by Calculated Risk on 7/28/2009 03:43:00 PM

Tuesday, July 28, 2009

A Few Comments on Housing Reports

This is very different for me ...

First, if I've let a little hubris slip into my recent posts, I apologize. My goal is to be the most humble blogger in the world (an old joke).

Second, I am not an investment advisor and I do not offer investment advice. I try to provide some hopefully useful data with sources - especially concerning real estate - and then add my own analysis. Nothing here is intended as investment advice.

Please keep the above in mind ... and although I rarely discuss investing, I'd like to quickly explain why I went mostly long in my own portfolio in late February and early March. Several readers can vouch for my change in view (like Brian and Michael). I only share my investment ideas with people I know - and who I know are responsible for their own actions.

Sentiment in February and March was for a Great Depression II, and it was clear to me that several key indicators were about to change: auto sales, single family starts and new home sales were three I mentioned frequently on this blog. I figured when that data changed, the sentiment would change. Buying at the time was difficult. And yes, I'm still long (although that could change at any time, and I will not disclose it).

The reason I bring this up is the Case-Shiller report today really bothered me. To be more accurate, the reporting on the Case-Shiller report bothers me. As I mentioned earlier today, there is a strong seasonal component to house prices, and although the seasonally adjusted Case-Shiller index was down (Case-Shiller was reported as up by the media) - I don't think the seasonal factor accurately captures the recent swings in the NSA data.

I have no crystal ball - and maybe prices have bottomed - but this potentially means a negative surprise for the market later this year - perhaps when the October or November Case-Shiller data is released (October will be released near the end of December). If exuberance builds about house prices, and the market receives a negative surprise, be careful. Just something to watch later this year (I will post about house prices, but I will not mention the possible impact on the stock market in future posts).

And a few comments on the reporting today. The WSJ reported: Home Prices Post Monthly Increase, Data Are Latest to Signal a Bottom in the Property Market

The Case-Shiller index of home prices in 20 metropolitan areas, produced by Standard & Poor's, rose 0.5% in May from the month before, the first increase after 34 straight months of decline.No mention that they are using the NSA data. And this would be a weird housing cycle if residential investment and house prices bottomed at almost the same time. See: Housing: Remember the Two Bottoms!

And from MSNBC: Crescenzi: Case-Shiller Supports Risk Assets

If there’s one indicator that investors are likely to embrace as their yardstick for the housing market predicament it is the Case-Shiller home price index. This is the index that turned lower in 2006, presaging the eruption of the credit crisis. Its apparent stabilization hence marks a turn in the housing dilemma.Like I said, I could be wrong about prices ... but this is the kind of information that is being disseminated by the MSM, and that means a negative surprise is possible.

Although a plethora of data have pointed to stabilization in housing of late, only the Case-Shiller index has the power to sway doubters, chiefly because it captures trends in the subprime mortgage market better than other indicators.

Not to just pick on the MSM reporting. I was sent (by several readers) a housing analysis yesterday. It was some sort of weird mash up between the excellent David Rosenberg and some blogger. The charts are great, but the analysis is sometimes inaccurate. The "research" made comments like this for the NAHB HMI: “Sales outlook is stuck at 26, and anything under 50 is a contraction”. Not correct. The NAHB index is a sentiment indicator and doesn’t indicate contraction. Any number under 50 indicates more builders view sales as poor than good. See this chart - the index moves with new home sales and housing starts. And another example: "Architectural billings Index slipped five points last month to 37.7 - a sign residential construction is just bouncing along bottom". The ABI is primarily for non-residential construction.

I'm not trying to pick on or embarrass any particular publication or blogger. But it helps to know your sources. And I could be wrong about prices; we will know when the October and November data is released (a six month wait!)

Best to all. Now back to my regular posts ...

