by Calculated Risk on 5/29/2009 08:11:00 PM

Friday, May 29, 2009

Rite Aid and CRE

Earlier today Bloomberg reported: Starbucks Pushing Landlords for 25% Cut in Cafe Rents

Starbucks Corp. ... is pushing some U.S. landlords for as much as a 25 percent reduction in lease rates, taking advantage of a declining real estate market to save on rent.Now I've heard through a reliable source (unconfirmed) that Rite Aid is also asking for rent reductions. Rite Aid apparently held a conference call with 60 Rite Aid landlords and asked for a 25% rent reduction - or they would close the stores.

Also, from the Baltimore Business Journal: Rite Aid nixes Baltimore convention

Rite Aid Corp. has canceled its annual convention in Baltimore ... one of Baltimore’s biggest conventions in recent years, bringing 6,000 people to town and pumping $6 million from direct spending into the city in 2008 ... The company had originally booked 14,500 hotel room nights for its nine-day expo in mid-August ...Just more problems for commercial real estate (CRE).

Restaurant Performance Index Improves in April

by Calculated Risk on 5/29/2009 04:54:00 PM

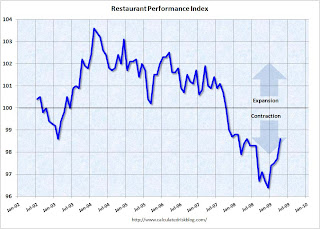

Note: Any reading below 100 shows contraction. So the improvement in the index to 98.6 means the business is still contracting, but contracting at a slower pace.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Continues to Improve as Restaurant Performance Index Hits Highest Level in 11 Months

The outlook for the restaurant industry grew more optimistic in April, as the National Restaurant Association’s comprehensive index of restaurant activity registered its fourth consecutive monthly gain. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 98.6 in April, up 0.8 percent from March, its highest level in 11 months.

“The recent growth in the RPI was driven by the Expectations component, which rose above 100 in April for the first time in 18 months, a level which indicates expansion,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Although the RPI’s Current Situation indicators are still in a period of contraction, the solid improvement in the forward-looking indicators suggests that the end of the industry’s downturn may be in sight.”

...

Restaurant operators reported negative customer traffic levels for the 20th consecutive month in April.

...

Along with an improving outlook, restaurant operators are also ramping up plans for capital expenditures in the months ahead. Forty-six percent of restaurant operators plan to make a capital expenditure for equipment, expansion or remodeling in the next six months, up from 44 percent last month and just 37 percent four months ago.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

This is another example of still contracting, but contracting at a slower pace.

The increase in operators planning capital expenditures is a positive.

Market and FDIC Insured Banks with High NPAs

by Calculated Risk on 5/29/2009 03:54:00 PM

First the market graph from Doug:

| Click on graph for larger image in new window. The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. |

TheStreet.com has a list of 89 banks to watch: Eighty-Nine U.S. Banks, Thrifts Lack Capital

Here are the banks with the highest percentage of Non-Performing Assets on TheStreet.com's list (note: Corus and Vineyard make the list)

