by Calculated Risk on 2/23/2010 08:27:00 PM

Tuesday, February 23, 2010

Housing: Price-to-Rent Ratio

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through December 2009 using the two Case-Shiller Home Price Composite Indices: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the price to rent ratio (January 2000 = 1.0).

This suggests that house prices are still a little too high on a national basis. But it does appear that prices are much closer to the bottom than the top.

Also, OER declined again in January, and with rents still falling, the OER index will probably continue to decline - pushing up the price-to-rent ratio.

Q4 Report: 11.3 Million U.S. Properties with Negative Equity

by Calculated Risk on 2/23/2010 05:27:00 PM

First American CoreLogic released the Q4 negative equity report today.

First American CoreLogic reported today that more than 11.3 million, or 24 percent, of all residential properties with mortgages, were in negative equity at the end of the fourth quarter of 2009, up from 10.7 million and 23 percent at the end of the third quarter of 2009. An additional 2.3 million mortgages were approaching negative equity at the end of last year, meaning they had less than five percent equity. Together, negative equity and near‐negative equity mortgages accounted for nearly 29 percent of all residential properties with a mortgage nationwide.From the report:

Negative equity continues to be concentrated in five states: Nevada, which had the highest percentage negative equity with 70 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (35 percent). Among the top five states, the average negative equity share was 42 percent, compared to 15 percent for the remaining 45 states. In numerical terms, California (2.4 million) and Florida (2.2 million) had the largest number of negative equity mortgages accounting for 4.6million, or 41 percent, of all negative equity loans.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentgage of homeowners underwater, 10 percent or more of homeowners have negative equity in 33 states, and over 20% have negative equity or near negative equity in 23 states. This is a widespread problem.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.The second graph shows homeowners with severe negative equity for five states.

These homeowners are far more likely to default.

The rise in negative equity is closely tied to increases in pre‐foreclosure activity and is a major factor in changing homeowners’ default behavior. Once negative equity exceeds 25 percent, or the mortgage balance is $70,000 higher than the current property values, owners begin to default with the same propensity as investors.

Here is figure 4 from the report.

Here is figure 4 from the report. The default rate increases sharply for homeowners with more than 20% negative equity.

This graph fits with figure 2 above and suggests a large number of future defaults in Nevada, Arizona, Florida and California.

Most homeowners with negative equity will probably not default, but this does suggest there are many more foreclosures coming - and more losses.The aggregate dollar value of negative equity was $801 billion, up $55 billion from $746 billion in Q3 2009. The average negative equity for an underwater borrower in Q4 was ‐$70,700, up from ‐$69,700 in Q3 2009. The segment of borrowers that are 25 percent or more in negative equity account for over $660 billion in aggregate negative equity.

Case Shiller House Price Graphs for December

by Calculated Risk on 2/23/2010 02:42:00 PM

Finally. The S&P website has been down all morning.

S&P/Case-Shiller released the monthly Home Price Indices for December (actually a 3 month average).

The monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted monthly data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.3% from the peak, and up about 0.3% in December.

The Composite 20 index is off 29.4% from the peak, and up 0.3% in December.

The impact of the massive government effort to support house prices is obvious on the Composite graph. The question is what happens to prices as these programs end over the next few months?  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 2.4% from December 2008.

The Composite 20 is off 3.1% from December 2008.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (SA) in 6 of the 20 Case-Shiller cities in December.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in December.

In Las Vegas, house prices have declined 55.9% from the peak. At the other end of the spectrum, prices in Dallas are only off about 3.1% from the peak. Several cities are showing price increases in 2009 - San Diego, San Francisco, Boston, Washington D.C., Denver and Dallas.

Shadow Rental Market Pushing down Rents

by Calculated Risk on 2/23/2010 12:57:00 PM

Here is an audio interview from Jon Lansner: Scott Monroe of South Coast Apartment Association visits Jon Lansner of the OC Register

"Rents are down and vacancies are up. Demand is off, and we attribute really to to the fact that here has been a pretty significant erosion of jobs in the Orange County markets. And it is having a trickle down effect. In addition to that, our members are saying that they are competing quite a bit with what historically has not been a competitor for us - that's the gray market or the shadow market - which are condominium rentals and single family home rentals and things of that nature. There is just a lot of product on the market."Monroe says they are seeing much more multi-generational housing, and he expects "doubling up" to last for another 12 months or so.

Scott Monroe, Pres. of South Coast Apartment Association

And this brings up a key point - the supply of rental units has been surging:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (Source: Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.7 million units added to the rental inventory.

Note: please see caution on using this data - this number might be a little too high, but the concepts are the same even with a lower increase.

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at 10.7% and the apartment vacancy rate is at a record high.

Where did these approximately 4.7 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.6 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

As Scott Monroe noted, this huge surge in rental supply - what he calls the "gray or shadow market" - has pushed down rents, and pushed the rental vacancy rate to record levels. Yes, people are doubling up with friends and family during the recession, and some renters are now buying again, but the main reason for the record vacancy rate is the surge in supply. Eventually many of these "gray market" rentals will be sold as homes again - keeping the existing home supply elevated for years.

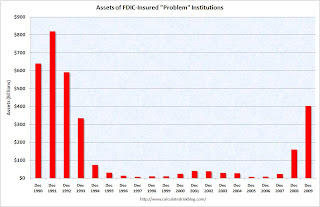

FDIC Q4 Banking Profile: 702 Problem Banks

by Calculated Risk on 2/23/2010 10:48:00 AM

The FDIC released the Q4 Quarterly Banking Profile today. The FDIC listed 702 banks with $403 billion in assets as “problem” banks in Q4, up from 552 banks with $346 billion in assets in Q3, and 252 and $159.4 billion in assets in Q4 2008.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 617 problem banks - and will continue to increase as more formal actions (or hints of pending actions) are released. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

The 702 problem banks reported at the end of Q4 is the highest since 1992.

The second graph shows the assets of "problem" banks since 1990. The assets of problem banks are the highest since 1992.

The assets of problem banks are the highest since 1992.

On the Deposit Insurance Fund:

The Deposit Insurance Fund (DIF) decreased by $12.6 billion during the fourth quarter to a negative $20.9 billion (unaudited) primarily because of $17.8 billion in additional provisions for bank failures. ... For the year, the fund balance shrank by $38.1 billion, compared to a $35.1 billion decrease in 2008.

The DIF’s reserve ratio was negative 0.39 percent on December 31, 2009, down from negative 0.16 percent on September 30, 2009, and 0.36 percent a year ago. The December 31, 2009, reserve ratio is the lowest reserve ratio for a combined bank and thrift insurance fund on record.Note: This doesn't mean the FDIC DIF is out of money or bankrupt. The FDIC reserves against future losses, and they don't include the prepay of assessments in the DIF (although they have the cash). The FDIC has plenty of cash right now - although there will probably be hundreds of bank failures over the next couple of years, and the FDIC might have to borrow from the Treasury in the future.

Forty-five insured institutions with combined assets of $65.0 billion failed during the fourth quarter of 2009, at an estimated cost of $10.2 billion. For all of 2009, 140 FDIC-insured institutions with assets of $169.7 billion failed, at an estimated cost of $37.4 billion. This was the largest number of failures since 1990 when 168 institutions with combined assets of $16.9 billion failed (excluding thrifts resolved by the RTC).