CRE: Office Building Owners Walk Away

by Calculated Risk on 7/28/2009 03:24:00 PM

From the SF Gate: S.F. tower's owners will forfeit it to lender (ht John, Jay)

The owners of a premier San Francisco office tower plan to forfeit the property to their lenders, the city's second distressed transaction involving a major commercial building in recent weeks ...Probably another half off sale (or worse) coming up. It is amazing that 75% of downtown San Francisco Class A office building were sold between 2005 and 2007.

Hines and Sterling American Property decided to transfer their interest in 333 Bush St. to the original financers, following the surprise dissolution of law firm Heller Ehrman in September ... The 118-year-old law firm defaulted on its 250,000-square-foot lease, leaving the nearly 550,000-square-foot property 65 percent vacant.

... Hines and Sterling bought the tower for $281 million in 2007, near the top of the market, when it was 75 percent leased.

The partnership is handing the property to Brookfield Real Estate Finance and Munich Hypo Bank ...

...

More distressed deals are expected. Nearly three-quarters of Class A office buildings downtown sold between 2005 and 2007 ...

Walking away in the City by the Bay will become common. At least it's a nice place to take a walk ...

Fed's Yellen: Outlook for the U.S. Economy and Community Banks

by Calculated Risk on 7/28/2009 12:36:00 PM

From San Francisco Fed President Janet Yellen: Outlook for the U.S. Economy and Community Banks. A few excerpts:

[T]he normal dynamics of the business cycle are turning more favorable. Some sectors are poised to rebound simply because they have sunk so low. For example, the auto industry has cut production so far that inventories have begun to shrink, even in the face of historically weak demand. Just slowing the pace of inventory liquidation will bolster economic activity. This story holds for many sectors of the economy where spikes in inventories occurred as cautious consumers cut back on purchases of durable goods, and businesses slashed spending on equipment and software. Looking forward, the demand for houses and durables should also eventually revive as old and broken-down goods need to be replaced. The resulting demand will help the economy recover.And on community banks:

But that recovery is likely to be painfully slow. History teaches that it often takes a long while to recover from downturns caused by financial crises. Financial institutions and markets won’t heal overnight. And it will take quite some time before households have repaired their tattered finances. Until recently, households were saving less and borrowing more in response to wealth gains in both stocks and housing. This pattern made their balance sheets vulnerable to adverse developments and the crashes in both house and stock prices during the last two years destroyed trillions of dollars of their wealth. Not surprisingly, the personal saving rate has now shot higher and I expect to see subdued consumer spending for some time. The unprecedented global nature of the recession also will act as a drag. Countries recovering from financial crises often receive a boost from foreign demand, but neither the United States nor its trading partners can count on such external stimulus this time.

A gradual recovery means that things won’t feel very good for some time to come. The unemployment rate currently is 9½ percent, and this figure is likely to rise further. Moreover, even after the economy begins to grow, it could still take several years to return to full employment. The same is true for capacity utilization in manufacturing, which has declined so far that it has fallen “off the charts”—now standing at its lowest level in the postwar period.

Finally, even though downside risks to the outlook have diminished, there remains some chance that economic conditions could turn out worse than what I’ve sketched. High on my worry list is the possibility of another shock to the still-fragile financial system. Commercial real estate is a particular danger zone...

Now let me turn to the business environment facing banks. The industry is going through one of the most difficult periods in modern times. ... Bank profits are down, loan delinquencies are up, and failures are climbing.

... Recessionary effects normally take some time to work their way through loan portfolios. So, even though I expect economic growth to resume in the second half of this year, banking conditions are likely to remain quite weak for another year or two.

To date, the community banks under greatest financial stress are those with high real estate concentrations in construction and land development lending. Banks that liberally funded speculative housing and condominium construction, and those that funded land acquisition and development, have been hardest hit. Over 20 District financial institutions have failed since last year. The vast majority of them had high concentrations in residential construction and development lending. In fact, these banks had construction loans that averaged about 40 percent of their loan portfolio, well above the District average of 16 percent. Unfortunately, some banks that aggressively pursued these loans had weak appraisal and risk-monitoring systems.

