by Calculated Risk on 3/30/2009 02:52:00 PM

Monday, March 30, 2009

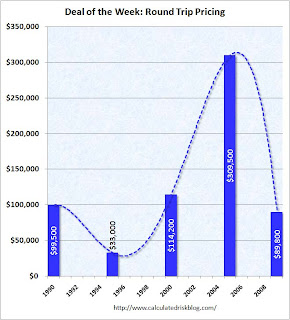

House Prices: Round Trip to 1990

Zach Fox at the North County Times brings us another Deal of the Week: Riding the waves in Oceanside Click on graph for larger image in new window.

Click on graph for larger image in new window.

The featured 2 BR 2 BA condo sold for just under $100 thousand new in 1990. It went into foreclosure during the early '90s California housing bust, and was resold in 1995 for $33,000.

By 2000 the condo was above the original selling price. And then "rode the bubble" to an outrageous price. The condo went through foreclosure last year and sold in February for less than the original price in 1990! Adjust that return for inflation ...

Administration on GM, Chrysler

by Calculated Risk on 3/30/2009 12:16:00 PM

Update2: From MarketWatch: Corrected: Chrysler, Cerberus agree to Fiat deal framework

Update: The government is also backing warranties for GM and Chrysler. That is a key step towards bankruptcy. US backs warranties for GM, Chrysler (ht Stephen)

The US government Monday said it is guaranteeing the warranties of new vehicles bought from General Motors and Chrysler in a bid to boost consumer confidence and auto sales.From the WSJ: Obama Outlines Plans for GM, Chrysler

The Treasury Department said it had taken the temporary step to allay consumer worries about buying new cars from the two nearly bankrupt manufacturers that are on government life support. The new plan addresses fears that the new car warranties would be worthless if the companies collapse.

Warning that they can't depend on unending taxpayer dollars, President Barack Obama on Monday gave General Motors Corp. and Chrysler LLC a brief window to craft plans that would justify fresh government loans.MarketWatch has the Key White House findings Excerpt:

...

The administration says a "surgical" structured bankruptcy may be the only way forward for GM and Chrysler, and President Obama held out that prospect Monday.

"I know that when people even hear the word 'bankruptcy,' it can be a bit unsettling, so let me explain what I mean," he said. "What I am talking about is using our existing legal structure as a tool that, with the backing of the U.S. government, can make it easier for General Motors and Chrysler to quickly clear away old debts that are weighing them down so they can get back on their feet and onto a path to success; a tool that we can use, even as workers are staying on the job building cars that are being sold."

Viability of Existing Plans:

The plans submitted by GM and Chrysler on February 17, 2009 did not establish a credible path to viability. In their current form, they are not sufficient to justify a substantial new investment of taxpayer resources. Each will have a set period of time and an adequate amount of working capital to establish a new strategy for long-term economic viability.

General Motors:

While GM's current plan is not viable, the administration is confident that with a more fundamental restructuring, GM will emerge from this process as a stronger more competitive business. This process will include leadership changes at GM and an increased effort by the U.S. Treasury and outside advisors to assist with the company's restructuring effort. Rick Wagoner is stepping aside as Chairman and CEO. In this context, the Administration will provide GM with working capital for 60 days to develop a more aggressive restructuring plan and a credible strategy to implement such a plan. The Administration will stand behind GM's restructuring effort.

Chrysler:

After extensive consultation with financial and industry experts, the Administration has reluctantly concluded that Chrysler is not viable as a stand-alone company. However, Chrysler has reached an understanding with Fiat that could be the basis of a path to viability. Fiat is prepared to transfer valuable technology to Chrysler and, after extensive consultation with the Administration, has committed to building new fuel efficient cars and engines in U.S. factories. At the same time, however, there are substantial hurdles to overcome before this deal can become a reality. Therefore, the Administration will provide Chrysler with working capital for 30 days to conclude a definitive agreement with Fiat and secure the support of necessary stakeholders. If successful, the government will consider investing up to the additional $6 billion requested by Chrysler to help this partnership succeed. If an agreement is not reached, the government will not invest any additional taxpayer funds in Chrysler.emphasis added

CRE: 'Half Off' Sale for Boston’s John Hancock Tower

by Calculated Risk on 3/30/2009 10:57:00 AM

From Bloomberg: Boston’s John Hancock Tower May Be Sold for Half of 2006 Price (ht Brian)

Boston’s John Hancock Tower, the tallest skyscraper in New England, may be sold to lenders led by Normandy Real Estate Partners for about half the $1.3 billion paid in 2006 by Broadway Partners, which defaulted on its loan.This auction will give a good idea of how far commercial real estate prices have fallen.

