by Calculated Risk on 10/06/2009 07:00:00 PM

Tuesday, October 06, 2009

Small Business and Employment

Atlanta Fed research economist Melinda Pitts writes at Macroblog: Prospects for a small business-fueled employment recovery

In a speech yesterday, William Dudley, the president of the Federal Reserve Bank of New York, identified financial constraints for small businesses as a restraint on the pace of economic recovery.Dr. Pitts excerpt from William Dudley's speech, and then notes:

President Dudley's comments are even more relevant in the current recession if one considers the disproportionate effect the recession has had on very small businesses.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Graph Credit: Melinda Pitts, Atlanta Fed research economist and associate policy adviser

This graph breaks down net job gains and losses by firm size since 1992. During the current employment recession, small firms have accounted for about 45% of the job losses - much higher than during the 2001 recession.

Dr. Pitts cautions:

Looking ahead, it's not clear whether small businesses will continue to play their traditional role in hiring staff and helping to fuel an employment recovery. However, if the above-mentioned financial constraints are a major contributor to the disproportionately large employment contractions for very small firms, then the post-recession employment boost these firms typically provide may be less robust than in previous recoveries.

Starwood to Buy Corus Assets

by Calculated Risk on 10/06/2009 04:00:00 PM

From Zachery Kouwe and Eric Dash at the NY Times DealBook: Sternlicht, Ross Strike Deal for Corus Assets

The Federal Deposit Insurance Corporation plans to announce on Tuesday that it will sell about $4.5 billion of troubled real estate loans that it recently seized from Corus Bancshares to a group of private investment firms led by the Starwood Capital Group ...The details are not available yet.

Under the terms of the complex deal, Starwood and its business partners agreed to pay $554 million for a 40 percent equity stake in the loan pool while the F.D.I.C. keeps a 60 percent stake ... By providing guaranteed financing to the buyers, the government hopes that they will be able finish developing the condo projects or turn them into apartments or hotels.

...

The sale reflects an estimated price of about 50 cents on the dollar for the batch of troubled loans ...

Inland Empire Retail Vacancy Rate Increases

by Calculated Risk on 10/06/2009 02:45:00 PM

Just to complete the CRE circle: rising vacancy rates for apartments, offices, and retail ...

From the Press Enterprise: Vacancy rates among Inland retailers mounts

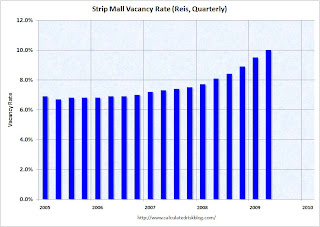

... Inland retail vacancy rates in the third quarter [were] 11.2 percent ...The REIS national Q3 retail vacancy rates will be released soon, but here is a preview based on the Q2 numbers:

That marked a rise from 10.6 percent in the prior quarter, and was well up from 7.6 percent in the third quarter of 2008, according to new data from commercial real estate broker CB Richard Ellis.

...

"I think we're going to be seeing these trends for the rest of this year and for much of 2010," said Matt Burnett, senior associate in the Ontario office of CB Richard Ellis.

Click on graph for larger image in new window.

Click on graph for larger image in new window.In Q2, the U.S. strip mall vacancy rate hit 10%, the highest level since 1992.

"Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."

Victor Calanog, director of research for Reis Inc, July 2009

Report: Manhattan Office Vacancy Rate Increases, Rents Decline

by Calculated Risk on 10/06/2009 11:43:00 AM

From Bloomberg: Manhattan Office Vacancies Reach Five Year High, Cushman Says

Manhattan’s third-quarter office vacancy rate hit a five-year high ... The rate rose to 11.1 percent, the highest since the third quarter of 2004, New York-based broker Cushman & Wakefield said in a statement today. Rents fell 5.2 percent from the second quarter to $57.08 a square foot and were down 22 percent from a year earlier.Yesterday, NY Fed President commented about falling commercial real estate prices:

emphasis added

First, the capitalization rate—the ratio of income to valuation—has climbed sharply. At the peak, capitalization rates for prime properties were in the range of 5 percent. That means that investors were willing to pay $20 for a $1 of income. Today, the capitalization rate appears to have risen to about 8 percent. That means that the same dollar of income is now capitalized as worth only $12.50. In other words, if income were stable, the value of the properties would have fallen by 37.5 percent. Second, the income generated by commercial real estate has generally been falling.According to Cushman, rents are off 22% over the last year (probably more since the peak), and combined with the higher cap rate, Dudley's estimate suggests office building prices have fallen by half or more in New York.

There was a little good news in the Cushman report:

Sublease space declined to 11.1 million square feet from 11.4 million at mid-year, the first drop since the end of 2007, Cushman said.However the vacancy rate is still expect to rise further, perhaps to 14% in New York according to Cushman.

“A decline in sublease space is indicative of the market beginning to move towards stabilization,” said Joseph Harbert, chief operating officer for Cushman’s New York metropolitan region.

The national office vacancy data from REIS will be released soon.

