by Calculated Risk on 1/04/2010 03:38:00 PM

Monday, January 04, 2010

Employment Week: Census and ISM

This will be busy week for employment related reports culminating with the BLS report on Friday. Here is some info on the impact of Census 2010 on employment, and the relationship between the ISM manufacturing report and BLS reported manufacturing payroll jobs. Click on photo for hi-res image in new window.

Click on photo for hi-res image in new window.

The Census Bureau kicked off the Census 2010 road tour today.

During the next four months, the tour will be part of the largest civic outreach and awareness campaign in U.S. history -- stopping and exhibiting at more than 800 events nationwide.Of course most of the Census will be conducted by mail in March, with followup visits for non-respondents. As we discussed on Friday, the Census Bureau will hire temporary census takers for most of the followup work (See: Impact of Census on Employment and Unemployment Rate).

The key point is that Census 2010 will boost employment in March, April and especially in May. And this boost will mostly be unwound over the period June through September. The Census gives, and the Census takes.

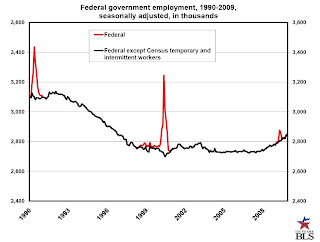

To track the impact on employment, the BLS provides a monthly report of Census hiring. This graph is from the BLS report and shows the historical impact of the Census on Federal Government employment.

To track the impact on employment, the BLS provides a monthly report of Census hiring. This graph is from the BLS report and shows the historical impact of the Census on Federal Government employment.There was a small spike in employment in April 2009, and currently the decennial census has little impact on employment. This will be something to check every month - especially from March through September.

And from the ISM Manufacturing report this morning on employment:

ISM's Employment Index registered 52 percent in December, which is 1.2 percentage points higher than the 50.8 percent reported in November. This is the third month of growth in manufacturing employment, following 14 consecutive months of decline. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.The following graph shows the ISM Manufacturing Employment Index vs. the BLS reported monthly change in manufacturing employment (as a percent of manufacturing employment).

emphasis added

The graph includes data from 1948 through 2009. The earlier period (1948 - 1988) is in red, and the last 20 years is in blue.

This shows that the ISM employment index is related to changes in BLS employment.

This shows that the ISM employment index is related to changes in BLS employment.The relationship is noisy, and the equation is for just the last 20 years. This suggest the ISM employment index of about 51.3 is consistent with an increase in BLS reported manufacturing employment. This is higher than the ISM estimate that appears to be based more on older data.

Fed's Duke on Economic Outlook

by Calculated Risk on 1/04/2010 01:09:00 PM

From Fed Governor Elizabeth Duke: The Economic Outlook

In my view, the outlook for economic activity depends importantly on our ability to build on the progress to date in improving the operation of financial markets and restoring the flow of credit to households and businesses.I think Ms. Duke is somewhat too optimistic on housing and employment. It might take more payroll jobs to lower the unemployment rate this time because the Labor Force Participation Rate has declined so sharply; the BLS reported the participation rate as 65.0% in November (the percentage of the working age population in the labor force). This is the lowest level since the mid-80s, and I expect a number of people will rejoin the labor force at the first sign of an employment recovery, putting upward pressure on the unemployment rate.

Although household wealth has received a boost from the gains in the stock market over the last nine months and from the stabilization in house prices, household balance sheets remain weak. In 2009, household income received some temporary support from the tax cuts and transfer payments enacted with the fiscal stimulus package and from the extensions of unemployment insurance. Over the coming year, households should begin to see gains in income associated with an improvement in the labor market, and the drag on spending from past declines in real net worth should ease. As their income and balance sheets improve, consumers should have better access to credit. Favorable trends in income and employment should also bolster consumer confidence, although one risk I see to the outlook for household spending is the possibility of a rise in the personal saving rate as consumers choose to shore up their balance sheets rather than spend. While good in the long run, increased saving means consumers are providing less of a short-run boost to the economy.