The next area of significant vulnerability for the banking system, particularly for community and regional banks with real estate concentrations, is income-producing office, warehouse, and retail commercial property. Market fundamentals in most western states are deteriorating. Vacancy rates are rising and rent pressures are hurting property cash flows. Office vacancy rates in both Boise and Portland are expected to reach or exceed 20 percent over the next year or two, the highest rates these cities have seen in many years. Retail shopping centers are struggling with falling occupancy rates and pressures to grant rent concessions. Property values are falling sharply across wide areas of the country, including the Pacific Northwest. Some analysts forecast that commercial property values could experience falls similar to housing of 30 to 40 percent.

...

Our biggest concern now is with maturing loans on depreciated commercial properties. In many cases, borrowers seeking to refinance will be expected to provide additional equity and to have underwriting and pricing adjusted to reflect current market conditions. In some cases, borrowers won’t have the resources to refinance loans.

Case-Shiller House Price Seasonal Adjustment and Comparison to Stress Tests

by Calculated Risk on 7/28/2009 10:48:00 AM

Case-Shiller released the May house price index this morning, and most news reports focused on the small increase, not seasonally adjusted (NSA), from April to May. As I noted earlier, the seasonally adjusted (SA) data showed a small price decline from April to May.

Case-Shiller reported that prices fell at a 2.5% annual rate in May (SA).

However I think the seasonal factor might be insufficient during the current period.

The following graph shows the month-to-month change of the Case-Shiller index for both the NSA and SA data (annualized). Note that Case-Shiller uses a three-month moving average to smooth the data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Blue line is the NSA data. There is a clear seasonal pattern for house prices.

The red dashed line is the SA data as provided by Case-Shiller.

The seasonal adjustment appears pretty good in the '90s, but it appears insufficient now. I expect that the index will show steeper declines, especially starting in October and November.

The second graph compares the Case-Shiller Composite 10 SA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts).

NOTE: I'm now using the Seasonally Adjusted (SA) composite 10 series. The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Edit correction: All data for May.

Case-Shiller Composite 10 Index, May: 151.13

Stress Test Baseline Scenario, May: 150.85

Stress Test More Adverse Scenario, May: 143.81

So far house prices are tracking the baseline scenario, but I believe the seasonal adjustment is insufficient and prices will decline faster in the Fall.

Case-Shiller Prices Fall in May Seasonally Adjusted

by Calculated Risk on 7/28/2009 09:41:00 AM

Just a note to the previous post.

Case-Shiller has released the Seasonally Adjusted house price index.

Prices fell slightly in May (compared to April) for the Composite 10 and Composite 20 indexes.

Seasonally adjusted, prices fell in 12 of the 20 Case Shiller cities.

There is a strong seasonal pattern to house prices, and it is important to use the SA data. Unfortunately Case-Shiller did not release the SA data earlier this morning. This has lead to numerous incorrect headlines about prices increasing from April to May. That is correct, if they mention the data is Not Seasonally Adjusted.

Case-Shiller House Prices for May

by Calculated Risk on 7/28/2009 09:00:00 AM

Important Note: Case-Shiller hasn't released the Seasonally Adjusted data yet for May. There is a strong seasonal pattern for prices and this is the NSA data.

S&P/Case-Shiller released their monthly Home Price Indices for May this morning.

This monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national index. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 33.3% from the peak, and up slightly in May.

The Composite 20 index is off 32.3% from the peak, and up slightly in May.

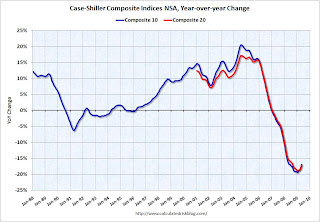

NOTE: This is the NSA data, prices probably fell using the SA data. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 16.8% over the last year.

The Composite 20 is off 17.1% over the last year.

