by Calculated Risk on 12/30/2009 03:12:00 PM

Wednesday, December 30, 2009

Reader Poll on Economic Outlook

I've added two polls on the right sidebar.

Predict the 2010 GDP growth and the Dec 2010 unemployment rate.

I'll post the poll results here tomorrow and post my own thoughts over the weekend.

Please feel free to post your predictions in the comments too - and I'll link to this post next year.

Best to all

House Prices and the Unemployment Rate

by Calculated Risk on 12/30/2009 12:35:00 PM

Here is a comparison of real house prices and the unemployment rate using the LoanPerformance national house price data (starts in 1976) and Case-Shiller Composite 10 index (starts in 1987). Both indexes are adjusted by CPI less shelter. This is an update to a post earlier this year. Click on image for larger graph in new window.

Click on image for larger graph in new window.

The two previous national declines in real house prices are evident on the graph (early '80s and early '90s). The dashed green lines are drawn at the peak of the unemployment rate following the peak in house prices.

In the early '80s, real house prices declined until the unemployment rate peaked, and then increased sluggishly for a few years. Following the late 1980s housing bubble, real house prices declined for several years after the unemployment rate peaked.

Although there are periods when there is no relationship between the unemployment rate and house prices, this graph suggests that house prices will not bottom (in real terms) until the unemployment rate peaks (or later, especially since the current bubble dwarfs those previous housing bubbles). This also suggests that real house prices are probably 10% or more too high on a national basis.

Chicago Purchasing Managers Increases in December

by Calculated Risk on 12/30/2009 09:51:00 AM

From MarketWatch: Chicago purchasing index reaches 16-month high

More businesses in the Chicago region were expanding in December than at any time in the past 16 months, based on the latest data from the Chicago purchasing managers index. The business activity index rose to 60.0% from 56.1% in November...Readings above 50% indicate expansion, and below 50% indicate contraction, so this suggests business activity is increasing.

This index is for both manufacturing and service activity in the Chicago region. In general the Chicago area is considered representative of the mix of manufacturing and non-manufacturing business activity in the nation.

The national ISM manufacturing index will be released Monday, and the ISM non-manufacturing index next Wednesday.

Japan: Twenty Years Later

by Calculated Risk on 12/30/2009 07:56:00 AM

From The Times: Japan pledges to end economic spiral (ht Jonathan)

Japan’s four-month-old Government ... today vowed to enlarge the economy by 150 trillion yen (£1 trillion) ...Talk about a high level of debt to GDP.

The Democratic Party of Japan said that the scheme would deliver annual real GDP growth of at least 2 per cent between now and 2020 and ... is thought to be an attempt by the Government to quash rising domestic fears over the country’s gargantuan mound of public debt. The debt equates to about 180 per cent of GDP and will probably hit 200 per cent in the wake of the record budget announced last week.

Halfway through the Government’s ten-year plan, Japan's debt relative to GDP may rise to 246 per cent, according to analysts from the International Monetary Fund.

...

Since its property bubble burst 20 years ago, Japan has borrowed heavily to stimulate the economy and recent years have seen the level of debt spiral wildly.

Tuesday, December 29, 2009

Fannie, Freddie Changes

by Calculated Risk on 12/29/2009 11:04:00 PM

There has been much more on the Dec 24th press release from Treasury.

From the WSJ: Questions Surround Fannie, Freddie

From Tim Duy: Why Christmas Eve?

I think Linda Lowell at HousingWire has a good explanation: Treasury Updates Its GSE Support; And the Mainstream Misleads

First on the timing:

It’s in the law: the Treasury’s authorization in [Housing and Economic Recovery Act (HERA) of 2008] to alter the terms, conditions and amounts under any agreements (such as the PSPAs) to purchase Fannie or Freddie obligations expires December 31, 2009. After that date, new authorization would be required from Congress.That explains the timing. My guess is some people at Treasury aren't working this week, so last Thursday was the deadline.

As far as why uncap Fannie and Freddie even though the current caps looked sufficient:

Too much is at stake, for taxpaying homeowners, to leave outstanding even a small “tail risk” that one of the enterprises would penetrate the cap. We’ve all seen how politics - even the agendas of a small minority - can stall lawmaking by the majority. Read the law (HERA): if a deficiency goes unfunded, the deficient enterprise goes into receivership.And receivership (as opposed to the current conservatorship) means the enterprise would be wound down. So Ms. Lowell suggests this was probably to avoid a low probability event that could have triggered a huge political battle - and put the housing market at further risk since the housing market is currently "overwhelmingly supported by FHA/Ginnie Mae, Fannie and Freddie".

Also, on my earlier speculation about whether this was related to HAMP, Nick Timiraos at the WSJ writes:

A Treasury representative said the bailout caps were suspended "specifically to ensure continued confidence in Fannie Mae and Freddie Mac, but were not based on any considerations" related to an expansion of the administration's loan-modification program.I guess this qualifies as a huge nothingburger.