NRF Forecasts One Percent Decline in Holiday Retail Sales

by Calculated Risk on 10/06/2009 08:50:00 AM

From the National Retail Federation: NRF Forecasts One Percent Decline in Holiday Sales

The National Retail Federation today released its 2009 holiday forecast, projecting holiday retail industry sales to decline one percent this year to $437.6 billion.* While this number falls significantly below the ten-year average of 3.39 percent holiday season growth, the decline is not expected to be as dramatic as last year’s 3.4 percent drop in holiday retail sales ...Notice the focus on cost controls, and that suggests retail hiring for the holiday season will be weak.

“The expectation of another challenging holiday season does not come as news to retailers, who have been experiencing a pullback in consumer spending for over a year,” said NRF President and CEO Tracy Mullin. “To compensate, retailers’ focus on the holiday season has been razor-sharp with companies cutting back as much as possible on operating costs in order to pass along aggressive savings and promotions to customers.”

* NRF defines “holiday sales” as retail industry sales in the months of November and December. Retail industry sales include most traditional retail categories including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

Here is a repeat of a graph from a post a couple weeks ago: Retail Hiring Outlook "Jobs Scarce"

Click on graph for larger image in new window.

Click on graph for larger image in new window.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. This graph shows the historical net retail jobs added for October, November and December by year.

Based on the NRF forecast, seasonal retail hiring might be around 400 thousand again in 2009.

More from Ylan Mui at the WaPo: Retailers Hope for Holiday Cheer

The retail federation's forecast "is a good number in that it shows stabilizing in sales," NRF spokesman Scott Krugman said. "However, it also acknowledges that the recovery is not going to be consumer-led."Typically recoveries are consumer led, and then the increase in end demand eventually leads to more business investment. Not this time. Just another reminder that the typical engines of recovery are still misfiring.

Apartment Vacancy Rate at 23 Year High

by Calculated Risk on 10/06/2009 12:20:00 AM

From Reuters: US apartment vacancy rate hits 23-year high-report

The U.S. apartment vacancy rate rose to 7.8 percent in the third quarter, its highest since 1986, ... according to Reis.Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a record 10.6% in Q2 2009. This also fits with the NMHC apartment market survey.

...

"It makes me wonder whether the avalanche is on its way for office and retail (real estate) unless things change really quickly and really drastically," Victor Calanog, Reis director of research, said.

Reis still expects the U.S. apartment vacancy rate to pass the 8 percent mark by perhaps next quarter but certainly by next year, Calanog said. That would make it the highest vacancy rate since Reis began tracking the market in 1980.

In the third quarter, the U.S. apartment asking rental rate fell 0.5 percent to $1,035 per month, the fourth consecutive declining quarter. ...

Rising vacancies. Falling Rents. Here comes the Fed's nightmare.

Monday, October 05, 2009

Sorkin Book Excerpt: "Too Big to Fail"

by Calculated Risk on 10/05/2009 10:48:00 PM

From Vanity Fair: Wall Street’s Near-Death Experience (ht jb)

The Vanity Fair piece is an excerpt from Andrew Ross Sorkin's "Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System---and Themselves" to be released on October 20th.

Sunday, September 21, 2008: The Last StandThe Vanity Fair excerpt is a page-turner.

...

Upstairs, [Morgan Stanley CEO John] Mack was on the phone with Mitsubishi’s chief executive, Nobuo Kuroyanagi, and a translator trying to nail down the letter of intent. His assistant interrupted him, whispering, “Tim Geithner is on the phone—he has to talk to you.”

Cupping the receiver, Mack said, “Tell him I can’t speak now. I’ll call him back.”

Five minutes later, Paulson called. “I can’t. I’m on with the Japanese. I’ll call him when I’m off,” he told his assistant.

Two minutes later, Geithner was back on the line. “He says he has to talk to you and it’s important,” Mack’s assistant reported helplessly.

Mack was minutes away from reaching an agreement. He looked at Ji-Yeun Lee, who was standing in his office helping with the deal, and told her, “Cover your ears.”

“Tell him to get fucked,” Mack said of Geithner. “I’m trying to save my firm.”

NY Fed's Dudley: Downside Risks to Inflation for "next year or two"

by Calculated Risk on 10/05/2009 08:00:00 PM

From NY Fed President William Dudley: A Bit Better, But Very Far From Best

... My assessment of where things stand today is mixed. On the positive side, the financial markets are performing better and the economy is now recovering. ...There is much more in the speech about resource slack and the Fed's tools "to exit smoothly from the very low federal funds rate".

On the negative side, the unemployment rate is much too high and it seems likely that the recovery will be less robust than desired. This means that the economy has significant excess slack and implies that we face meaningful downside risks to inflation over the next year or two. ...

... I also suspect that the recovery will turn out to be moderate by historical standards. This is a disappointing outcome in that growth will likely not be strong enough to bring the unemployment rate—currently 9.8 percent —down quickly.

I see three major forces restraining the pace of this recovery. First, households are unlikely to have fully adjusted to the net wealth shock that has been generated by the housing price decline and the weakness in share prices. ...