This is still a very strong YoY decline.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices increased (NSA) in 14 of the 20 Case-Shiller cities in May. In Phoenix, house prices have declined 54.5% from the peak. At the other end of the spectrum, prices in Dallas are only off about 8% from the peak. Prices have declined by double digits almost everywhere.

Prices increased (NSA) in 14 of the 20 Case-Shiller cities in May. In Phoenix, house prices have declined 54.5% from the peak. At the other end of the spectrum, prices in Dallas are only off about 8% from the peak. Prices have declined by double digits almost everywhere.

I'll compare house prices to the stress test scenarios soon.

Monday, July 27, 2009

WaPo: Foreclosures Frequently Best Alternative for Lenders

by Calculated Risk on 7/27/2009 11:57:00 PM

Note: I covered this research a few weeks ago: Researchers: "Few Preventable Foreclosures", but this is worth repeating ...

From the WaPo: Foreclosures Are Often In Lenders' Best Interest

Government initiatives to stem the country's mounting foreclosures are hampered because banks and other lenders in many cases have more financial incentive to let borrowers lose their homes than to work out settlements, some economists have concluded.If the option is foreclosure or modification - and the modification will work, then the economics favor foreclosure.

Policymakers often say it's a good deal for lenders to cut borrowers a break on mortgage payments to keep them in their homes. But, according to researchers and industry experts, foreclosing can be more profitable.

The problem is it is hard to tell if the borrowers will self-cure or redefault.

Nearly a third of the borrowers who miss two payments are able to self-cure without help from their lender, according to the Boston Fed study. Separately, Moody's Economy.com, a research firm, estimated that about a fifth of those who miss three payments will self-cure.And on redefault:

Lenders also worry that borrowers may re-default even after receiving a loan modification. This only delays foreclosure, which can be costly to the lender because housing prices are falling throughout the country and the home's condition may deteriorate if the owner isn't maintaining it. In some cases, lenders lose twice as much foreclosing on a home as they did two years ago, said Laurie Goodman, senior managing director at Amherst Securities.When you compare the losses from foreclosure to the losses from modifications - and include self-cure risk and redefault risk - the researchers argue there are very few preventable foreclosures.

Just something to remember, meanwhile from the WSJ: U.S. Effort to Modify Mortgages Falters

An Obama administration effort to reduce home foreclosures by lowering the mortgage payments of struggling borrowers before they fall behind is failing to help as many people as expected.Should be an interesting discussion.

Among the problems: Some homeowners are being told they must be behind on their payments to receive help, which runs counter to the aim of the program. In other cases, delays are so long that borrowers who are current on their payments when they ask for a loan modification are delinquent by the time they receive one. There is also confusion about who qualifies.

Administration officials have summoned executives of 25 mortgage-servicing companies to Washington on Tuesday to discuss efforts to help borrowers, both delinquent and at risk.

Truck Tonnage Index Declined 2.4 Percent in June

by Calculated Risk on 7/27/2009 08:22:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Fell 2.4 Percent in June Click on graph for larger image in new window.

Click on graph for larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index fell 2.4 percent in June. In May, SA tonnage jumped 3.2 percent. June’s decrease, which lowered the SA index to 99.8 (2000=100), wasn’t large enough to completely offset the robust gain in the previous month. ...Some interesting comments from Costello. Maybe the cliff diving is over, but the sideways motion is "choppy". Not exactly little green shoots ...

Compared with June 2008, tonnage fell 13.6 percent, which surpassed May’s 11 percent year-over-year drop. June’s contraction was the largest year-over-year decrease of the current cycle, exceeding the 13.2 percent drop in April.

