by Calculated Risk on 5/26/2009 03:01:00 PM

Tuesday, May 26, 2009

Revisiting the JPMorgan / WaMu Acquisition

From Bloomberg: JPMorgan’s WaMu Windfall Turns Bad Loans Into Income (ht Mike in Long Island)

When JPMorgan bought WaMu out of receivership last September for $1.9 billion, the New York-based bank used purchase accounting, which allows it to record impaired loans at fair value, marking down $118.2 billion of assets by 25 percent. Now, as borrowers pay their debts, the bank says it may gain $29.1 billion over the life of the loans in pretax income before taxes and expenses.Let's review the JPMorgan's "judgment at the time" of the acquisition. First, here is the presentation material from last September.

...

JPMorgan took a $29.4-billion writedown on WaMu’s holdings, mostly for option adjustable-rate mortgages (ARMs) and home- equity loans.

“We marked the portfolio based on a number of factors, including housing-price judgment at the time,” said JPMorgan spokesman Thomas Kelly. “The accretion is driven by prevailing interest rates.”

JPMorgan said first-quarter gains from the WaMu loans resulted in $1.26 billion in interest income and left the bank with an accretable-yield balance that could result in additional income of $29.1 billion.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Here are the bad asset details. Also see page 16 for assumptions.

This shows the $50 billion in Option ARMs, $59 billion in home equity loans, and $15 billion in subprime loans on WaMu's books at the time of the acquisition. Plus another $15 billion in other mortgage loans.

And the second excerpt shows JPMorgan's economic judgment at the time of the acquisition.

JPMorgan's marks assumed that the unemployment rate would peak at 7.0% and house prices would decline about 25% peak-to-trough.

JPMorgan's marks assumed that the unemployment rate would peak at 7.0% and house prices would decline about 25% peak-to-trough.Note that the projected losses at the bottom of the table are from Dec 2007. As the article noted, in September 2008, JPMorgan took a writedown of close to $30 billion mostly for Option ARMs and home equity loans.

This graphic shows the unemployment rate when the deal was announced (in purple), the three scenarios JPMorgan presented (the writedowns were based on unemployment peaking at 7%) and the current unemployment rate (8.9%).

This graphic shows the unemployment rate when the deal was announced (in purple), the three scenarios JPMorgan presented (the writedowns were based on unemployment peaking at 7%) and the current unemployment rate (8.9%).Clearly JPMorgan underestimated the rise in unemployment, and this suggests the $29.4 billion writedown was too small.

And the last graph compares JPMorgan's forecast for additional house price declines and the actual declines using the Case-Shiller national home price index and the Case-Shiller composite 20 index.

And the last graph compares JPMorgan's forecast for additional house price declines and the actual declines using the Case-Shiller national home price index and the Case-Shiller composite 20 index.House prices have declined about 32.2% peak-to-trough according to Case-Shiller - nearing JPMorgan's 37% projection for a severe recession.

This shows JPMorgan underestimated additional house price declines when they acquired WaMu. Instead of $36 billion in additional losses since December 31, 2007 (and the $29.4 billion writedown), this suggests JPMorgan expects losses will be $54 billion or more.

GM Closer to Bankruptcy

by Calculated Risk on 5/26/2009 02:03:00 PM

A couple of stories ...

From Reuters: GM Bondholders Reject Plan, Setting Stage for Bankruptcy

General Motors has failed to persuade enough bondholders to accept a debt-for-equity swap, setting the stage for the largest-ever U.S. industrial bankruptcy ...And from The WSJ: UAW Discloses Terms of GM Deal

Reuters' sources said GM will likely file for bankruptcy some time after midnight Tuesday, but before June 1.

According to the WSJ, the UAW Voluntary Employee Beneficiary Association (VEBA) was owed $20 billion, but will take $10 billion in cash, a note for $2.5 billion (payable over the next 7 years), $6.5 billion in preferred stock, and own 17.5% of GM - plus a warrant for 2.5% more of GM's new common stock.

It sounds like the bankruptcy will be filed this week.

