by Calculated Risk on 7/24/2009 11:36:00 AM

Friday, July 24, 2009

The Surge in Rental Units

Please see this earlier post for graphs of the homeownership rate, and homeowner and rental vacancy rates.

The supply of rental units has been surging: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (all data from the Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.3 million units added to the rental inventory.

Note: please see caution on using this data - this number might be a little too high, but the concepts are the same even with a lower increase.

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at a record 10.6%.

Where did these approximately 4.3 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.2 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

This huge surge in rental supply has pushed down rents, and pushed the rental vacancy rate to record levels.

Yes, people are doubling up with friends and family during the recession, and some renters are now buying again, but the main reason for the record vacancy rate is the surge in supply.

Q2: Homeowner Vacancy Rate Declines, Rental Vacancy Rate at Record High

by Calculated Risk on 7/24/2009 10:36:00 AM

This morning the Census Bureau reported the homeownership and vacancy rates for Q2 2009. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

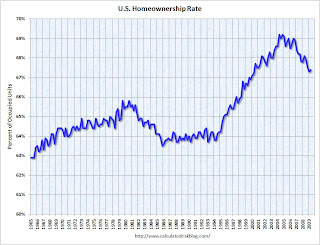

The homeownership rate increased slightly to 67.4% and is now at the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

The homeowner vacancy rate was 2.5% in Q2 2009. This is the lowest vacancy rate since mid-2006, but still very high. A normal rate for recent years appears to be about 1.7%.

This is the lowest vacancy rate since mid-2006, but still very high. A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.8% above normal, and with approximately 75 million homeowner occupied homes; this gives about 600 thousand excess vacant homes.

The rental vacancy rate increased to a record 10.6% in Q2 2009.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 40 million units or about 1.04 million units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 10.6% to 8%, there would be 2.6% X 40 million units or about 1.04 million units absorbed.

These excess units will keep pressure on rents and house prices for some time.

Guaranty Financial: Probably "Not be able to continue as a going concern"

by Calculated Risk on 7/24/2009 08:02:00 AM

To start BFF off ...

Guaranty Financial Group filed an 8-K with the SEC last night (ht Russ). Here are a few excerpts:

[T]he Company no longer believes that it will be possible for the Company or the Bank to raise sufficient capital to comply with the Orders to Cease and Desist described in the Company’s Current Report on Form 8-K filed on April 8, 2009. In light of these developments, the Company believes that it is probable that it will not be able to continue as a going concern.That is more than your typical 'going concern' warning.

emphasis added

Current stockholders will get nothing:

The Company continues to cooperate with the OTS and the FDIC as they pursue potential alternatives for the business of the Bank. Any such transaction would not be expected to result in the receipt of any proceeds by the stockholders of the Company.The bank has consented to be seized:

[T]he OTS has directed that the Board of Directors of the Bank consent to the OTS exercising its statutory authority to appoint the FDIC as receiver or conservator for the Bank. ... The Board has complied with the OTS demand for such consent, but the appointment of a receiver or conservator has not yet occurred.Its subsidiary, Guaranty Bank, is deep in the hole:

[T]he Bank’s core capital ratio stood at negative 5.78% as of March 31, 2009. The Bank’s total risk based capital ratio as of March 31, 2009 stood at negative 5.52%. Both of these ratios result in the Bank being considered critically under-capitalized under regulatory prompt corrective action standards.It is just a matter of when. Guaranty Financial will be the largest bank failure this year with approximately $14 billion in assets.

Here is a story from Brendan Case at the Dallas Morning News: Guaranty Bank may face federal control

California Budget: Misery Loves Company

by Calculated Risk on 7/24/2009 12:51:00 AM

One of the key elements of the new California budget is to have the state use money that is normally allocated to cities. This is a crushing blow to the finances of many cities. Here is an example from the O.C. Register: State revenue raids could bankrupt city, officials say

Placentia city officials are howling in effort to keep state hands out of their coffers. The plan to seize millions could bankrupt the city, they say.

"We may have to declare bankruptcy – that's how serious this is," said City Administrator Troy Butzlaff. "This is something the system can't endure. We just avoided bankruptcy by doing all the right things; by cutting back, by getting concessions from staff, by cutting $4.5 million over last year's budget."

...

Butzlaff said earlier this week the state legislators' budget proposals could take roughly $900,000 from gas tax money, $800,000 from property tax money, and $400,000 from the Redevelopment Agency.

...

"Some of my cities are in good shape, some are teetering on the edge," [State Sen. Bob Huff, R- Diamond Bar] said. "It's not fair for the state to outsource its miseries to the local level."

Thursday, July 23, 2009

More on Foreclosure Modification Scams

by Calculated Risk on 7/23/2009 09:22:00 PM

From Matt Padilla at the O.C. Register: DA raids Ladera homes tied to alleged loan-aid scam

Investigators with the Orange County District Attorney early Thursday morning searched three Ladera Ranch homes tied to an alleged foreclosure rescue scam.Once again some of these scamsters are former subprime mortgage brokers. I bet many people hope Ms. Henderson is successful!

