by Calculated Risk on 6/26/2009 02:02:00 PM

Friday, June 26, 2009

Freddie Mac: Portfolio Shrinks, Delinquencies Rise

Click on graph for large image.

Click on graph for large image.

This graph shows the Freddie Mac single family delinquency rate since January 2005.

Here is the Freddie Mac portfolio data.

From Reuters: Freddie Mac May portfolio shrank annualized 9.9 pct (ht Ron)

Freddie Mac ... said its mortgage investment portfolio shrank by an annualized 9.9 percent rate in May, while delinquencies on loans it guarantees accelerated.

The portfolio decreased to $823.4 billion, for an annualized 5.6 percent increase year to date, the McLean, Virginia-based company said in its monthly volume summary.

In May 2008, the portfolio was $770.4 billion.

Delinquencies ... jumped to 2.62 percent of its book of business in May from 2.44 percent in April and 0.86 percent in May 2008.

...

Freddie Mac said refinance-loan purchase volume was $40.3 billion in May, down from April's $43.3 billion. March's $52 billion was its largest refinance month since 2003.

FDIC: 104 Cease and Desist Orders through May

by Calculated Risk on 6/26/2009 11:43:00 AM

The FDIC has been very busy issuing Cease and Desist orders this year. Through May, the FDIC has issued 104 Cease and Desist orders and this does not include any orders by the OCC or OTS. (ht Terry)

Most of these oreders are very similar - here is an excerpt:

IT IS HEREBY ORDERED, that the Bank, its institution-affiliated parties, as that term is defined in section 3(u) of the Act, 12 U.S.C. § 1813(u), and its successors and assigns, cease and desist from the following unsafe and unsound banking practices, as more fully set forth in the FDIC's Report of Visitation ...:All of these institutions are ordered to make changes - and some do, and then the cease and desist order is terminated (15 orders have been teriminated). The remaining are BFF candidates.

a) operating with management whose policies and practices are detrimental to the Bank and jeopardize the safety of its deposits;

(b) operating with a board of directors which has failed to provide adequate supervision over and direction to the active management of the Bank;

(c) operating with a large volume of poor quality loans;

(d) engaging in unsatisfactory lending and collection practices;

(e) operating in such a manner as to produce operating losses; and

(f) operating with inadequate provisions for liquidity.

emphasis added

Here are the FDIC press releases this year:

May Cease and Desist Orders (23)

April Cease and Desist Orders (24)

March Cease and Desist Orders (23)

February Cease and Desist Orders (21)

January Cease and Desist Orders (13)

NY Fed and AIG Deal

by Calculated Risk on 6/26/2009 10:22:00 AM

From the WaPo: N.Y. Fed to Trim AIG Debt, Receive $25 Billion Stake in Two Subsidiaries

American International Group announced yesterday that it has reached a deal to reduce its debt to the Federal Reserve Bank of New York by $25 billion.The Fed is now in the insurance business ...

[AIG] said that it would give the New York Fed preferred stakes in ... Asian-based American International Assurance, or AIA, and American Life Insurance Co., or Alico, which operates in more than 50 countries.

Under the agreement, AIG will split off AIA and Alico into separate company-owned entities called "special purpose vehicles," or SPVs. The New York Fed will receive preferred shares now valued at $25 billion -- $16 billion in AIA and $9 billion in Alico -- and in exchange will forgive an equal amount of AIG debt.

Personal Income and Outlays Boosted by Stimulus

by Calculated Risk on 6/26/2009 08:30:00 AM

From the BEA: Personal Income and Outlays, April 2009

Personal income increased $167.1 billion, or 1.4 percent, and disposable personal income (DPI) increased $178.1 billion, or 1.6 percent, in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $25.1 billion, or 0.3 percent. In April, personal income increased $78.3 billion, or 0.7 percent, DPI increased $140.0 billion, or 1.3 percent, and PCE increased $1.0 billion, or less than 0.1 percent, based on revised estimates. The pattern of changes in personal income and in DPI reflect, in part, the pattern of increased government social benefit payments associated with the American Recovery and Reinvestment Act of 2009.The May numbers were impacted by the American Recovery and Reinvestment Act of 2009. As an example, payments to seniors increased sharply and “Personal Current Transfers,” increased by $165 billion (annual rate). This boosted personal income.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in May, in contrast to a decrease of 0.1 percent in April.

...

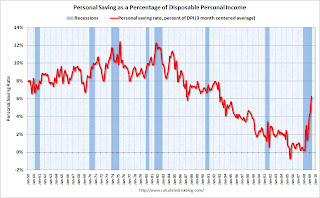

Personal saving -- DPI less personal outlays -- was $768.8 billion in May, compared with $608.5 billion in April. Personal saving as a percentage of disposable personal income was 6.9 percent in May, compared with 5.6 percent in April.

This also pushed up the saving rate sharply to the highest rate since Dec 1993 (but this is a temporary boost).

A couple points:

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the April Personal Income report. The saving rate was 6.9% in April. (6.3% with average)

The saving rate was boosted by the stimulus package, but this suggests households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably dip - the stimulus boost is unsustainable - but then continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but this will also keep pressure on personal consumption.

The following graph shows real Personal Consumption Expenditures (PCE) through May (2000 dollars). Note that the y-axis doesn't start at zero to better show the change.

PCE declined sharply in Q3 and Q4 2008, and rebounded slightly in Q1 2009.