Chicago Fed: April National Activity Index

by Calculated Risk on 5/26/2009 12:12:00 PM

Note: the title for the Chicago Fed report says "activity improved in April". That is not accurate - the index improved, but economic activity is still declining, just at a slower pace.

From the Chicago Fed: Index shows economic activity improved in April

The Chicago Fed National Activity Index was –2.06 in April, up from –3.36 in March. All four broad categories of indicators improved in April, but each continued to make a negative contribution to the index. The index’s three-month moving average in April reached its highest level since October 2008.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"[T]he Chicago Fed National Activity Index (CFNAI), is a weighted average of 85 existing, monthly indicators of national economic activity. The CFNAI provides a single, summary measure of a common factor in these national economic data ...

[T]he CFNAI-MA3 appears to be a useful guide for identifying whether the economy has slipped into and out of a recession. This is useful because the definitive recognition of business cycle turning points usually occurs many months after the event. For example, even though the 1990-91 recession ended in March 1991, the NBER business cycle dating committee did not officially announce the recession’s end until 21 months later in December 1992. ...

When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures."

Note: this is based on only a few recessions, but this is one of the indicators to watch for when the recession ends. Obviously not yet!

House Prices: Real Prices, Price-to-Rent, and Price-to-Income

by Calculated Risk on 5/26/2009 11:00:00 AM

Note earlier house price posts: Case-Shiller: Prices Fall Sharply in March and Case-Shiller: House Prices Tracking More Adverse Scenario

Here are three key measures of house prices: Price-to-Rent, Price-to-Income and real prices based on the Case-Shiller quarterly national home price index.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through Q1 2009 using the Case-Shiller National Home Price Index: Click on image for larger graph in new window.

Click on image for larger graph in new window.

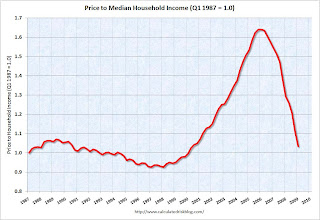

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is maybe 85% complete as of Q1 2009 on a national basis. This ratio will probably continue to decline.

It is important to note that it appears rents are now falling (this is not showing up in the OER measure yet) and rents will probably continue to decline. Goldman Sachs notes that declining rents for REITS typically lead declines in Owners' equivalent rent of primary residence (OER) - so OER will probably be falling later this year and in 2010.

And declining rents will impact the price-to-rent ratio.

Price-to-Income:

The second graph shows the price-to-income ratio: This graph is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008 and flat for 2009).

This graph is based off the Case-Shiller national index, and the Census Bureau's median income Historical Income Tables - Households (and an estimate of 2% increase in household median income for 2008 and flat for 2009).

Using national median income and house prices provides a gross overview of price-to-income (it would be better to do this analysis on a local area). However this does shows that the price-to-income is still too high, and that this ratio needs to fall another 10% or so. A further decline in this ratio could be a combination of falling house prices and/or rising nominal incomes.

In Q2 2008 this index was over 1.25. In Q4, the index was just over 1.1. Now the index is at 1.04. At this pace the index will hit 1.0 in mid-2009. However, during a recession, nominal household median incomes are usually stagnate - so it might take a little longer. And the index might overshoot too.

Real Prices This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

This graph shows the real and nominal house prices based on the Case-Shiller national index. (Q1 2000 = 100 for nominal index)

Nominal prices are adjusted using CPI less Shelter.

The Case-Shiller real prices are still significantly above prices in the '90s and perhaps real prices will decline another 10% to 20%.

Summary

These measures are useful, but somewhat flawed. These measures give a general idea about house prices, but there are other important factors like inventory levels and credit issues. All of this data is on a national basis and it would be better to use local area price-to-rent, price-to-income and real prices.

One thing is pretty certain - as long as inventory levels are elevated, prices will continue to decline. And right now inventory levels of existing homes (especially distressed properties) are still very high.

Case-Shiller: House Prices Tracking More Adverse Scenario

by Calculated Risk on 5/26/2009 09:33:00 AM

Please see: Case-Shiller: Prices Fall Sharply in March for the seasonally adjusted composite indices.