...

Attorney General Jerry Brown last week said he has filed suit against the men for allegedly charging homeowners $4,000 in upfront fees and then failing to get them cheaper payments on their home loans.

...

Earlier in the week District Attorney Tony Rackauckas told a group of community leaders his office is expanding investigations into real estate fraud.

Elizabeth Henderson, an assistant DA who spoke at the same event in Garden Grove, said 30% of the cases handled by the office’s major fraud unit are tied to real estate, up from an average 10% in past years ...

“We want to send people to jail,” she said.

Report: Corus Bank may be Seized by early August

by Calculated Risk on 7/23/2009 07:14:00 PM

Another preview for BFF ...

From Bloomberg: Lubert-Adler Said to Mull Bid for Chicago’s Corus Bankshares

Lubert-Adler Partners LP, the Philadelphia-based private-equity firm, is among at least four investors weighing bids for Corus Bankshares Inc. ... The Federal Deposit Insurance Corp. has indicated that the bank ... may be seized as soon as Aug. 6, the people said.It is just a matter of when ...

More on Banning ‘Naked’ CDS

by Calculated Risk on 7/23/2009 06:07:00 PM

Note: Credit Default Swap (CDS) is an insurance contract for a credit instrument. A naked CDS is when someone buys insurance for an underlying asset that they do not own (like buying fire insurance on a neighbor's house). A put option on a stock is somewhat similar - and you don't have to own the stock to buy the put, but the exchange sets the liquidity rules for traders. And that is probably what will happen with CDS: My guess is non-exchange naked CDS trading will be banned.

From Bloomberg: ‘Naked’ Default Swaps May Be Banned in House Bill

“The question of banning naked credit-default swaps is on the table,” Frank, a Massachusetts Democrat, said during an interview on Bloomberg Television today. The legislative proposal will be released next week, Frank said.

...

“Frank has indicated to me he wants a total ban on naked credit default swaps,” [House Agriculture Committee Chairman Collin] Peterson said in a statement through a spokesman today. “While the Agriculture Committee had concerns about this proposal when we considered it in February, I am inclined to support it because I would rather err on the side of caution when it comes to these instruments.”

Credit-default swaps do “perform a useful function” in the economy, Frank said, and there may be “alternatives to banning naked credit-default swaps” if most derivatives are moved to a regulated exchange.

“If we can get rules where almost every derivative is traded on an exchange, and those that aren’t because they are just too unique” are backed by extra capital, he said, “then that may do it.”

...

Geithner said that while comprehensive oversight is needed, a ban would be inappropriate.

Bloomberg's Weil on Proposed New FASB Mark-to-Market Initiative

by Calculated Risk on 7/23/2009 03:56:00 PM

From Jonathan Weil at Bloomberg: Accountants Gain Courage to Stand Up to Bankers (ht James, Michael)

The scope of the FASB’s initiative, which has received almost no attention in the press, is massive. All financial assets would have to be recorded at fair value on the balance sheet each quarter, under the board’s tentative plan.I'll believe it when I see it!

This would mean an end to asset classifications such as held for investment, held to maturity and held for sale, along with their differing balance-sheet treatments. Most loans, for example, probably would be presented on the balance sheet at cost, with a line item below showing accumulated change in fair value, and then a net fair-value figure below that. For lenders, rule changes could mean faster recognition of loan losses, resulting in lower earnings and book values.

And on how this would apply to CIT:

[CIT] said in a footnote to its last annual report that its loans as of Dec. 31 were worth $8.3 billion less than its balance sheet showed. The difference was greater than CIT’s reported shareholder equity. That tells you the company probably was insolvent months ago, only its book value didn’t show it.And for those looking for a market graph:

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Real Estate: Commercial and Residential Prices

by Calculated Risk on 7/23/2009 02:02:00 PM

Here is a comparison of the Moody's / Real Capital Analytics CRE price index and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller. Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

There has been some discussion recently of the “de-stickification” of house prices in areas of heavy foreclosure activity. Price behavior for foreclosure resales is probably similar to CRE because there is no emotional attachment to the property. But prices in bubble areas like coastal California, with little foreclosure activity, will probably exhibit more stickiness and decline, in real terms, over a longer period than the high foreclosure areas.

Hotel RevPAR Off 17.5% YoY

by Calculated Risk on 7/23/2009 12:30:00 PM

From HotelNewsNow.com: STR reports US performance for week ending 18 July 2009

In year-over-year measurements, the industry’s occupancy fell 8.9 percent to end the week at 66.2 percent. Average daily rate dropped 9.4 percent to finish the week at US$97.33. Revenue per available room for the week decreased 17.5 percent to finish at US$64.41.Although the occupancy rate was off 8.9 percent compared to last year, the occupancy rate is off about 13 percent compared to the same week in 2006 and 2007. This is a multi-year slump ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 8.0% from the same period in 2008.

The average daily rate is down 9.4%, and RevPAR is off 17.5% from the same week last year.

Note: Business travel is off much more than leisure travel - so the summer months will probably not be as weak as other times of the year. September will be a real test for business travel.