ATA Chief Economist Bob Costello said truck tonnage is likely to be choppy in the months ahead. “While I am hopeful that the worst is behind us, I just don’t see anything on the economic horizon that suggests freight tonnage is about to rise significantly or consistently,” Costello said. “The consumer is still facing too many headwinds, including employment losses, tight credit, and falling home values, to name a few, that will make it very difficult for household spending to jump in the near term.” He also noted that inventories, relative to sales, are still too high in much of the supply chain, especially in the manufacturing and wholesale industries. “As a result, this is likely to be the first time in memory that truck tonnage doesn’t lead the macro economy out of a recession. Today, many new product orders can be fulfilled with current inventories, not new production, thus suppressing truck tonnage.”

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.2 billion tons of freight in 2008. Motor carriers collected $660.3 billion, or 83.1 percent of total revenue earned by all transport modes.

"Precipitous" House Price Declines at the High End

by Calculated Risk on 7/27/2009 05:58:00 PM

From the Chicago Tribune: Luxury prices keep falling (ht Ann)

Real estate agents say they have never seen prices drop so precipitously when dealing with opulent, often empty high-end homes along the North Shore ... "It is a phenomenon we've never seen in our lifetime," said real estate agent Jason Hartong with Rubloff Residential Properties, who has seen some multimillion-dollar price tags cut nearly in half.The problems are movin' on up the value chain.

...

Developers, many now in bankruptcy, were caught by surprise, as well. Vacant and unfinished homes dot the Chicago suburbs, with for sale signs that tout the "New Price."

For instance, a custom-built stone home at 750 Sheridan Rd. in Winnetka priced at $5.5 million in November 2007 is going for $3.3 million.

Option ARMs: Good News, Bad News

by Calculated Risk on 7/27/2009 04:04:00 PM

The good news, according to a Barclays Capital report, is not as many Option ARMs will recast in 2011 as forecast earlier by Credit Suisse.

The bad news is borrowers are defaulting en masse before the recast.

From Bloomberg: Option ARM Defaults Shrink Size of Recast Wave, Barclays Says (ht Brian)

The wave of “option” adjustable- rate mortgages recasting to higher payments, projected by some economists to represent a looming source of foreclosures that will hurt housing markets over the next few years, will be smaller “than feared” because many borrowers will default before their bills change, Barclays Capital analysts said.Also some of the loans (mostly Wells Fargo) will probably recast later than the Credit Suisse chart.

...

About 40 percent of borrowers with option ARMs are already delinquent, and “many” of the others will start missing payments before their obligations change, the Barclays mortgage- bond analysts wrote in a July 24 report. ...

“The additional risk really will only be for borrowers who manage to stay current over the next couple of years and might default due to a payment shock,” the New York-based analysts including Sandeep Bordian and Jasraj Vaidya wrote.

...

More than $750 billion of option ARMs were originated between 2004 and 2008 ...

Also on Option ARMs from the WSJ a couple weeks ago: Pick-a-Pay Loans: Worse Than Subprime

This suggests the recast related problems will happen sooner than the Credit Suisse chart suggests. That is good news in that the problems might not linger as long, and also suggests further price pressure in the short term for the mid-to-high end areas with significant Option ARM activity.

UPDATE on Wells Fargo Option ARM portfolio, from Q2 recorded comments (ht HealdsburgBubble):

The Pick-a-Pay portfolio also performed as expected as we continued to de-risk the portfolio. I want to highlight some key points that are important for every investor to understand about this portfolio:

First, not all option ARM portfolios are alike and we believe we have the best portfolio in the industry. While recently reported industry data, as of April 2009, indicates 37 percent of all industry option ARM loans are at least 60 days past due, our portfolio is performing significantly better with only 18 percent 60 days or more past due as of June 30. Not surprisingly, our non-impaired portfolio is performing significantly better than our impaired portfolio with only 4.7 percent 60 days or more past due. In fact, 92 percent of the non-impaired portfolio is current, compared with 62 percent of the impaired portfolio. In addition, while many other option ARM loans have recast periods as short as five years, our Pick-a-Pay loans generally have ten-year contractual recasts. As a result, we have virtually no loans where the terms recast over the next three years, allowing us more time to work with borrowers as they weather the current economic downturn.

emphasis added