The first graph compares the Case-Shiller Composite 10 NSA index with the Stress Test scenarios from the Treasury (stress test data is estimated from quarterly forecasts). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Stress Test scenarios use the Composite 10 index and start in December. Here are the numbers:

Case-Shiller Composite 10 Index, March: 151.41

Stress Test Baseline Scenario, March: 154.82

Stress Test More Adverse Scenario, March: 149.96

It has only been three months, but prices are tracking close to the 'More Adverse' scenario so far.

The second graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. In Phoenix, house prices have declined 53% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

In Phoenix, house prices have declined 53% from the peak. At the other end of the spectrum, prices in Charlotte and Dallas are off about 11% to 12% from the peak. Prices have declined by double digits everywhere.

Prices fell sharply in most Case-Shiller cities in March, with Minneapolis off 6.1% for the month alone. Denver, Dallas, and Charlotte showed small price gains.

I'll have more on price-to-rent and price-to-income using the National Index soon.

Case-Shiller: Prices Fall Sharply in March

by Calculated Risk on 5/26/2009 09:08:00 AM

S&P/Case-Shiller released their monthly Home Price Indices for March this morning and also the quarterly national house price index.

The monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national index soon. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.4% from the peak, and off 2.0% in March.

The Composite 20 index is off 31.4% from the peak, and off 2.2% in March.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.6% over the last year.

The Composite 20 is off 18.7% over the last year.

This is near the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

I'll have much more soon (on individual cities, comparing to the stress test scenarios, price-to-rent, price-to-income).

Monday Night Futures

by Calculated Risk on 5/26/2009 12:11:00 AM

Big week for housing data: Case-Shiller house prices will be released Tuesday, existing home sales on Wednesday, and new home sales on Thursday.

The U.S. futures are flat tonight:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the Asian markets are mixed.

Best to all.

Monday, May 25, 2009

Housing: More problems ahead for the low end?

by Calculated Risk on 5/25/2009 08:06:00 PM

Bob_in_MA points out some interesting comments on low price areas in the WaPo article: Housing Bust Leaves Most Sellers at a Loss

In the Virginia and Maryland suburbs, prices for single-family homes are down to where they were five years ago. In Prince William and Loudoun counties, a flood of foreclosures has pushed prices so low that bargain hunters have flocked there in recent months, helping to boost sales.It will be interesting to see if sales in the low end areas start to decline after the recent reports of booming sales to another round of investors and first time buyers ...

But while in past slumps a surge in sales has signaled the start of a rebound, this downturn is unlike any in recent times and it's premature to call a recovery, said Barry Merchant, senior housing policy analyst at the Virginia Housing Development Authority.

The encouraging signs have been offset by more troublesome ones, he said. After tapering off for a few months, foreclosures in Northern Virginia are starting to creep up again and may keep climbing now that several lenders have lifted foreclosure moratoriums.

Meanwhile, the year-over-year sales increases of the past few months are petering out in some Virginia suburbs, suggesting that interest in the fire-sale prices may have peaked, Merchant said. In April, Loudoun sales declined 12.5 percent from a year earlier.

"If sales are not increasing and foreclosures are on the uptick, then the question is: 'Is there another shoe to fall?' " Merchant said. "Maybe what we were hoping was the bottom was just a bump on the way down."

The low end of the real estate market [in Phoenix] — and in some equally hard-hit places like inland California and coastal Florida — is becoming as wild as anything during the boom.and

... record or near-record-high sales this spring in many of the [California] Bay Area’s most affordable, foreclosure-heavy communities.and

... the number of single-family houses that resold last month was at record or near-record-high levels for an April in many of the more affordable, foreclosure-heavy [Southern California] inland markets.

GM Bondholders watching Chrysler Bankruptcy

by Calculated Risk on 5/25/2009 05:22:00 PM

An update on a key court ruling tomorrow - not just for Chrysler, but probably for GM too.

From the Financial Times: GM creditors watch Chrysler lawsuit (ht jb)

General Motors bondholders ... will be watching a New York court on Tuesday as a group of Chrysler creditors tries to block the imminent emergence of GM’s smaller rival from bankruptcy protection.So Chrysler will probably emerge from bankruptcy this week - and GM will likely file for bankruptcy by next Monday, June 1st.

