair, Jürgen Stark, Member of the Executive Board, European Central Bank, and Brian Sack, Executive Vice President, Federal Reserve Bank of New York - and others - will be speaking at the NABE Economic Policy Conference that is being held in Arlington, Va. The topic is: The New Normal? Policy Choices After the Great Recession

Stark's talk is titled: "Is the Global Economy Headed for a Lost Decade? A European Perspective". Might be interesting.

Sack will discuss "Implementing the Fed's Balance Sheet Policies" and he will probably comment on the MBS purchase program.

There will be much more from the NABE conference on Tuesday like "The State of the States" discussion. Also on Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for January will be released. This report has been showing very little hiring and turnover in the labor market.

On Wednesday, the MBA Mortgage Applications Index, the Regional and State Employment and Unemployment report, and the Wholesale Inventory report will be released.

On Thursday, the closely watched initial weekly unemployment claims, and the January U.S. Trade Balance (consensus is for a slightly larger trade deficit of around $41 billion). Also the Q4 Fed Flow of Funds report will be released (Always interesting!)

And on Friday, the Retail Sales report, Consumer Sentiment (some improvement expected), Business Inventories and another round of bank failures. Once again I'm thinking Puerto Rico will make an appearance.

And a summary of last week ...

Click on graph for larger image.

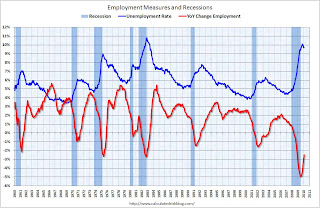

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 36,000 in February. The economy has lost almost 3.3 million jobs over the last year, and 8.43 million jobs since the beginning of the current employment recession.

The unemployment rate is at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: the impact of the weather on the survey is unknown. Census hiring was 15,000 (NSA).

Employment-Population Ratio

The Employment-Population ratio ticked up slightly to 58.5% in February, after plunging since the start of the recession. This is about the same level as in 1983.

The Employment-Population ratio ticked up slightly to 58.5% in February, after plunging since the start of the recession. This is about the same level as in 1983.This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

Part Time for Economic Reasons

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 8.8 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 8.8 million. The all time record of 9.2 million was set in October. The increase this month might have been weather related.

For much more on the employment report see:

1) Employment Report: 36K Jobs Lost, 9.7% Unemployment Rate for graphs of unemployment rate and a comparison to previous recessions.

2) Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

3) Diffusion Index and Temporary Help

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 10.4 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for February (red, light vehicle sales of 10.4 million SAAR from AutoData Corp).This is a 3.5% decline from the January sales rate.

This is the lowest level since September - when sales fell sharply after the "Cash-for-clunkers" program ended in August. The current level of sales are very low, and are still below the lowest point for the '90/'91 recession (even with a larger population).

From Zach Fox at SNL Financial: Credit Suisse: $1 trillion worth of ARMs still face resets

Source: SNL Financial, posted with permission.

Source: SNL Financial, posted with permission.This graph shows the numbers of ARMs resetting and recasting over the next few year. Resets are not a huge worry right now - because interest rates are so low - but if interest rates rise, this could lead to more defaults in the future.

Recasts - when the loans reamortize - are a concern, although it is unclear how large the payment shock will be. For borrowers with negative equity, any payment shock might be lead to default.

This graph (ht Tom Lawler) shows the REO inventory for Fannie, Freddie and FHA through Q4 2009. REO: Real Estate Owned.

This graph (ht Tom Lawler) shows the REO inventory for Fannie, Freddie and FHA through Q4 2009. REO: Real Estate Owned.Even with all the delays in foreclosure, the REO inventory has increased sharply over the last two quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, and 172,357 at the end of Q4 2009.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Residential construction spending increased slighltly in January, and nonresidential spending declined.

Private residential construction spending is now 61.4% below the peak of early 2006.

Private non-residential construction spending is 25.8% below the peak of late 2008.

Best wishes to all.

Graphs: Duration of Unemployment

by Calculated Risk on 3/07/2010 08:48:00 AM

Here are two graphs that show the weeks unemployed over the last 40 years. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the number of unemployed in four categories as provided by the BLS: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Note: The BLS reports 15+ weeks, so the 15 to 26 weeks number was calculated.

The second graph shows the same information as a percent of the civilian labor force. It appears there was more turnover in the '70s and '80s, since the 'less than 5 weeks' category was much higher as a percent of the civilian labor force than in recent years. This changed in the early '90s - perhaps as a result of more careful hiring practices or changes in demographics or maybe other reasons - but if the level of normal turnover was the same as in the '80s, the current unemployment rate would probably be the highest since WWII.

It appears there was more turnover in the '70s and '80s, since the 'less than 5 weeks' category was much higher as a percent of the civilian labor force than in recent years. This changed in the early '90s - perhaps as a result of more careful hiring practices or changes in demographics or maybe other reasons - but if the level of normal turnover was the same as in the '80s, the current unemployment rate would probably be the highest since WWII.

What really makes the current period stand out is the number of people (and percent) that have been unemployed for 27 weeks or more. In the early '80s, the 27 weeks or more unemployed peaked at 2.9 million or 2.6% of the civilian labor force.

In January, there were 6.3 million people unemployed for 27 weeks or more, or 4.1% of the labor force. The number declined slightly in February, but this is much higher than earlier periods.

Saturday, March 06, 2010

Shiller: Homeownership and American Culture

by Calculated Risk on 3/06/2010 09:07:00 PM

From Robert Shiller in the NY Times: Mom, Apple Pie and Mortgages. Shiller asks:

[W]hat is the long-term justification for putting taxpayers on the line to subsidize homeownership? Is this nothing more than a sacred cow in American society — a political necessity because so many voters own homes and are mindful of their resale value?Shiller argues that home ownership is part of the American culture, and that the reason for subsidizing housing is the "preservation of a sense of national identity".

[T]he best answer isn’t found in traditional economics but rather in American culture: a long-standing feeling that owning homes in healthy communities is connected to individual liberties that embody our national identity.Shiller adds on renting:

[We] should rethink the idea of renting, which could be a viable option for many more Americans and needn’t endanger the traditional values of individual liberty and good citizenship.This is an interesting debate. There are probably advantages to society of a fairly high homeownership rate (as opposed to tax advantages to the individual) - perhaps homeownership creates a stronger bond to the community (more community involvement, awareness of crime, and more), and homeowners tend to keep up their properties (unless they have negative equity!). Shiller argues for other psychological benefits that are harder to quantify.

There are negatives too; as an example, homeownership reduces geographic mobility, especially right now, and that makes it harder for some homeowners to move for employment reasons.

And of course withdrawing all of the subsidies for housing would lead to plummeting house prices. So any unwinding of the housing subsidies, like government subsidized mortgage rates, would probably have to be reduced gradually. This is an interesting discussion as we decide what to do with Fannie and Freddie.

Volcker on Derivatives "Abuse"

by Calculated Risk on 3/06/2010 06:38:00 PM

From Bloomberg: Volcker Criticizes Greek Budget Derivatives ‘Abuse’ (ht jb)

“Surely the recent revelations about the use (and abuse) of complex derivatives in obscuring the extent of Greek financial obligations reinforces the need for greater transparency and less complexity,” Volcker said in the text of a speech to the American Academy in Berlin.Ouch.

And at the same event, Bloomberg quotes European Central Bank President Jean-Claude Trichet as saying:

“what I fear really is that we are currently underestimating the systemic instability which is associated with” derivatives.Hopefully a video of Volcker's speech will be available soon.