The outlook for homebuilding will depend critically on the continuation of the uptrend in the demand for housing that began in early 2009. I anticipate that low mortgage rates and house prices that are still very low compared with the recent past will continue to provide important support for demand. And a shift in expectations from falling house prices to modest appreciation should encourage buyers to invest in houses. That said, the headwinds in housing and mortgage markets remain relatively strong and are likely to restrain the pace at which the residential construction sector recovers. Many of the existing homeowners who face payment problems are having trouble restructuring their loans, and the large backlog of foreclosed properties will likely take several years to resolve. Tighter standards for government-backed loans and still-restrictive credit conditions in private loan markets are also likely to slow the housing recovery. Nevertheless, with the inventory of new homes having been worked down to a relatively low level, even a gradual strengthening of demand should lead to an upturn in homebuilding.

Prospects for a recovery in business investment are getting better as we move into 2010. Typically, business confidence builds as firms see a sustained increase in sales and output. Various indicators of business sentiment rebounded over the second half of 2009 as economic activity accelerated, and the latest surveys of capital spending plans have been more positive. That said, the amount of unused capacity in the business sector is substantial, which implies that the recovery in spending on equipment and software will likely be more gradual than typically occurs during a cyclical recovery.

...

Unfortunately, the outlook for commercial real estate is much less favorable. Hit hard by the loss of businesses and employment, a good deal of retail, office, and industrial space is standing vacant. In addition, many businesses have cut expenses by renegotiating existing leases. The combination of reduced cash flows and higher rates of return required by investors leads to lower valuations, and many existing buildings are selling at a loss. As a result, credit conditions in this market are particularly strained. Commercial mortgage delinquency rates have soared. ...

In this environment, a turnaround in CRE is likely to lag the improvement in overall economic activity. However, compared with the situation in the early 1990s, the problems in this sector now appear to be due largely to poor business fundamentals rather than widespread overbuilding, suggesting that the performance of the CRE sector will gradually begin to improve as the economy continues to strengthen.

An important element of a sustained economic recovery will be an improvement in labor market conditions. Employment gains typically lag the recovery in sales and production in the early months of an economic upturn. In many cycles, the lag occurs because businesses need to restore productivity and are reluctant to hire until they are more confident that any pickup in sales will be maintained. In this cycle, the reductions in jobs and hours of work have been so deep, and the pressure to cut costs has been so strong, that businesses in the aggregate have already realized solid gains in productivity. As a result, I expect that businesses will begin to add jobs this year, but I anticipate that they will do so cautiously in order to hang on to their cost savings and efficiency gains.

Even as the unemployment rate begins to decline later this year, it likely will remain high by historical standards. Based on the experience of the last two economic recoveries, net gains of roughly 100,000 payroll jobs each month are needed to reduce the jobless rate by 0.1 percentage point. ...

emphasis added

Construction Spending Declines in November

by Calculated Risk on 1/04/2010 10:23:00 AM

Through November construction spending has followed the expected script for 2009: a likely bottom for residential construction spending, and a collapse in private non-residential construction.

Residential construction spending was off slightly in November, and is now only 5.8% above the bottom earlier in 2009. I expect some residential spending growth in 2010, but the increases in spending will probably be sluggish until the large overhang of existing inventory is reduced.

Non-residential appeared flat in November, but that was only because of a downward revision to October spending. The collapse in non-residential construction spending continues ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

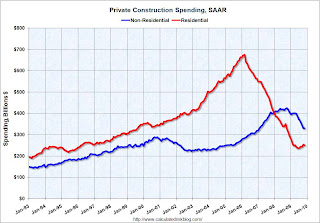

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending decreased in November, and nonresidential spending continued to decline.

Private residential construction spending is now 62.9% below the peak of early 2006.

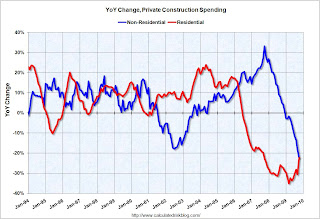

Private non-residential construction spending is 22.5% below the peak of October 2008. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 22.5% on a year-over-year (YoY) basis.

Residential construction spending is still off 22.2% from a year ago, but the negative YoY change is getting smaller.

For the first time since the housing bust started, nonresidential spending is off more on a YoY basis than residential.