GM’s offer to the bondholders of a 10 per cent equity stake in the restructured company expires at midnight. The bondholders, with $27bn in unsecured claims, are widely expected to reject the proposal, setting the stage for GM to file for bankruptcy protection by June 1.

...

The bankruptcy court is expected to approve the deal tomorrow, paving the way for the new company to emerge from Chapter 11.

Krugman: World economy stabilising

by Calculated Risk on 5/25/2009 02:09:00 PM

From Reuters: World economy stabilising says Krugman

"I will not be surprised to see world trade stabilise, world industrial production stabilise and start to grow two months from now," Krugman told a seminar [in the UAE].And Krugman also suggested the GCC countries might consider abandoning the dollar peg, from BI-ME and Bloomberg: Gulf countries should drop dollar peg, says Paul Krugman

"I would not be surprised to see flat to positive GDP growth in the United States, and maybe even in Europe, in the second half of the year."

...

"In some sense we may be past the worst but there is a big difference between stabilising and actually making up the lost ground," he said.

"We have averted utter catastrophe, but how do we get real recovery?

"We can't all export our way to recovery. There's no other planet to trade with."

emphasis added

“You have a region that does as much trade with the eurozone as the United States,” Krugman, an economics professor at Princeton University in New Jersey, told reporters in Dubai. “If you feel that you must have a peg, the economics suggest that it ought to be a basket that reflects trade weights.”I hope Krugman posts on his impressions of Dubai.

Foreclosures and Mosquito Hunters

by Calculated Risk on 5/25/2009 11:41:00 AM

From Carolyn Said at the SF Chronicle: Aerial hunter sniffs out mosquito-ridden pools

Last year, mosquito districts hired [Aerial Services of Livermore] to fly over almost every county in California. It covered 3,500 square miles - about one-third of the state's urban area - and "harvested" 27,000 algae-ridden pools, providing the districts with photographs, maps, street addresses, latitude/longitude and parcel data, including ownership.This story isn't new - but it is interesting:

"We find lots of mosquito sources at foreclosed homes," said John Rusmisel, district manager for Alameda County's Mosquito Abatement District. "It's an ongoing and big problem."

[Bob Franklin] bought a Cessna plane with a 30-inch-wide hole in the bottom to mount a downward-facing camera. The hole is a $40,000 option, as it requires rerouting wires and making structural changes. ... He wrote software for flight planning, camera control and specialized image processing.I find it amusing that he got the idea for the business while towing an advertising banner for Circuit City.

Real Estate Agents Giving Up

by Calculated Risk on 5/25/2009 09:11:00 AM

From the LA Times: Realtors are abandoning a listing ship

Already weakened by the sour housing market, the profession faces increasing challenges from Internet-based services that help people save thousands on a home purchase.

The number of agents typically declines in a housing slump and rebounds when the market recovers. But this time, "when we see an upturn in the cycle, any recovery in the ranks of residential real estate brokers will be limited by a reduced need for their services," said Stuart Gabriel, director of UCLA's Ziman Center for Real Estate.

"The real estate brokerage industry is not going away, but the combination of efficiency gains via the Internet and the cyclical downturn will both be significant forces to their rapidly shrinking ranks," Gabriel said.

The National Assn. of Realtors reports a 13% drop in membership since 2006.

Click on graph for larger image in new window.

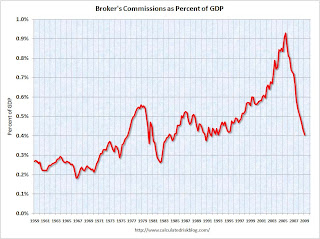

Click on graph for larger image in new window. This graph shows broker's commissions as a percent of GDP.

Not surprisingly - giving the housing bubble - broker's commissions soared in recent years, rising from $56 billion in 2000, to $109 billion in 2005. Commissions have declined to an annual rate of $57 billion in Q1 2009 - the lowest since 2000.

As a percent of GDP (shown on graph), broker's commissions are at the lowest level since 1993. All data from the BEA.

Here is a simple formula: Commissions = transactions X price X commission percent.

