by Calculated Risk on 3/05/2010 08:30:00 AM

Friday, March 05, 2010

Employment Report: 36K Jobs Lost, 9.7% Unemployment Rate

From the BLS:

Nonfarm payroll employment was little changed (-36,000) in February, and the unemployment rate held at 9.7 percent, the U.S. Bureau of Labor Statistics reported today. Employment fell in construction and information, while temporary help services added jobs. Severe winter weather in parts of the country may have affected payroll employment and hours; however, it is not possible to quantify precisely the net impact of the winter storms on these measures.

...

Major winter storms affected parts of the country during the February reference periods for the establishment and household surveys.

In the establishment survey, the reference period was the pay period including February 12th. In order for severe weather conditions to reduce the estimate of payroll employment, employees have to be off work for an entire pay period and not be paid for the time missed. About half of all workers in the payroll survey have a 2-week, semi-monthly, or monthly pay period. Workers who received pay for any part of the reference pay period, even one hour, are counted in the February payroll employment figures. While some persons may have been off payrolls during the survey reference period, some industries, such as those dealing with cleanup and repair activities, may have added workers.

In the household survey, the reference period was the calendar week of February 7-13. People who miss work for weather-related events are counted as employed whether or not they are paid for the time off.

Click on graph for larger image.

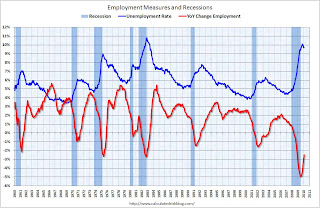

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 36,000 in February. The economy has lost almost 3.3 million jobs over the last year, and 8.43 million jobs since the beginning of the current employment recession.

The unemployment rate is at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: the impact of the weather on the survey is unknown, but was probably minimal. Census hiring was 15,000 (NSA).

I'll have much more soon ...

Thursday, March 04, 2010

Bank Failure Friday Preview

by Calculated Risk on 3/04/2010 11:08:00 PM

While everyone is thinking snow and (un)employment ... this is just a reminder that the weather is nice in Puerto Rico. It is very possible that the FDIC will close a bank there tomorrow, see: Reports on Possible Imminent Bank Failures.

Also Dow Jones had some interesting speculation today (no link) about the differences between the assets of the number of banks with formal actions or capital deficiencies, and the assets of the banks on the FDIC's problem bank list.

[W]hat's known about the list, combined with data about banks known to have capital deficiencies, suggests one or more regional banks, those with maybe $20 billion or more in assets, are deemed to be in danger.So it is possible that a fairly large regional bank has been added to the list.

I think it's quite possible that someone in that size range is on the list," said Bert Ely, an independent banking consultant.

Dow Jones Newswires found 653 banks with some outward indication of a capital deficiency--that is, banks below regulators' "well-capitalized" thresholds on one or more key capital ratios or subject to a formal order from regulators requiring them to improve or monitor their capital. The numbers were compiled using data from SNL Financial, a financial-information company. [CR Note: Our Unofficial list has 644 banks].

Most of these banks are likely on the FDIC's problem list. The total is close to the 702 tallied by the FDIC. But the 653 banks have total assets of $313.2 billion--far below the $402.8 billion of the FDIC list.

The Very Expensive Home Buyer Tax Credit

by Calculated Risk on 3/04/2010 06:58:00 PM

First a quote from a Bloomberg story: U.S. Economy: Pending Sales of Existing Homes Decline

“When you take away all the support from the housing market, the underlying demand for housing is a lot weaker than we thought,” said Mark Vitner, a senior economist at Wells Fargo Securities LLC in Charlotte, North Carolina. “We clearly pushed some demand forward, and there wasn’t that much demand to pull forward anyway. The housing recovery is going to be very, very slow.”This is no surprise and suggests that the extension and expansion of the home buyer tax credit will probably cost taxpayers over $100,000 for each additional home sold.

Just about every economist opposed the tax credit as expensive and ineffective. Here are some quotes from a post last September from an article by Patrick Coolican in the Las Vegas Sun: Economists say extending tax credit for first-time homebuyers is bad policy

It’s terrible policy,” says Mark Calabria of the libertarian Cato Institute.The only good news is the tax credit supporters have promised "practically in blood" that they will not ask for another extension.