Here is the report from the Census Bureau: November 2009 Construction at $900.1 Billion Annual Rate

ISM Manufacturing Index shows Expansion in December

by Calculated Risk on 1/04/2010 10:00:00 AM

PMI at 55.9% in December, from 53.6 in November, and down from 55.7 in October.

From the Institute for Supply Management: December 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in December for the fifth consecutive month, and the overall economy grew for the eighth consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading above 50 shows expansion.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the fifth consecutive month in December as the PMI rose to 55.9 percent, its highest reading since April 2006 when it registered 56 percent. This month's report is quite strong as both the New Orders and Production Indexes are above 60 percent. The sector may be benefiting from an excessive destocking cycle as indicated by the recent performance of the Customers' Inventories Index. Customers' inventories have been 'too low' for nine consecutive months, and this month's index is the lowest reading since the inception of the index in January 1997. Overall, the recovery in manufacturing is continuing, but there are still some industries mired in the downturn as evidenced by the seven industries still in decline."

...

ISM's Employment Index registered 52 percent in December, which is 1.2 percentage points higher than the 50.8 percent reported in November. This is the third month of growth in manufacturing employment, following 14 consecutive months of decline. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

emphasis added

California to "aggressively seek new federal assistance"

by Calculated Risk on 1/04/2010 08:40:00 AM

From Wyatt Buchanan at the San Francisco Chronicle: California leaders seek budget help from D.C.

California's political leaders, who are facing the daunting challenge of closing an estimated $20.7 billion budget deficit this year, are looking to Washington for help. Just don't call it a bailout.As the article notes, California sends far more to Washington D.C. then they receive (they are 43rd on the list of states) - we will probably hear more of that argument. Hey - it is an investment, not a bailout!

...

"No one is looking for a bailout. We're looking for an investment," [Senate President Pro Tem Darrell Steinberg] said ...

On Friday, Schwarzenegger will release his initial budget proposal for the next fiscal year, and the Legislative Analyst's Office already has called on state leaders to "aggressively seek new federal assistance" to help close the projected deficit.

Krugman: Beware the Blip

by Calculated Risk on 1/04/2010 12:29:00 AM

From Paul Krugman at the NY Times: That 1937 Feeling

The next employment report could show the economy adding jobs for the first time in two years. The next G.D.P. report is likely to show solid growth in late 2009. There will be lots of bullish commentary ...A couple months ago I suggested a few possible upside surprises and downside risks to the 2010 outlook, and I suppose the most likely upside surprise would come from consumer spending. As Dr. Yellen noted in November: "Consumers have surprised us in the past with their free-spending ways and it’s not out of the question that they will do so again."

Such blips are often, in part, statistical illusions. But even more important, they’re usually caused by an “inventory bounce.” ... Unfortunately, growth caused by an inventory bounce is a one-shot affair unless underlying sources of demand, such as consumer spending and long-term investment, pick up.

Which brings us to the still grim fundamentals of the economic situation.

...

There can’t be a new housing boom while the nation is still strewn with vacant houses and apartments left behind by the previous boom, and consumers — who are $11 trillion poorer than they were before the housing bust — are in no position to return to the buy-now-save-never habits of yore.

... A boom in business investment would be really helpful right now. But it’s hard to see where such a boom would come from: industry is awash in excess capacity, and commercial rents are plunging in the face of a huge oversupply of office space.

Can exports come to the rescue? ... But the deficit is widening again, in part because China and other surplus countries are refusing to let their currencies adjust.

So the odds are that any good economic news you hear in the near future will be a blip, not an indication that we’re on our way to sustained recovery.

Note: I wrote that post when we though Q3 GDP growth was 3.5%, and I expected Q4 to be about the same. Since Q3 was revised down substantially, I now expect more of a transitory boost to Q4 GDP growth.

And I still think a sluggish 2010 is the most likely scenario. Dr. Krugman's concern is that policy makers will buy into the bullish commentary after a solid Q4, and repeat the mistakes of 1937.

