by Calculated Risk on 12/29/2009 06:09:00 PM

Tuesday, December 29, 2009

Are Homes now "Cheap"?

First, from Brett Arends in the WSJ on May 6, 2008: Is Housing Slump at a Bottom?

Wellesley College Prof. Karl E. Case, one of the leading experts on the housing market in the country ... suggests we may be at, or near, the bottom of the housing crash.Total starts were at 574 thousand in November after falling to a low of 479 thousand earlier this year - half the number of starts from when Prof. Case called the bottom in 2008.

...

"It is really remarkable how much where we are today looks like the bottom we've had in the last three cycles," Mr. Case says. "Every time we've gone below a million starts, the market has cleared at that moment."

...

"It's bottom-fishing time, I think," says Mr. Case. "There's got to be bargains in Florida, Arizona and Nevada."

And on "bottom-fishing" in Florida, Arizona and Nevada: prices have fallen 23.5%, 31,3% and 36.4% in Miami, Phoenix and Las Vegas respectively since Prof. Case's suggestion in May 2008 using his own Case-Shiller index.

Why bring this up now? Because Brett Arends wrote in the WSJ today: Latest Home Price Data Is Good News for Buyers

Homes are now cheap.Mr. Arends does write that homes are not cheap everywhere, but his main argument is:

If you buy an average home today, and take out a 30-year mortgage at 5%, the annual bill for interest and repayment of principal will come to about 19 times typical weekly earnings ...He then provides a chart that shows this is the lowest level since the early '70s for this metric. Mr. Arends does add many cautions and caveats.

Well, allow me to retort.

House prices are not cheap nationally. This is apparent in the price-to-income, price-to-rent, and also using real prices. Sure, most of the price correction is behind us and it is getting safer to be a bottom caller! But "cheap" means below normal, and I believe that is incorrect.

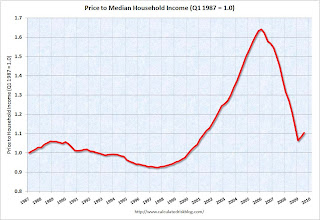

The following graph shows the price-to-income ratio using the Case-Shiller national index as of Q3 2009, and the Census Bureau's median income tables (assuming no increase for 2009).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 10% or so. A further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes.

The second graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices through October. For rents, the national Owners' Equivalent Rent from the BLS is used.

The second graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices through October. For rents, the national Owners' Equivalent Rent from the BLS is used.Although most of the adjustment in the price-to-rent ratio is behind us, it appears this ratio is still a little high.

As Mr. Arends also noted, this is national data, so beware of the local variations.

So why does Mr. Arends think "homes are now cheap"? Because he is using a measure of affordability based on mortgage interest rates. This is a mistake without further anlaysis.

Imagine this simplified example with a buyer willing to pay $1000 per month. With a 5% mortgage rate, the buyer could afford a $186,282 30 year fixed rate mortgage (principal and interest). But the buyer expects to sell the home in seven years, and he expects mortgage rates to be 7% then. That means the new buyer - who will also be willing to pay $1000 per month - can only afford a mortgage of $150,308.

So how does the affordability index account for this expected $36,000 loss? It doesn't.

It ends up in this simplified example, the current buyer would be willing to pay about $161,000 today because of the lower interest rate if he was planning on selling in seven years at $150,000 - excluding all expenses, transaction costs, tax savings, discount rates, etc. The actual calculation would be extremely complicated.

Sometimes it is smart to buy when "affordability" is low like in the early '80s when mortgage rates were very high - but smart buyers were expecting rates to fall. And sometimes it is smart not to buy when "affordability" appears high - like say last year when Mr. Arends wrote in May 2008:

[I]nterest rates are low right now. ... you can get a 30-year fixed-rate mortgage under 6%. If the economy recovers that won't last. If you are shopping for a home, it is probably worth seeing if you can lock in one of these rates cheaply.But the real key is to focus on supply and demand, and on the general fundamentals of price-to-income and price-to-rent (not perfect measures). House prices are not currently "cheap". They just aren't outrageously expensive nationally anymore.