Broker's commissions increased because of both soaring prices and soaring activity. A double bubble.

Now a combination of lower prices, less activity, and innovation is putting pressure on commissions, and leading to fewer real estate agents.

Late Night Cranes

by Calculated Risk on 5/25/2009 12:29:00 AM

The U.S. Markets are closed Monday for Memorial Day (enjoy with your friends and family!). This will be a busy week for housing data: Case-Shiller house prices on Tuesday, existing home sales on Wednesday, and new home sales on Thursday. Should be interesting ...

The Asian markets are mixed tonight.

This video fits with an earlier post: Lost Vegas. This video is from about a year and a half ago ... but the Vegas skyline looked similar a few months ago when I was driving through Nevada ... maybe not Dubai (or Beijing) but still crazy!

Sunday, May 24, 2009

NY Times: We're All Subprime Now!

by Calculated Risk on 5/24/2009 09:24:00 PM

From Peter Goodman and Jack Healy at the NY Times: Job Losses Push Safer Mortgages to Foreclosure (ht shaun)

In the latest phase of the nation’s real estate disaster, the locus of trouble has shifted from subprime loans ... to the far more numerous prime loans issued to those with decent financial histories.

...

From November to February, the number of prime mortgages that were delinquent at least 90 days, were in foreclosure or had deteriorated to the point that the lender took possession of the home increased more than 473,000, exceeding 1.5 million, according to a New York Times analysis of data provided by First American CoreLogic, a real estate research group. Those loans totaled more than $224 billion.

During the same period, subprime mortgages in those three categories increased by fewer than 14,000, reaching 1.65 million. The number of similarly troubled Alt-A loans — those given to people with slightly tainted credit — rose 159,000, to 836,000.

Over all, more than four million loans worth $717 billion were in the three distressed categories in February, a jump of more than 60 percent in dollar terms compared with a year earlier.

Geithner Blames Borrowers and more, but not Regulators for Bubble

by Calculated Risk on 5/24/2009 05:38:00 PM

A WaPo interview with Secretary Geithner ...

WaPo's Lois Romano: "You mentioned that Americans borrowed beyond their means. When you look at the collapse of the housing market, who do you think bears the greatest responsibility? Is it the banks for pushing these loans? Is it the consumer for borrowing over their means? The regulators? Where do you see the fault lines there?"

Geithner: "For something this big and damaging to happen it takes a lot of mistakes over time. And it is that combination of things. Interest rate here and around the world were kept too low for too long. Investors made - took a bunch of risks without understanding the risks. They were betting on the expectation that house prices would continue to go up - to go up forever. Rating agencies failed to rate these products adequately. Supervisors failed to underwrite loans with sufficiently conservative standards. So those basic checks and balances failed. And people borrowed too much. It took all those things for it to happen."

CR Note: (short transcript by CR). Although there were many factors in the housing and credit bubble, the two keys were: 1) rapid innovation in the mortgage industry (securitization, automated underwriting, rapidly expanded wholesale lending, etc), and 2) a complete lack of oversight by regulators. As the late William Seidman wrote in his memoir (published in 1993): "Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid."

Geithner failed to mention the rapid changes in lending and the failure of government oversight as the two critical causes of the bubble. Either Geithner misspoke or he still doesn't understand what happened - and that is deeply troubling.

VIDEO Here (embedding was causing problems)

Lost Vegas

by Calculated Risk on 5/24/2009 01:13:00 PM

"These are times completely different than anything I have experienced in my lifetime. I didn't see this coming, and when it hit it hit virtually overnight."According to the Las Vegas Convention and Visitors Authority, vistor volume is off 6.5% from last year, room rates are off 31.6%, and convention attendance is off 30%.

Mayor Oscar Goodman told CNN, from John King: Luck running low in Las Vegas

This puts RevPAR (Revenue per available room) off 36%!

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows visitor volume and convention attendance since 1970. Vistors are back to 1998 levels, however the number of rooms has increased 28.5% since then - from 109,365 rooms in 1998 to 140,529 in 2008. Ouch.

Note: 2009 is estimated based on data through March.