Treasury plans GMAC cash infusion

by Calculated Risk on 12/29/2009 08:06:00 PM

From the Detroit News: Treasury plans to inject around $3.5 billion into GMAC (ht jb)

The Treasury Department plans to announce as early Wednesday afternoon that it will give GMAC Inc. around $3.5 billion in additional capital, sources told The Detroit News.Most of the losses have come from ResCap, GMAC's mortgage unit.

... The Treasury Department said earlier this year it would invest up to $5.6 billion more in GMAC -- on top of $13.4 billion GMAC has received over the last year.

...

GMAC is the primary lender to most GM and Chrysler dealers and customers ...

Just a few billion more. Nothing compared to AIG, Freddie and Fannie.

Are Homes now "Cheap"?

by Calculated Risk on 12/29/2009 06:09:00 PM

First, from Brett Arends in the WSJ on May 6, 2008: Is Housing Slump at a Bottom?

Wellesley College Prof. Karl E. Case, one of the leading experts on the housing market in the country ... suggests we may be at, or near, the bottom of the housing crash.Total starts were at 574 thousand in November after falling to a low of 479 thousand earlier this year - half the number of starts from when Prof. Case called the bottom in 2008.

...

"It is really remarkable how much where we are today looks like the bottom we've had in the last three cycles," Mr. Case says. "Every time we've gone below a million starts, the market has cleared at that moment."

...

"It's bottom-fishing time, I think," says Mr. Case. "There's got to be bargains in Florida, Arizona and Nevada."

And on "bottom-fishing" in Florida, Arizona and Nevada: prices have fallen 23.5%, 31,3% and 36.4% in Miami, Phoenix and Las Vegas respectively since Prof. Case's suggestion in May 2008 using his own Case-Shiller index.

Why bring this up now? Because Brett Arends wrote in the WSJ today: Latest Home Price Data Is Good News for Buyers

Homes are now cheap.Mr. Arends does write that homes are not cheap everywhere, but his main argument is:

If you buy an average home today, and take out a 30-year mortgage at 5%, the annual bill for interest and repayment of principal will come to about 19 times typical weekly earnings ...He then provides a chart that shows this is the lowest level since the early '70s for this metric. Mr. Arends does add many cautions and caveats.

Well, allow me to retort.

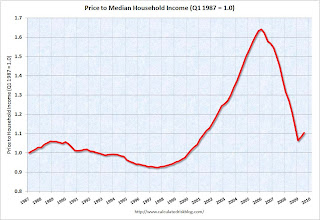

House prices are not cheap nationally. This is apparent in the price-to-income, price-to-rent, and also using real prices. Sure, most of the price correction is behind us and it is getting safer to be a bottom caller! But "cheap" means below normal, and I believe that is incorrect.

The following graph shows the price-to-income ratio using the Case-Shiller national index as of Q3 2009, and the Census Bureau's median income tables (assuming no increase for 2009).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 10% or so. A further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes.

The second graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices through October. For rents, the national Owners' Equivalent Rent from the BLS is used.

The second graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices through October. For rents, the national Owners' Equivalent Rent from the BLS is used.Although most of the adjustment in the price-to-rent ratio is behind us, it appears this ratio is still a little high.

As Mr. Arends also noted, this is national data, so beware of the local variations.

So why does Mr. Arends think "homes are now cheap"? Because he is using a measure of affordability based on mortgage interest rates. This is a mistake without further anlaysis.

Imagine this simplified example with a buyer willing to pay $1000 per month. With a 5% mortgage rate, the buyer could afford a $186,282 30 year fixed rate mortgage (principal and interest). But the buyer expects to sell the home in seven years, and he expects mortgage rates to be 7% then. That means the new buyer - who will also be willing to pay $1000 per month - can only afford a mortgage of $150,308.

So how does the affordability index account for this expected $36,000 loss? It doesn't.

It ends up in this simplified example, the current buyer would be willing to pay about $161,000 today because of the lower interest rate if he was planning on selling in seven years at $150,000 - excluding all expenses, transaction costs, tax savings, discount rates, etc. The actual calculation would be extremely complicated.

Sometimes it is smart to buy when "affordability" is low like in the early '80s when mortgage rates were very high - but smart buyers were expecting rates to fall. And sometimes it is smart not to buy when "affordability" appears high - like say last year when Mr. Arends wrote in May 2008:

[I]nterest rates are low right now. ... you can get a 30-year fixed-rate mortgage under 6%. If the economy recovers that won't last. If you are shopping for a home, it is probably worth seeing if you can lock in one of these rates cheaply.But the real key is to focus on supply and demand, and on the general fundamentals of price-to-income and price-to-rent (not perfect measures). House prices are not currently "cheap". They just aren't outrageously expensive nationally anymore.