The shock to household net worth seems likely to have several important implications for household behavior. The shock creates a risk that the household saving rate could increase further. For example, during the period from 1990 to 1992, the household saving rate averaged about 7 percent of disposable personal income, considerably higher than the 4.3 percent average rate during the first half of this year. If the household saving rate were to rise, then consumption would rise more slowly than income, making it more difficult for the economy to develop strong forward momentum. ...

The second force that could restrain the recovery is the fiscal outlook. The fiscal stimulus that is currently providing support to economic activity is temporary rather than permanent. This has to be the case if we are to ensure that fiscal policy is on a sustainable path over the long-run. This means that the positive impulse from fiscal stimulus will abate over the next year.

The third, and perhaps most important factor, is that the banking system has still not fully recovered. Bank credit losses lag the business cycle and are still climbing. ...

The commercial real estate sector is under particular pressure because the fundamentals of the sector have deteriorated sharply and because the sector is highly dependent upon bank lending. In terms of the fundamentals, there are two problems. First, the capitalization rate—the ratio of income to valuation—has climbed sharply. At the peak, capitalization rates for prime properties were in the range of 5 percent. ... Today, the capitalization rate appears to have risen to about 8 percent. ... Second, the income generated by commercial real estate has generally been falling. ...

The decline in commercial real estate valuations has created a significant amount of “rollover risk” when commercial real estate loans and mortgages mature and need to be refinanced. ... This means that more pain likely lies ahead for this sector and for those banks with heavy commercial real estate exposures.

For small business borrowers, there are three problems. First, the fundamentals of their businesses have often deteriorated because of the length and severity of the recession—making many less creditworthy. Second, some sources of funding for small businesses—credit card borrowing and home equity loans—have dried up as banks have responded to rising credit losses in these areas by tightening credit standards. Third, small businesses have few alternative sources of funds. ...

All of these factors will tend to inhibit the pace of the economic recovery. Given that the recovery is starting with an abnormally large amount of slack, and the pace of recovery is not likely to be robust, this means the economy is likely to have significant excess resources for some time to come. As a result, the balance of risks to inflation lies on the downside, not the upside, at least for the next year or two.

...

In summary, I believe the current balance of risks around the inflation outlook lie to the downside due to the very low level of resource utilization and the fact that long-run inflation expectations remain stable. This balance of risks is problematic because the current level of inflation is already so low—the core PCE (personal consumption expenditures) deflator has increased only 1.3 percent over the past 12 months. Thus, we would not need much of a decline in inflation to run the risk of an outright deflation. Outright deflation, in turn, would be a dangerous development because it would drive up real debt burdens and make it much more difficult for households and businesses to deleverage.

emphasis added

CityCenter Las Vegas Cuts Condo Prices 30% for Existing Buyers

by Calculated Risk on 10/05/2009 05:59:00 PM

Press Release: CityCenter Announces Residential Price Reductions (ht Charlie)

CityCenter ... on the Las Vegas Strip, has announced that a 30 percent price reduction will be offered at closing to the existing buyers of CityCenter's three luxury residential offerings: The Residences at Mandarin Oriental, Las Vegas, Veer Towers and Vdara Condo Hotel.This is a price concession to existing buyers; those buyers who originally signed contracts starting in January 2007. This is an attempt to get those buyers to close escrow and not walk away from their deposits.

"We believe that in this economic climate this price reduction is an appropriate step to take on behalf of our buyers so as to provide them greater flexibility in closing on their residences," said Bobby Baldwin, president and CEO of CityCenter.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Case-Shiller house price index for Las Vegas.

The CityCenter condos were first offered for sale in January 2007 (almost at the price peak), and prices in Las Vegas have fallen 55% since then according to Case-Shiller.

The Case-Shiller index suggests these buyers will still be far underwater.

New York Income Tax Revenue Falls 36%

by Calculated Risk on 10/05/2009 02:05:00 PM

From Bloomberg: New York Income Tax Revenue Falls 36% in Year, Paterson Says (ht Mike In Long Island)

New York State’s income tax revenue has dropped 36 percent from the same period in 2008 ...And in Massachusetts from Reuters: Massachusetts government to announce emergency budget cuts

“We added personal income tax, which we thought would make the falloff 10 percent to 15 percent,” Paterson ... referring to $5.2 billion in new or increased taxes. “This is what is so frustrating. It’s still 36 percent, meaning our revenues fell more in 2009 than they did in 2008.”

...

Besides boosting taxes for the fiscal year that began April 1, lawmakers made $5.1 billion in spending cuts. The plan also includes $6.2 billion in federal stimulus money and $1.1 billion in one-time revenue ...

Massachusetts officials have begun identifying emergency cuts to make to the fiscal year 2010 budget after the state's September tax revenue collections missed their target, Governor Deval Patrick said on Friday.And this will lead to cuts in state and local employment (tend to lag private sector cuts).

"Our cabinet has effectively managed through a $7 billion gap already" with spending cuts, layoffs and other measures, Patrick said. "But today's news means we have more to do."

September's monthly tax collection totaled $1.766 billion, an estimated $243 million below its target, highlighting the state's struggling finances in the midst of the recession.