Meanwhile, rents are falling too. From Bloomberg: Job cuts mean more office space available in Manhattan

The amount of Manhattan office space available for rent in the first quarter rose to 12 percent and rents fell as companies fired workers, FirstService Williams said.So much for those $100 per sq ft pro forma projections ...

The share of empty space plus occupied offices available for lease climbed from 10.9 percent at the end of 2008 ... The average rent sought by landlords fell to $65.18 a square foot from $74.49 in the fourth quarter, the company said.

FHA Mortgage Defaults Increase

by Calculated Risk on 3/30/2009 09:23:00 AM

From the WSJ: Mortgage Defaults, Delinquencies Rise

... A spokesman for the FHA said 7.5% of FHA loans were "seriously delinquent" at the end of February, up from 6.2% a year earlier. Seriously delinquent includes loans that are 90 days or more overdue, in the foreclosure process or in bankruptcy.

...

The FHA's share of the U.S. mortgage market soared to nearly a third of loans originated in last year's fourth quarter from about 2% in 2006 as a whole, according to Inside Mortgage Finance, a trade publication. That is increasing the risk to taxpayers if the FHA's reserves prove inadequate to cover default losses.

Government: GM, Chrysler "may well require" Bankruptcy

by Calculated Risk on 3/30/2009 01:11:00 AM

From the WSJ: Government Forces Out Wagoner at GM

The administration's auto team announced the departure of [General Motors Corp. Chief Executive Rick Wagoner] on Sunday. In a summary of its findings, the task force added that it doesn't believe Chrysler is viable as a stand-alone company, and suggested that the best chance for success for both GM and Chrysler "may well require utilizing the bankruptcy code in a quick and surgical way."On Chrysler:

The government said it would provide Chrysler with capital for 30 days to cut a workable arrangement with Fiat SpA, the Italian auto maker that has a tentative alliance with Chrysler.From the NY Times: U.S. Moves to Overhaul Ailing Carmakers

...

If the two reach a definitive alliance agreement, the government would consider investing up to $6 billion more in Chrysler. If the talks fail, the company would be allowed to collapse.

President Obama is scheduled to announce details of the auto package at the White House on Monday, but two senior officials, offering a preview on condition of anonymity, made clear that some form of bankruptcy — a quick, court-supervised restructuring, as they described it — could still be an option for one or both companies.On GM:

G.M., on the other hand, has made considerable progress in developing new energy-efficient cars and could survive if it can cut costs sharply, the task force reported. The administration is giving G.M. 60 days to present a cost-cutting plan and will provide taxpayer assistance to keep it afloat during that time.As expected, it sounds especially grim for Chrysler.

Sunday, March 29, 2009

Sunday Night Futures

by Calculated Risk on 3/29/2009 11:59:00 PM

Here is an open thread for discussion. I'm out for a few hours (if there is breaking news) ...

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

And a graph of the Asian markets.

Best to all.

Cajas: The Pain in Spain

by Calculated Risk on 3/29/2009 08:25:00 PM

From Bloomberg: Spain Rescues Caja Castilla With EU9 Billion in Funds (ht Carlomagno, Bob_in_MA)

The Spanish government said it will provide as much as 9 billion euros ($12 billion) to Caja Castilla-La Mancha to shore up the regional lender’s finances and protect depositors in the first bank rescue since 1993.To understand a "Caja", here is a Financial Times article on the Spanish banking system from last October: Cajas in the balance

...

Loan defaults in Spain have tripled since the global financial crisis began in 2007, ending the country’s real estate boom and boosting unemployment to a European-Union high of 14 percent. The economy is in the grip of its worst recession in half a century with the government forecasting a contraction of 1.6 percent this year.

... Half of Spain's financial system consists of 45 unlisted mutuals owned by local governments, called cajas. They are entirely domestically focused, therefore highly exposed to property, and also - because they cannot raise equity - potentially short of capital.The Pain in Spain happens mainly in the - uh - Cajas.

