by Calculated Risk on 10/27/2009 10:35:00 AM

Tuesday, October 27, 2009

House Prices: Stress Test and Price-to-Rent

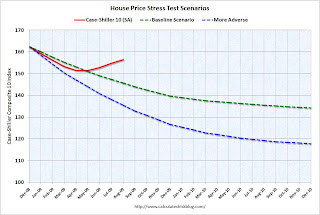

This following graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index (SA), August: 156.4

Stress Test Baseline Scenario, August: 145.6

Stress Test More Adverse Scenario, August: 135.5

House prices are 7.4% higher than the baseline scenario, and 15% higher than the more adverse scenario.

There were three key economic stress test parameters: house prices, GDP and unemployment. Both house prices and GDP are performing better than the baseline scenario, and unemployment is performing worse than both stress test scenarios.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through August 2009 using the Case-Shiller Composite Indices (SA): Click on image for larger graph in new window.

Click on image for larger graph in new window.

This graph shows the price to rent ratio (January 2000 = 1.0) for the Case-Shiller composite indices. For rents, the national Owners' Equivalent Rent from the BLS is used.

At the peak of the housing bubble it was obvious that prices were out of line with fundamentals. Now most of the adjustment in the price-to-rent ratio is behind us. It appears the ratio is still a little high, and I expect some further decline in prices - especially with rents now falling.

The BLS reported for September:

The increase [in CPI] occurred despite declines in the indexes for rent and owners' equivalent rent, the first decreases in those indexes since 1992.The decrease in OER was at an annual rate of 1.7% and based on media reports, and apartment surveys, it appears rents will continue to decline for some time. This will push up the price-to-rent ratio unless house prices fall.

Note: some would argue the price-to-rent ratio being a little too high is reasonable based on mortgage rates and "affordability".

Case-Shiller Home Price Index Increases in August

by Calculated Risk on 10/27/2009 09:15:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for August this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.5% from the peak, and up about 1.0% in August.

The Composite 20 index is off 31.3% from the peak, and up 1.0% in August. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 10.7% from August 2008.

The Composite 20 is off 11.4% from August 2008.

This is still a very significant YoY decline in prices.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (SA) in 16 of the 20 Case-Shiller cities in August.

Prices increased (SA) in 16 of the 20 Case-Shiller cities in August.

In Las Vegas, house prices have declined 55.6% from the peak. At the other end of the spectrum, prices in Dallas are only off about 4.8% from the peak - and up in 2009. Prices have declined by double digits from the peak in 18 of the 20 Case-Shiller cities.

The debate continues - is the price increase because of the seasonal mix (distressed sales vs. non-distressed sales), the impact of the first-time home buyer frenzy on prices, less supply because of modifications and the general slowdown in the foreclosure process, or have prices actually bottomed? My guess is we will see further house price declines in many areas.

I'll compare house prices to the stress test scenarios soon.

Case-Shiller Composite 20 Home Price Index Increases 1.2% in August

by Calculated Risk on 10/27/2009 09:10:00 AM

From MarketWatch: U.S. home prices rise 1.2% in Aug.: Case-Shiller

The market value of U.S. homes in 20 major cities rose by 1.2% compared with July [not seasonally adjusted] ... In August prices rose in 17 of 20 citiesJust headlines ... I'll post graphs after the data is released online.

Johnson and Kwak: The home-buyer tax credit: Throwing good money after bad

by Calculated Risk on 10/27/2009 08:18:00 AM

While we wait for the August Case-Shiller house prices ...

Simon Johnson and James Kwak write in the WaPo: The home-buyer tax credit: Throwing good money after bad.

What happens when you artificially prop up housing prices? Imagine the credit were expanded to all home buyers and made permanent. This would simply boost housing prices at the low end of the market by close to $8,000, since all buyers would be willing to pay $8,000 more. (Prices would rise by a little less than $8,000 because at higher prices, more people would be willing to sell.) Whom does this benefit? Not first-time home buyers. It benefits people who already own houses (and their real estate agents) because it's a one-time boost in housing values. This would be just the latest chapter in a long history of government policies to boost housing prices -- the mortgage interest tax deduction, the capital gains exclusion on houses, the extension of the mortgage interest tax deduction to second houses, etc. Each of these policies pushes up prices just once; if you want to keep pushing up housing prices, you have to keep adding sweeteners.