| Bank | City | State | Assets (Millions) | Percent NPA |

|---|---|---|---|---|

| Community Bank of Lemont | Lemont | Ill. | $86 | 36.3% |

| Security Bank of Gwinnett County | Suwanee | Ga. | $322 | 34.14 |

| Corus Bank, NA | Chicago | Ill. | $7,626 | 32.78 |

| First Security National Bank | Norcross | Ga. | $137 | 32.7 |

| Union Bank, NA | Gilbert | Ariz. | $129 | 31.85 |

| First State Bank of Altus | Altus | Okla. | $105 | 28.48 |

| Southern Community Bank | Fayetteville | Ga. | $372 | 25.9 |

| First Piedmont Bank | Winder | Ga. | $124 | 25.17 |

| Neighborhood Community Bank | Newnan | GA | $213 | 23.24 |

| Bank of Lincolnwood | Lincolnwood | Ill. | $213 | 23.13 |

| McIntosh Commercial Bank | Carrollton | Ga. | $367 | 22.96 |

| Vineyard Bank, NA | Corona | Calif. | $1,856 | 22.22 |

| Florida Community Bank | Immokalee | Fla. | $980 | 21.8 |

| Security Bank of North Metro | Woodstock | Ga. | $224 | 20.96 |

Hotel Occupancy: RevPAR Off 19.4%

by Calculated Risk on 5/29/2009 02:21:00 PM

From HotelNewsNow.com: STR posts US results for 17-23 May 2009

In year-over-year measurements, the industry’s occupancy fell 11.1 percent to end the week at 59.4 percent. Average daily rate dropped 9.3 percent to finish the week at US$98.31. Revenue per available room for the week decreased 19.4 percent to finish at US$58.39.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 10.3% from the same period in 2008.

The average daily rate is down 9.3%, so RevPAR is off 19.4% from the same week last year.

Note: HotelNewsNow has a free hotel related newsletter available here.

More on S&P and Possible CMBS Downgrades

by Calculated Risk on 5/29/2009 12:54:00 PM

On Tuesday, S&P issued a request for comments on proposed changes to their CMBS rating methodology. This was the key sentence:

Our preliminary findings indicate that approximately 25%, 60%, and 90% of the most senior tranches (by count) within the 2005, 2006, and 2007 vintages, respectively, may be downgraded.After some negative analyst reactions, S&P extended the comment period (ht Jason):

Standard & Poor's Ratings Services today extended the comment period for its proposed changes to its methodology for rating U.S. CMBS conduit/fusion pools to June 9, 2009. The longer consultation period, which many market participants have requested, will allow time to provide further constructive feedback.downgraded.Citi held a conference call this morning to discuss the proposed S&P changes. One of the key points was that Citi considered the S&P rent assumptions draconian. Basically S&P was going to start with the lower of current or market rents, and then decrease rents a further 6 to 30% depending upon property type.

Actually this seems reasonable - rents are falling for all property types. Of course existing tenants will keep paying their current rent - or will they? From Bloomberg: Starbucks Pushing Landlords for 25% Cut in Cafe Rents

Starbucks Corp., the world’s largest coffee-shop operator, is pushing some U.S. landlords for as much as a 25 percent reduction in lease rates, taking advantage of a declining real estate market to save on rent.This seems like deja vu with analysts arguing against subprime rating cuts - the duper AAA are bulletproof - only to find the rating agencies were actually behind the curve.

Philly Fed State Coincident Indexes

by Calculated Risk on 5/29/2009 10:53:00 AM

Click on map for larger image.

Click on map for larger image.

Here is a map of the three month change in the Philly Fed state coincident indicators. All 50 states are showing declining three month activity.

This is the new definition of "Red states" and this is what a widespread recession looks like based on the Philly Fed states indexes.

On a one month basis, activity decreased in 45 states in April. Here is the Philadelphia Fed state coincident index release for April.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for all 50 states for April 2009. In the past month, the indexes increased in three states, decreased in 45, and were unchanged in the other two, for a one-month diffusion index of -84. Over the past three months, the indexes decreased in all 50 states, for a three-month diffusion index of -100.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.

The second graph is of the monthly Philly Fed data of the number of states with one month increasing activity. Most of the U.S. was has been in recession since December 2007 based on this indicator.Almost all states showed declining activity in April. Still a widespread recession ...

Home Sales Ratio: Existing to New

by Calculated Risk on 5/29/2009 10:02:00 AM

Yesterday I posted a graph labeled the distressing gap showing that existing home sales have held up much better during the housing bust than new home sales - probably because of distressed sales (foreclosure resales and short sales). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the same information, but as a ratio for existing home sales divided by new home sales (ht Michael)

The recent change in the ratio is probably related to distressed sales - home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Although distressed sales will stay elevated from some time, eventually I expect this ratio to decline - with a combination of falling existing home sales and eventually rising new home sales.  The second graph shows the ratio back to 1969 (annual data before 1994).