PCE declined sharply in Q3 and Q4 2008, and rebounded slightly in Q1 2009.Although PCE increased in May (compared to April), Q2 2009 is off to a somewhat weak start, with PCE in both April and May slightly below the levels of Q1. Although it is possible that PCE will pick up in June, it seems likely that PCE will be flat to slightly negative in Q2 (although not the cliff diving of the 2nd half of 2008). The two-month estimate suggests a real PCE decline of 0.7% in Q2 2009.

Usually PCE and Residential Investment (RI) lead the economy out of recession, and right now both remain weak. As households increase their savings rate to repair their balance sheets, it seems unlikely that PCE will increase significantly any time soon.

Thursday, June 25, 2009

The Leveraged Loan "Wall of Worry"

by Calculated Risk on 6/25/2009 11:51:00 PM

From the WSJ: Rates Low, Firms Race to Refinance Their Debts

[C]ompanies are seeking to sidestep what is likely to be the biggest-ever wave of loan refinancing among risky companies as $440 billion in debt comes due in a span of three years [from 2012 to 2014]. That is about 85% of the $518 billion in current leveraged loans outstanding ...The looming credit problems are not just Option ARMs and CRE loans; there are about $75 billion in leveraged coming due in 2012, another $150 billion in 2013 and close to $215 billion in 2014.

Some firms [are negotiating extensions]. Others are issuing junk bonds or stock, using the cash raised to repay some of their loans well ahead of schedule.

The pre-emptive moves demonstrate rising concern about the massive bubble of lending that developed from 2005 to 2007.

The credit bubble: the gift that keeps on giving.

CRE: Office Building sold in Denver

by Calculated Risk on 6/25/2009 08:05:00 PM

This is an interesting transaction for several reasons:

From the Denver Post: 17th Street Plaza sale is biggest in Denver this year

A Massachusetts-based real-estate investment trust has paid $135 million in cash for 17th Street Plaza in the largest real-estate deal done in Denver this year.A few months ago, CoStar noted that Class A office space average actual cap rates had risen from 6.1% in Q4 2007 to 7.9% in Q4 2008. And this sale suggests cap rates have risen further ... as CRE prices fall.

HRPT Properties Trust bought the 32-story building at 1225 17th St. from J.P. Morgan, which was represented by brokers Mary Sullivan and Tim Swan of CB Richard Ellis.

Sullivan declined to reveal the sale price, but people in the real-estate community pegged the deal at $135 million.

...

"It's substantially below the replacement cost to build that building," [Todd Roebken, managing director of Jones Lang LaSalle] said.

House Committee on Oversight Releases BofA Merrill Documents

by Calculated Risk on 6/25/2009 06:22:00 PM

The Committee on Oversight and Government Reform released a couple of interesting documents this afternoon.

The first document contains some Federal Reserve emails and documents.

See page 2 you will find an overview of Merrill's legacy portfolio.

How about this message from a Senior Fed Vice President on 12/20/2008 (page 8):

Some very preliminary thoughts on getting a pound of flesh out of Ken Lewis. Should we do this as part of the agreement to bail them out or just let them know we will be contacting them with a board resolution/mou in January. Your thoughtsAnd many other memos.

And another document of interest. There is an interesting discussion on PDF pages 11 through 16 on the financial system that was apparently prepared by the Federal Reserve staff.

There will be quiz later ...

Market and LO Quiz

by Calculated Risk on 6/25/2009 04:11:00 PM

A few stories too ... a major auto supplier is near bankruptcy ...

From Dow Jones: Lear Corp. Working On Prepackaged Bankruptcy - Sources

Lear Corp. (LEA), a maker of automotive seats and interior electronics, is working on a pre-packaged bankruptcy five days before it must make a $38 million interest payment on two of its bonds ... If the prepackaged bankruptcy deal falls apart, Lear could file for a traditonal-style bankruptcy next week ... The company has also lined up debtor-in-possession financing with its lenders ...From MarketWatch: Fitch downgrades California to A-minus

Fitch Ratings downgraded the California's general obligation credit rating on Thursday to A-minus from A, based on the magnitude of the state's financial challenges and persistent weakening economy.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

And Jillayne Schlicke (of CEForward.com) brings us a few sample questions provided by the National Mortgage Licensing System for the new national loan originator exam: Will the New National Loan Originator Exam be Too Easy?. Here are the first two of six questions she posted:

If an applicant works 40 hours every week and is paid $13.52 per hour, what is the applicant’s monthly income?Take the test.

(A) $2,163.20

(B) $2,343.47

(C) $2,379.52

(D) $2,487.68

The requirement for private mortgage insurance is generally discounted when the loan-to-value ratio falls below:

(A) 20%

(B) 50%

(C) 80%

(D) 90%

New BankUnited CEO John Kanas: No Green Shoots

by Calculated Risk on 6/25/2009 03:04:00 PM

From CNBC interview (video here, comments start at 6:40) (ht Brian)

Q: You've said in some cases what appears to be a green shoot might actually end up being moss - moss growing on a rock ...There is a discussion on the saving rate too and the impact on consumption. The personal income and outlays (and saving rate) for May will be released tomorrow.

Kanas: Actually what I said is I hope it's not mold growing on a stagnant economy. But frankly I understand that there are - I hate the term green shoots, and we all talk about it every day - but I don't see it that much. I'm on main street every day, and I'm in a lot of different markets - I'm in New York half the week, and Florida half the week, and were dealing with thousands of people and hundreds of businesses every day and there are very limited green shoots from my perspective.