A temporary tax credit has a similar effect, but for a shorter period of time. It boosts the price of a transaction that would have happened anyway. It may create additional transactions, but is that a good thing? If someone could not have afforded a house without the tax credit, then what is he or she going to do when the tax credit goes away and the price of the house falls? In effect, the tax credit is a way of making houses temporarily affordable that would not otherwise be affordable, and we know where that leads.

emphasis added

Monday, October 26, 2009

A Little Good News for Retail CRE in Britain

by Calculated Risk on 10/26/2009 10:14:00 PM

From The Times: Land Securities calls halt to softer retail rent deals as demand rises

Francis Salway, the chief executive of Land Securities [Britain’s biggest property developer], said that he would no longer offer rental deals amid signs of increasing demand for space. ... "[W]e do not believe across-the-board changes to agreed contracts are appropriate.”Rents might fall further - because of high vacancy rates - but it seems there is some increase in demand, and Land Securities is no longer willing to offer across-the-board concessions to existing contracts (but they will cut deals in special cases).

...

A spokesman for British Land, the UK’s second-biggest property company, said: "British Land is seeing more demand from new and existing tenants. ..."

Of course the "good news" is relative ... the retail vacancy rate in the U.K. is up significantly from last year - From RetailWeek: Vacancy rates almost treble

Vacant shops on the UK high street have almost trebled in the last year from just over 4 per cent to 12 per cent at the end of June.

Big cities such as Liverpool, Leeds and Derby are now suffering over 20 per cent vacancy rates ...

CRE Prices: Healthy and Distressed

by Calculated Risk on 10/26/2009 06:59:00 PM

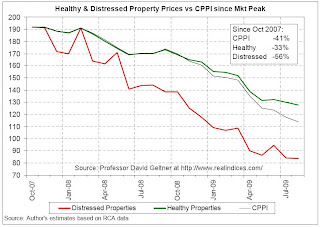

Last week it was reported CRE prices were off 41% according to the Moodys/REAL Commercial Property Price Index (CPPI).

MIT Professor David Geltner discusses the index and the differences between price declines for healthy and distressed properties: Where we are in the aggregate: A two-year anniversary ... (pdf)

Note: Dr. Geltner's column appears on Real Estate Analytics LLC website on the lower right under "Professor's Corner".

From Dr. Geltner:

August 2009 marks the two-year anniversary of the CPPI’s “real peak”, that is, the price index peak adjusted for inflation (the nominal peak was two months later). To celebrate, the CPPI fell for the eleventh month in a row, dropping another 3.5 points, or 3%, to a value just above 114, down from 192 in October 2007. Through August the index is down 29% in 2009, 33% over the past 12 months, and close to 41% since that 192 value in October 2007. The current index level of 114 implies average market transaction prices in August 2009 at levels where they were in the spring of 2003.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from Dr. Geltner shows the price declines for healthy and distressed properties.

Based on the same repeat-sales database as the CPPI, the chart uses RCA’s identification of “troubled assets” to produce separate indices of “healthy” and “distressed” property price movements since the October 2007 peak. The chart reveals that, through August 2009, while the overall CPPI has dropped 41%, “distressed” properties (indicated by the RCA “troubled asset” designation) have dropped 56%, while “healthy” properties (those not flagged by the RCA “troubled asset” designation) have dropped “only” 33%.** See Dr. Geltner's piece for a description of the methodology.

The chart of the “healthy” and “distressed” property price movements since the peak provides a compelling visualization of the bifurcation in the U.S. commercial property market that many industry participants have noted anecdotally.There is much more in the piece.

...

Sales of “healthy” properties has remained nearly stagnant. Distressed property transactions made up a record 25% of the repeat-sales observations in the August CPPI.

SF Fed: Recent Developments in Mortgage Finance

by Calculated Risk on 10/26/2009 03:30:00 PM

From San Francisco Fed Senior Economist John Krainer: Recent Developments in Mortgage Finance

As the U.S. housing market has moved from boom in the middle of the decade to bust over the past two years, the sources of mortgage funding have changed dramatically. The government-sponsored enterprises—Fannie Mae, Freddie Mac, and Ginnie Mae—now own or guarantee an overwhelming share of originations. At the same time, non-agency mortgage securitization and loans retained in lender portfolios have largely dried up.

Click on graph for slightly larger in new window.

Click on graph for slightly larger in new window.This is figure 3 from the Economic Letter. This shows the surge in non-agency securitized loans, and loans held in bank portfolios, in 2004 through 2006 (the worst loans).