Sunday, January 03, 2010

PIMCO's McCulley: Three Major Issues for 2010

by Calculated Risk on 1/03/2010 09:41:00 PM

From PIMCO's Paul McCulley: PIMCO’s Cyclical 2010 Outlook

The first issue is the peg between the Chinese yuan and the U.S. dollar, which essentially gives us a one-size-fits-all monetary policy in a very differentiated world. Progress, or lack of progress, on this issue could lead to several outcomes. If China were to let its currency appreciate, it could regain a degree of monetary policy autonomy and a better ability to manage the risk of overheating and asset price inflation. Another outcome, however, is that China refuses to let the yuan appreciate, essentially maintaining too easy of a monetary policy for itself and the developing countries that shadow Chinese policies. This would create bubble risk, particularly for assets such as emerging market (EM) equities and commodities.Professor Krugman discussed the Chinese peg a few days ago: Chinese New Year

The second major uncertainty is what will happen when the Fed completes its mortgage-backed securities (MBS) buying programs. We know that it will have an unfriendly effect on the interest rate markets, but we don’t know the magnitude, because it’s too hard to isolate the supply and demand dynamics between fundamentals and the stimulus programs. ...

The third uncertainty is any change in the Fed’s pre-commitment language, which is currently committed to keeping the fed funds rate exceptionally low for an “extended period.” We don’t think the Fed is going to tighten any time in 2010, but long before the FOMC (Federal Open Market Committee) actually does the deed, it will have to change its language. That could very well happen in 2010, and there is genuine uncertainty over how quickly and strongly the market will anticipate a tightening process. Our gut feeling is that the moment the Fed changes any one of its words, it’s going to be a very unpleasant experience, because the marketplace has very little patience and a very big imagination. The most important book at the Fed right now is a thesaurus, and it’s probably sitting on top of Paul Samuelson’s Foundations of Economic Analysis.

emphasis added

China has become a major financial and trade power. But it doesn’t act like other big economies. Instead, it follows a mercantilist policy, keeping its trade surplus artificially high. And in today’s depressed world, that policy is, to put it bluntly, predatory.And the Fed MBS purchase program is just one of several government housing support programs that is scheduled to end in the next six months (the MBS program is scheduled to be complete by the end of Q1). My estimate is mortgage rates will rise by about 35 to 50 bps relative to the Ten Year treasury yield when the Fed stops buying MBS.

...

My back-of-the-envelope calculations suggest that for the next couple of years Chinese mercantilism may end up reducing U.S. employment by around 1.4 million jobs.

And on the Fed Funds rate, it is very unlikely that the Fed will raise rates in 2010. However McCulley thinks the Fed might change the wording of the statement - and he believes "it’s going to be a very unpleasant experience, because the marketplace has very little patience and a very big imagination".

I think jobs and the housing market (prices, supply and demand) are the two biggest economic issues in the U.S. this year.

What Bernanke Didn't Say

by Calculated Risk on 1/03/2010 05:19:00 PM

Note: Here is weekly summary and a look ahead.

From Fed Chairman Ben Bernanke: Monetary Policy and the Housing Bubble

And reports on the speech:

From the WSJ: Bernanke Says Rate Increases Must Be an Option

From the NY Times: Bernanke Blames Weak Regulation for Financial Crisis

Dr. Bernanke said that monetary policy (a low Fed Funds rate) was probably not to blame for the housing bubble, and he used data from other countries to make this argument: "the relationship between the stance of monetary policy and house price appreciation across countries is quite weak".

He suggested the primary cause was the lack of effective regulation associated with non-traditional mortgage products.

I noted earlier that the most important source of lower initial monthly payments, which allowed more people to enter the housing market and bid for properties, was not the general level of short-term interest rates, but the increasing use of more exotic types of mortgages and the associated decline of underwriting standards. That conclusion suggests that the best response to the housing bubble would have been regulatory, not monetary. Stronger regulation and supervision aimed at problems with underwriting practices and lenders' risk management would have been a more effective and surgical approach to constraining the housing bubble than a general increase in interest rates. Moreover, regulators, supervisors, and the private sector could have more effectively addressed building risk concentrations and inadequate risk-management practices without necessarily having had to make a judgment about the sustainability of house price increases.Here are his two slides about exotic mortgages:

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Slide 7 also shows initial monthly payments for some alternative types of variable-rate mortgages, including interest-only ARMs, long-amortization ARMs, negative amortization ARMs (in which the initial payment does not even cover interest costs), and pay-option ARMs (which give the borrower considerable flexibility regarding the size of monthly payments in the early stages of the contract). These more exotic mortgages show much more significant reductions in the initial monthly payment than could be obtained through a standard ARM. Clearly, for lenders and borrowers focused on minimizing the initial payment, the choice of mortgage type was far more important than the level of short-term interest rates.