ATA Trucking Tonnage Index Increases in November

by Calculated Risk on 12/29/2009 04:40:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 2.7 Percent In November Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.7 percent in November, following a 0.2 percent contraction in October. The latest gain boosted the SA index from 103.6 (2000=100) in October to 106.4, its highest level in a year. The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 100.8 in November, down 8.0 percent from October.The economy fell off a cliff in September 2008, so the year-over-year comparisons are getting easier. As ATA Chief Economist Bob Costello noted, trucking benefited from the inventory correct, and he believes that is nearing completion - and trucking will likely "exhibit starts and stops" until there is a pickup in domestic end demand.

Compared with November 2008, SA tonnage fell 3.5 percent, which was the best year-over-year showing in twelve months. In October, the index was down 5.2 percent from a year earlier.

ATA Chief Economist Bob Costello said that tonnage is moving in the right direction. “Slowly, but surely, truck freight has started the recovery process and November’s solid increase is a very positive sign,” Costello noted. He said that November’s tonnage levels were pushed higher by improved economic activity, as well as by an inventory correction that is near completion. “Truck freight had been hurt by both slow economic output and bloated inventories; however, we now have evidence that the inventories are in much better shape, which will not be such a drag on truck freight volumes.” Costello continued to be cautious about the future though. “While the economy and trucking is improving, the industry should not get overly excited about the sizeable increase in November. I continue to believe that both the economy and truck tonnage will exhibit starts and stops in the months ahead, but the general trend should be for moderate growth.”

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

Note: I think this is the highest level since January, unless January was revised down.

FDIC Insurance: Changes to TAGP effective on Jan 1st

by Calculated Risk on 12/29/2009 02:38:00 PM

Kathleen Pender at the San Francisco Chronicle reminds everyone of the changes to the FDIC's Transaction Account Guarantee Program: $250,000 in bank? Check deposit insurance

There is no change for those with less than $250,000 in the bank:

Deposits at all banks will still be insured up to $250,000 through 2013 under the FDIC's general deposit insurance rules, so the vast majority of consumers don't need to worry. But starting Friday, checking account balances that exceed $250,000 will no longer be covered under the FDIC's Transaction Account Guarantee Program at some banks.The FDIC's Transaction Account Guarantee Program will continue (insuring non-interest-bearing transactional accounts above $250,000), but the FDIC raised the fees and many banks have opted-out.

...

Although few individuals keep more than $250,000 in a checking account, many businesses and nonprofits do to handle payroll, accounts receivable and other cash-flow needs. Even a small business might occasionally have a balance exceeding $250,000 when a large payment comes in or a big bill is coming due.

The program was supposed to expire at the end of this year, but in August the FDIC announced it would continue through June 30. However, starting Friday the fee will jump to 15, 20 or 25 cents per $100 in insured deposits, depending on the bank's risk category.What matters for most people is that deposits are still insured up to $250,000. For more, here is the FDIC site: Your Insured Deposits

Banks had until Nov. 2 to tell the FDIC if they would opt out of the program at the end of this year. The FDIC could not say how many banks did, but many large ones - including Citibank, Bank of America, Chase and Wells Fargo - have disclosed they are dropping out.

House Prices: Stress Test, Price-to-Rent, and More

by Calculated Risk on 12/29/2009 11:46:00 AM

This following graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index (SA), October: 157.56

Stress Test Baseline Scenario, October: 142.3

Stress Test More Adverse Scenario, October: 130.6

House prices are 10.7% higher than the baseline scenario, and 20.6% higher than the more adverse scenario.

There were three key economic stress test parameters: house prices, GDP and unemployment. Both house prices and GDP are performing better than the baseline scenario, and unemployment is performing worse than both stress test scenarios.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through October 2009 using the Case-Shiller Composite Indices (SA): This graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices. For rents, the national Owners' Equivalent Rent from the BLS is used.

This graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices. For rents, the national Owners' Equivalent Rent from the BLS is used.

At the peak of the housing bubble it was obvious that prices were out of line with fundamentals such as price-to-rent, price-to-income and real prices. Now most of the adjustment in the price-to-rent ratio is behind us.

It appears the ratio is still a little high, and the recent increase was a combination of falling rents and rising house prices (probably due to the massive government intervention). I expect some further decline in prices, although it isn't as obvious as in 2005.

Comparison to LoanPerformance And finally, here is a graph of the LoanPerformance index (with and without foreclosures) and the Case-Shiller Composite 20 index. Earlier LoanPerformance announced that house prices fell 0.7% in October.

And finally, here is a graph of the LoanPerformance index (with and without foreclosures) and the Case-Shiller Composite 20 index. Earlier LoanPerformance announced that house prices fell 0.7% in October.

This graph shows the three indices with January 2000 = 100.

The indices mostly move together over time. Notice how the total LoanPerformance index fell further than the index excluding foreclosures - and also rebounded more.

The seasonally adjusted Case-Shiller index increased slightly in October and the LoanPerformance index showed a decline. However Case-Shiller is an average of three months, so there might be a decline next month.