by Calculated Risk on 1/05/2010 09:39:00 PM

Tuesday, January 05, 2010

Leonhardt: Bernanke Should Discuss Fed Failures

From David Leonhardt at the NY Times: If Fed Missed That Bubble, How Will It See a New One? (ht Ann)

So why did Mr. Greenspan and Mr. Bernanke get it wrong?Bernanke continues to dodge the key questions: what went wrong with regulation, and how will the new regulatory structure catch a bubble the next time?

The answer seems to be more psychological than economic. They got trapped in an echo chamber of conventional wisdom. Real estate agents, home builders, Wall Street executives, many economists and millions of homeowners were all saying that home prices would not drop, and the typically sober-minded officials at the Fed persuaded themselves that it was true. “We’ve never had a decline in house prices on a nationwide basis,” Mr. Bernanke said on CNBC in 2005.

He and his colleagues fell victim to the same weakness that bedeviled the engineers of the Challenger space shuttle, the planners of the Vietnam and Iraq Wars, and the airline pilots who have made tragic cockpit errors. They didn’t adequately question their own assumptions. It’s an entirely human mistake.

Which is why it is likely to happen again.

What’s missing from the debate over financial re-regulation is a serious discussion of how to reduce the odds that the Fed — however much authority it has — will listen to the echo chamber when the next bubble comes along. A simple first step would be for Mr. Bernanke to discuss the Fed’s recent failures, in detail. If he doesn’t volunteer such an accounting, Congress could request one.

Suggesting “better and smarter" execution just doesn't cut it.

Pimco's Gross on Fed MBS Purchases

by Calculated Risk on 1/05/2010 06:49:00 PM

From an interview in Time: Pimco's Bill Gross Sees 2010 as Year of Reckoning. Excerpts on MBS:

Gross: I think the Fed's statements suggest that they really want to exit in some fashion from the buying program. The first step in that direction, logically, would be to stop buying and our sense is that they're at least going to try that. But based on our forecasts for the second half of the year they may have to re-initiate it, and that will be difficult to do once they stop because it then becomes a political hot potato.So Bill Gross is thinking we will see about a 50 bps increase in mortgage rates when the Fed stops buying MBS, but admits he really doesn't know. He also thinks the Fed will stop buying - probably on the current schedule - but he thinks they may want to re-initiate the program in the 2nd half of 2010.

All that said, I think they'll stop buying mortgage agency securities, and the trillion-and-a-half dollar check that's been written over the past 9 to 12 months basically disappears. ...

TIME: Because they might have to restart the buying program later?

Yes, I think the Fed wonders about this as well. ... They won't sell — it's a near impossibility to unload what they've purchased over past 12 months. But they'll at least stop buying.

TIME: Won't that put upward pressure on interest rates?

I think it will. I mean the mortgage market would be your first place to look in terms of something that's overvalued that would become normalized. Nobody knows what the Fed's buying is worth — we think about half a percentage point on rates, but we don't know.

But secondly, there's a ripple affect. ... They're buying a trillion dollars of them, or have over the past 9-12 months, and so we sold them a lot of ours. Now, what did we do with the money? We bought Treasuries, we bought corporate bonds, and so the bond markets in general have benefited, as have stocks because this available money effectively flows through the capital markets. ... How that affects the markets, I just don't know. I'm not eagerly anticipating the answer, but I think it holds some surprises in 2010, not just in mortgage securities but stocks as well. We could miss the money, put it that way.

emphasis added

U.S. Light Vehicle Sales 11.25 Million SAAR in December

by Calculated Risk on 1/05/2010 03:48:00 PM

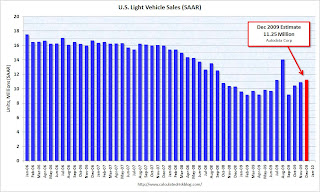

Click on graph for larger image in new window.

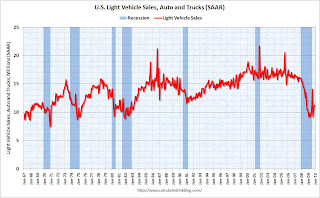

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for December (red, light vehicle sales of 11.25 million SAAR from AutoData Corp). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

Excluding August, December was the strongest month since September 2008 (12.5 million SAAR) before sales fell off the final cliff.

The current level of sales are still very low, and are still below the lowest point for the '90/'91 recession (even with a larger population). On an annual basis, 2009 sales were probably just above the level of 1982 (10.357 million light vehicles).