[T]he sources of mortgage finance have shifted as the housing market has gone from boom to bust. Figure 3 plots the evolution of these funding sources over the past decade. Fannie Mae and Freddie Mac combined have consistently been the largest players in the market, owning or guaranteeing about half or more of the mortgages in the sample at any given time. Non-agency securitization peaked in the first quarter of 2006, when it accounted for nearly 40% of new originations. Finally, the share of mortgages retained in the originating institution's portfolio averaged about 15% throughout the boom, but has fallen considerably since.Although Krainer doesn't mention it, notice the increase in bank portfolio loans in early 2007 - that was probably because the banks were stuck with loans when the securitization market seized up.

...

In the present day, when Ginnie Mae's activities are included, the three GSEs are providing unprecedented support to the housing market—owning or guaranteeing almost 95% of the new residential mortgage lending.

Krainer concludes:

With the vast majority of current mortgage lending now intermediated in some form by the GSEs, it will be difficult for the housing market to return to normal.Note: Tanta wrote this last year on the naming of the GSEs: On Maes and Macs. An excerpt:

Trivia buffs will know that once upon a time there were three "agencies": the Government National Mortgage Association, the Federal National Mortgage Association, and the Federal Home Loan Mortgage Corporation. It didn't take all that long for market participants to start coming up with pronunciations for the abbreviations GNMA (Ginnie Mae), FNMA (Fannie Mae), and FHLMC (Freddie Mac, which makes no sense whatsoever except that nobody liked "Filly Mac." ... Old farts whose favorite childhood treat was a box of Pixies will remember the old-time candy company Fannie May, whose name is said to have inspired the whole thing, probably in the throes of a major sugar rush.

Report: First Time Homebuyer Tax Credit to be Phased Out

by Calculated Risk on 10/26/2009 01:01:00 PM

Update: The Reid/Baucus proposal is to extend the tax credit and phase it out over 2010. The credit would be $8,000 through the end of Q1 2010, and decline $2,000 per quarter after that ... ($6,000 in Q2, $4,000 in Q3, $2,000 in Q4 2010)

From Bloomberg: Housing Tax Credit Probably Won’t Be Extended in U.S., ISI Says

“There could be an agreement reached as early today on the Reid/Baucus amendment that would PHASE OUT (not extend, as we originally understood when the idea was first proposed last week) the home buyer tax credit,” ISI analysts said in the note.We should know more soon. Most economists oppose an extension of the tax credit because it is poorly targeted, very expensive per additional home sold, there was little job creation, fraud was widespread, and there are many serious unintended consequences.

ATA Truck Tonnage Index Declines in September

by Calculated Risk on 10/26/2009 11:28:00 AM

From the American Trucking Association: ATA Truck Tonnage Index Slipped 0.3 Percent in September Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 0.3 percent in September, after increasing 2.1 percent in both July and August. The latest decline lowered the SA index to 103.9 (2000=100). ...Trucking has benefited from some inventory restocking, and exports - two key positive areas for the economy, however further growth will probably be "modest" and "choppy" until there is a pickup in domestic end demand.

Compared with September 2008, SA tonnage fell 7.3 percent, which was the best year-over-year showing since November 2008. In August, the index was down 7.5 percent from a year earlier.

ATA Chief Economist Bob Costello said that the latest reading fits with the premise that the recovery will be moderate and choppy. “The trucking industry should not be alarmed by the very small decrease in September,” Costello noted. “We took two steps forward in July and August and this was a miniscule step backward.” He added that the industry should be prepared for ups and downs in the months ahead, but the general trend should be modest improvement. ...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.2 billion tons of freight in 2008. Motor carriers collected $660.3 billion, or 83.1 percent of total revenue earned by all transport modes.

Chicago Fed Index: Near Pre-Recession Levels

by Calculated Risk on 10/26/2009 08:50:00 AM

From the Chicago Fed: Index shows economic activity approaching pre-recessionary levels

The Chicago Fed National Activity Index was –0.81 in September, down from –0.65 in August. Three of the four broad categories of indicators made negative contributions to the index in September, but the production and income category made a positive contribution for the third consecutive month.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"At –0.63 in September (up from –0.96 in the previous month), the index’s three-month moving average, CFNAI-MA3, suggests that growth in national economic activity was below its historical trend. However, the CFNAI-MA3 in September improved to a level greater than –0.7 for the first time since the early months of this recession. For the four previous recessions, the first month when the CFNAI-MA3 was above –0.7 coincided closely with the end of each recession as eventually determined by the National Bureau of Economic Research."

This index suggests that the official recession might be over. However the index is still fairly weak.