In addition to building too many hotel rooms, there is an oversupply of office and retail space too. From Voit Real Estate Services on Offices:

The Las Vegas office market continued to report increased vacancies, weaker demand and reduced pricing through the first quarter of 2009. An imbalance in the commercial office sector has clearly emerged as selected portions of the market reported vacancies well beyond historical high points.And Voit on retail:

...

During the quarter, new supply entered the market as existing product reported a net loss in occupancies. The valley-wide average vacancy rate reached 19.6 percent, which represented a 2.0-point increase from the preceding quarter (Q4 2008). Compared to the prior year (Q1 2008), vacancies were up 4.9 points from 14.7 percent. As a point of reference, average vacancies bottomed out in the third quarter of 2005 at 8.1 percent.

emphasis added

By the close of the first quarter of 2009, the Las Vegas retail market continued to be impacted by a softening economic climate, reduced consumer spending and a number of corporate restructurings for retailers. Overall vacancies climbed to 9.3 percent, which represented a 1.9-point rise from the preceding quarter. Compared to the same quarter of the prior year, vacancies were up 3.7 points from 5.6 percent.And, of course, Las Vegas had a huge housing bubble too:

Market expansions continued to despite the downturn as a number of retail centers were well under construction by late-2008. Approximately 812,900 square feet completed construction, bringing total market inventory to 51.3 million square feet. As of March 31, 2009, a total of 2.5 million square feet was in some form of construction. It is worth noting a couple of major retail projects have stalled construction (1.7 million square feet) ...

The market reported negative demand for the second consecutive quarter with 221,000 square feet of negative net absorption.

This graph shows the Case-Shiller house price index for Las Vegas. This is one of most exaggerated bubbles in the U.S.

This graph shows the Case-Shiller house price index for Las Vegas. This is one of most exaggerated bubbles in the U.S.Prices almost doubled from January 2003 to the peak in early 2006 - and now are off almost 50% from the peak!

And don't forget the condos ...

This photo (credit: Anthony May 4, 2009) shows the only activity at ManhattanWest condo project in Vegas - a security guard relaxing in the sun.

This photo (credit: Anthony May 4, 2009) shows the only activity at ManhattanWest condo project in Vegas - a security guard relaxing in the sun.And ManhattanWest isn't the only halted project in Las Vegas (From the Las Vegas Review-Journalin March: ManhattanWest latest casualty of crisis):

Last year, Mira Villa condos and Vantage Lofts stopped construction and went into bankruptcy. Sullivan Square had barely begun excavation before the project was canceled. Spanish View Towers was the first high-rise project to stop construction after partially building an underground parking garage.

House Price Round Trip

by Calculated Risk on 5/24/2009 10:43:00 AM

This is another "Deal of the Week" from Zach Fox at the North County Times (San Diego): New construction, same discount.

August 2000: $310,000 (new)

January 2006: $620,000

March 2009: $339,000

Zach describes the house: 'four bedrooms, two-and-a-half baths, 2,231 square feet and a lot some might compare to a postage stamp.'

Saturday, May 23, 2009

Fed Vice Chairman Kohn on Economy

by Calculated Risk on 5/23/2009 07:30:00 PM

From Federal Reserve Vice Chairman Donald Kohn: Interactions between Monetary and Fiscal Policy in the Current Situation

A few excerpts:

[I]n the current weak economic environment, a fiscal expansion may be much more effective in providing a sustained boost to economic activity. With traditional monetary policy currently constrained from further reductions in the target policy rate, and with many analysts forecasting lower-than-desired inflation and a persistent, large output gap, agents may anticipate that the target federal funds rate will remain near zero for an extended period. In this situation, fiscal stimulus could lead to a considerably smaller increase in long-term interest rates and the foreign exchange value of the dollar, and to smaller decreases in asset prices, than under more normal circumstances. Indeed, if market participants anticipate the expansionary fiscal policy to be relatively temporary, and the period of weak economic activity and constrained traditional monetary policy to be relatively extended, they may not expect any increase in short-term interest rates for quite some time, thus damping any rise in long-term interest rates.And on the transition back to normal monetary policy:

emphasis added

An important issue with our nontraditional policies is the transition back to a more normal stance and operations of monetary policy as financial conditions improve and economic activity picks up enough to increase resource utilization. These actions will be critical to ensuring price stability as the real economy returns to normal. The decision about the timing of a turnaround in policy will be similar to that faced by the Federal Open Market Committee (FOMC) in every cyclical downturn--it has to choose when, and how quickly, to start raising the federal funds rate. In the current circumstances, the difference will be that we will have to start this process with an unusually large and more extended balance sheet.Kohn argues:

In my view, the economy is only now beginning to show signs that it might be stabilizing, and the upturn, when it begins, is likely to be gradual amid the balance sheet repair of financial intermediaries and households. As a consequence, it probably will be some time before the FOMC will need to begin to raise its target for the federal funds rate. Nonetheless, to ensure confidence in our ability to sustain price stability, we need to have a framework for managing our balance sheet when it is time to move to contain inflation pressures.

Our expanded liquidity facilities have been explicitly designed to wind down as conditions in financial markets return to normal, because the costs of using these facilities are set higher than would typically prevail in private markets during more usual times.

The Phoenix Housing Boom

by Calculated Risk on 5/23/2009 05:38:00 PM

A couple of articles on Phoenix...

From David Streitfeld at the NY Times: Amid Housing Bust, Phoenix Begins a New Frenzy

With this sweltering desert city enduring one of the largest tumbles in housing prices for any urban area since the Depression, there is an unrelenting stream of foreclosures to choose from. On some days, hundreds are offered for sale at the auctions that take place on the plaza in front of the county courthouse.And from Nicholas Riccardi at the LA Times: Phoenix's housing bust goes boom

There is also a large supply of foreclosed families who can no longer qualify for a loan. And that is prompting a flood of investors like Mr. Jarvis, who wants to turn as many of these people as possible into rent-paying tenants in the houses they used to own.

...

The low end of the real estate market here — and in some equally hard-hit places like inland California and coastal Florida — is becoming as wild as anything during the boom.

One real estate agent was showing a foreclosed house to a prospective client when a passer-by saw the open door, came in and snapped up the property. Another agent says she was having the lock changed on a bank-owned home when a man happened by, found out from the locksmith that it was available, and immediately bought it. Bidding wars are routine.

After four years of renting because they were priced out of the real estate market, Jamia Jenkins and Scott Renshaw concluded the time had arrived for them to buy.It is important to note that this activity is at the low end, and many of these buyers are cash flow investors (assuming they can find renters).

They saw that home prices had dropped so fast here -- faster than in any other big city in the nation -- that mortgage payments would be less than the $900 they paid in rent. The city is littered with foreclosed houses, so the couple figured they could easily snatch up something in the low $100,000s.

Three months later, they're still looking.

They have submitted 13 offers and been overbid each time.

"It's just pathetic," said Jenkins, 53. "Investors are going out there and outbidding everyone."

“If Phoenix loses population,” Mr. Jarvis says, “then buying houses here is a bad bet.”But this is just at the low end. Since most of the activity is distressed sales - foreclosures and short sales - there are no move up buyers. As Mike Orr, a Phoenix real estate analyst notes in the LA Times:

Orr thinks mid- and high-priced properties still will lose value in the coming months.And Streitfeld concludes:

"I wouldn't be investing in luxury right now," he said.

As Mr. Jarvis scouts for houses, he sometimes finds a familiar one. In February, he saw a home that one of his brothers bought from a builder in 2005, camping out overnight for the opportunity. With its value now shrunk, the brother was letting it go to foreclosure.At the low end there is demand from first time buyers, renters and cash flow investors. The supply is coming from foreclosures and short sales - and when that activity eventually slows, the supply will probably come from these investors!

Mr. Jarvis’s daughter Jade also bought a house at the market’s peak — in her case to live in. The other day she asked for advice: should she keep paying the mortgage on something that had declined in value by 60 percent? His conclusion: “probably not.”

“Am I teaching my kids right by letting them walk away from something they made a commitment to?” Mr. Jarvis wonders.

But without move up buyers, where will the mid-to-high priced buyers come from? That is an important question.

For more, see House Price Puzzle: Mid-to-High End