“It’s awful policy,” says Andrew Jakabovics, associate director for housing and economics at the liberal Center for American Progress. “It’s incredibly expensive. It’s not well targeted.”

...

“We paid $8,000 to at least 1.5 million people to do something they were going to do anyway,” Jakabovics says.

...

“A heck of a lot of people would have bought the house anyway,” says Ted Gayer, an economist at the Brookings Institution.

...

The tax break, due to expire at the end of November, is on track to cost $15 billion, twice what Congress had planned. In other words, it will cost $43,000 for every new homebuyer who would not have bought a house without the tax break.

Gayer also questions whether moving people from renting to owning is really all that useful ...

The tax credit is one, albeit very expensive, way to create more households, but rental vouchers to get people out of their parents’ basements should also be considered, economists say.

Fed Balance Sheet and MBS Purchases

by Calculated Risk on 3/04/2010 04:36:00 PM

Here is the Federal Reserve balance sheet break down from the Atlanta Fed weekly Financial Highlights released today (as of last week): Click on graph for larger image in new window.

Click on graph for larger image in new window.

Graph Source: Altanta Fed.

From the Atlanta Fed:

The balance sheet expanded $9.7 billion, to $2.3 trillion, for the week ended February 24.Holdings of agency debt and mortgage backed securities, which rose by $8 billion, accounted for the majority of the expansion of the balance sheet and continue to replace lending to nonbank credit markets and short-term lending to financials. The balance sheet is expected to peak during the first half of this year after the MBS purchase program is completed and purchases settle on the balance sheet.

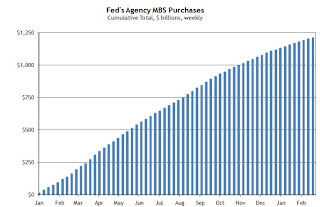

The second graph shows the cumulative MBS purchases by week. From the Atlanta Fed:

The second graph shows the cumulative MBS purchases by week. From the Atlanta Fed: The NY Fed purchased an additional net $10 billion in MBS for the week ending ending March 3rd. This puts the total purchases at $1.220 trillion or almost 98% complete. Just $30 billion more to go ...The Fed purchased a net total of $11 billion of agency-backed MBS through the week of February 24, bringing its total purchases up to $1.210 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 97% complete).

The Fed's balance sheet released today shows "only" $1.027 trillion in MBS. The difference is that the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles. Most of the agency MBS market is "To-Be-Announced" trading, and many of the contracts will not settle for a couple of months.

To understand ""To-Be-Announced", here is a discussion from SIFMA (ht Windward.Broach):

"To-Be-Announced" Trading of Agency Passthrough Securities

Much of the volume in the agency MBS market today is in the form of “To-Be-Announced” (TBA) trading. A TBA is a contract for the purchase or sale of agency mortgage-backed securities to be delivered at a future agreed-upon date; however, the actual pool identities or the number of pools that will be delivered to fulfill the trade obligation or terms of the contract are unknown at the time of the trade.

...

For example, in a typical trade, a buyer may ask to purchase $100 million of 30 year Fannie Mae MBS with a 6% coupon for delivery next month. The buyer does not know the exact bonds that will be delivered. According to industry practice, two days before the contractual settlement date of the trade, the seller will communicate to the buyer the exact details of the MBS pools that will be delivered. It takes some time for the purchases to settle, and this has confused some people. The NY Fed number is the one to follow when tracking the Fed MBS purchase program. The Fed's MBS balance sheet holdings will continue to expand even after the MBS purchase program ends on March 31st as contracts settle.

Freddie Mac: Mortgage Rates below 5% Again

by Calculated Risk on 3/04/2010 02:58:00 PM

From Freddie Mac:

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.97 percent with an average 0.7 point for the week ending March 4, 2010, down from last week when it averaged 5.05 percent. Last year at this time, the 30-year FRM averaged 5.15 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.As an aside, in a research note yesterday, Goldman Sachs argued "our analysis only points to a modest rise in mortgage rates of around 10bp when the Fed stops buying MBS in a few weeks." Further they argue the large increase (maybe 80 bps increase in spread) will not happen until the Fed announces they will be selling MBS.