The second graph shows the ratio back to 1969 (annual data before 1994).

Note: the NAR has changed their data collection over time and the older data does not include condos: Single-family data collection began monthly in 1968, while condo data collection began quarterly in 1981; the series were combined in 1999 when monthly collection of condo data began.

Tim Duy: "A Return to a Nasty External Dynamic?"

by Calculated Risk on 5/29/2009 08:57:00 AM

From Tim Duy's Fed Watch: A Return to a Nasty External Dynamic?

An excerpt:

[W]e are stuck with two apparently contrasting views. On one hand, rising long rates and the related steepening of the yield curve should indicate improving economic conditions - after all, rising yields simply imply that market participants are gaining confidence to put their money to work in more risky endeavors. The steeper yield curve should boost bank earnings and, in time, encourage lending. On the other hand, higher yields may undermine support for the housing market, thus extending the downturn.And Duy concludes:

I want to believe that the rapid reversal of Treasury yields is a benign, even positive, event. This is likely the Fed's view; consequently, the[y] will hold steady on policy. Challenging this benign view is that the reversal appears to be lock step with a return to dynamics seen in 2007 and 2008 - exceedingly low US rates encouraging Dollar outflows, stepping up the pace of foreign central bank reserve accumulation and putting upward pressure on key commodity prices. I worry that policymakers have forgotten the external dynamic that was hidden by the crisis induced flight to Dollars last fall. Indeed, capital outflows (indicated by a foreign central bank effort to reverse those flows) would signal that much work still needs to be done to curtail US consumption to bring the global economy back into balance. Policymakers are unprepared for this possibility.A long post well worth reading.

Thursday, May 28, 2009

The U.K Stress Test Scenario

by Calculated Risk on 5/28/2009 11:52:00 PM

From The Times: House prices halved in FSA stress test

The key assumptions in the stress test were that the economy would shrink by 6 per cent from peak to trough with growth not returning until 2011 and trend growth not until 2012. The regulators also assumed unemployment rising to 12 per cent of the workforce, or 3.7 million people, which is 1.5 million more than the present number and would be a higher level of joblessness even than in the recession of the early 1980s.The U.S. more adverse scenario is for unemployment to rise to 10.4% and house prices (Case-Shiller Composite 10) to fall by almost half.

Finally, the FSA posited a 50 per cent fall in house prices from their peak and a 60 per cent fall in commercial property prices - office blocks and shops.

So far, house prices have fallen by 19 per cent from their peak in October 2007, according to the Nationwide Building Society.

...

Analysts said the stress test parameters were, if anything, not severe enough. The market is already expecting a peak-to-trough fall in GDP of 4.5 per cent and unemployment peaking at 10.5 per cent, “which is not significantly better than the assumptions made,” analysts at Credit Suisse commented. However, the house price scenario did look more extreme, it added.

And how about a 60% decline in commercial real estate? How would that impact the S&P CMBS assumptions?

Report: $75 billion of CMBS Market Capitalization Lost in Two Days

by Calculated Risk on 5/28/2009 08:35:00 PM

In a research note today, Citigroup analysts estimated that "more than $75 billion of CMBS market capitalization has been lost" since the S&P request for comment on changes to their U.S. CMBS rating methodology was issued two days ago.

S&P noted:

Our preliminary findings indicate that approximately 25%, 60%, and 90% of the most senior tranches (by count) within the 2005, 2006, and 2007 vintages, respectively, may be downgraded.Citigroup commented that the changes were "a complete surprise", "flawed", lacked "justification" and the "S&P methodology changes do not seem rational or predictable". Ouch.

Citi also noted that this will impact the CMBS legacy TALF announced last week by the Fed. According to Citi the "S&P changes could impact nearly 40% of the triple-A TALF eligible universe" and they expect the Fed to change their criteria.