Iceland President Refuses to Sign Bill to Compensate UK Investors

by Calculated Risk on 1/05/2010 02:23:00 PM

From the Guardian: Iceland president vetoes collapsed Icesave Bank's bill to UK

Iceland was plunged back into crisis after its president refused to sign a bill promising to repay more than €3.8bn (£3.4bn) to Britain and the Netherlands after the collapse of the country's Icesave bank in 2008.And from The Times: Iceland blocks repayment of £2.3bn to Britain

Olafur Grimsson said he would force a referendum on the deeply unpopular legislation, causing a schism within the Icelandic government, with prime minister Johanna Sigurdardottir maintaining that the money would be repaid.

The escalating row threatens to further destablise the Icelandic economy, which went into meltdown after the failure of its three big banks, cutting off further aid from the International Monetary Fund and jeopardising efforts to join the European Union. The credit rating agency Fitch immediately downgraded Iceland, describing the latest political row as a "significant setback".

The British Government's already stretched finances came under further pressure today when Iceland's President vetoed the repayment of a £2.3 billion loan from the British taxpayer.Here is the actual Declaration: DECLARATION BY THE PRESIDENT OF ICELAND

The cash was paid out by Britain in 2008 to compensate UK investors in Icesave, whose parent bank Landsbanki had collapsed.

Alistair Darling, the Chancellor, handed over the money because he had promised that UK savers would not lose a penny to Landsbanki's bankruptcy.

... I have decided, according to Article 26 of the Constitution, to refer this new Act to the people. As stated in the Constitution, the new Act will nevertheless become law and the referendum will take place “as soon as possible.”

If the Act is approved in the referendum then naturally it will remain in force. If the referendum goes the other way, then the Act No. 96/2009, which the Althingi passed on 28 August, on the basis of the agreement with the Governments of the United Kingdom and the Netherlands, will continue to be law, recognizing that the people of Iceland acknowledge their obligations. That Act was passed by the Althingi with theinvolvement of four of the parliamentary parties, as stated in the President’s declaration of 2 September.

Now the people have the power and the responsibility in their hands.

Ford: December U.S. Sales up 32.8% Compared to 2008

by Calculated Risk on 1/05/2010 12:01:00 PM

From MarketWatch: Ford December U.S. sales up 32.8% to 184,655 units

From CNBC: Ford December Sales Jump 23.3%

Ford Press Release.

We need to see the details to see why the two reports are different, but this is based on an easy comparison; in December 2008 U.S. light vehicle sales fell sharply to 10.3 million (SAAR) following the financial crisis.

I'll add the other major reports as updates to this post.

UPDATE: From MarketWatch: Chrysler Dec. U.S. sales fall 3.7% to 86,523

UPDATE2: GM posts 6.1% decline in December U.S. sales

UPDATE3: Toyota Dec. U.S. auto sales up 32% to 187,860

Once all the reports are released, I'll post a graph of the estimated total December sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET.

Pending Home Sales Decrease Sharply

by Calculated Risk on 1/05/2010 09:49:00 AM

The Pending Home Sales Index,* a forward-looking indicator based on contracts signed in November, fell 16.0 percent to 96.0 from an upwardly revised a 114.3 in October, but is 15.5 percent higher than November 2008 when it was 83.1.On the extended and expanded tax credit:

[Lawrence Yun, NAR chief economist] projects an additional 900,000 first-time buyers will qualify for the extended tax credit in addition to about 2 million who have already purchased; 1.5 million repeat buyers also are expected to benefit from the credit.The extended and expanded tax credit was estimated to cost taxpayers $10.8 billion, but based on Mr. Yun's numbers, the tax credit will cost close to $17 billion (way over the initial estimate and just like the first tax credit, most buyers who receive the tax credit would have bought anyway).

Personal Bankruptcy Filings Increase Sharply in 2009

by Calculated Risk on 1/05/2010 08:40:00 AM

The WSJ reports: Personal Bankruptcy Filings Rising Fast

Overall, personal bankruptcy filings hit 1.41 million last year, up 32% from 2008, according to the National Bankruptcy Research Center ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by year.

Note: Data from Administrative Office of the U.S. Courts, 2009 is estimated using media reports of data from the National Bankruptcy Research Center.

The annual rate is at about the same level as prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

"I can't see over the top of the files on my desk," said Cathleen Moran, a bankruptcy attorney at Moran Law Group in Mountain View, Calif., likening it to the rush of clients before the revised law went into effect.

| Click on cartoon for larger image in new window. And a repeat: Cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

Monday, January 04, 2010

Krugman: 30% to 40% Chance of 2010 Recession

by Calculated Risk on 1/04/2010 11:55:00 PM

From Bloomberg: Krugman Sees 30-40% Chance of U.S. Recession in 2010 (ht many thanks!)

“[A recession] is not a low probability event, 30 to 40 percent chance,” [Paul] Krugman said today in an interview in Atlanta, where he was attending an economics conference. “The chance that we will have growth slowing enough that unemployment ticks up again I would say is better than even.”On the recession probabilities, I think Professor Krugman is warning policy makers about complacency, similar to his Monday column: That 1937 Feeling.