An estimated 70 per cent of cajas' combined €900bn loan portfolio is in real estate. Bad debts doubled last year and Credit Suisse expects them to double again to 5 per cent, twice the current European average. Add in the odd bankruptcy - such as property developer Martinsa Fedesa's recent collapse - and this could eliminate the cajas' provisioning cushions. That presents a problem. ...

... Rescue deals for some of the smaller, more opaque banks look inevitable. The financial fuse on Spain's property bomb is burning slowly. But the bang could still be big.

GM CEO to Step Down as part of Bailout Agreement

by Calculated Risk on 3/29/2009 06:08:00 PM

From Bloomberg: General Motors Chief Rick Wagoner Said to Step Down

General Motors Corp. Chief Executive Officer Rick Wagoner will step down after more than eight years running the largest U.S. automaker ...It sounds like the next round of the auto bailout will be announced Monday.

The departure of Wagoner comes as President Barack Obama prepares an address tomorrow morning on his plans for the future of the U.S. auto industry. GM is surviving on $13.4 billion in U.S. loans and is asking for as much as $16.6 billion in additional aid to survive.

Personal Saving and Mortgage Equity Withdrawal

by Calculated Risk on 3/29/2009 03:42:00 PM

Much has been made about the personal saving rate falling to zero during the housing bubble, and rising sharply in recent months. This decline in the saving rate was probably related to homeowner's borrowing against their homes.

During the housing bubble there was a huge surge in home equity borrowing or cash-out refinancing - commonly called mortgage equity withdrawal (MEW) - that led many people to spend more than their usually defined disposable personal income (DPI). (ht Professor Martha Olney)

However this didn't capture MEW. The following two graphs show the impact of MEW. Note: I used 50% of MEW, because that appears to be the amount consumed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows disposal personal income (blue), disposal personal income plus MEW (green) and personal outlays (red). Note: Graph doesn't start at zero to better show the change.

The BEA defines personal saving as the difference between the blue and red lines:

Personal Savings = Disposable Personal Income - Personal Outlays

However many people acted as if MEW was income, and that would mean personal saving was the difference between the green and red lines. The second graph shows the same data except as a saving rate.

The second graph shows the same data except as a saving rate.

As Professor Olney mentioned to me, the aggregate saving rate captures the behavior of both savers (who probably didn't change their behavior) and "dissavers" (who borrowed heavily). The saving rate declined to zero, probably because the dissavers were using MEW as income.

Now that the Home ATM is closed, the saving rate is rising because of less borrowing - as dissavers are forced to live within their incomes.

Newsweek Cover Story on Krugman

by Calculated Risk on 3/29/2009 01:16:00 PM

Evan Thomas writes in Newsweek: Obama’s Nobel Headache. An excerpt:

If you are of the establishment persuasion (and I am), reading Krugman makes you uneasy. You hope he's wrong, and you sense he's being a little harsh (especially about Geithner), but you have a creeping feeling that he knows something that others cannot, or will not, see. By definition, establishments believe in propping up the existing order. Members of the ruling class have a vested interest in keeping things pretty much the way they are. Safeguarding the status quo, protecting traditional institutions, can be healthy and useful, stabilizing and reassuring. But sometimes, beneath the pleasant murmur and tinkle of cocktails, the old guard cannot hear the sound of ice cracking. The in crowd of any age can be deceived by self-confidence, as Liaquat Ahamed has shown in "Lords of Finance," his new book about the folly of central bankers before the Great Depression, and David Halberstam revealed in his Vietnam War classic, "The Best and the Brightest." Krugman may be exaggerating the decay of the financial system or the devotion of Obama's team to preserving it. But what if he's right, or part right? What if President Obama is squandering his only chance to step in and nationalize—well, maybe not nationalize, that loaded word—but restructure the banks before they collapse altogether?Krugman is making the establishment nervous! Probably because they all missed the housing bubble - and Krugman called it correctly.

emphasis added

Krugman foreshadowed the Newsweek article yesterday: The magazine cover effect

I’ve long been a believer in the magazine cover indicator: when you see a corporate chieftain on the cover of a glossy magazine, short the stock. Or as I once put it (I’d actually forgotten I’d said that), “Whom the Gods would destroy, they first put on the cover of Business Week.”

There’s even empirical evidence supporting the proposition that celebrity ruins the performance of previously good chief executives.

Presumably the same effect applies to, say, economists.

You have been warned.