Hotel Occupancy Up Compared to Same Week in 2009

by Calculated Risk on 3/04/2010 11:53:00 AM

From HotelNewsNow.com: San Francisco leads weekly results

Overall the U.S. industry’s occupancy ended the week with a 2.5-percent increase to 55.3 percent, ADR dropped 4.7 percent to US$96.06, and RevPAR fell 2.3 percent to US$53.15.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

The YoY change suggests that occupancy rates may have bottomed, but the level is still very low - the average occupancy rate for this week is around 62%, well above the current 55.3%. This low occupancy rate is still pushing down room rates and revenue per available room (RevPAR).

Business travel is very important for the next few months, and right now it appears the weekday occupancy rate (mostly business travel) is slightly above the levels of last year during the worst of the recession.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Existing Home Pending Sales Index Declines 7.6%

by Calculated Risk on 3/04/2010 10:02:00 AM

From the NAR: Pending Home Sales Down; Severe Weather Impacting Market

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in January, fell 7.6 percent to 90.4 from an upwardly revised 97.8 in December ...The Pending Home Sales Index isn't perfect, but this does generally lead existing home sales by about 45 days. The January index suggests sales in February and March will probably be lower than the 5.05 million SAAR in January (Seasonally Adjusted Annual Rate).

“We will see weak near-term sales followed by a likely surge of existing-home sales in April, May and June,” [Lawrence Yun, NAR chief economist] said. “The real question is what happens in the second half of the year."

I also expect sales to increase in May and June (above the normal seasonal factors) because of the deadline for the home buyer tax credit. Although I don't think we will see an increase like last year when sales spiked to 6.54 million SAAR in November.

The NAR is currently forecasting an annualized existing home sales rate of 5.1 million homes in Q1, 5.8 million in Q2, and about 5.5 million in the 2nd half of 2010. I think those numbers are generally high - especially in the 2nd half of 2010.

Weekly Initial Unemployment Claims decline to 469,000

by Calculated Risk on 3/04/2010 08:29:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 27, the advance figure for seasonally adjusted initial claims was 469,000, a decrease of 29,000 from the previous week's revised figure of 498,000. The 4-week moving average was 470,750, a decrease of 3,500 from the previous week's revised average of 474,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 20 was 4,500,000, a decrease of 134,000 from the preceding week's revised level of 4,634,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 3,500 to 470,750.

The current level of 469,000 (and 4-week average of 470,750) are very high and suggest continuing job losses in February.

Wednesday, March 03, 2010

Greece Cuts, Germany says "no aid", IMF Next?

by Calculated Risk on 3/03/2010 11:33:00 PM

From the Financial Times: Greece prepared to turn to IMF

Mr Papandreou said that the latest austerity package ... fulfilled Greece’s commitment to its eurozone partners ... “We are waiting for European support – the other side of the agreement,” Mr Papandreou said ... he told ministers that Greece could turn to the IMF for an emergency loan if its EU partners were unable to deliver adequate assistance ...And from Bloomberg: Greece Aid Plea Snubbed by Germany in ‘Historic Moment’ for EU

excepted with permission

“We have fulfilled to the utmost all that we must from our side; now it’s Europe’s turn,” Papandreou told his ministers yesterday, according to an e-mailed transcript. “It is a historic moment for the European Union.”The story remains fluid, and a key date is March 16th when the euro-zone finance ministers meet.

...

“I expressly want to say that Friday isn’t about aid commitments, but about good relations between Germany and Greece,” [German Chancellor Angela Merkel] said yesterday in an interview with N-TV ...

Unemployment Benefits: One Month Extension of Final Date

by Calculated Risk on 3/03/2010 08:06:00 PM

Just an update:

H.R. 4691: Temporary Extension Act of 2010 was signed into law last night.

Extends the final date for entering a federal-state agreement under the Emergency Unemployment Compensation (EUC) program through April 5, 2010.From Ron Scherer at the Christian Science Monitor:

The extension means if an individual was about to exhaust their state benefits and about to exhaust a tier of emergency unemployment compensation, they are eligible to apply to move up to the next tier. However, if an individual is about to exhaust their final tier or extended benefits, this will not help them.I wonder how many people have exhausted all of their unemployment benefits?

“This does not add more weeks of benefits, it just extends the deadline in which people can qualify for either Emergency Unemployment Compensation or extended benefits,” says Judy Conti of NELP in Washington.

The 30-day extension of the benefits will cost the federal government about $10 billion.