My guess is the U.S. will see sluggish growth in 2010, but will avoid a recession. However I do think the unemployment rate ticking up from the current 10% is a high probability event.

Unofficial Problem Bank List Change Summary

by Calculated Risk on 1/04/2010 08:42:00 PM

Commentary from surferdude808:

Since August 7, 2009, each week an Unofficial Problem Bank List has been posted to Calculated Risk. The Unofficial Problem Bank List is an attempt to mirror the number of problem banks the FDIC reports each quarter.

The FDIC does not disclose the institutions on its Problem Bank List and CAMELS ratings are confidential. For the most part, institutions on the FDIC Problem Bank List have a CAMELS rating of 4 or 5. Normally, problem institutions or those with a CAMELS rating of 4 or 5 are subject to a safety & soundness formal enforcement action by their respective primary federal supervisor (Federal Reserve, FDIC, OCC, or OTS).

Since the last crisis, much to the consternation of the federal supervisory agencies, they are required to make all formal enforcement actions public. Historically, there is a high positive correlation between a safety & soundness formal enforcement action and a CAMELS rating of 4 or 5. This relationship is the basis for the Unofficial Problem Bank List, which is comprised of institutions operating under a safety & soundness formal enforcement action, and some institutions that have made public announcements that lead us to believe a formal enforcement action is likely.

With the passage of the year, we thought it would be of interest to analyze how the Unofficial Problem Bank List has changed since it was first published. The list had 389 institutions on August 7, 2009 and it finished the year at 575. During the past five months, there have been 277 additions and 91 deletions.

There are four ways to be removed from the list – failure, voluntary dissolution, merger with another institution (without FDIC assistance), or improvement in condition whereby the action is terminated. Of the 91 deletions, 74 are from failure, 9 are from termination of the enforcement action, and 8 are from an unassisted merger.

Of the 389 institutions on the August 7, 2009 list, 325 are still on the January 1, 2010 list as 64 were removed because of failure (48), action termination (9), and unassisted merger (7). Interestingly, 26 institutions that were added after August 7, 2009 failed before January 1, 2010.

So far, only 74 or 11.1 percent of the 666 institutions that have been on the list have failed. However, failure is the cause for 81.3 percent of all deletions. While failures only represent 11.1 percent of institutions that have appeared on the list, failed bank assets (quarter before failure) of $135.8 billion represent 30 percent of the $450.2 billion of assets that have been on the list. Moreover, failure is responsible for 98 percent of the $138.6 billion of assets of institutions deleted from the list. Thus, for the second half of 2009, failure was the primary way institutions and assets were removed from the list.

| Unofficial Problem Bank List Change Summary | |||

|---|---|---|---|

| Number of Institutions | Assets ($Thousands) | ||

| Start | (8/7/2009) | 389 | 276,313,429 |

| Additions | 277 | 173,919,123 | |

| Subtractions | |||

| Action Terminated | 9 | 1,605,652 | |

| Unassisted Merger | 8 | 1,141,008 | |

| Failures | 74 | 135,814,823 | |

| Asset Change | 8,453,550 | ||

| End | (1/01/2010) | 575 | 303,217,519 |

Oil Prices Push Above $81 per Barrel

by Calculated Risk on 1/04/2010 05:51:00 PM

From the NY Times: Oil Surges Above $81, Driven by Several Factors

A combination of frigid weather, expectations of an improving economy and new tensions between Russia and Belarus catapulted crude oil prices above $81 a barrel on Monday.Higher prices could impact the U.S. economic recovery (it is probably time to start watching U.S. vehicle miles driven again). Here is a graph of nominal oil prices ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.These are spot prices for Cushing WTI from the EIA (source).

Back in the Spring of 2008, we started seeing many signs of potential demand destruction - including fewer U.S miles driven, Asian countries reducing gasoline subsidies, and China stock piling oil for the Olympics.

And maybe we are seeing the first signs of demand destruction again, since the Dept of Transportation reports that U.S. vehicle miles declined in October: Traffic Volume Trends

Travel on all roads and streets changed by -0.5% (-1.4 billion vehicle miles) for October 2009 as compared with October 2008. ...

Cumulative Travel for 2009 changed by +0.2% (4.8 billion vehicle miles).

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT.

The second graph shows the comparison of month to the same month in the previous year as reported by the DOT. Miles driven in October 2009 were 0.5% less than in October 2008, the first year-over-year decline since May 2009.

Still - I haven't seen any stories like the following from the NY Times on June 28, 2008: Cruise Night, Without the Car

For car-loving American teenagers, this is turning out to be the summer the cruising died.There couldn't have been a clearer sign of a top in oil!

...

From coast to coast, American teenagers appear to be driving less this summer. Police officers who keep watch on weekend cruising zones say fewer youths are spending their time driving around in circles...