by Calculated Risk on 2/24/2010 11:55:00 AM

Wednesday, February 24, 2010

Freddie Mac: "Potential Large Wave of Foreclosures"

"We start 2010 with some early signs of stabilization in the housing market, with house prices and home sales likely nearing the bottom sometime in 2010. We expect that low mortgage rates, relatively high affordability and the homebuyer tax credit will help continue to fuel the recovery. Still, the housing recovery remains fragile, with significant downside risk posed by high unemployment and a potential large wave of foreclosures."The quote is from the Freddie Mac Q4 earnings release:

Freddie Mac Chief Executive Officer Charles E. Haldeman, Jr.

Freddie Mac Releases Fourth Quarter and Full-Year 2009 Financial Results Fourth quarter 2009 net loss was $6.5 billion. After the dividend payment of $1.3 billion to the U.S. Department of the Treasury (Treasury) on the senior preferred stock, net loss attributable to common stockholders was $7.8 billion ... for the fourth quarter of 2009.Another $7.8 billion in losses ...

...

Full-year 2009 net loss was $21.6 billion. After dividend payments of $4.1 billion during the year to Treasury on the senior preferred stock, net loss attributable to common stockholders was $25.7 billion ... for the full-year 2009.

New Home Sales fall to Record Low in January

by Calculated Risk on 2/24/2010 10:15:00 AM

Note: See previous post for video and discussion of Bernanke's testimony.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 309 thousand. This is a record low and a sharp decrease from the revised rate of 348 thousand in December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2010. In January 2010, 21 thousand new homes were sold (NSA).

This is below the previous record low of 24 thousand in January 2009. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

Sales of new single-family houses in January 2010 were at a seasonally adjusted annual rate of 309,000 ... This is 11.2 percent (±14.0%)* below the revised December rate of 348,000 and is 6.1 percent (±15.1%)* below the January 2009 estimate of 329,000.And another long term graph - this one for New Home Months of Supply.

There were 9.1 months of supply in January. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.

There were 9.1 months of supply in January. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.The seasonally adjusted estimate of new houses for sale at the end of January was 234,000. This represents a supply of 9.1 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, but sales have set a new record low. New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of excess housing inventory declines much further.

Obviously this is another extremely weak report.

Bernanke Humphrey-Hawkins Testimony at 10 AM ET

by Calculated Risk on 2/24/2010 09:50:00 AM

Federal Reserve Chairman Ben Bernanke is scheduled to provide the Semiannual Monetary Policy Report to the Congress before the House Committee on Financial Services at 10 AM ET.

I'll add a link to the prepared testimony, and I'll be posting the New Home sales numbers shortly after 10 AM. Commenters: Hopefully we can discuss Bernanke's testimony (especially the Q&A) on this thread, and New Home sales on the following thread).

Here is the CNBC feed.

Here is the C-Span Link

Prepared Testimony: Semiannual Monetary Policy Report to the Congress

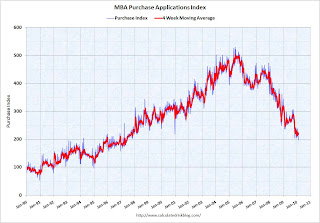

MBA: Mortgage Purchase Applications at Lowest Level Since May 1997

by Calculated Risk on 2/24/2010 08:12:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index ... decreased 8.5 percent on a seasonally adjusted basis from one week earlier. ...

“As many East Coast markets were digging out from the blizzard last week, purchase applications fell, another indication that housing demand remains relatively weak,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “With home prices continuing to drift amid an abundant inventory of homes on the market, potential homebuyers do not see any urgency to lock in purchases.”

The Refinance Index decreased 8.9 percent from the previous week. The seasonally adjusted Purchase Index decreased 7.3 percent from one week earlier, putting the index at its lowest level since May 1997. ...

The refinance share of mortgage activity decreased to 68.1 percent of total applications from 69.3 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.03 percent from 4.94 percent, with points increasing to 1.34 from 1.09 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Once again, the decline in purchase applications since October appears significant.

Also, with mortgage rates back above 5% again, refinance activity declined too.

AIA: Architecture Billings Index Shows Contraction in January

by Calculated Risk on 2/24/2010 01:13:00 AM

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index decreased to 42.5 in January from 43.4 in December. Any reading below 50 indicates contraction.

The index has remained below 50, indicating contraction in demand for design services, since January 2008. Its lowest recent reading was in January 2009, when it reached a revised 33.9 level.The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through this year, and probably longer.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.