by Calculated Risk on 5/29/2009 04:54:00 PM

Friday, May 29, 2009

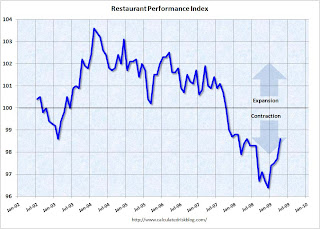

Restaurant Performance Index Improves in April

Note: Any reading below 100 shows contraction. So the improvement in the index to 98.6 means the business is still contracting, but contracting at a slower pace.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Continues to Improve as Restaurant Performance Index Hits Highest Level in 11 Months

The outlook for the restaurant industry grew more optimistic in April, as the National Restaurant Association’s comprehensive index of restaurant activity registered its fourth consecutive monthly gain. The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 98.6 in April, up 0.8 percent from March, its highest level in 11 months.

“The recent growth in the RPI was driven by the Expectations component, which rose above 100 in April for the first time in 18 months, a level which indicates expansion,” said Hudson Riehle, senior vice president of Research and Information Services for the Association. “Although the RPI’s Current Situation indicators are still in a period of contraction, the solid improvement in the forward-looking indicators suggests that the end of the industry’s downturn may be in sight.”

...

Restaurant operators reported negative customer traffic levels for the 20th consecutive month in April.

...

Along with an improving outlook, restaurant operators are also ramping up plans for capital expenditures in the months ahead. Forty-six percent of restaurant operators plan to make a capital expenditure for equipment, expansion or remodeling in the next six months, up from 44 percent last month and just 37 percent four months ago.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Unfortunately the data for this index only goes back to 2002.

This is another example of still contracting, but contracting at a slower pace.

The increase in operators planning capital expenditures is a positive.