The availability of these alternative mortgage products proved to be quite important and, as many have recognized, is likely a key explanation of the housing bubble. Slide 8 shows the percentage of variable-rate mortgages originated with various exotic features, beginning in 2000. As you can see, the use of these nonstandard features increased rapidly from early in the decade through 2005 or 2006. Because such features are presumably not appropriate for many borrowers, Slide 8 is evidence of a protracted deterioration in mortgage underwriting standards, which was further exacerbated by practices such as the use of no-documentation loans. The picture that emerges is consistent with many accounts of the period: At some point, both lenders and borrowers became convinced that house prices would only go up. Borrowers chose, and were extended, mortgages that they could not be expected to service in the longer term. They were provided these loans on the expectation that accumulating home equity would soon allow refinancing into more sustainable mortgages.But it seems Bernanke left out a couple key points.

I'm more interested in what Dr. Bernanke didn't say.

Weekly Summary and a Look Ahead

by Calculated Risk on 1/03/2010 01:58:00 PM

The first week of the new year will be chock-full of economic data, culminating with the December employment report on Friday. Expectations are for the BLS to report somewhere between 50,000 jobs lost or gained, with a consensus of no change in net jobs and the unemployment rate to remain steady.

On Monday, the ISM manufacturing index and construction spending will be released. The highlight for Tuesday will be auto sales and on Wednesday the ISM non-manufacturing index will be released.

Other economic releases include the number of personal bankruptcy filings for December, the apartment vacancy rate for Q4, factory orders, and various employment reports.

And a summary of last week ...

S&P/Case-Shiller released their monthly Home Price Indices for October. The following graph shows the Seasonally Adjusted data - some sites report the NSA data.

Click on graph for larger image in new window.

Click on graph for larger image in new window. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.5% from the peak, and up about 0.4% in October.

The Composite 20 index is off 29.5% from the peak, and up 0.4% in October.

NOTE: S&P reported this as "flat", but they were using the NSA data.

The seconrd graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices decreased (SA) in 9 of the 20 Case-Shiller cities in October.

Prices decreased (SA) in 9 of the 20 Case-Shiller cities in October. In Las Vegas, house prices have declined 56.3% from the peak. At the other end of the spectrum, prices in Dallas are only off about 5.4% from the peak - and up slightly in 2009. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 4.98% in October, up from 4.72% in September - and up from 1.89% in October 2008.

Best wishes and Happy New Year to all.

Unofficial Problem Bank List Increases to 575

by Calculated Risk on 1/03/2010 10:31:00 AM

The FDIC is on bank failure holiday until Jan 8th, but surferdude808 is still working!

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased this week by 30 institutions to 575 primarily because the FDIC released its actions for November 2009.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Aggregate assets increased by $7.6 billion. There were no removals this week from closure, action termination, or unassisted merger.

Among the additions are Torrey Pines Bank, San Diego, CA ($1.1 billion); United Bank & Trust Company, Versailles, KY ($761 million); Peninsula Bank, Englewood, FL ($646 million); Viking Bank, Seattle, WA ($632 million); and Northwest Georgia Bank, Ringgold, GA ($586 million).

Also, the FDIC issued a Cease & Desist Order against Legacy Bank, Scottsdale, AZ ($194 million), which is a subsidiary of Peotone Bancorp, Inc. Legacy Bank and its sister bank, Peotone Bank and Trust Company, which also is operating under a formal enforcement action, are controlled by an ownership group that had seven banks closed on July 2, 2009 that cost the FDIC $314 million.

In 1989, the FDIC received authority to assess affiliates for resolution costs under what is commonly referred to as cross-guaranty. The FDIC used cross guaranty to close still solvent banks controlled by FBOP Corp. on October 30, 2009. It is interesting that the FDIC has not applied cross guaranty to the remaining banking subsidiaries of Peotone Bancorp.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC