by Calculated Risk on 3/20/2009 08:35:00 PM

Friday, March 20, 2009

Credit Unions, Bank Failures, and More

Regulators swoop and seize,

None "too big to fail".

by Soylent Green Is People

A couple of key points: these "corporate credit unions" don't serve the general public, and all "natural person" credit union money held at these corporate credit unions was guaranteed earlier this year.

From the WSJ: U.S. Seizes Key Cogs for Credit Unions

The affected institutions don't serve the general public. They provide critical financing, check clearing and other tasks for the retail institutions. These wholesale credit unions, known in industry parlance as corporate credit unions, are owned by their retail credit-union members.And from the NCUA January letter to Credit Unions:

Offering a temporary National Credit Union Share Insurance Fund (NCUSIF) guarantee of member shares in corporate credit unions. The guarantee will cover all shares, but does not include paid-in-capital and membership capital accounts, through December 31, 2010. This guarantee is the equivalent of full share insurance on member shares and will be extended beyond that date by the NCUA Board if necessary.So the natural person credit unions (the ones that serve the public) have had their money guaranteed.

Still the losses will be huge:

[Michael E. Fryzel, chairman of the National Credit Union Administration, the industry's federal regulator] said NCUA's latest estimate is that wholesale credit unions will eventually have to realize between $10 billion and $16 billion in losses on their holdings. The agency on Friday also raised its estimate for what these losses will cost its insurance fund, to $5.9 billion from the prior $4.7 billion estimate.

The federal government will announce as soon as Monday a three-pronged plan to rid the financial system of toxic assets, betting that investors will be attracted to the combination of discount prices and government assistance.

BF 19 & 20: FDIC Seizes Teambank, National Association, Paola, Kansas and Colorado National Bank, Colorado Springs, Colorado

by Calculated Risk on 3/20/2009 07:29:00 PM

From the FDIC: Herring Bank, Amarillo, Texas, Assumes All of the Deposits of Colorado National Bank, Colorado Springs, Colorado

Colorado National Bank, Colorado Springs, Colorado, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Herring Bank, Amarillo, Texas, to assume all of the deposits of Colorado National.From the FDIC: Great Southern Bank, Springfield, Missouri, Assumes All of the Deposits of Teambank, National Association, Paola, Kansas

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $9 million. Herring Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Colorado National is the nineteenth FDIC-insured institution to fail in the nation this year and the first in the state. The last FDIC-insured institution closed in Colorado was BestBank, Boulder, on July 23, 1998.

Teambank, National Association, Paola, Kansas, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Great Southern Bank, Springfield, Missouri, to assume all of the deposits of Teambank.That makes three today (the Corporate Credit Unions are different, but probably a bigger story).

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $98 million. Great Southern Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Teambank is the twentieth FDIC-insured institution to fail in the nation this year and the first in the state. The last FDIC-insured institution closed in Kansas was The Columbian Bank and Trust Company, Topeka, on August 22, 2008.

Teambank was affiliated with Colorado National Bank, Colorado Springs, which was also closed today by the Office of the Comptroller of the Currency. The FDIC entered into a separate transaction with Herring Bank, Amarillo, Texas, to assume the banking operations of Colorado National Bank.

Regulators Seize Two Large Credit Unions: U.S. Central and WesCorp

by Calculated Risk on 3/20/2009 07:10:00 PM

From National Credit Union Administration: NCUA Conserves U.S. Central and Western Corporate Credit Unions

The National Credit Union Administration Board today placed U.S. Central Federal Credit Union, Lenexa, Kansas, and Western Corporate (WesCorp) Federal Credit Union, San Dimas, California, into conservatorship to stabilize the corporate credit union system and resolve balance sheet issues. These actions are the latest NCUA efforts to assist the corporate credit union network under the Corporate Stabilization Plan.Assets of $57 billion? There are some losses coming ...

The two corporate credit unions were placed into conservatorship to protect retail credit union deposits and the interest of the National Credit Union Share Insurance Fund (NCUSIF), as well as to remove any impediments to the Agency’s ability to take appropriate mitigating actions that may be necessary. ...

Corporate credit unions do not serve consumers. They are chartered to provide products and services to the credit union system. These products and services will continue uninterrupted and there is no direct impact by NCUA’s actions on the 90 million credit union members nationwide. ...

U.S. Central has approximately $34 billion in assets and 26 retail corporate credit union members. WesCorp has $23 billion in assets and approximately 1,100 retail credit union members. The member accounts of both credit unions are guaranteed under provisions of the previously announced NCUA Share Guarantee Program, through December 31, 2010. The Program extends NCUSIF coverage to all funds held by the two corporate credit unions.

...

Additional mortgage and asset backed security analysis and assessment of the two credit unions by NCUA staff enabled NCUA to refine NCUSIF’s required reserve for potential loss. The findings indicated an overall estimated reserve level, previously announced by NCUA, had increased from $4.7 to $5.9 billion. The specific computation and the impact of the refined reserve level are addressed in NCUA Letter No: 09-CU-06, which NCUA issued and posted online today at http://www.ncua.gov/letters/letters.html.

NCUA is hosting a webcast Monday, March 23 at 2 p.m. to provide the credit union community with an update on the corporate credit union stabilization program.

Bank Failure #18: FDIC Closes FirstCity Bank, Stockbridge, Georgia

by Calculated Risk on 3/20/2009 06:26:00 PM

From the FDIC: FDIC Approves the Payout of Insured Deposits of FirstCity Bank, Stockbridge, Georgia

The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of FirstCity Bank, Stockbridge, Georgia. The bank was closed today by the Georgia Department of Banking and Finance, which appointed the FDIC as receiver.It feels like Friday ...

...

As of March 18, 2009, FirstCity had total assets of $297 million and total deposits of $278 million. At the time of closing, the bank had approximately $778,000 in deposits that exceeded the insurance limits. This amount is an estimate that is likely to change once the FDIC obtains additional information from these customers.

...

The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $100 million. FirstCity Bank is the eighteenth FDIC-insured institution to fail this year. The last bank to fail in Georgia was Freedom Bank of Georgia, Commerce, on March 6, 2009.

Stock Market: More Volatility

by Calculated Risk on 3/20/2009 04:12:00 PM

While we wait for the FDIC, here is a look at the market.

The S&P 500 was off 2%

The Dow was off 1.65%

The NASDAQ was off 1.8% Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Citi Forecloses on General Growth Mall

by Calculated Risk on 3/20/2009 03:33:00 PM

From Reuters: General Growth loses some malls after defaults

A Louisiana court issued an order to seize and sell a General Growth Properties Inc GGP.N shopping center in a New Orleans suburb after the No. 2 U.S. mall owner failed to repay a $95 million loan, a Citigroup ... unit said on Friday.A possible General Growth Properties bankruptcy could happen in the next few days.

The Oakwood Shopping Center in the town of Gretna is the fourth General Growth property seized in the last few days after the company failed to pay mortgage debt.

California Unemployment Rate Rises to 10.5% in February

by Calculated Risk on 3/20/2009 12:52:00 PM

From the LA Times: California unemployment hits 10.5% in February

California's unemployment rate rose for the 11th straight month in February, hitting 10.5% as a recession-wracked economy shed 116,000 jobs across all professions and industries, the state reported today.The unemployment rate in California peaked at 11% in the early '80s.

The number is up from 10.1% in January and is the highest since April 1983.

Here is the EDD report. Construction employment is off 18.5% from Feb '08 to Feb '09. This is over 155,000 construction jobs lost in California alone over the last 12 months.

Bernanke to Speak at Noon ET

by Calculated Risk on 3/20/2009 11:30:00 AM

UPDATE: Here is the transcript of Bernanke's speech.

Federal Reserve Chairman Ben Bernanke will speak at Noon ET on "The Financial Crisis and Community Banking", at the Independent Community Bankers of America’s convention in Phoenix, AZ.

I expect CNBC to cover this ...

Here is the CNBC feed.

General Growth Faces 5 PM Deadline

by Calculated Risk on 3/20/2009 11:12:00 AM

In addition to watching for bank failures this afternoon, the 2nd largest mall owner in the U.S. - General Growth Properties - is facing a significant deadline:

From the WSJ: General Growth Shakes Up Executive Ranks

[General Growth's] most critical deadline is 5 p.m. Friday, when it hopes the majority of its bondholders will have agreed to refrain from demanding payment this year on $2.25 billion in bonds. If that effort fails, General Growth says it might need to seek Chapter 11 bankruptcy protection.Yesterday: Moody's Cuts General Growth To Last Pre-Default Level

Moody's Investors Service lowered its ratings on debt-laden mall owner General Growth Properties Inc. (GGP) and some of its subsidiaries to C, the last stop before default, after the company let a $395 million bond payment pass without a payment earlier this week.

...

On Wednesday, Standard and Poor's Ratings Services lowered its credit ratings on the company to default on the missed bond payment.

Hotel Occupancy Rate Off Sharply

by Calculated Risk on 3/20/2009 09:03:00 AM

From HotelNewsNow.com: STR reports U.S. hotel data for week ending 14 March

The U.S. hotel industry posted declines in three key performance measurements during the week of 8-14 March 2009, according to data from STR..

In year-over-year measurements, the industry’s occupancy fell 15.7 percent to end the week at 55.2 percent. Average daily rate dropped 11.2 percent to finish the week at US$99.60. Revenue per available room for the week decreased 25.1 percent to finish at US$55.02.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week centered average).

The three week average is off 14.4% from the same period in 2008.

Note that the average daily rate dropped significantly too, so RevPAR (Revenue per available room) is off 25.1% from last year.

FDIC Closes Sale of Indymac, Loses $10.7 billion

by Calculated Risk on 3/20/2009 01:45:00 AM

From the FDIC: FDIC Closes Sale of Indymac Federal Bank, Pasadena, California

The Federal Deposit Insurance Corporation (FDIC) has completed the sale of IndyMac Federal Bank FSB, Pasadena, California, to OneWest Bank, FSB, a newly formed Pasadena, California-based federal savings ...The original loss estimate was $4 to $8 billion, and that estimate was later increased to $8.9 billion. Now it is $10.7 billion.

IndyMac Federal sustained losses of $2.6 billion in the fourth quarter 2008 due to deterioration in the real estate market. The total estimated loss to the Deposit Insurance Fund is $10.7 billion.

Ouch.

Thursday, March 19, 2009

Travel Spending: Cliff Diving

by Calculated Risk on 3/19/2009 09:11:00 PM

From the WSJ: Travel Spending Sinks Sharply

Spending on travel and tourism declined last year for the first time since the Sept. 11, 2001, terrorist attacks, the Commerce Department said Thursday, as Americans canceled vacations, a strong dollar kept foreigners away and businesses slashed travel budgets.More cliff diving ... and more bad news for the hotel industry.

Spending fell at a 22% annualized rate in the October through December quarter, compared with the prior three-month period. The decline was the sharpest since the government's quarterly records began in 2001, topping the 19% drop after the terrorist attacks that year.

As a result, the trillion-dollar industry -- a major employer in the U.S. -- is reeling ...

Banks Sell Some REOs in Bulk below Market Prices

by Calculated Risk on 3/19/2009 04:55:00 PM

From Zach Fox at the North County Times: HOUSING: Banks selling properties in bulk for cheap

Lenders have become so overwhelmed by the foreclosure crisis that they are starting to unload properties in bulk to investor groups at steep discounts.There is much more in the story.

Investors then flip the properties for a profit without necessarily improving the home.

For example, a unit of Citigroup, the troubled financial giant, sold a foreclosure in Temecula to an Arizona investment firm for $139,000 when comparable homes in the area were selling for $240,000 to $260,000.

The firm listed the home for $249,000, received multiple offers and the property has entered escrow, said Amber Schlieder, the real estate agent who handled the listing.

...the Temecula foreclosure was first listed for sale by Citigroup in May 2007 for $420,000, according to Multi-Regional Multiple Listing Service ...

The property was listed on the site for 19 months before selling to the investors in a bulk sale in December 2008. The lowest price it was listed for was $314,000.

"It should have been listed for less," said Craig Finlayson, a real estate agent in the area who listed the property for Citigroup. "But it would have sold for more than 139 (thousand); 139 was a giveaway price."

I'm hearing stories frequently of banks selling REOs far below market prices, only to have local investors flip the properties.

A reader sent me some info on a property in Redwood City that is typical. The lender turned down two short sale offers at close to $649,000, and then, after foreclosing on the property, the bank listed the property at $509,000. The property sold for $493,000 all cash, even though there were other offers above the list price.

What is going on? I think the lenders are swamped, and this is OPM (other people's money). The money doesn't belong to the people making the decisions, and it is hard for them to accept a short sale, and after foreclosure, it is probably easier for them to just take a check and get the property off their desk. The result is the banks make a series of less than optimal decisions, and they leave money on the table at several points in the process.

In the story above, Citigroup left $100,000 on the table with just this one property.

Fed Expands TALF to include more Securities

by Calculated Risk on 3/19/2009 04:37:00 PM

The Federal Reserve Board on Thursday announced that the set of eligible collateral for loans extended by the Term Asset-Backed Securities Loan Facility (TALF) is being expanded to include four additional categories of asset-backed securities (ABS):ABS backed by mortgage servicing advances ABS backed by loans or leases relating to business equipment ABS backed by leases of vehicle fleets ABS backed by floorplan loans

Mortgage servicing advances are loans extended by residential mortgage servicers to cover payments missed by homeowners. Accepting ABS backed by mortgage servicing advances should improve the servicers' ability to work with homeowners to prevent avoidable foreclosures. The additional new ABS categories complement the consumer and small business loan categories that were already eligible--ABS backed by auto loans (including auto floorplan loans), credit cards loans, student loans, and SBA-guaranteed small business loans.

The new categories of collateral will be eligible for the April TALF funding. Additional details on the April funding will be released on March 24. Subscriptions for the April funding will be accepted on April 7, and those loans will settle on April 14.

The subscription period for the first TALF funding ends today. The requested loans will settle on March 25.

The Board authorized the TALF on November 24, 2008, under section 13(3) of the Federal Reserve Act. Under the TALF, the Federal Reserve Bank of New York extends three-year loans secured by AAA-rated ABS backed by newly and recently originated loans.

On February 10, 2009, the Board announced that it is prepared to undertake a significant expansion of the TALF. Today's announcement marks the first step in that expansion; a number of other asset classes are under review.

A new term sheet and a revised frequently-asked-questions document are attached.

Terms and conditions

Frequently asked questions

How far will mortgage rates fall?

by Calculated Risk on 3/19/2009 02:45:00 PM

With the Fed buying longer term Treasury securities, how far will 30 year mortgage rates fall?

On CNBC yesterday, PIMCO's Bill Gross suggested mortgage rates might fall to 4%. I think this is unlikely. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the relationship between the Ten Year yield (x-axis) and the 30 year mortgage rate (y-axis, monthly from Freddie Mac) since 1971. The relationship isn't perfect, but the correlation is very high.

Based on this historical data, the Fed would have to push the Ten Year yield down to around 2.3% for the 30 year conforming mortgage rate to fall to 4.5%.

Currently the Ten Year yield is 2.58% (typo corrected) suggesting a 30 year mortgage rate around 4.7%.

If the Fed buys Ten Year treasuries with the goal of 4.0% mortgage rates, they might have to push Ten Year yields down under 2.0%, maybe close to 1.5%.

DataQuick: Foreclosure Resales now 52% of Sales in California Bay Area

by Calculated Risk on 3/19/2009 01:04:00 PM

From DataQuick: Bay Area home sales climb above last year as median falls below $300K

Note: Beware of the median price. That is skewed by the change in mix towards the low end.

Bay Area home sales beat the year-ago mark for the sixth straight month in February as the winter market sizzled in many foreclosure-heavy inland areas offering the deepest discounts. The median price dipped below $300,000 for the first time since late 1999, pushed lower by an abundance of inland distressed sales and a dearth of coastal high-end activity ...And there is this interesting comment:

A total of 5,032 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was essentially unchanged from 5,050 in January but up 26.1 percent from 3,989 in February 2008, according to MDA DataQuick of San Diego.

...

The allure of such discounted foreclosures helped lift sales of existing single-family houses to record levels for a February in Vallejo, Brentwood, Antioch, Pittsburg, Oakley and Gilroy.

The use of government-insured, FHA loans – a common choice among first-time buyers – represented a record 24.9 percent of all Bay Area purchase loans last month.

Conversely, use of so-called jumbo loans to finance high-end property remained at abnormally low levels. Before the credit crunch hit in August 2007, jumbo loans, then defined as over $417,000, represented 62 percent of Bay Area purchase loans, compared with just 17.5 percent last month.

...

Last month 52 percent of all homes that resold in the Bay Area had been foreclosed on at some point in the prior 12 months, up from a revised 51.9 percent in January and 22.3 percent a year ago.

At the county level, foreclosure resales last month ranged from 12.1 percent of resales in San Francisco to 69.5 percent in Solano County. In the other seven counties, foreclosure resales were as follows: Alameda, 46.2 percent; Contra Costa, 65.1 percent; Marin, 18.9 percent; Napa, 63.1 percent; Santa Clara, 42.9 percent; San Mateo, 31.3 percent; and Sonoma, 57.1 percent.

emphasis added

Only 321 newly constructed homes sold last month, down 55 percent from 713 a year ago, the lowest on record for a February, and the second-lowest for any month back to 1988. Many builders have had a difficult time competing with falling resale prices – especially foreclosures.Only 321 new homes in the entire Bay Area? Wow.

This really shows what is happening. Volumes have all but disappeared for high end homes (and jumbo loans), and the low end is dominated by foreclosure resales (and more FHA loans). The builders can't compete with the foreclosure resales, so new home sales have declined sharply.

DOT: U.S. Vehicle Miles Off 3.1% in January

by Calculated Risk on 3/19/2009 11:49:00 AM

The Dept of Transportation reports on U.S. Traffic Volume Trends:

[T]ravel during January 2009 on all roads and streets in the nation changed by -3.1 percent (-7.0 billion vehicle miles) resulting in estimated travel for the month at 222.4 billion vehicle-miles.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the rolling 12 month total vehicle miles driven since 1971.

The second graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in January 2009 were 3.1% less than January 2008.

Even with much lower gasoline prices in January 2009 ($1.84 per gallon) compared to January 2008 ($3.09 per gallon), the total vehicle miles driven is less because of the weaker economy.

Philly Fed: Continued Contraction, Employment Index at Record Low

by Calculated Risk on 3/19/2009 10:00:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector continued to contract this month, according to firms polled for the March Business Outlook Survey. Indexes for general activity, new orders, shipments, and employment remained significantly negative. Employment losses were substantial again this month, with over half of the surveyed firms reporting declines. ...

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, edged higher, from -41.3 in February to -35.0 this month. Last month's reading was the lowest since October 1990. The index has been negative for 15 of the past 16 months, a period that corresponds to the current recession ...

The current employment index fell for the sixth consecutive month, declining six points, to -52.0, its lowest reading in the history of the survey.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 15 of the past 16 months, a period that corresponds to the current recession ."

Moody's may Downgrade $241 Billion in Prime Jumbo Securities

by Calculated Risk on 3/19/2009 09:19:00 AM

From Reuters: Moody's may cut $241 billion jumbo mortgage debt

... reflecting widening stress in the U.S. housing market, Moody's Investors Service on Thursday said it may downgrade $240.7 billion of securities backed by prime-quality "jumbo" U.S. residential mortgages because defaults will be higher than they expected.Defaults continue to increase in higher priced areas ...

...

It said 70 percent of the 2005 senior securities will likely remain investment-grade, with the rest falling to "junk." Securities issued later may suffer deeper downgrades. Moody's also said subordinated securities from 2006, 2007 and 2008 transactions "will likely be completely written down."

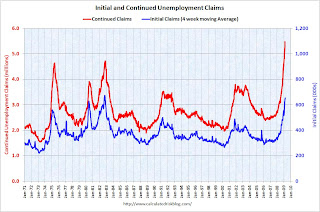

Unemployment Claims: Continued Claims at 5.5 Million

by Calculated Risk on 3/19/2009 08:32:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 14, the advance figure for seasonally adjusted initial claims was 646,000, a decrease of 12,000 from the previous week's revised figure of 658,000. The 4-week moving average was 654,750, an increase of 3,750 from the previous week's revised average of 651,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending March 7 was 5,473,000, an increase of 185,000 from the preceding week's revised level of 5,288,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971.

The four week moving average is at 654,750, the highest since 1982.

Continued claims are now at 5.473 million - the all time record (although not if adjusted by covered employment - I'll post the normalized graph next week).

Another weak employment report ...