by Calculated Risk on 3/04/2010 04:36:00 PM

Thursday, March 04, 2010

Fed Balance Sheet and MBS Purchases

Here is the Federal Reserve balance sheet break down from the Atlanta Fed weekly Financial Highlights released today (as of last week): Click on graph for larger image in new window.

Click on graph for larger image in new window.

Graph Source: Altanta Fed.

From the Atlanta Fed:

The balance sheet expanded $9.7 billion, to $2.3 trillion, for the week ended February 24.Holdings of agency debt and mortgage backed securities, which rose by $8 billion, accounted for the majority of the expansion of the balance sheet and continue to replace lending to nonbank credit markets and short-term lending to financials. The balance sheet is expected to peak during the first half of this year after the MBS purchase program is completed and purchases settle on the balance sheet.

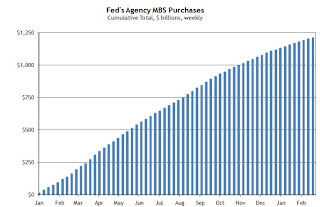

The second graph shows the cumulative MBS purchases by week. From the Atlanta Fed:

The second graph shows the cumulative MBS purchases by week. From the Atlanta Fed: The NY Fed purchased an additional net $10 billion in MBS for the week ending ending March 3rd. This puts the total purchases at $1.220 trillion or almost 98% complete. Just $30 billion more to go ...The Fed purchased a net total of $11 billion of agency-backed MBS through the week of February 24, bringing its total purchases up to $1.210 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 97% complete).

The Fed's balance sheet released today shows "only" $1.027 trillion in MBS. The difference is that the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles. Most of the agency MBS market is "To-Be-Announced" trading, and many of the contracts will not settle for a couple of months.

To understand ""To-Be-Announced", here is a discussion from SIFMA (ht Windward.Broach):

"To-Be-Announced" Trading of Agency Passthrough Securities

Much of the volume in the agency MBS market today is in the form of “To-Be-Announced” (TBA) trading. A TBA is a contract for the purchase or sale of agency mortgage-backed securities to be delivered at a future agreed-upon date; however, the actual pool identities or the number of pools that will be delivered to fulfill the trade obligation or terms of the contract are unknown at the time of the trade.

...

For example, in a typical trade, a buyer may ask to purchase $100 million of 30 year Fannie Mae MBS with a 6% coupon for delivery next month. The buyer does not know the exact bonds that will be delivered. According to industry practice, two days before the contractual settlement date of the trade, the seller will communicate to the buyer the exact details of the MBS pools that will be delivered. It takes some time for the purchases to settle, and this has confused some people. The NY Fed number is the one to follow when tracking the Fed MBS purchase program. The Fed's MBS balance sheet holdings will continue to expand even after the MBS purchase program ends on March 31st as contracts settle.